Bitcoin Enters a Danger Zone as Investor Profits Collapse – What’s Next?

Bitcoin’s on-chain profit metrics are sliding back into territory that has historically appeared near the end of bear markets, setting the stage for a decisive period that could shape the next phase of the cycle.

While price action alone may appear relatively contained, deeper blockchain data suggests that investor stress is quietly building beneath the surface.

- Bitcoin’s adjusted unrealized profit metrics are falling to levels historically seen near major cycle turning points

- Late-arriving investors are under increasing pressure as paper gains continue to evaporate

- Investor behavior during this phase is likely to determine whether Bitcoin stabilizes and recovers or slips into a deeper bearish trend

According to analysis shared by on-chain researcher Darkfost, unrealized profits and losses across the Bitcoin network are compressing rapidly following the latest all-time high. The shift reflects mounting pressure on late-arriving investors, many of whom entered near peak levels and are now watching paper gains fade as momentum stalls.

Unrealized profits are fading after the all-time high

Since Bitcoin peaked, the balance between unrealized profits and unrealized losses has steadily deteriorated. This does not necessarily imply an immediate crash, but it does signal a cooling market where optimism is being tested. Historically, these phases tend to coincide with elevated emotional stress, particularly among short-term holders who are more sensitive to drawdowns.

Late-cycle buyers are typically the first to feel discomfort when upside momentum weakens. As price fluctuates sideways or pulls back, unrealized losses begin to accumulate, and confidence can erode quickly. On-chain data now shows that this process is already underway, echoing conditions seen near previous macro inflection points.

What the adjusted NUPL indicator is showing

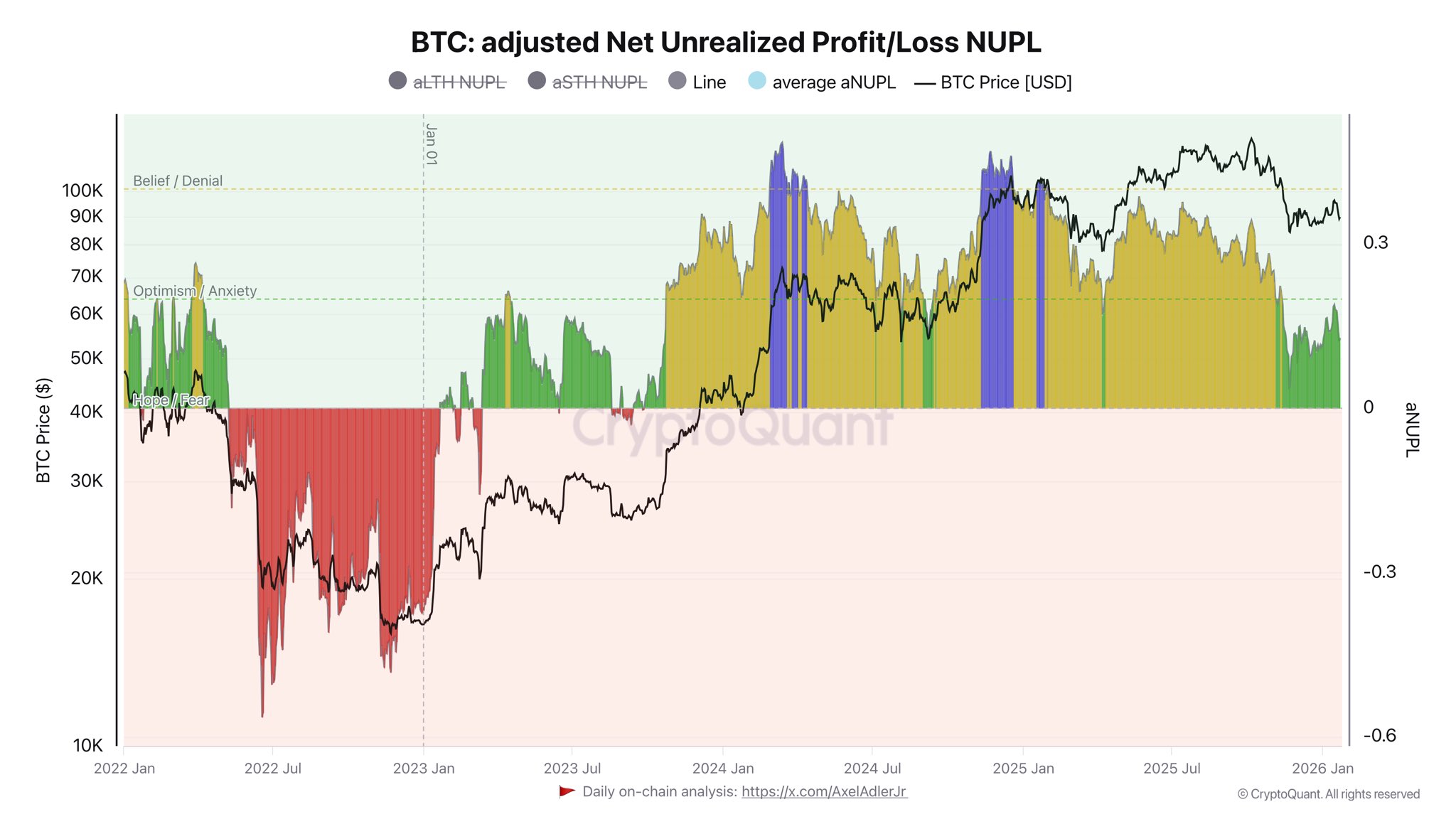

At the center of this analysis is an adjusted version of the Net Unrealized Profit/Loss metric, often referred to as aNUPL. Unlike the traditional NUPL indicator, this version incorporates the realized capitalization of both short-term holders and long-term holders, comparing that combined figure to Bitcoin’s market capitalization. The result is then smoothed to better reflect broad investor sentiment rather than short-term noise.

This adjustment matters because it captures behavior across different cohorts of the market. Long-term holders tend to be less reactive and often anchor cycle bottoms, while short-term holders amplify volatility during transitional phases. When both groups show declining unrealized profits simultaneously, it often signals that the market is approaching a psychological tipping point.

Recent readings place aNUPL near levels that, in past cycles, appeared during the late stages of bear markets or during sharp mid-cycle resets. Importantly, these zones have not always marked final bottoms. Instead, they have frequently preceded periods where the market had to “choose” a direction based on investor response.

A market defined by behavior, not price

What makes the current setup particularly important is that it is driven more by sentiment than by dramatic price movement. Bitcoin does not need to collapse for stress to build. Extended consolidation, failed breakouts, and repeated rejections can slowly drain confidence, especially when unrealized profits continue to shrink.

Historically, when the market reaches this type of compression, investors tend to fall into one of two camps. Some choose to hold through the discomfort, viewing declining unrealized profits as an opportunity to accumulate at more favorable levels. This behavior can absorb selling pressure and eventually support a renewed bullish phase.

Others capitulate. As losses deepen and patience wears thin, selling accelerates, liquidity thins out, and price weakness feeds on itself. When that dynamic dominates, the market often transitions into a broader bearish regime rather than a short-lived correction.

Why the next phase matters for the broader cycle

This period is critical because it often determines whether Bitcoin enters a prolonged downturn or manages to reset before resuming its long-term uptrend. In previous cycles, similar conditions either marked the final shakeout before powerful rallies or the opening chapter of extended bear markets.

From an on-chain perspective, the key variable is not price alone but how investors respond to pressure. Continued monitoring of realized and unrealized profit metrics, holder behavior, and supply dynamics will be essential in the weeks ahead.

Bitcoin, for now, appears less focused on chasing new highs and more focused on testing conviction.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.