Are you feeling lost in the sea of buzzwords and technical jargon surrounding NFTs? Fear not, as we’ve got you covered with our comprehensive guide to NFTs explained for dummies.

Non-Fungible Tokens may sound intimidating, but in reality, they are a fascinating and innovative way to create, trade, and own digital assets.

In this article, we’ll answer all your burning questions, from “What is an NFT?” to “How to buy them?” and everything in between.

What is an NFT? An NFT Definition for Dummies

An NFT is a unique digital asset that’s stored on a blockchain. Like other cryptocurrencies such as Bitcoin and Ethereum, NFTs use blockchain technology to establish ownership and authenticity. So, an NFT comes with proof of ownership. But unlike other cryptocurrencies, NFTs are not interchangeable – they represent a unique digital asset.

Imagine that you collect and have a baseball card that’s very rare and valuable. It’s not just any baseball card – it’s a one-of-a-kind card that no one else in the world has. Because it’s so unique and special, it’s worth a lot of money to collectors and fans.

Now, imagine that instead of a physical baseball card, you have a digital version of it. And instead of just showing a picture of the card, you have a unique code proving you own the original, one-of-a-kind digital version. That code is an NFT or non-fungible token.

NFTs can be used to define all kinds of digital assets, such as artwork, music, videos, and even tweets. For example, in March 2021, the digital artist Beeple sold an NFT of his artwork for a record-breaking $69 million at a Christie’s auction.

NFT Characteristics

Non-fungible tokens have three defining characteristics that give them value and differentiate them from other tokens or digital assets:

- Uniqueness – NFTs can offer metadata that identifies the asset as a unique and one-of-a-kind item, distinguishing it from other assets.

- Rarity, also known as scarcity – Unlike traditional tokens, their unique nature limits the supply of NFTs. Once an NFT is created and registered on the blockchain, it cannot be duplicated or replicated, making it highly prized by collectors. The value of NFTs is based on their rarity, as only one person can own an NFT at any given time.

- Indivisibility – Most NFTs cannot be divided or broken down into smaller units. Unlike cryptocurrencies such as Bitcoin, which are fungible and can be divided into smaller denominations, NFTs are unique and indivisible. However, note that there are still some fractional NFTs on the market in specific networks.

What are Fractional NFTs?

Fractional NFTs (F-NFTs) are a type of non-fungible token that can be divided into smaller pieces so that multiple people can claim ownership of a portion of the same NFT. This is done using a smart contract that generates a fixed number of tokens linked to the original NFT.

These tokens represent each holder’s ownership percentage and can be exchanged or traded on NFT-supported exchanges. Ethereum’s ERC-721 standard is the most popular choice for fractionalizing NFTs.

The process involves locking the NFT in a smart contract that splits it into multiple fragments in the form of ERC-20 tokens, each representing partial ownership of the whole NFT. Blockchains like Solana, Polygon, and Cardano support NFT fractionalization with lower gas fees and faster transaction speeds.

Fractionalization makes owning expensive NFTs more affordable and accessible to a larger pool of investors.

How are NFTs created?

Non-fungible tokens (NFTs) are created using a process called “minting,” where the item’s information is recorded on a blockchain. This process involves using smart contracts to assign ownership and manage transferability.

Each NFT is given a unique identifier linked to a blockchain address that shows who the owner is. This information is publicly available, making it easy to trace the item’s ownership. Even if thousands of NFTs are made of the same item, each one has a unique identifier that makes it different from the rest. Think of it as a digital collector’s item you can own and trade with others.

Benefits of NFTs

Ownership

NFTs allow for the ownership of digital assets, which was not possible before. In the past, digital art, music, and other digital items were easily duplicated and shared without the owner’s permission. With NFTs, the owner has the exclusive right to use, sell, or distribute the asset.

Authenticity

Some NFTs are also incredibly valuable because of their authenticity. Because they are stored on a blockchain, they cannot be duplicated or tampered with, making them an incredibly secure way to store and transfer digital assets.

This is especially important for artists and creators who can use NFTs to prove the authenticity of their work and prevent others from stealing their creations.

Transferability

Another benefit of NFTs is their transferability, meaning they can be sold or traded like any other asset. Unlike in-game objects or other digital assets that are limited to a particular game or platform, NFTs can be transferred between different platforms and even sold for real money.

This means that players can invest in in-game items that they can later sell or trade, giving them more control over their gaming experience.

Smart contracts are a crucial component of NFTs and make ownership transfers simple. Smart contracts specify the terms and conditions that must be met before ownership can be transferred, ensuring that both the buyer and the seller are protected.

Is There a Need for NFT?

Of course, there is! You may not live in an ex-communist country, but you surely heard at least once of nationalization.

Although the government is the one protecting your rights, across history, we notice that the rulers did sometimes confiscate properties from their citizens just because they could. And once the situation changed, it was nearly impossible to prove who was the rightful owner in one or more generations.

These days, the government is less likely to take the initiative in confiscating stuff from its citizens. However, we still hear of nasty gangs stealing and modifying papers to expand their wealth at the expense of regular citizens.

However, we see governmental institutions investing in security to improve the safety of their centralized ledgers. But an event like the one in Haiti in 2010 shows us that it is still not enough.

SIDENOTE. In 2010, an earthquake devastated Haiti and destroyed the municipal buildings containing documents regarding land ownership. After the destruction, citizens had to reclaim their land without proof of ownership, and the rebuilding became complicated.

Going inside the digital world, we discover that the definition of ownership has changed drastically. Thanks to the internet, you can watch movies, get software, and play video games without going to a store to buy a CD or a DVD.

However, if you have ever used Netflix, you already know you cannot close your account and just take all the movies to move to Amazon Prime.

And if you have ever used Steam, you may have realized that by requiring you to be logged in, you are actually at the mercy of an external middleman to play the games and use the software you paid for with your own money.

Popular NFTs Use Cases

Art and Collectibles

NFTs are widely used to represent unique and rare pieces of digital art, as well as physical artwork. For example, the NFT artwork “Everydays: The First 5000 Days” we mentioned before, created by Beeple, was sold for $69 million at Christie’s auction in March 2021. Additionally, musicians and bands have started releasing NFTs as collectibles, including Kings of Leon’s album “When You See Yourself” and Grimes’ digital art or NFT collection “WarNymph.”

Gaming

NFTs are increasingly being used in gaming to represent in-game items, characters, and assets. For example, the popular game Axie Infinity has an economy built around NFTs, where players can earn and in-game trade assets using cryptocurrency.

Another example is Decentraland, a virtual reality platform where users can buy, sell, and develop virtual real estate using NFTs.

Identity and Authenticity

NFTs can be used to prove ownership and authenticity of physical and digital assets. For example, the fashion brand RTFKT Studios released limited edition sneakers as NFTs that are linked to physical shoes. This allows buyers to verify the authenticity of their physical shoes using the corresponding NFT. Another example is Verisart, a platform that uses NFTs to create a digital certificate of authenticity for physical artwork.

Sports

NFTs are becoming increasingly popular in the sports industry as a way to represent unique moments, collectibles, and memorabilia. For example, NBA Top Shot allows fans to buy and trade NFTs defining memorable basketball moments, such as a LeBron James dunk or a Steph Curry three-pointer. Soccer clubs like Paris Saint-Germain and AC Milan have also released NFTs to represent limited-edition merchandise and digital collectibles.

Charity and Fundraising

NFTs can be used as a fundraising tool for charity organizations. For example, the NFT artwork “CryptoPunk 3100” was sold for $7.5 million at a Christie’s auction in May 2021, with a portion of the proceeds going to the humanitarian organization GiveDirectly. The digital artist Mad Dog Jones also released a series of NFTs to raise money for a mental health charity called SickKids.

Real Estate

NFTs can be used to represent ownership of physical real estate and virtual real estate in online platforms. For example, the company RealT allows users to invest in fractional ownership of physical real estate properties using NFTs.

Ticketing

NFTs can be used as digital tickets for events, concerts, and sports games. For example, the musical artist Shawn Mendes released NFT tickets for his Wonder: The Experience Tour. This allows fans to buy and sell tickets on the blockchain, as well as collect unique digital memorabilia associated with the event.

The sports team FC Barcelona also released NFT tickets for a game against Valencia, which included access to VIP experiences and exclusive merchandise.

The Most Popular Smart Contracts for NFTs

Currently, the most widely used smart contracts for minting and launching an NFT are those on the Ethereum, Solana, and Cardano networks.

Ethereum

Ethereum is a network that has developed a set of token standards known as ERC (Ethereum Request for Comment) to enable interactions between smart contracts and applications. Two of the most important smart contract standards for NFTs are ERC-721 and ERC-1155.

ERC-721

Most NFTs presently exist on the Ethereum blockchain, using Ethereum’s ERC-721 standard. ERC-721 is a revolutionary token standard that introduced the concept of non-fungible tokens (NFTs) to the world. This standard allows NFTs to be transferred between accounts and traded for other currencies.

ERC-721 also enables users to identify the total supply of a set of NFTs available on the network and approve the number of tokens within an account that a third-party account can transfer. NFTs based on ERC-721 are most commonly used for digital artwork but can be used for music and blockchain-based games.

ERC-1155

ERC-1155 is a multi-token standard that provides a standard interface for smart contracts managing multiple types of tokens. This standard can support an infinite quantity of tokens in a single contract, underpinning fungible, semi-fungible, and NFTs, which can transition between both of the former during its lifecycle.

It improves upon the functionality of ERC-721 by increasing its efficiency and correcting evident implementation errors. ERC-1155 also has a security function that verifies a transaction’s validity, allowing tokens to be returned to the issuer if a transaction fails. This function safeguards against exploitation and eliminates the anxiety of potential user mistakes, such as sending tokens to the wrong address.

Both ERC-721 and ERC-1155 have been essential in driving the growth of the NFT market and expanding the possibilities of blockchain technology. With the help of these smart contract standards, developers and creators can continue to push the boundaries of what NFTs can accomplish in various industries.

Cardano

Cardano is a blockchain platform with two layers, the Cardano Settlement Layer (CSL) and the Cardano Computation Layer (CCL). The CSL is used for transferring ADA (Cardano’s native currency) and recording transactions, while the CCL contains the smart contract logic for developers to move money.

Cardano is built on Haskell, a programming language that serves as the basis for Plutus, Cardano’s programming language for smart contracts. Marlowe, a language used specifically for building smart financial contracts, is also powered by Haskell.

There are many popular NFT projects on Cardano, such as CardanoKidz, Spacebudz, Professor Cardano, Crypto Kitties, and CryptoMayor. In October 2021, the first Cardano-powered NFT and digital collectibles, a DeFi platform called Cadalabs NFTs & Crypto Collectibles Market, was released. This platform aims to allow consumers to produce and brand their digital products independently.

Users who want to start with Cardano can discover its APIs through Cardano tools, which are listed as a free community resource on the official Cardano website.

Solana

The Solana blockchain is unique because it combines proof-of-stake (PoS) and proof-of-history (PoH) mechanisms, making transaction verification faster and less expensive. Unlike other blockchains, PoH allows validators to keep their clocks and validate timestamps more efficiently. Solana’s smart contracts, called programs, are written in Rust, C, and C++ and are published on the chain. The transaction cost on Solana is relatively low, approximately $0.00025.

Solana has already become home to several notable NFT projects, including Degenerate Ape Academy, Solana Monkey Business, SolPunks, and Frakt. The blockchain also enables the creation of advanced marketplaces such as Solanart.io, DigitalEyes.market, Solsea, and Megaplex.

Popular NFT Marketplaces

With the rise of non-fungible tokens (NFTs) as a new way to own and trade digital assets, there’s been an explosion of marketplaces catering to creators and collectors. If you’ve ever wondered “Where can I buy these NFTs?”, these marketplaces are the best solution. Here are some of the most popular ones to get started:

OpenSea

OpenSea is a peer-to-peer platform that boasts an extensive collection of rare digital items and collectibles. It allows creators to sell their NFTs and buyers to browse and purchase them using cryptocurrency. The site is user-friendly, with an easy-to-navigate interface that allows you to filter and sort pieces by sales volume, price, and more. OpenSea also features a robust community of creators and collectors, making it a great place to discover new artists and connect with like-minded individuals.

Rarible

Identical to OpenSea, Rarible is an open marketplace where artists and creators can issue and sell their NFTs. Rarible’s unique feature is the RARI token, which gives holders a say in platform features such as fees and community rules. This democratic approach to NFT trading means that buyers and sellers have more control over the marketplace’s direction. Rarible also offers a wide range of NFT categories, from digital art and music to gaming and memes.

Foundation

Foundation is a premier NFT marketplace that requires artists to receive “upvotes” or an invitation from fellow creators to post their art. The site’s exclusivity and high cost of entry make it an attractive platform for high-caliber artwork. For instance, Nyan Cat creator Chris Torres sold the NFT on the Foundation platform. While the entry barrier may be high, the quality of art on the site is impressive. Foundation also offers a curation process that showcases only the best art.

The Most Popular Crypto Collectibles

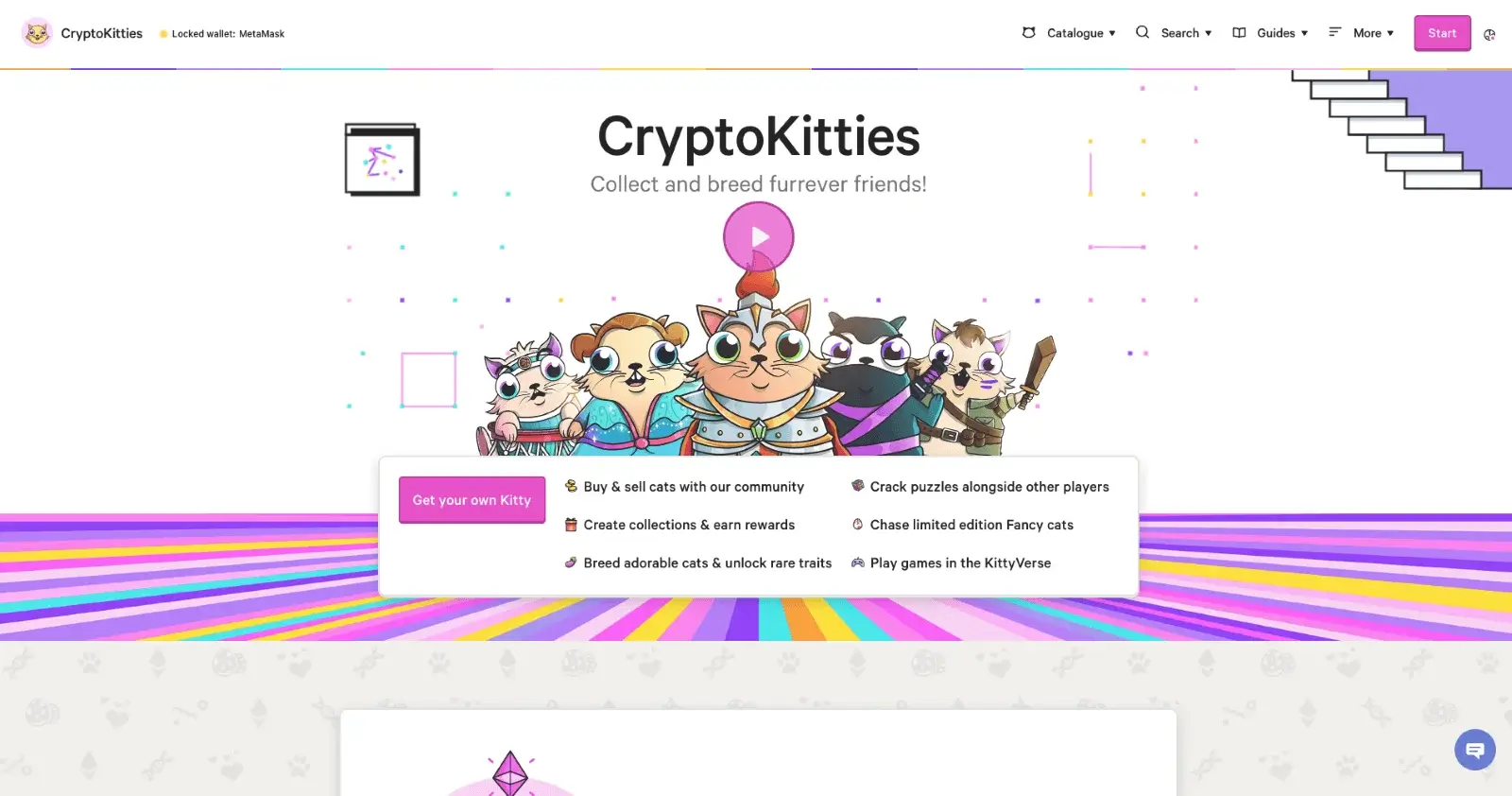

CryptoKitties in CryptoKitties

CryptoKitties is the most popular crypto game built on top of the Ethereum blockchain, which uses crypto collectibles. It has the highest all-time volume of $36,557,745.64, and besides the base game, it also offers many games and experiences built on top of the platform.

Land in Decentraland

Decentraland is the second most popular crypto game, with an all-time volume of $21,772,371.07. Also, it is listed on CMC as the 6th top NFT by market cap.

This game is a virtual reality hosted on the Ethereum blockchain in which users can own Land as crypto-collectibles and create, experience, and monetize content and applications.

The main selling point is the idea of permanently owning LAND in virtual reality and having entire control over it. The community members control the published content on their portions of land, which is identified by a set of cartesian coordinates (x,y).

Heroes and Items in MyCryptoHeroes

MyCryptoHeroes is the third most popular crypto game, with an all-time volume of $4,401,045.14. It is an RPG-style game based on the Ethereum blockchain. The game has quick battle cycles and gameplay that involves creating teams of heroes. MyCryptoHeroes uses ERC-721 tokens to create crypto collectibles in the form of Uncommon Heroes and Original Extension unique items.

How to Buy an NFT?

Now that you know where you can buy an NFT and the best options, let’s see the straightforward process you must go through to buy. Note that this process is general and summarizes the buying process on the above-mentioned platforms.

- Choose an NFT Marketplace

- Create a Wallet: Once you’ve chosen a marketplace, you must create a digital wallet to store your NFTs. The most popular wallet for NFTs is MetaMask, but other options are available, such as Trust Wallet, Coinbase Wallet, and MyEtherWallet. It’s essential to choose a wallet that is compatible with the marketplace you’ve chosen.

- Add Funds to Your Wallet: After creating your wallet, you’ll need to add funds to it. Most NFT marketplaces require you to pay for NFTs with cryptocurrencies, such as Ethereum (ETH) or Bitcoin (BTC). You can buy these cryptocurrencies on a cryptocurrency exchange, such as Coinbase, Binance, or Kraken.

- Find the NFT You Want to Buy: Once you’ve added funds to your digital wallet, you can start looking for the NFT you want to buy.

- Make a Bid or Buy the NFT: After finding the NFT you want to buy, you can either bid or buy it outright. If you make a bid, you’ll need to wait for the seller to accept it. If you buy it outright, the NFT will immediately be transferred to your wallet.

- Transfer the NFT to Your Wallet: Once you’ve bought the NFT, you’ll need to transfer it to your wallet. To do this, you’ll need to copy the contract address and paste it into your wallet’s “add token” section. The NFT will then be added to your wallet, and you’ll be able to see it in your collection.

Before buying an NFT on any platform, it’s essential to do your research carefully. While these marketplaces have many creators and collectors, not all NFT listings and creators are equal. Some artists have been victims of impersonators who have listed and sold their work without permission. It’s also important to note that verification processes for creators and NFT listings aren’t consistent across platforms. Some are more stringent than others, and buyer protections may be sparse. Always remember the old adage “caveat emptor” (let the buyer beware) when shopping for NFTs.

FAQ

What does NFT stand for?

NFT stands for Non-Fungible Token. It’s a unique digital asset representing ownership of a specific item or piece of content on a blockchain network.

What are Crypto Collectibles?

Crypto collectibles are digital collectibles based on blockchain technology known as non-fungible tokens (NFTs). Each collectible is unique and stored on a smart contract, allowing them to be bought, sold, and traded based on rarity and demand. They have evolved into a sub-industry with marketplaces for easy buying and selling. Some popular crypto collectibles are used in crypto games like CryptoKitties, where players can buy, breed, and sell unique cats with varying traits, with rarer traits making them more valuable. The value of these collectibles is driven by the human desire to possess rare and unique items, similar to traditional collectibles like stamps and baseball cards.

How much is an NFT?

The value of an NFT can vary greatly depending on several factors, including the artist’s or creator’s popularity, the asset’s uniqueness, and the demand from buyers. Some NFTs have sold for millions of dollars, while others have sold for just a few dollars.

What is an NFT art?

NFT art refers to digital artwork that is verified on a blockchain network through the use of an NFT. This allows the artwork to be authenticated as a one-of-a-kind piece and gives the owner of the NFT ownership rights over the digital asset. NFT art has become a popular way for artists to monetize their digital creations and for collectors to own unique digital art pieces.

NFT for Dummies Bottom Line

So, NFTs may seem like a complex topic, but with a little bit of knowledge, anyone can understand the basics. From their origins in blockchain technology to their use in the art and entertainment industries, NFTs have the potential to revolutionize the way we think about digital ownership. As more creators and investors jump on the NFT bandwagon, it’s important to stay informed about what an NFT is and how they work.

With this NFT for dummies guide, we hope to have demystified the world of non-fungible tokens and provided a solid foundation for you to explore this exciting new frontier. We wish you the best of luck on your NFT journey!