CBO Forecast Shows Record Interest Payments and Rising Debt

The Congressional Budget Office (CBO) has significantly revised its 10-year fiscal outlook, projecting an additional $1.4 trillion in cumulative federal deficits between 2026 and 2035 compared to its January 2025 baseline. The updated forecast reflects higher government spending, softer revenue expectations, and a rapidly expanding interest burden.

Key Takeaways

- CBO now projects $23.1 trillion in cumulative deficits from 2026–2035, $1.4 trillion higher than previously estimated.

- Federal spending is expected to rise by $1.3 trillion above prior forecasts, while revenues fall by $49 billion.

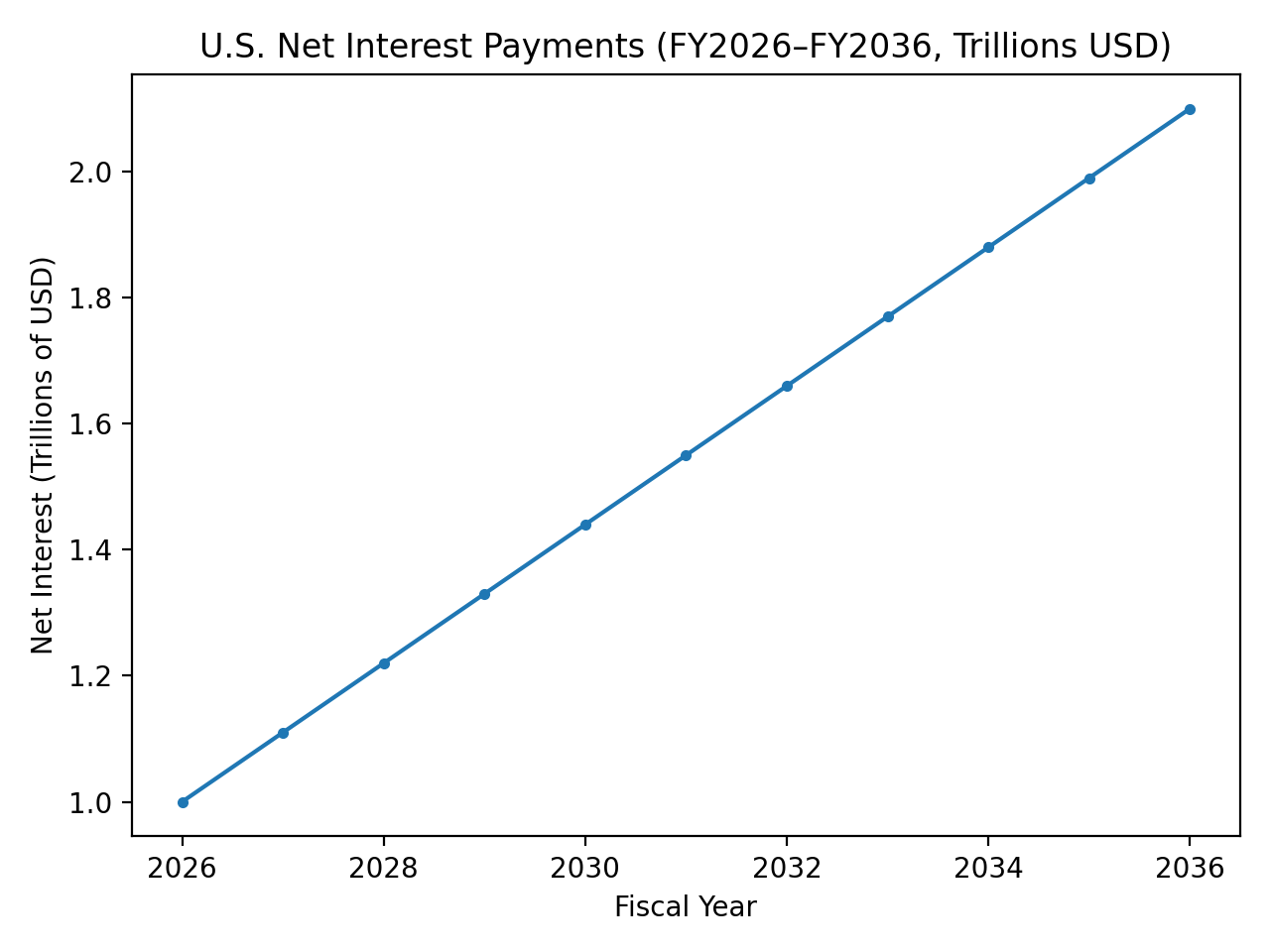

- Net interest payments are projected to reach $2.1 trillion in 2036, consuming nearly 20% of total federal outlays.

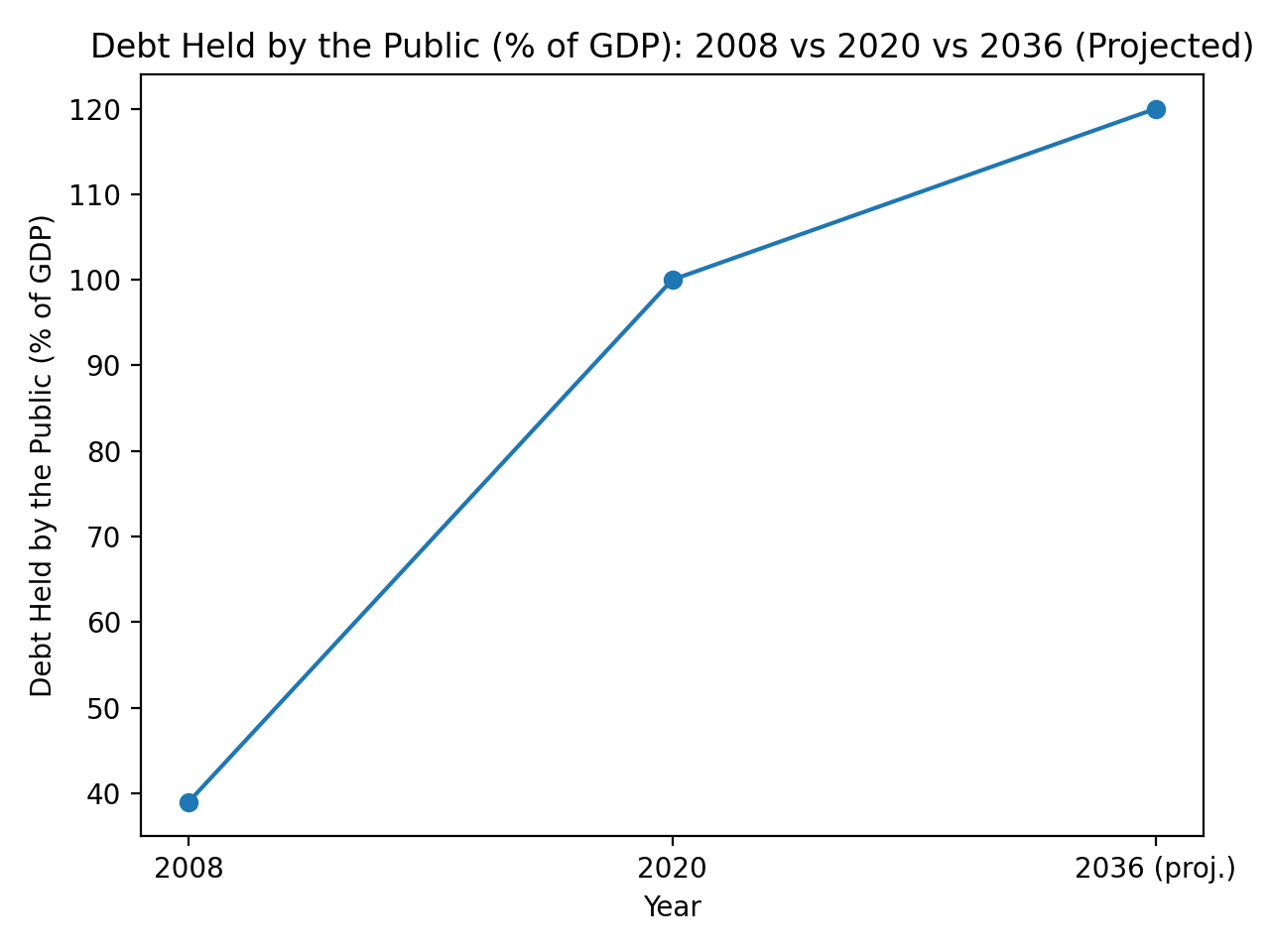

- Debt held by the public is forecast to climb to 120% of GDP, with annual deficits rising to 6.7% of GDP by 2036.

The new projections underscore mounting structural pressures on U.S. public finances, with deficits and debt levels continuing to diverge from historical norms despite steady economic growth assumptions.

Deficit Path Worsens in Latest 10-Year Outlook

According to the CBO’s Budget and Economic Outlook for 2026–2036, cumulative deficits are now projected at $23.1 trillion over the coming decade. That represents a 6% increase relative to last year’s baseline forecast.

The US debt spiral is about to intensify:

The CBO projects that US budget deficits will rise by an additional $1.4 trillion over the next 10 years.

This comes as government spending is set to be $1.3 trillion higher than previously expected.

At the same time, revenues are… pic.twitter.com/FIhynYrDjm

— The Kobeissi Letter (@KobeissiLetter) February 13, 2026

Annual deficits are expected to widen from $1.9 trillion (5.8% of GDP) in fiscal 2026 to $3.1 trillion (6.7% of GDP) by 2036. These levels remain well above the 50-year average of 3.8% of GDP, signaling a sustained peacetime departure from historical fiscal norms.

Spending Pressures Outpace Revenue Gains

The upward revision stems primarily from higher spending projections. The CBO attributes much of the increase to legislative changes enacted in 2025, including tax extensions and policy adjustments under the reconciliation framework, as well as increased administrative costs linked to immigration enforcement.

While new tariff measures are expected to reduce deficits by roughly $3 trillion over the projection period, those gains only partially offset higher outlays. Overall revenues are now projected to be $49 billion lower than previously estimated, reflecting slower-than-anticipated growth in certain tax categories.

Interest Costs Become a Dominant Budget Category

One of the most pronounced shifts in the forecast is the acceleration in debt-service costs. Net interest payments are projected to exceed $1 trillion in 2026 for the first time and rise to $2.1 trillion by 2036 – more than doubling within a decade.

As a share of GDP, net interest is expected to increase from 3.3% to 4.6%, rivaling major spending categories such as defense or non-defense discretionary programs. The increase reflects both a larger debt stock and higher assumed average interest rates, including an upward revision to projected 10-year Treasury yields.

As a share of GDP, net interest is expected to increase from 3.3% to 4.6%, rivaling major spending categories such as defense or non-defense discretionary programs. The increase reflects both a larger debt stock and higher assumed average interest rates, including an upward revision to projected 10-year Treasury yields.

Structural Drivers: Demographics and Slower Growth

Beyond policy changes, demographic trends continue to exert pressure on federal finances. Social Security and Medicare expenditures are projected to rise as the population ages, while economic growth is expected to average approximately 1.8% annually, insufficient to materially offset rising obligations.

CBO Director Phillip Swagel reiterated that the current trajectory is not sustainable under existing policy settings. Without adjustments to spending, taxation, or structural growth drivers, debt dynamics are projected to intensify.

Macroeconomic and Market Implications

Persistent large deficits carry broader economic consequences. Elevated Treasury issuance may exert upward pressure on long-term interest rates, potentially crowding out private investment. Higher borrowing costs could weigh on sectors sensitive to financing conditions, including housing and capital expenditures.

While financial markets have so far absorbed rising issuance with limited disruption, sustained expansion in debt levels could test demand dynamics, particularly among foreign holders of U.S. Treasuries.

At the same time, higher deficits increase fiscal vulnerability in the event of economic downturns or geopolitical shocks, limiting policy flexibility.

Debt held by the public is projected to reach approximately 120% of GDP by 2036. This level would exceed prior post-war peaks and mark a significant departure from long-term averages. The projected increase reflects the compounding effect of sustained primary deficits and rising interest obligations.

Debt held by the public is projected to reach approximately 120% of GDP by 2036. This level would exceed prior post-war peaks and mark a significant departure from long-term averages. The projected increase reflects the compounding effect of sustained primary deficits and rising interest obligations.

Limited Margin for Policy Error

The updated forecast reinforces the structural imbalance between federal spending commitments and revenue generation. As deficits approach 7% of GDP and interest payments claim a growing share of the budget, the scope for discretionary policy maneuvering narrows.

Absent structural reforms, whether through entitlement adjustments, revenue measures, or stronger productivity growth, the fiscal path suggests continued debt accumulation and elevated borrowing costs over the coming decade.

For investors and policymakers, the trajectory underscores the importance of monitoring Treasury supply dynamics, interest rate trends, and longer-term growth assumptions in assessing the sustainability of U.S. public finances.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.