Financial markets are heading into one of the most event-heavy weeks of the month, with multiple Federal Reserve-related developments, liquidity injections, and positioning data releases that could trigger sharp cross-asset swings.

The European Central Bank has unveiled a sweeping overhaul of its Eurosystem repo facility for central banks, signaling a strategic push to strengthen the euro’s global footprint and shield financial markets from sudden liquidity shocks.

The U.S. government has issued new interim guidance that reshapes how clean energy projects qualify for federal tax credits, tightening rules on supply chains tied to adversarial nations.

The Congressional Budget Office (CBO) has significantly revised its 10-year fiscal outlook, projecting an additional $1.4 trillion in cumulative federal deficits between 2026 and 2035 compared to its January 2025 baseline. The updated forecast reflects higher government spending, softer revenue expectations, and a rapidly expanding interest burden.

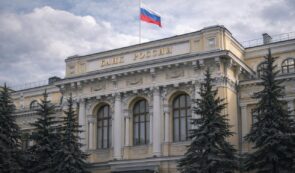

The Bank of Russia lowered its benchmark key interest rate by 50 basis points to 15.5% on February 13, 2026, extending its easing cycle with a sixth consecutive cut. The decision came as a surprise to most economists, who had expected policymakers to hold rates steady at 16% amid a recent inflation uptick.

US inflation eased in January, reflecting a sharp decline in energy costs even as underlying price pressures showed signs of firmness.

The European Central Bank has entered what officials describe as a “monitoring phase” after the euro climbed roughly 14% in the first half of 2025.

A new wave of economic research is challenging one of the most repeated claims surrounding the 2025 tariff escalation - that foreign exporters would ultimately shoulder the cost of higher import taxes.

China’s policy debate over capital controls is intensifying in early 2026, as prominent economists argue the country may finally be in a position to loosen long-standing restrictions without triggering destabilizing outflows.

The United States and Japan are moving closer to launching the first wave of projects under their massive $550 billion bilateral investment framework, a cornerstone of a broader trade agreement between the two nations.

U.S. Initial Jobless Claims came in at 227,000 for the week ending February 7, exceeding market expectations of 223,000 and coming in below the prior week’s 231,000 reading.

The United States is approaching a potential partial government shutdown centered on the Department of Homeland Security (DHS), with funding set to expire at midnight on February 13.