Bitcoin’s Quiet Buyers Absorb Record Supply During Market Dip

Bitcoin’s latest pullback is unfolding against a very different on-chain backdrop than many might expect.

Key Takeaways

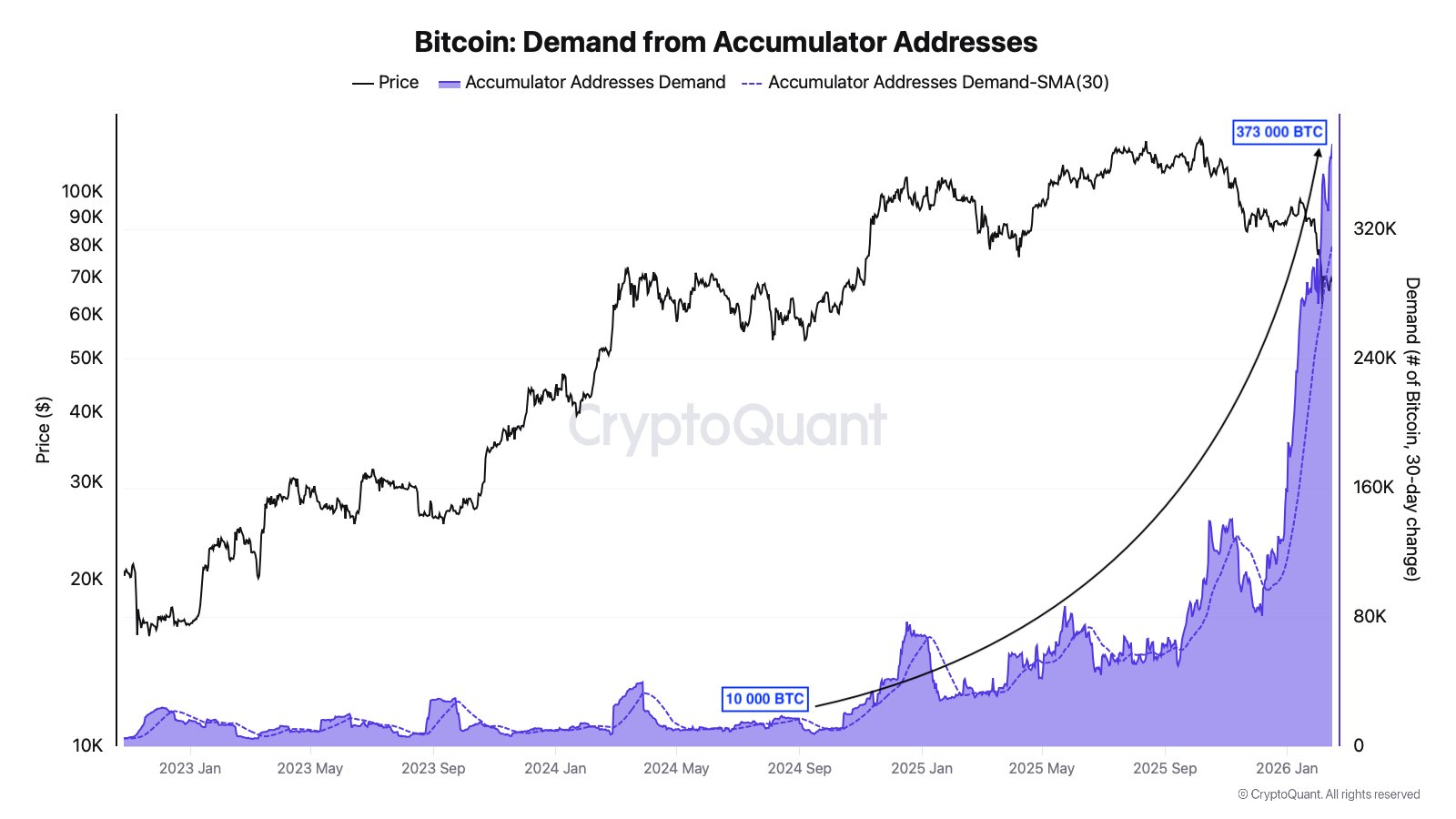

- Accumulator addresses are buying at record levels, averaging about 372,000 BTC per month.

- This is a massive jump from roughly 10,000 BTC per month in September 2024.

- The recent price dip is being used as a buying opportunity by long-term holders.

- CryptoQuant’s strict filtering suggests the data reflects genuine accumulation, not exchange or miner activity.

While short-term traders react to volatility, a specific group of long-term holders is quietly absorbing supply at an aggressive pace. Data from CryptoQuant shows that so-called accumulator addresses are now buying Bitcoin at levels rarely seen before.

Monthly accumulation from these wallets is averaging around 372,000 BTC – a staggering figure compared to roughly 10,000 BTC per month recorded in September 2024. The contrast highlights how dramatically behavior has shifted. Instead of retreating during weakness, this cohort appears to be accelerating purchases.

The recent price decline seems to be functioning as an opportunity window rather than a warning sign. Historically, similar phases of strong absorption during corrections have preceded larger structural moves, though the timing of any reversal remains uncertain.

What Defines an “Accumulator”

CryptoQuant does not classify these addresses loosely. The framework is deliberately restrictive. To qualify, a wallet must show no outflows, hold a minimum BTC balance, record at least two separate inflows, and include a meaningful purchase in its latest transaction.

Additionally, the address must have been active at least once over the past seven years. Known exchange wallets, miner addresses, and smart contract-related activity are excluded. The goal is to isolate genuine long-term holders rather than operational or custodial entities.

According to CryptoQuant analyst Maartunn, the scale of the recent spike initially invites skepticism. Sharp chart movements often require careful scrutiny. However, he argues that in this case the selection criteria significantly reduce the probability of distortion.

Why does a true Bitcoin bottom take time to form? 🤔

~9.31M $BTC — ≈46% of circulating supply — is sitting above the current price.

A large share of holders are waiting to sell at breakeven or a small profit.

That overhead supply must be absorbed and redistributed to stronger… https://t.co/x4SX61f3RD pic.twitter.com/oHDC44aM8z

— Maartunn (@JA_Maartun) February 15, 2026

He also acknowledges one limitation: labeling coverage. While CryptoQuant’s dataset is extensive, no on-chain system can perfectly identify every exchange or mining wallet. Some margin of error always exists. Still, Maartunn suggests that the magnitude of the current accumulation wave is too large to dismiss as misclassification noise.

Long-Term Positioning vs. Emotional Selling

The divergence in behavior is becoming more visible. On one side are investors reacting emotionally to short-term price action. On the other are entities steadily building positions with a multi-year horizon.

Overhead supply – coins held above the current market price – remains a structural factor that could slow recovery. Durable bottoms typically form only after that supply is absorbed. The ongoing accumulation trend suggests that such redistribution may already be underway.

If the current monthly pace near 372,000 BTC continues, it would mark one of the most aggressive long-term absorption phases in Bitcoin’s history. Whether it signals an early-stage bottom or an extended consolidation, the message from on-chain data is clear: some participants are treating this decline as a strategic entry point, not a reason to exit.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.