In the past few years, Revolut has made a name for itself in digital banking by keeping things simple and innovative. But what makes Revolut a good choice for people interested in crypto? With so many apps out there—some trustworthy, others not—it can be hard to find one that does it all. Revolut aims to be that go-to app, giving you a safe and easy way to explore crypto.

In this guide, we’ll walk you through everything Revolut offers in the crypto world. From its services and security features to fees and other unique perks, we’ll cover it all. By the end, you’ll have a clear picture of how to get started with crypto using Revolut.

Let’s dive in!

Revolut Crypto Key Takeaways

- Convenience and User-Friendliness: Revolut’s mobile app offers a seamless user experience for managing crypto assets.

- Multiple Supported Cryptocurrencies: The platform supports diverse cryptocurrencies, allowing you to diversify your portfolio.

- Security and Regulation: Revolut employs robust security measures and is regulated by various financial authorities, ensuring the safety of your funds.

- Limited Availability: Revolut’s services may not be available in all regions, so checking its availability in your location is crucial.

What is Revolut?

Revolut is one of the most well-known digital banks. Its popularity has risen in recent years (along with numerous other innovations) due to its crypto features, easy accessibility, and security measures. Launched in 2015 by Nik Storonsky and Vlad Yatsenko, Revolut offers various services, from traditional banking to cryptocurrency trading.

One of Revolut’s main features is its ability to help you manage your money more effectively. You can easily track your spending, set budgets, and even automate savings. The app also offers a variety of investment options, including stocks, ETFs, and cryptocurrencies.

Overall, Revolut is a convenient and affordable way to manage your finances. Whether you’re looking to save money, invest, or travel, the app offers something.

Revolut: A Comprehensive Overview

Revolut Details:

- Name: Revolut Ltd.;

- Founded: 2017;

- Headquarters: London, England.

Launch Date of Crypto Platform:

- Revolut launched its cryptocurrency trading platform in 2017.

Additional Features and Benefits:

- Instant Transfers: Revolut allows for fast and efficient transfers between your crypto and fiat wallets;

- Crypto Pockets (Vaults): You can create separate pockets for different cryptocurrencies to organize your holdings better;

- Metal Cards: Revolut premium metal cards offer additional benefits, such as cashback on cryptocurrency purchases and exclusive perks;

- Crypto Rewards: Some Revolut plans offer cashback or other rewards on cryptocurrency purchases;

- Market Analysis: The app provides real-time market data, charts, and analysis to help you make informed trading decisions.

Important Considerations:

- Regulations Compliance: Revolut is regulated by various financial authorities, including the Financial Conduct Authority (FCA) in the UK, under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations, and is licensed by the European Central Bank and is regulated by the Bank of Lithuania;

- Security: The platform employs advanced security measures to protect user funds, such as two-factor authentication and cold storage;

- Tax Statements Feature: With a partnership with a third party (Koinly), users can download and use it across 100 countries, showing a breakdown of all capital gains, transactions, etc.;

- Learn and Earn Content: Educational courses on crypto and finance with potential rewards. Available in the UK (no rewards), EEA (incl. CH), SG, AU, and NZ.

- Customer Support: Revolut offers 24/7 customer support to assist users with any questions or issues.

The Revolut Crypto Services

Revolut is mainly known for its banking services, so it extended its offerings to all crypto investors and traders. Thus, Revolut offers crypto services.

So, to offer robust crypto transactions and services, Revolut designed a mobile app. The Revolut app easily supports crypto trading with a user-friendly interface and a secure user experience.

Acquiring over 45 million users globally and holding over $15.5 billion in customer deposits, Revolut Bank has positioned itself as a solid crypto-friendly bank. It integrates traditional banking and investment services and caters to a broader range of customers’ financial needs.

But let’s get into the details!

Revolut Crypto Features At-a-Glance

- Wide range of supported crypto assets;

- Buy, sell, deposit, and withdraw digital assets;

- Hold crypto assets;

- Easy transfer of crypto assets to other Revolut users;

- Pay for goods with crypto assets from your Revolut Card;

- Crypto staking;

- Revolut X – crypto exchange.

Revolut Crypto: In-Depth Features

As mentioned, Revolut goes above and beyond to support the crypto community. It offers everything from basic crypto services such as buying, selling, and withdrawing crypto to paying in crypto with its Revolut Card, staking crypto, and more.

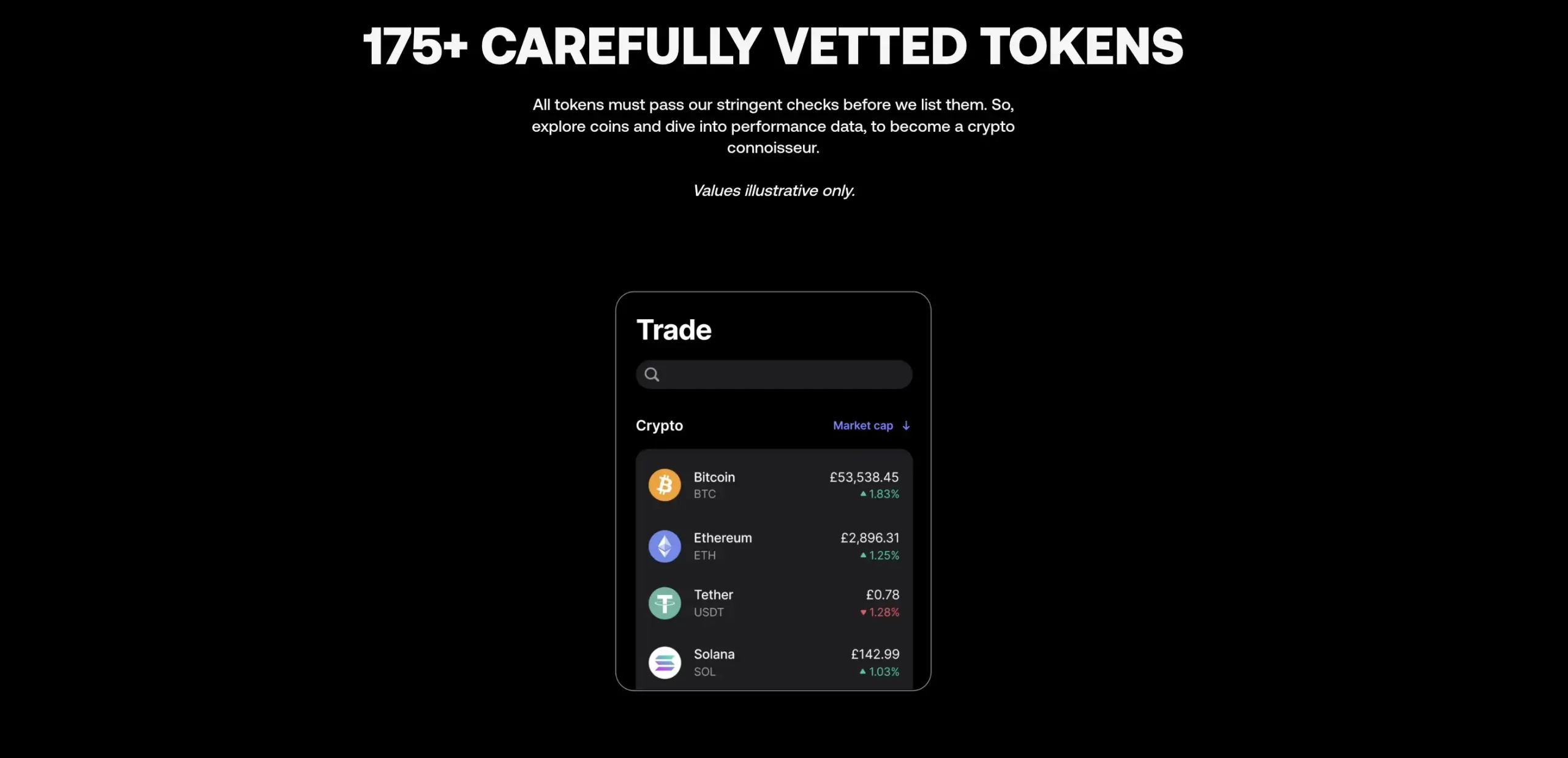

1. Wide Range of Supported Crypto Assets

For retail users, Revolut offers a range of crypto assets. Retail customers can trade over 200 cryptocurrencies (208 tokens as of September 2024), including major assets like Bitcoin (BTC), Ethereum (ETH), and others, using Revolut’s web and in-app platforms.

Also, when discussing the Revolut Business account, as of September 2024, there are over 170 tokens, with plans to increase this number to over 200 soon. Using it, you can sell or buy crypto, such as:

- Bitcoin (BTC);

- Ethereum (ETH);

- Solana (SOL);

- Polygon (MATIC);

- Polkadot (DOT);

- Cardano (ADA);

- Ripple (XRP) and *others (including ERC-20 tokens).

*The entire list of supported cryptocurrencies is available on the Revolut official website.site.

2. Buy, Sell, Deposit, and Withdraw Digital Assets

The Buying Crypto Assets Process

For Revolut users who want to buy crypto within their Revolut desktop or Revolut app, you can use money or e-money through your Revolut account or the available crypto assets.

Also, there are several ways to purchase cryptocurrencies:

- Buy Now option from your Revolut account;

- Set up an Auto Exchange, meaning you’ll buy crypto assets in the future;

- The Recurring Buy option to buy cryptos at regular intervals in the future;

- Buy multiple cryptos through a Collection of Crypto Assets;

- The Spare Change Round-up feature auto rounds up your Revolut Card purchase.

Selling Cryptos

Selling crypto assets through Revolut is easy, mainly when you can sell them at the exchange rate at the time, sell crypto assets for money, e-money, or your crypto asset pocket.

Depositing and Withdrawing Crypto Assets

Depending on your eligible location and country, and if you have an eligible plan, you can deposit cryptos into your Revolut account from an external wallet.

No fees will be applied for crypto deposits, but depending on your crypto wallet or third-party service provider, you may be charged a fee for the transaction as it is a withdrawal from that location.

You can look up the Receive section to check the supported cryptocurrencies available for receiving. It is essential to understand that if you receive unsupported currencies, they will be permanently lost.

Your Revolut crypto deposits might be initially placed in a unique wallet. Revolut then moves these funds to our main account to provide better security and accessibility.

You can deposit either in cryptocurrency or fiat to Revolut. To complete the deposit, go to your Revolut app, click the Add Money button, select your preferred fiat currency, choose the payment method, and enter the top-up amount.

Network fees fluctuate occasionally, but to ensure that Revolut can process your crypto deposits efficiently and minimize fees, they may require a minimum deposit amount for certain coins. Revolut also sets minimum deposit amounts for specific cryptocurrencies to ensure efficient processing and minimize network fees.

Please note that purchasing crypto assets directly in the app doesn’t count towards this minimum.

There’s no limit to the amount of cryptocurrency you can deposit. However, Revolut may restrict the amount you can withdraw, which we’ll specify before confirming your request.

Also, regarding the Revolut withdrawal, there are many ways to withdraw crypto or fiat from your Revolut account.

For withdrawals, fees start from £1 and can go up to £3 GBP, depending on the blockchain. Network fees may also apply. Additionally, Revolut supports multiple native blockchains, including Bitcoin, Ethereum, Solana, and Avalanche. For USDT, Revolut currently supports the TRON blockchain and will add Ethereum blockchain support in Q4 2024.

In certain countries, withdrawals can go up to £250k daily and £1m monthly, though restrictions may apply based on location when withdrawing crypto to an external wallet.

ATM Fees Withdrawal: While you can withdraw from ATMs, the company sets monthly limits based on your plan, usually between £200 and £2,000. Any withdrawal outside of this limit will be allocated a 2% fee of the transaction value.

3. Holding Cryptocurrency

When you use Revolut crypto services, you give them the legal title to your crypto assets, but you remain the beneficial owner of the digital assets.

As the owner, you have complete control over your crypto assets, and Revolut will only act based on your instructions for selling, transferring, or withdrawing them, but you cannot directly transact or move the assets yourself.

4. Transferring Cryptocurrencies

You can transfer cryptocurrencies to other Revolut users who have already been onboarded using the Revolut app. As these transfers occur within the Revolut platform, they are often referred to as “off-chain transfers.”

5. Spending Throughout the Revolut Card

Did you know that you can use the Revolut Card for everyday spending?

For many users, this is an excellent feature that offers peace of mind, primarily when Revolut instantly converts your crypto balance into the equivalent fiat amount to pay for cryptocurrency transactions.

Regarding the crypto fees, an exchange rate will be applied at the time of the transaction, as will any crypto fees applicable to your subscription plan.

Once the conversion rate is done, your payments will be processed by the Revolut account.

However, if you request a refund from the merchant, you’ll receive the refund in fiat currency in your Revolut account. The credit will be applied to the original crypto asset balance if the transaction is pending and later reversed. Keep in mind that crypto asset values can fluctuate.

6. Crypto Staking

Crypto enthusiasts in eligible locations can take advantage of Revolut’s staking option, available exclusively to retail users (not currently available for business users).

As you already know, crypto staking is a process by which you can support the operation of a blockchain network by participating in the crypto transactions validation process of a Proof-of-Stake network. In return, you’ll be rewarded for your hard work.

Tokens Supported for Revolut Crypto Staking

- Ethereum (ETH);

- Cardano (ADA);

- Polkadot (DOT);

- Solana (SOL);

- Polygon (POL, prev. MATIC);

- Tezos (XTZ).

Please note that Revolut Business currently does not offer remittances or staking products. Timelines for remittances are expected in Q4 2024, while the staking timeline is to be confirmed (TBC).

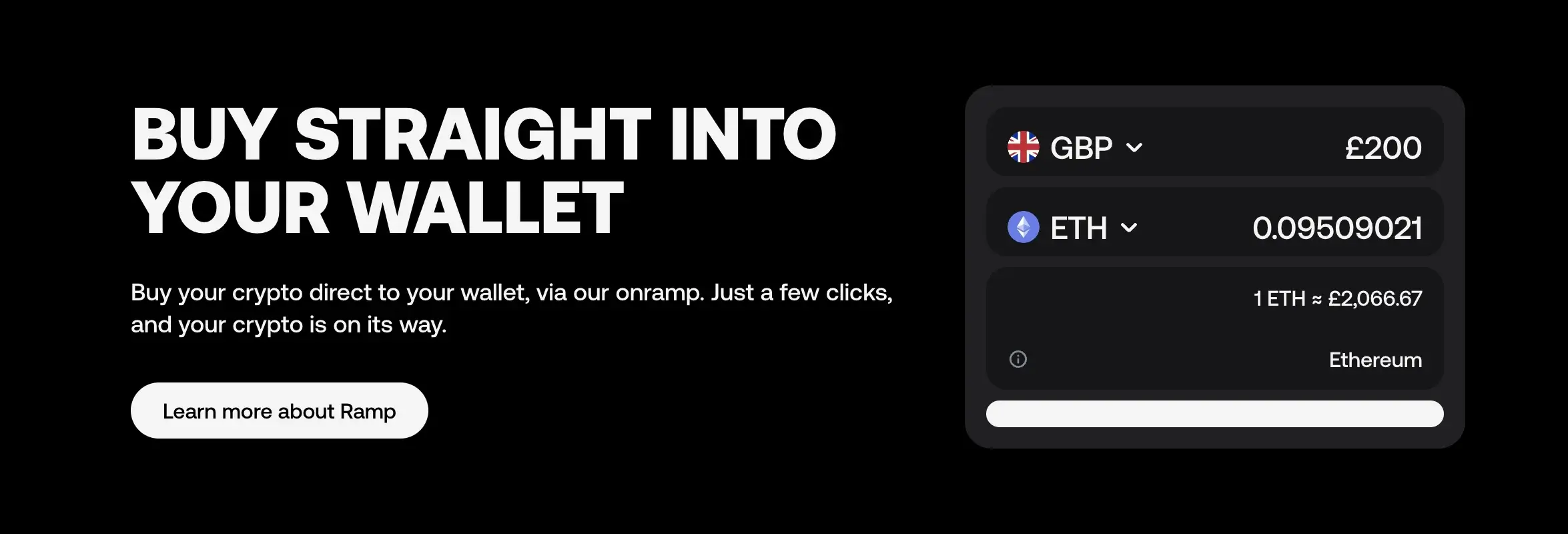

7. The Revolut X – Cryptocurrency Dedicated Exchange

The digital bank account Revolut introduced us to its cryptocurrency exchange, Revolut X, in May 2024. Revolut X targets advanced traders and is a separate desktop product with advanced crypto features (yes, it is only on the web at the moment, but they plan to launch a mobile app in 2024).

It offers analytical tools and lower fees, such as the 0% and 0.09% maker trader service fees. Users can trade using limits, market orders, and lower spreads.

Revolut X is accessible to Revolut retail account holders and offers real-time trading, advanced analytics, and integration with TradingView charts.

These tools give crypto enthusiasts insights into market trends, top-traded tokens, and gainers. To use Revolut X, you must first have a main Revolut account and then download the app.

The launch of Revolut X underscores Revolut’s dedication to the crypto industry. It follows the recent introduction of Revolut Ramp and the partnership with MetaMask, which allows users to purchase crypto directly within their wallets.

Moreover, given Revolut’s Trust Pilot review and positive note, most users seem to like Revolut’s crypto services, easy-to-follow interface, and overall customer support.

Revolut Cryptocurrency Exchange Features

1. Swapping Crypto

If you want to swap cryptos so quickly, then the Revolut cryptocurrency exchange is the place to do it. You can exchange your cryptos for your favorite tokens in just a few moments.

2. Selling Digital Assets for Fiat Currency

We could safely say that this is the main feature of this cryptocurrency exchange as it allows you to sell your cryptos for fiat quickly. Moreover, you can sell them for any available fiat option, thus becoming a good cash-out option.

3. Multiple Order Types

This surprised many traders and investors, but the Revolut exchange supports multiple order types, such as market orders, stop orders, and limit orders.

Revolut Crypto Wallet: Features

Revolut’s crypto wallet allows users to store, transfer, and swap cryptos, monitor their assets, and even set up price alerts. Now, let’s discuss security, supported cryptocurrencies, and service fees.

Revolut Wallet: Security

When discussing the security of your cryptos, the Revolut wallet integrates various security measures to store your funds in cold storage and keep your crypto assets away from potential online threats.

Revolut Wallet: Supported Cryptocurrencies

This cold storage wallet can hold over 200 digital assets for retail users and over 170 for business users, from small caps to some of the most popular ones, ensuring you can easily diversify your portfolio.

Revolut Wallet: Fees

It is important to understand that you must cover the network fee whenever you want to send or receive money on Revolut. Also, you will be charged for withdrawals to an external wallet.

Revolut Crypto: User Experience

These days, user experience is mandatory for any digital product, regardless of its type. Thus, Revolut considers this and creates a well-thought-out user experience.

The Revolut Website

The Revolut website is thoroughly designed with a user-centric approach, yet its features cannot be used within the website (at least not all its features).

The Revolut Mobile App

On the Revolut app, you can experience the full in-app features for crypto, fiat, card management, and more.

With an intuitive interface and easy access to multiple in-app features for both personal and business accounts, Revolut offers a seamless crypto experience.

The Revolut Customer Support

Their support team offers help center articles, chatbot assistance, and in-app live chat support.

Revolut Crypto: Pros and Cons

Revolut Pros

- Easy to use with a simple user interface;

- Supports the most popular assets;

- Multiple payment methods;

- Multiple features, both crypto and non-crypto;

- High security and fully regulated;

- Store multiple cryptocurrencies.

Revolut Cons

- You aren’t the crypto holder;

- High fees;

- Mobile-only;

- Many restricted locations and countries.

Revolut Crypto FAQs

Is Revolut Good for Crypto?

The answer is… it depends. We wouldn’t recommend it due to its high trading fees. But if you’re looking for ease of use and convenience, Revolut is the way to go. Overall, avid crypto traders should look for other dedicated exchanges, or at least at Revolut X.

Can I Buy USDT on Revolut?

Yes, Revolut customers can buy, hold, or sell Tether directly in-app Revolut.

Can I Sell Crypto from Revolut?

For all new or existing users, Revolut allows you to buy and sell crypto, including Bitcoin, Ethereum, Polygon, Solana, Dogecoin, and many others.

Can I Transfer Crypto from Binance to Revolut?

Yes! You can transfer crypto from Binance to Revolut, as well as fiat. Before, please check to see if your chosen assets are Revolut-supported. Then, copy your Revolut deposit address, log into your Binance account, and complete the digital assets transfer.

How to Send Crypto from Coinbase to Revolut?

From your Coinbase account, select the cryptocurrency you wish to send to Revolut. Copy your Revolut address and log into your Coinbase account to complete the transfer. Revolut is well known for supporting deposits from trusted major crypto services like Coinbase, Binance, Kraken, Bitstamp, Etoro, etc.

Final Thoughts

Revolut has become a major player in digital banking and cryptocurrency, providing users with a wide range of financial services.

With its secure, user-friendly platform, Revolut makes it easy to manage all the money in your account, as well as handle on-chain transactions for buying, selling, and storing crypto.

However, it’s important to be aware of the platform’s fees and limitations. Whether Revolut is the best fit for your crypto needs depends on what matters most to you. It may be worth exploring additional options if your top priorities are the lowest fees or the most advanced trading features.