These days, more than ever, crypto-friendly banks need to downturn traditional banking services that are not in line with the emerging crypto markets.

Especially as more businesses and individuals embrace the crypto world, they need blockchain banking services that seamlessly facilitate their crypto transactions.

Moreover, crypto-friendly banks are not just a trend but a practical necessity for institutional investors as they bridge traditional financial services with the emerging crypto market, allowing them to access crypto trading and secure asset management services easily.

Indeed, past events such as the Bitcoin ETF approval, Bitcoin’s surge past the $70,000 mark, the mainstream adoption of stablecoins and tokenization, and even Trump’s crypto donation campaign funding have had a significant legitimization effect, attracting new crypto investments like a honey pot.

This led to a new era of investment and crypto services for banks, in which only those banks manage the compliance and risk management for all their investors while providing reliable crypto banking services.

But what are those crypto-friendly banks that anyone wishes to know about and use them confidently?

Read further to discover them, but based on the latest studies, we only give one hint: Europe is a leading contender for comprehensive banking services, with over 60 banks up and running.

Moreover, you can find details on choosing the best crypto-friendly banks to help you succeed in your crypto trading journey.

The Best Crypto-Friendly Banks at a Glance

| Company | Available in | Access | Crypto Features |

|---|---|---|---|

| Amina Bank (formerly SEBA Bank) | Switzerland | Online & App | Custody, Trading, Lending, Payment Processing, Staking |

| Sygnum Bank | Switzerland | Online | Custody, Trading, Asset Tokenization, Asset Management |

| Contovista | Germany | Online & App | Business Crypto Accounts, Individual Wire Transfers, International Wire Transfers, SEPA Network Access |

| BCB Group | UK | Online & App | Secure Crypto Transactions, Digital Asset Custody |

| Bank Frick | Liechtenstein | Online & App | Trading, Custody, Staking, Payment Processing |

| Revolut Business | Global | Online & App | Multi-Currency Transaction Businesses Solutions, Crypto Exchanges |

| Monzo Bank | UK | Online & App | Integration with External Crypto Exchanges |

| BankProv | US | Online & App | Full-Service USD Banking Products, Crypto Lending, Secure Cash Vault Services |

| Goldman Sachs | US | N/A | Trading Desk for Cryptocurrencies, Bitcoin Futures Trading |

| JP Morgan Chase Bank | US | Online & App | Allows Connecting to Crypto Exchanges, JPM Coin for Cross-Border Payments |

| Evolve Bank & Trust | US | Online & App | Secure Custody of Digital Assets, Trading Platform, Lending Products, Payment Processing |

| Mercury Bank | US | Online & App | Trading, Payment Processing, FDIC Insured |

| Ally Bank | US | Online & App | Allows Using Bank Account on External Crypto Exchanges |

| Wirex Bank | Multiple Countries | Online & App | Dual Currency Support (Fiat & Crypto), Debit Card Services, Staking |

| DBS Bank | Singapore | Online & App | Custody, Trading, Lending, Asset Management |

| Mizuho Bank | Japan | Online & App | Custody, Trading, Asset Management |

| SBI Sumishin Net Bank | Japan | Online & App | Asset Management, Custody, Trading, Lending |

The Best 7 Crypto-Friendly Banks in Europe

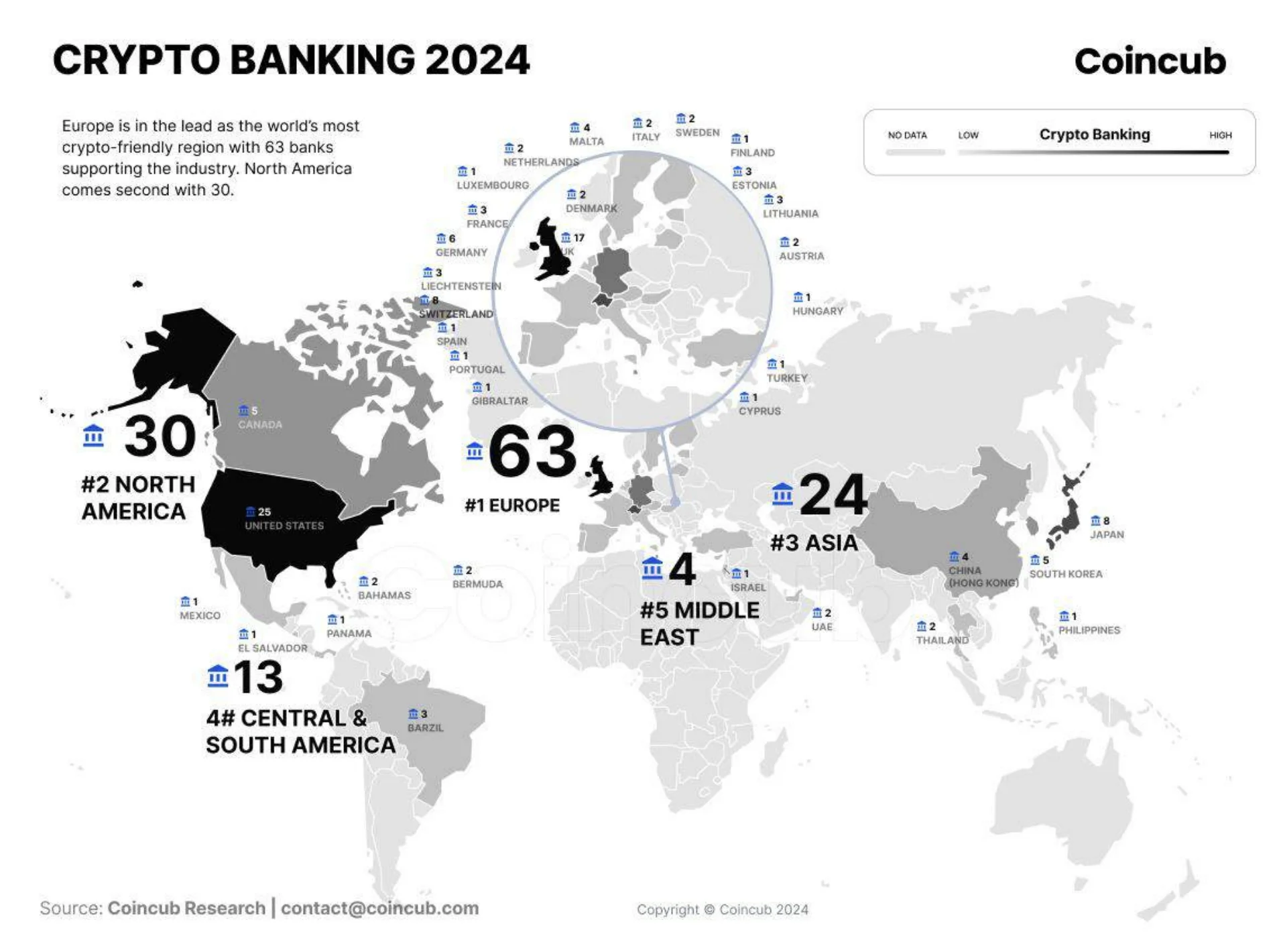

As briefly mentioned, a recent study from CoinCub highlighted and discovered that some of the most crypto-friendly banks are in Europe. With 63 crypto financial institutions, only the UK holds 17 units alone, becoming the center of crypto investment innovation.

Europe is at the forefront of crypto banking. The continent’s clear regulatory pathways and supportive ecosystem foster a thriving market for crypto services, setting a benchmark for global standards.

European banks and financial institutions are increasingly recognizing the strategic importance of integrating crypto services, underpining Europe’s position as a bastion of crypto innovation, advised Sam McQuade, Founder and CEO of Panterra Finance.

1. Amina Bank (formerly SEBA Bank)

Founded in 2018 in Switzerland, Amina Bank is at the center of the crypto banking landscape, offering innovative blockchain banking services that operate under the Swiss Banking and Securities Dealer Licence from FINMA.

Amina Bank offers secure financial standards for both fiat and crypto transactions for individuals, institutions, and corporate bodies for custody, trading, lending, and payment processing on a global level, with the help of its regulated hubs in Switzerland, Abu Dhabi, and Hong Kong.

Aminas’ Bank Key Services:

- Banking: current accounts, online banking, banking packages.

- Custody: hot and cold wallets, custody services.

- Lending: crypto-backed loans, credit cards, overdrafts.

- Deposits: fixed term, 7-day notice, 35-day notice.

- Staking: ETH, SOL, DOT, XTZ.

- Trading: spot and derivatives.

- API.

- Payment processing for crypto businesses.

- Swiss Bankers Association membership.

- Research resources and media outlet platform.

2. Sygnum Bank

This Zurich-based crypto-friendly bank was opened in 2017 to serve all its institutional and private investors through tokenization services, crypto trading, and custody asset management, thus becoming a secure and reliable crypto assets bank.

Also regulated by FINMA and a member of the Swiss Bankers Association, this crypto-friendly bank became the first bank in 2021 to offer custody and banking services for Internet Computer utility tokens.

Furthermore, Sygnum Bank offers a seamless blend of conventional financial services and crypto accounts through crypto and fiat currencies in one e-banking platform.

Sygnum Bank Key Services:

- Digital asset banking throughtrading spot, options, AMCs, API, staking green-yield generation, lending cost-effective credit lines, and custody bank-grade security.

- Asset Tokenization.

- Asset Management platform winners protocol layer access, crypto sector indices first institutional framework, multi-manager fund diversified alpha strategies, yield core diversified crypto income, VC early-stage opportunities.

- B2B Banking Services: trading secure infrastructure, asset management for institutions, crypto compliance and RegTech, bank-grade custody.

3. Contovista

Contovista is a German-based crypto bank that offers more limited financial services but is still holding its position. Regulated by the German Federal Financial Supervisory Authority (BaFin), Contovista offers its services to private individuals and crypto businesses looking for a secure financial future.

As such, from business crypto accounts for crypto companies to individual wire transfers and international ones, besides its access to the SEPA network, Contovista could be your cup of tea within the crypto market.

Contovista Bank Key Services:

- Personal Finance Manager throughcarbon footprint manager, multi-banking for retail.

- Business Finance Manager for crypto companies.

- Enrichment Engine throughclient analytic tools.

- Wire Transfers for international and domestic transactions.

- SEPA payments network.

- Access to EUR and USD accounts.

4. BCB Group

If you’re looking for crypto-friendly banking services for institutional investors, hedge funds, family offices, asset managers, crypto exchanges, and blockchain companies, you must open a bank account with BCB Group.

Founded in 2017 in London, BCB Group has managed to scorch a mid-cap market segment at $239 million. It stands out due to its robust and secure services, closing even further the gap between traditional banking services and the crypto space.

Regulated by the Authorised Payment Institution (API) license from the UK Financial Conduct Authority, BCB Group offers secure crypto transactions in over 30 digital currencies, digital asset custody, and other services, making it a true contender among the top crypto-friendly banks in Europe.

BCB Group Key Services:

- BCB Business Accounts: a multi-currency transaction business solution.

- BLINC: a payment processing network for all BCB Group customers, available 24/7/356 for free.

- BCB Crypto: securecrypto trading services on crypto assets over the counter while safely storing them.

- BCB FX: Crypto trading with ease.

- Virtual IBANs: Separate business accounts into individual virtual IBANs.

- BCB Treasury: Corporate digital assets treasury.

5. Bank Frick

Back in 2018, Bank Frick was the only bank in Europe to offer blockchain banking services. Since then, this crypto-friendly bank has grown to offer robust crypto services such as trading, custody, and staking for many digital assets.

Founded in 1998, Bank Frick alleviates the needs of many blockchain and digital custody institutions, financial intermediaries, asset managers, and trust companies, creating a secure medium for businesses across the globe, such as Europe, Singapore, Australia, and the US.

Furthermore, with licenses from Visa and MasterCard, the bank offers secured debit card services and processes payments for its clients, making it a pioneer within the industry.

Bank Frick Digital Financial Services:

- Traditional Banking Services and Classic Crypto: Payment processing for fiat and convertible digital currencies, exchange trading, 24/7 direct market access, and crypto lending.

- Blockchain banking means blockchain support, secure custody, crypto trading, staking, and more.

- Fund and Capital Markets.

- E-Commerce: Traditional payment processing, recurring financial transactions, PSD2/SCA compliance, risk management.

6. Revolut Business

Revolut Business is a robust financial institution and one of those financial platforms that offers secure digital asset management for multiple trading currencies along with multiple fiat currencies, catering to a global user base.

Moreover, with its recent MetaMask collaboration, Revolut simplified the buying process, thus securing its spot among many crypto-friendly banks.

Additionally, this UK-based financial institution worked on having an easy-to-use mobile app through which its users can confidently trade popular digital currencies like Bitcoin, Ethereum, and many others, in addition to asset management.

Therefore, with a Revolut bank account, anyone has access to different financial transactions and services at competitive rates, including crypto vaults and many more beneficial features.

Revolut Business Financial Services:

- Revolut Personal: Savings accounts, freelancer accounts, joint accounts, cards, crypto, stocks, commodities, etc.

- Revolut Business: multi-currency account, crypto exchanges, cards, payment gateways, Revolut pay, Revolut ramp, and reader.

- Depending on the chosen plan, the transaction fees might vary.

7. Monzo Bank

Monzo Bank is one of those financial platforms that bridges the gap between traditional banking services and digital asset firms, traders, and investors, fully embracing the new crypto banking industry.

Also, due to its integration with external crypto exchanges, Monzo empowers its user base to use the feature by syncing their traditional bank accounts with their listed external cryptocurrency exchanges, monitoring their crypto holdings and financial transactions within the Monzo app.

Did you know that you can use the Monzo Cards on cryptocurrency exchanges? Yes, that’s right! With Monzo by your side, you will benefit from increased traditional and digital asset management flexibility.

Please note that Monzo is for UK residents only, and Ts&Cs apply.

Monzo Bank Financial Services:

- Monzo Personal: Savings accounts, fiat currency vaults, cashbacks, Monzo investment, credit cards and loans.

- Monzo Business: 24/7 customer support, tax vaults, integrated accounting, invoicing, faster payments and direct debits to cryptocurrency exchanges, and others.

- The use of Monzo Cards on external crypto exchanges.

- Monzo App for asset management.

The Best 7 Crypto-Friendly Banks in the United States

Indeed, the US offers a dynamic crypto-friendly banking industry that supports and alleviates crypto users’ needs and provides easy access to new and emerging crypto markets. Moreover, traditional banks and giants like Goldman Sachs, JPMorgan, BNY Mellon, and others are already introducing blockchain tech to tokenize various real-world assets.

Sam McQuade, the Founder and CEO of Panterra Finance, said that In North America, the juxtaposition of innovative spirit against regulatory hurdles paints a complex picture of the crypto banking landscape.

While the region boasts a vibrant ecosystem of startups and established players pushing the boundaries of digital finance, the pace of regulatory clarity remains a critical factor shaping its global competitiveness.

The drive towards embracing crypto banking services reflects a broader ambition to lead in financial innovation, contingent upon a harmonized regulatory framework.

So, read further and discover some of the best banks that overthrow traditional banks by bringing new crypto services, compliance, risk management features for digital assets, and secure cryptocurrency transactions.

1. BankProv

Suppose you are looking for a crypto-friendly bank and a financial institution that provides full-service USD banking products. In that case, you are in the right place, as BankProv offers a broad spectrum of payment solutions to help you or your business leverage the merits of crypto.

Furthermore, all you deposit in this bank, whether fiat or crypto, are under FDIC insurance coverage and operate as a Federal Reserve System member under one BankProv bank account.

BankProv has a rapidly expanding specialty lending desk to meet the needs of crypto enthusiasts and other exceptional cases. The crypto-lending line of credit is backed by ether and seeks to provide a full-service offering to the crypto community.

Additionally, the bank provides secure cash vault services by partnering with leading crypto-friendly armored couriers, accessing your money faster using the available Bitcoin ATMs.

With its crypto banking team, you can easily navigate the banking process without hassling too much. Their dedicated team will also help you on your business trajectory journey. Above all, the bank’s advanced API technology makes the banking process seamless, intuitive, and convenient for even new users in the crypto sphere.

BankProv Banking Services:

- Lending products for individuals and businesses;

- Business Banking: business checking products, cash management services, web, and mobile banking, thoroughly ensured deposits up to $250,000;

- Banking-as-a-Service: white-labeled insured banking products, modern API, compliance, and risk management, FBO and virtual accounts, KYC and KYB, and others;

2. Goldman Sachs

Goldman Sachs is not a newbie in the banking industry. In fact, it is a leading Wall Street bank and one of those traditional banks that has now adopted crypto banking from outrightly rejecting crypto, even going ahead to execute an over-the-counter crypto transaction. This is a positive step in developing a crypto market for investors.

Moreover, the bank has a trading desk for cryptocurrencies. The financial giant provides a Bitcoin futures trading product through a partnership with Galaxy Digital, which augments its trading desk.

Currently, the bank offers its clients access to Ethereum funds through its partnership with Galaxy Digital, which offers minimal crypto funds of $250,000.

Goldman Sachs Services:

- Individual: private wealth management, global investment research, high-yield savings, managed portfolios, educational resources.

- Corporate and Institutional: asset management, financial planning and advice, customized investment solutions, credit cards, installment financing, high-yield savings accounts, etc.

- They have proven track experience.

3. JP Morgan | Chase Bank

JP Morgan Chase is one of the most crypto-friendly banks. It is a multinational investment bank that serves retail and institutional clients. JP Morgan entered banking history by being one of the first global traditional banks to use blockchain technology to design a network that facilitates instant cryptocurrency transactions.

By unveiling the JPM Coin, Chase facilitates real-time value movement to expedite cross-border payments. So, why is Chase featured in our list of the best crypto-friendly banks?

Therefore, US users of these crypto exchanges have access to deposits and withdrawal services via Automated Clearing House (ACH) cryptocurrency transactions and wire transfers. The exchanges also benefit from cash management services.

In addition, the global bank has a passively managed in-house Bitcoin fund through a partnership with investment firm New York Digital Investment Group (NYDIG) to serve its wealthy customers and cryptocurrency businesses.

Furthermore, in August 2021, the bank opened access to five other crypto funds that provide users with wealth management platforms, such as the self-directed Chase trading app.

JP Morgan Chase Financial Services:

- Swift cross-border transactions through the JP Coin, showcasing its commitment to technological advancement;

- Crypto-friendly banking services for specific cryptocurrency exchanges and digital asset companies.

- A trusted partner, bridging the gap between traditional banks and the crypto world.

- Institutional research of crypto markets that offers crucial insights for more informed investment decisions.

4. Evolve Bank & Trust

If you’re looking for a trusted bank account that is crypto-friendly and offers additional key features to support its investors, then Evolve Bank & Trust could be the one for you.

Based in Tennessee, the bank is known within the crypto space due to its dedication to supporting and securing custody for different digital assets, as well as its trading platform, lending products, and payment processing service.

Why trust Evolve Bank & Trust? It’s fully regulated by the FDIC and is a member of the Federal Reserve System, which gives its users peace of mind because all their deposits are protected.

Evolve Bank & Trust Services:

- Secure and regulated custody of digital assets.

- Trading platform for institutional investors.

- Lending products for businesses and individuals.

- Payment processing services for crypto companies.

- FDIC insurance for deposits up to $250,000.

5. Mercury Bank

We know that opening a crypto-friendly bank account can sometimes be daunting, especially when you don’t know what services they provide, if your digital assets will be ensured, and so on. What if we tell you that Mercury Bank takes these concerns and transforms them into benefits for its customers?

This US-based bank offers multiple reliable services to businesses, including crypto-friendly features such as trading and payment processing. It is also FDIC-regulated and a member of the Federal Reserve System.

Therefore, Mercury addresses all Web3 entities that aim to easily buy cryptocurrencies through this bank account. It protects them through insurance coverage up to $5 million and offers yield on balances over $500,000.

And to make it even more attractive, Mercury provides cashback bonuses and prepaid cards for more flexibility.

Mercury Financial Services:

- No monthly maintenance fees allow business companies to shift their financial resources strategically.

- Increased security since Mercury is FDIC-regulated and part of the Federal Reserve System for deposits up to $250,000.

- Trading platform for all its institutional investors.

- Lending products and services for both individuals and businesses.

- Payment processing services, sub-accounts, and virtual IBANs.

- Crypto fiat exchange, and crypto-fiat OTC.

- Robust and secure API.

- Attractive yields through Mercury Treasury.

6. Ally Bank

Ally Bank is one of those financial platforms that blends traditional banks, and the crypto space needs to answer and offer its customers robust and secure services. Thus, it allows its customers to use their Ally Bank accounts on external exchanges for trading inquiries.

As a result, Ally Bank customers can enjoy an extensive range of tools and services to manage their financial resources easily, including crypto.

Moreover, since it offers transparent transaction fees and competitive interest rates, Ally Bank seems to be a good choice for anyone looking to optimize their financial portfolio.

Ally Bank Services:

- FDIC-insured US bank offering secured services.

- Ally Bank accounts can be used on external crypto exchanges to empower users.

- Increased Annual Percentage Yields (APYs) on fiat deposits.

- Multiple investment options, including crypto funds, are included for its customers to diversify their investment portfolios.

- Benefit from transparent transaction fees and competitive interest rates on traditional banking and crypto investments.

7. Wirex Bank

For starters, Wirex is not your traditional banking platform. Yet, due to its digital payment features and robust wallet application, it is among some of the best crypto-friendly banks and a key player within the crypto space.

Also, since it collaborates with Mastercard on payment cards, Wirex stands out and supports fiat and cryptocurrencies for all its customers, allowing them to enjoy borderless access to multiple currencies and digital assets.

With the wallet, anyone can easily send and receive money via cards. Note that debit card payments and SEPA/SWIFT transfers are free. Another essential aspect is that the app does not charge monthly fees, which is in customers’ favor.

Wirex has an international appeal because it is available in over 130 countries, and you can use the wallet anywhere!

You do not have to worry about security because the FCA licenses Wirex as a money issuer and PCI DSS Level 1-certified. Unlike other wallets that rely on seed phrases and private keys, Wirex relies on biometrics for access.

Wirex Bank Services and Features:

- Wirex has its WXT token that unlocks DeFi opportunities and other crypto-related features.

- Dual currency support for both fiat currency and cryptos.

- Web3 free accounts for financial freedom.

- Secured debit card services for customers.

- Increased passive income through staking, contributing to the blockchain network.

- Institutional asset pricing for crypto markets insights while discovering market trends.

Top 3 Crypto-Friendly Banks in Asia

In recent years, Asia has become a dynamic hub for crypto-friendly banks, allowing businesses and individuals to blend their financial income seamlessly.

China, Singapore, Tokyo, and many others are working restlessly to bridge the gap between traditional banking systems and the emergence of the crypto space. As such, big names like DBS Bank, Mizuho Bank, and SBI Sumishin Net Bank are paving the way for new strategic financial approaches.

Let’s find out more!

1. DBS Bank

Undoubtedly, DBS Bank is one of the most prominent and largest banks in Southeast Asia. Its headquarters are in Singapore, and it has been operating since 1968.

As with traditional banks that aim to secure both the legacy financial system and acquire new crypto financial institutions, DBS Bank offers a secure and highly regulated platform for digital asset custody, trading operations, lending products, asset management services, and more.

DBS Bank is regulated by the Monetary Authority of Singapore (MAS) and is a member of the Association of Banks in Singapore (ABS). It could be the best option for many crypto investors and businesses.

DBS Bank Services and Features:

- High-regulated custody of digital assets offers users peace of mind.

- Robust trading platform for institutional investors and lending products for individuals and businesses.

- Digital asset management services and high expertise in tokenization processes.

- Singapore Association of Banks membership.

2. Mizuho Bank

With headquarters in Tokyo, Mizuho Financial Group is the second-largest bank in Japan by assets. Its presence demonstrates a commitment to innovating and delivering the best possible services to the crypto banking industry.

Regulatory by the Financial Services Agency (FSA) and a member of the Federation of Bankers Associations of Japan (FBAJ), the Mizuho Financial Group offers its customers secure custody services for digital assets, a robust trading platform, asset management services, and expertise in tokenization processes and systems.

Mizuho Financial Group Services:

- Regulated and secured asset custody.

- Trading platform, lending products, and asset management services.

- Membership in the Federation of Bankers Associations of Japan.

3. SBI Sumishin Net Bank

As with the other two Asian-based banks, the SBI Sumishin Net Bank has become a key player within the e Asian crypto-friendly banking industry, especially after the joint venture between SBI Holdings and Sumitomo Mitsui Banking Corporation.

With secure services such as asset management and custody, easy-to-use trading platforms for institutional investors, lending products, and others, SBI Sumishin Net Bank alleviates users’ needs with ease.

Moreover, the bank is regulated by the Financial Services Agency (FSA) and is a member of the Federation of Bankers Associations of Japan (FBAJ), which ensures user security and trust.

SBI Sumishin Net Bank Features:

- Secure assets management and custody.

- Trading platform, lending products, and proven track record of tokenization expertise.

- Federation of Bankers Associations of Japan membership.

The Best Features of Crypto-Friendly Banks

1. Reliable and secure crypto and fiat asset management services are the most crucial aspect when choosing a crypto-friendly bank, as this ensures flexibility over your financial transactions when trading.

2. Reasonable fees and monthly crypto account services make the world go round, not only for small or medium traders but also for big players.

As such, no one likes to pour their earnings into administrative fees, whereby they can benefit from passive income through staking and access to institutional asset pricing elsewhere.

Moreover, regardless of actions, such as trading, exchange, withdrawals, and others, transparent fee structures could ensure even more users’ trust. As word of mouth is still the best marketing tactic, crypto-friendly banks should consider it even more.

3. Crypto cards aren’t new; as such, crypto-friendly banks and crypto financial institutions must integrate them to facilitate buying and selling digital assets and offer other digital financial services.

Therefore, it’s a win-win for both cryptocurrency businesses and investors. The golden rule is that the shorter the process, the more beneficial it is for crypto-friendly banks and crypto companies.

Indeed, these aren’t the only specs prominent crypto-friendly banks must offer, and we could also add:

- The integration with crypto exchanges and wallets;

- Seamless cash-out process;

- Mobile apps;

- Reliable customer support;

- Crypto-backed loans;

- Saving accounts;

- Crypto holdings;

- Transparent and low transaction fees, and the list could go on.

So, you could start by listing your banking needs and looking at each crypto-friendly bank’s offerings to find the only bank account that directly supports your financial endeavors.

Crypto-Friendly Banks FAQ

What crypto-friendly banks worldwide are there?

Here are the top 17 crypto-friendly banks worldwide:

- Amina Bank (Switzerland);

- Sygnum Bank (Switzerland);

- Contovista (Germany);

- BCB Group (UK);

- Bank Frick (Liechtenstein);

- Revolut Business (UK);

- Monzo Bank (UK);

- BankProv (US);

- Goldman Sachs (US);

- JP Morgan Chase Bank (US);

- Evolve Bank & Trust (US);

- Mercury Bank (US);

- Ally Bank (US);

- Wirex Bank (US);

- DBS Bank (Singapore);

- Mizuho Bank (Japan);

- SBI Sumishin Net Bank (Japan).

Why won’t my bank let me buy crypto?

First, ensure that your bank supports crypto transactions in any way possible, as you could already use a traditional banking system. If so, choose among the top 17 best crypto-friendly banks, sign up, and take it from there.

Depending on your geographical location, you could choose between Sygnum Bank from Switzerland, Evolve Bank & Trust from the US, or Mizuho Bank in Japan. There are many options; you only need to find what best suits your investment strategy.

Final Thoughts

As cryptocurrencies gain universal acceptance, the urge to find the best crypto-friendly banks keeps growing. Therefore, we have compiled a list of crypto-friendly banks in the United States and worldwide to save you time.

However, do your due diligence to inspect each wisely and only choose what suits your financial needs.