Bitcoin, Ethereum, XRP, and Cardano Are Sending Mixed Signals Beneath the Surface

Crypto markets continue to trade near cycle highs, but on-chain valuation signals suggest that strength beneath the surface is becoming increasingly uneven.

While prices alone still support bullish narratives, data that tracks how current valuations compare to the average cost basis of holders shows that not all major assets are benefiting equally from the rally.

Key Takeaways

- Bitcoin’s rising price is no longer supported by improving on-chain valuation metrics.

- Ethereum’s brief dip into negative MVRV territory acted as support, hinting at long-term holder defense.

- XRP’s declining MVRV trend points to fading holder conviction.

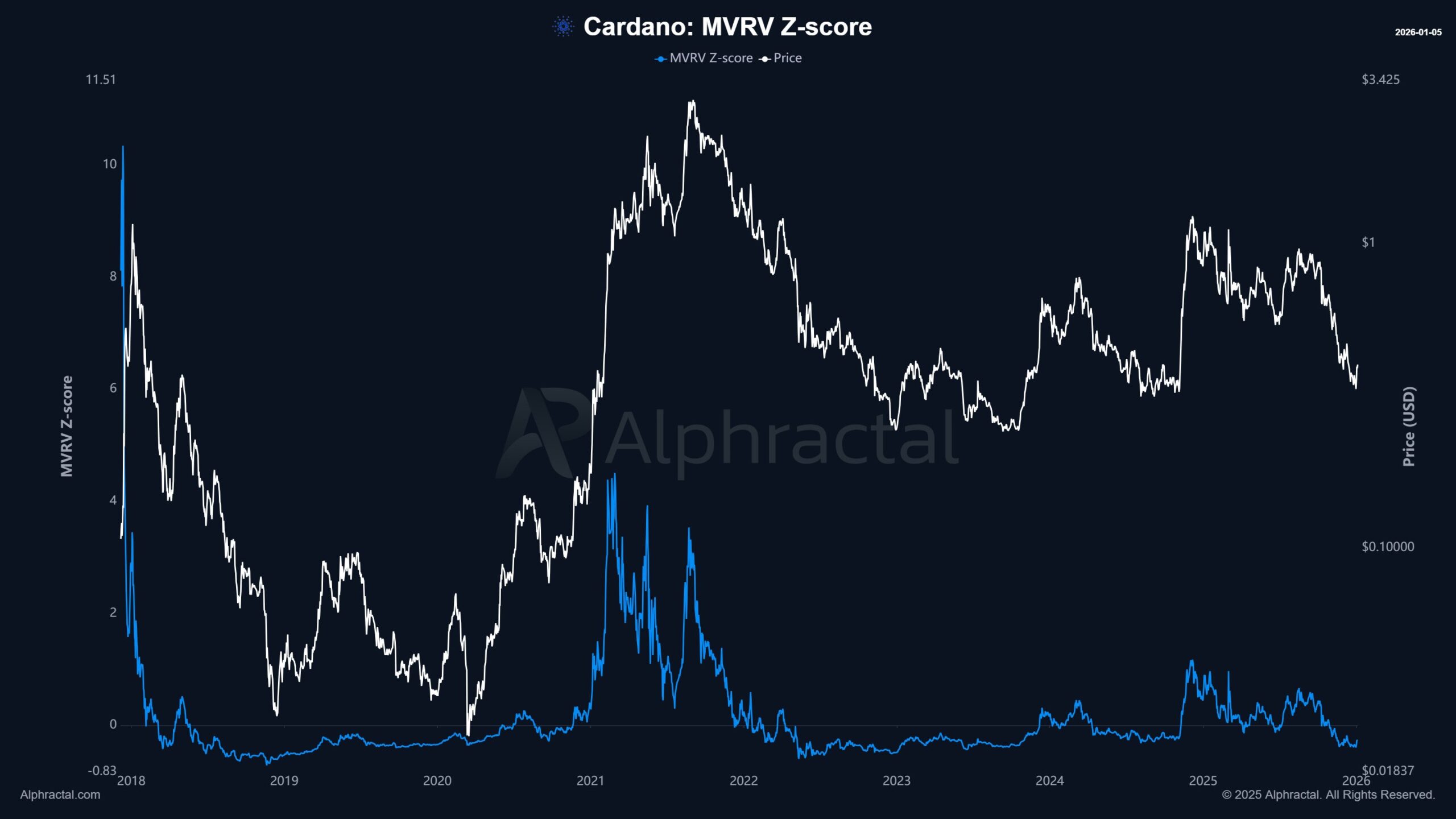

- Cardano’s negative MVRV Z-Score aligns with historical accumulation zones.

At the core of this divergence is the MVRV indicator, which helps assess whether an asset is trading above or below its on-chain “fair value.” Recent readings, shared by Alphractal, point to growing fragmentation across large-cap cryptocurrencies, with some showing signs of stress while others hint at early-stage accumulation.

Bitcoin’s rally shows signs of internal fatigue

Bitcoin remains close to record levels, yet the underlying on-chain picture has weakened. Each new high has been accompanied by less confirmation from long-term holders, suggesting that accumulation is no longer keeping pace with price appreciation.

Historically, this pattern has emerged when markets rely more on momentum and liquidity rather than broad conviction. While this does not signal an immediate reversal, it does imply that Bitcoin’s upside is becoming more sensitive to shifts in sentiment.

Ethereum finds buyers during brief periods of stress

Ethereum’s on-chain behavior stands in contrast. A short dip into historically stressed valuation territory was quickly met with support, indicating that long-term investors were willing to defend price rather than exit.

This type of reaction has previously aligned with stabilization phases rather than extended drawdowns. The data points to resilience, though not to aggressive expansion, as Ethereum appears to be consolidating rather than overheating.

XRP continues to lose structural support

XRP shows a more persistent deterioration beneath the surface. Its valuation relative to holder cost basis has been trending lower for an extended period, reflecting shrinking unrealized gains and fading conviction.

Even when price attempts to recover, the lack of underlying reinforcement suggests that rallies may struggle to sustain momentum unless participation meaningfully improves.

Cardano drifts into long-term accumulation territory

Cardano is positioned at the opposite end of the spectrum. Its valuation has already moved below levels typically associated with fair value, a zone that has historically coincided with accumulation rather than distribution. In past cycles, similar conditions have reduced selling pressure while attracting longer-term positioning.

Although this does not guarantee a near-term rebound, it suggests that downside risk may be more limited compared with assets trading well above holder cost.

A market no longer moving as one

Taken together, the data suggests that the crypto market is entering a more selective phase. Bitcoin remains strong on the surface but shows signs of internal strain, Ethereum appears structurally defended, XRP continues to weaken, and Cardano may be transitioning into a value-driven setup.

As the cycle matures, on-chain valuation signals imply that future performance could depend less on broad market momentum and more on asset-specific fundamentals.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.