Bitcoin Leaves S&P 500 in the Dust Despite Buffett’s Longtime Faith in Stocks

For decades, Warren Buffett’s go-to advice for investors has been simple: buy the S&P 500 and hold it. But over the last few years, Bitcoin has made that mantra look outdated.

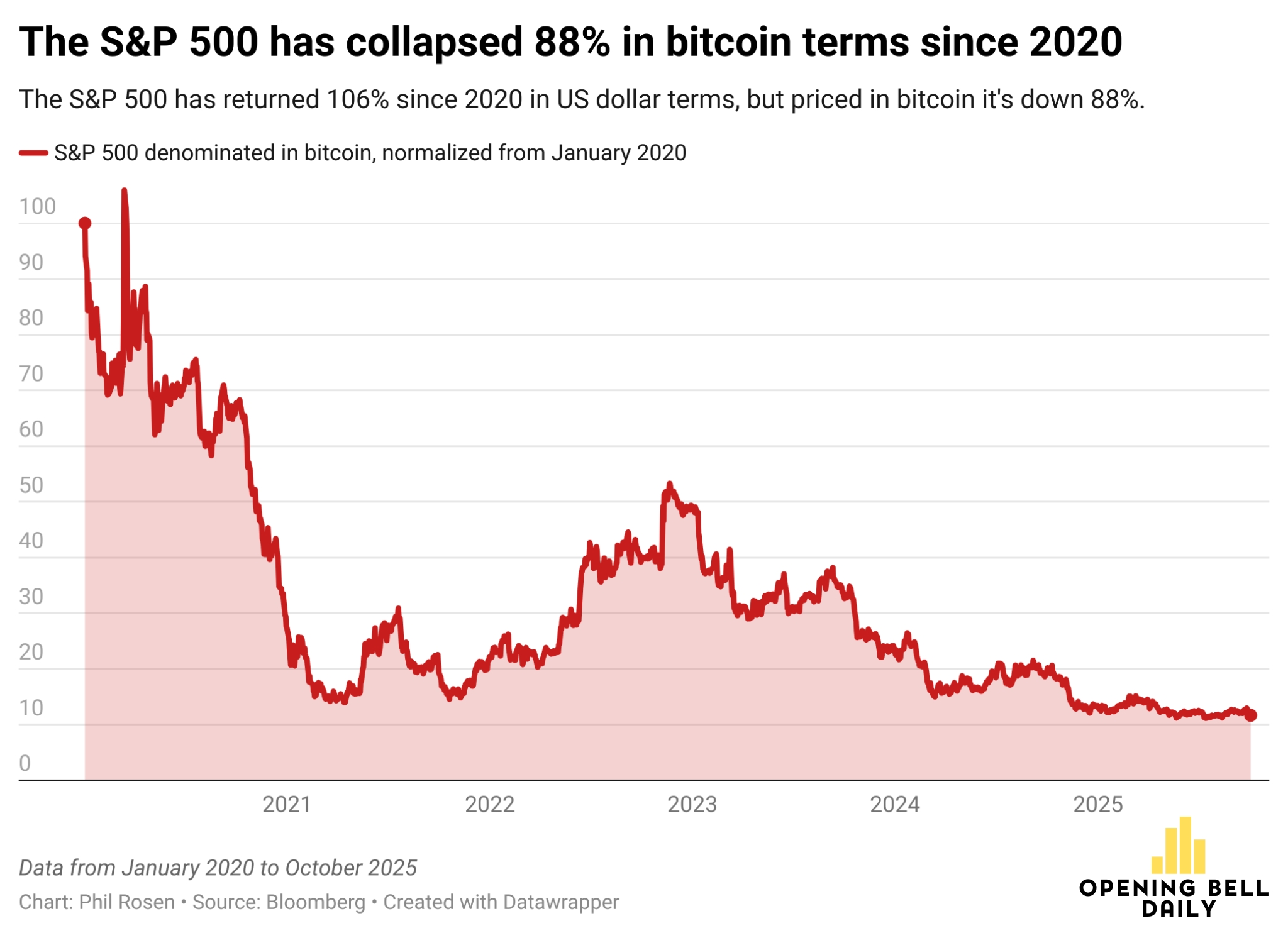

Fresh market data shows that while the S&P 500 has delivered a solid performance in dollar terms since 2020, its value has collapsed when measured against Bitcoin. Phil Rosen of Opening Bell Daily highlighted that the index, though up around 106% in USD, has lost roughly 88% of its worth in BTC terms. The revelation has reignited the long-standing debate over whether traditional equities can keep pace with the rise of digital assets.

Bitcoin’s growth has been staggering. After climbing above $125,000 for the first time this month, the asset has gained about 32% in 2025 alone. In comparison, the S&P 500 – now trading near 6,716 points – has risen 14% since January, despite setting new all-time highs. A simple $100 investment made in early 2020 would now be worth around $210 in the S&P 500, but the same amount in Bitcoin would have multiplied to nearly $1,500.

Buffett’s conservative “90/10” portfolio rule – 90% in the S&P 500 and 10% in short-term Treasuries – has long reflected his faith in steady, compounding growth. Yet the numbers show that Bitcoin’s decade-long trajectory far outpaces traditional benchmarks, even as it carries greater volatility and risk.

The two assets, however, operate on very different principles. The S&P 500 mirrors corporate America’s combined output, backed by earnings, dividends, and long-term stability. Bitcoin, on the other hand, is built on scarcity, decentralization, and resistance to inflation – qualities that increasingly appeal to investors wary of currency debasement and soaring government debt.

With Bitcoin’s market capitalization approaching $2.5 trillion against the S&P 500’s $56 trillion, the comparison might still seem uneven. Yet the message is clear: in a world of eroding fiat confidence, even Buffett’s most trusted index is struggling to keep up with the new digital standard.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.