Bitcoin’s 50% Drop Mirrors 2021 With Stronger Base

Bitcoin’s latest drawdown is being framed by several market analysts as a controlled reset rather than the start of a prolonged collapse, with historical data suggesting the current cycle remains structurally stronger than previous downturns.

Key Takeaways

- Bitcoin is down about 50% from its October 2025 peak – milder than past 70% to 90% crashes.

- The $50,000 level is seen as critical support for accumulation.

- Cycle models signal a confirmed bear phase, but volatility appears lower than in prior downturns.

- Macro conditions will likely decide whether the correction stabilizes or deepens.

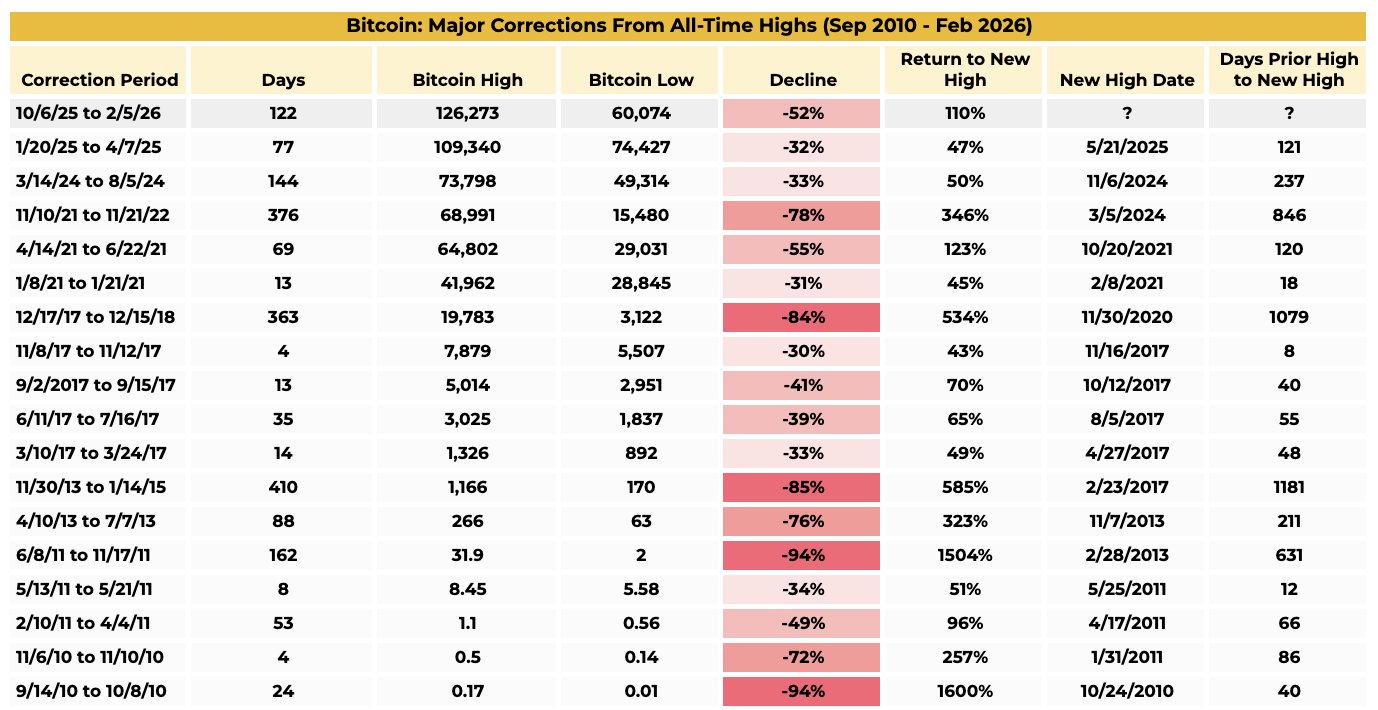

According to data shared by Binance Research, Bitcoin’s roughly 50% decline from its October 2025 all-time high stands out as relatively moderate compared to prior bear markets. Previous cycles routinely delivered drawdowns of 70% to more than 90% before establishing lasting bottoms.

The comparison suggests that while the correction has been sharp, it has not yet reached the historical extremes seen in earlier downturns. Analysts argue this could reflect gradually declining volatility as the asset class matures and institutional participation deepens.

Echoes of 2021 – But With a Higher Base

Market technician Merlijn The Trader says Bitcoin is “rhyming” with 2021, but from a stronger structural foundation. He highlights the formation of higher lows and a more resilient macro backdrop compared to previous cycles.

In this framework, the $50,000 zone is viewed as a key structural floor. If that level holds, accumulation may accelerate. If it fails decisively, further liquidity-driven downside could follow. The symmetry with prior cycles is visible on charts, but the magnitude of the decline so far remains smaller.

BITCOIN IS RHYMING WITH 2021.

But this time:

– Higher base

– Higher lows

– Stronger macro backdrop$50K is the structural floor.

Hold it? Accumulation.

Lose it? The liquidity hunt continues.Same symmetry.

Different strength. pic.twitter.com/fJexnvLrwG— Merlijn The Trader (@MerlijnTrader) February 13, 2026

Bear Market Confirmed by Cycle Metrics

Research firm Matrixport maintains that Bitcoin has formally entered a bear phase based on its position below the 21-week moving average. Historically, this signal has coincided with extended corrective periods before durable cycle bottoms formed.

Their analysis suggests the critical question is no longer whether the trend has turned, but when downside exhaustion will create a high-probability re-entry window. Previous cycles show that once leverage is cleared and long-term holders regain control of supply, strong recoveries often follow.

Maturation or Calm Before More Volatility?

The broader takeaway is nuanced. By historical standards, a 50% retracement is significant, but not extreme. If the correction remains shallower than prior cycles, it could reinforce the argument that Bitcoin’s volatility profile is compressing over time.

However, macroeconomic variables remain decisive. Liquidity conditions, rate expectations, and global risk sentiment continue to shape price action. The next few months may determine whether this cycle marks genuine structural resilience – or simply a temporary pause before deeper volatility resumes.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.