Usually, nearly everyone wants to be anonymous when performing online activities. This also applies when dealing with crypto transactions. The present technologically advanced world has made it easier for people with hidden motives to steal information through the internet and use it elsewhere without the user’s consent.

The same principle applies in the crypto world. Cryptocurrencies were developed to ensure security and anonymity during transactions. In that case, this article discusses the best anonymous Bitcoin wallets that ensure users remain anonymous during their transactions.

Anonymous Bitcoin Wallet – Introduction

Most cryptocurrency holders will agree they enjoy using Bitcoin and other cryptos for transactions. However, this feeling intensifies when they get a chance to transact anonymously.

Transacting and leaving no traces of your information behind is considered the very essence of cryptocurrencies.

However, it is a daunting task to use your Bitcoin anonymously without the help of anonymous Bitcoin wallets. So, this article highlights the top 10 anonymous Bitcoin wallets and their features.

Each crypto wallet has unique features; therefore, you can choose what works best for you.

Best Anonymous Bitcoin Wallet

After analyzing various Bitcoin wallets on the market, we selected the following three digital wallets for anyone looking for an anonymous Bitcoin wallet.

1. Ledger Nano X and Ledger Nano S

Ledger is a well-known and reputable producer of secure Bitcoin and cryptocurrency hardware wallets. Their most popular products are Ledger Nano S and Ledger Nano X. Both models are highly praised hardware wallets for their sturdy security and versatility. Each wallet supports thousands of cryptos and tokens in addition to Bitcoin.

The hardware wallets have NIST certification for True Random Number Generator to secure signatures. It is a Hierarchical Deterministic wallet, meaning that it uses a seed to derive several public and private keys.

Ledger enables you to create hidden wallets; thus, the data is hard to tell apart from random bytes, and only the owner can know their location. It also features a 24-word mnemonic backup that allows users to recover their funds in case the device is broken.

Main Features

Both Ledger Nano X and Nano S work with the Ledger Live app. However, while Nano X supports desktops, iOS, and Android devices, Nano S can be accessed only via a Windows, Linux, Mac desktop, or Android 7+ device.

Ledger Nano X has Bluetooth and can quickly connect to a mobile device. In Nano S’s case, users must purchase an OTG (On-the-Go) kit of 3 USB cables to use the hardware wallet. Nano X can also be connected through a Type-C USB, while Ledger Nano S uses a Micro-B USB.

Ledger Nano X has a battery of 100mAh, which can last longer than other similar devices. On the other hand, Ledger Nano S does not require a battery.

Security

Both Ledger Nano X and Ledger Nano S are pretty secure wallets and have chips that are certified using the Common Criteria (CC) EAL5+ process.

The Ledger anonymous wallet has the following personal security measures:

- A PIN code of minimum 4 digits;

- A 24-word recovery phrase that is displayed only on the device;

- Whenever users want to complete a purchase, they have to push both physical device buttons at once.

Supported Assets

Both Ledger Nano X and Nano S support over 1,800 cryptocurrencies, including the most popular, such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Polkadot (DOT).

The Ledger wallets support ERC-20, ERC-721, TRC-10, TRC-20, BEP-2, NEP-5 tokens, and Solana (SOL).

However, some cryptocurrencies can be stored on cold wallets but are not supported by Ledger Live, and these include Binance Coin (BNB), EOS (EOS), Cardano (ADA), Monero (XMR), and others.

Costs

Ledger Nano X has a price of approximately $160, while Ledger Nano S can be purchased for around $90.

Pros & Cons

- Ledger Nano X

| Compatible with over 50 wallets | Higher price ($160) |

| Supports over 1,800 cryptocurrencies | |

| Bluetooth connectivity | |

| Can run up to 100 apps simultaneously |

- Ledger Nano S

| Supports over 1,800 cryptocurrencies | Does not have Bluetooth connection |

| Can run up to 100 apps simultaneously | Is not compatible with iOS |

| Has a CC EAL5+ certification | Requires an OTG USB kit |

| Has native support for NFTs |

2. Trezor Wallet

With two models launched in 2014 and 2018 (Model One and Model T), Trezor was one of the first wallets that could function simultaneously, like a hardware wallet and a software wallet. If you ever landed upon the Trezor website, you came across a surprising section dedicated entirely to their security and safety.

The section discusses the issues they had previously faced in terms of the security of the account holders. Moreover, you can find out the steps and updates they have made to the anonymous crypto wallet.

It is worth noting that Trezor is compatible with Android, iOS, macOS, and Linux. So, you can just plug in your hardware wallet anytime, and anywhere you want with a device.

Trezor provides the best-in-class security features. The use of the recovery phase for entering the wallet is a very secure feature, so even if someone gets hold of your wallet, it is impossible to know the full-fledged phrase.

It entails a strict PIN setup process, which is difficult to be cracked by someone. If you are looking for a hardware wallet that will serve you right, then Trezor should work the best for you.

Main Features

While Trezor Model One was developed with 2 clickable buttons and USB-C, Trezor Model T was designed with a touchscreen and USB-A. Besides, their processors are a little different, as well as their sizes, weights, and screen resolutions.

Furthermore, Trezor Model T comes with built-in mobile connectivity, an SD card slot, and a magnetic dock.

Security

Both Trezor wallets are highly secure, and Model T has two additional features that can offer even more security than before: FIDO2 authentication and Shamir backup.

Supported Assets

While Trezor Model One supports 1,289 coins and tokens, Trezor Model T supports 1,456 cryptocurrencies. However, some cryptocurrencies are not supported by Trezor devices, such as Solana (SOL), PancakeSwap (CAKE), or Polkadot (DOT).

Costs

Trezor Model One can be purchased for around $67, while Trezor Model T has a price of approximately $215.

Pros & Cons

- Trezor Model One

| Supports over 1,200 cryptocurrencies | Does not support some major coins (e.g., SOL and DOT) |

| High security |

- Trezor Model T

| Supports over 1,400 cryptocurrencies | More expensive ($215) |

| Offers FIDO2 authentication | Does not support some major coins (e.g., SOL and DOT) |

| Offers Shamir backup | |

| Has built-in mobile connectivity |

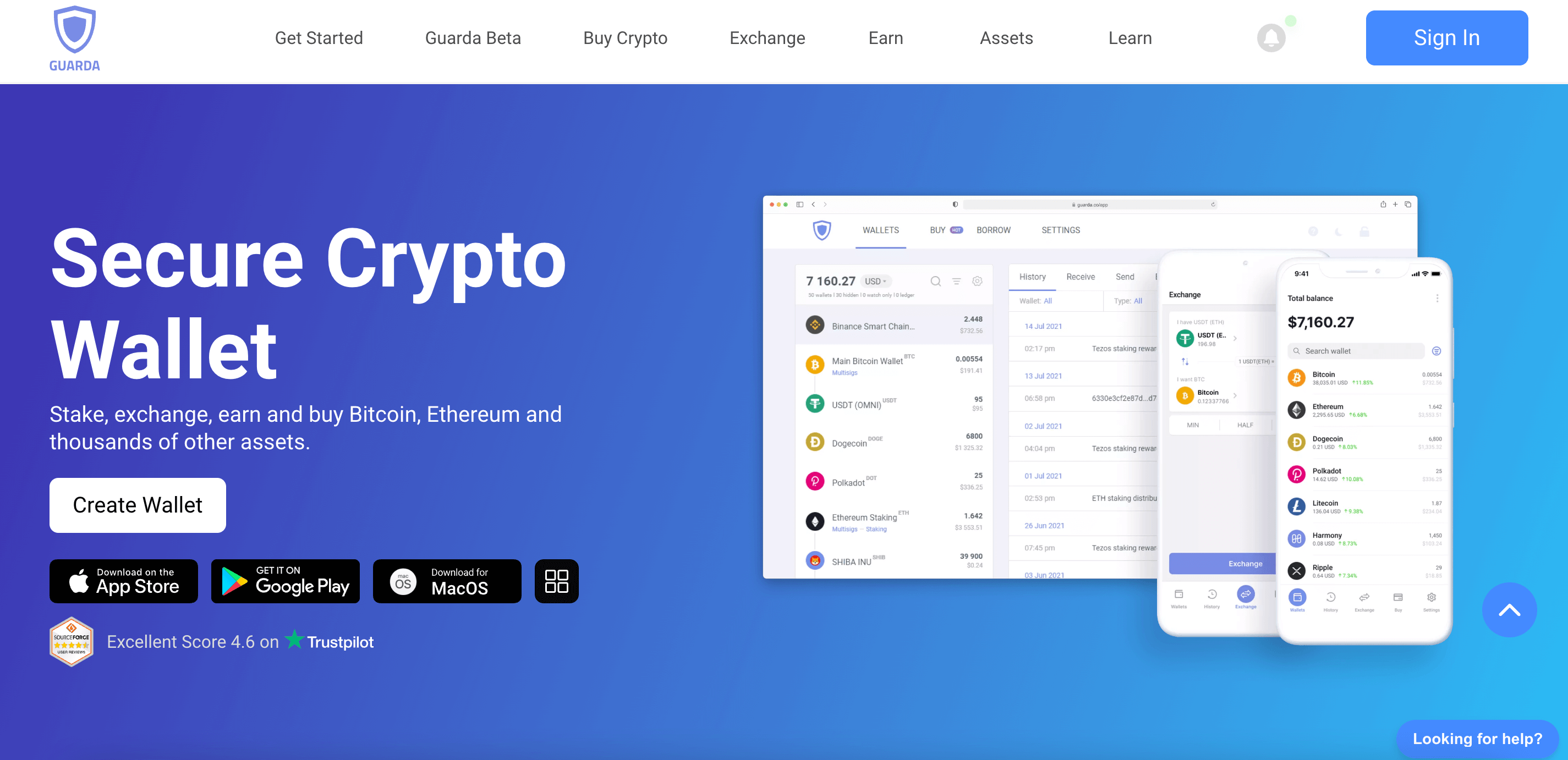

3. Guarda Wallet

Guarda is a custody-free multiplatform cryptocurrency wallet that allows you to earn, buy, exchange, and stake. You can buy Bitcoin, Ethereum, and more than 300 other different coins and tokens for as low as $50.

It provides support for over 50 major blockchains and 400,000+ tokens of the leading protocols. Specifically, Guarda supports any ERC-20 tokens, Binance Smart Chain, Binance Tokens (BEP2), NFT collectibles (ERC-721), TRON tokens (TRC10 and TRC20), WAVES, OMNI, Hedera & XinFin Tokens, EOS, and NEO, among others.

Also, opportunities exist for staking assets where you can earn up to 40% annual yield. Apart from assets, you can stake to Guarda’s own validator node with 100% uptime and earn 8% rewards with Harmony staking. You can also earn 3.88% rewards with Ethereum Staking and 22% with Ontology Staking. Notably, the wallet offers a referral program to give you passive income.

Guarda allows you to get crypto loans in the form of stablecoins within 5-10 minutes at 10% APR. You do not have to own any specific tokens in your portfolio to access this loan.

Furthermore, no credit checks or account registration is required. Everything is private and anonymous. Moreover, you can instantly exchange crypto with the best rates.

The wallet has an easy-to-use token generator that allows users to create their own HBAR or ERC tokens. You only set up your token supply and name, distribute it through the wallet, and list it on the UNISWAP exchange.

The wallet has a Chrome extension that lets you interact with any DeFi or entertainment app. It is also supported by the Brave browser to make dApps very accessible.

The wallet is also secure by ensuring that keys and backups are generated on the user’s device and encrypted with the Advanced Encryption Standard (AES).

Main Features

Guarda wallet comes with an extremely user-friendly interface and is available on desktop, mobile, and web. Furthermore, the platform provides excellent customer support and suits both beginners and experienced investors.

Security

Considering the fact that Guarda Wallet is a non-custodial wallet, it provides a pretty high level of security. This means that even if the company was compromised or its servers hacked (which did not happen ever since launch), users’ assets would still be safe, and only they would have access to their crypto coins stored on Guarda Wallet.

Supported Assets

Guarda Wallet supports over 400,000 coins and tokens and 50 blockchains. Moreover, the wallet allows users to store most of the major cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Solana, Polkadot, Dogecoin, and many more. Guarda Wallet also supports ERC-721 tokens.

Costs

Usually, Guarda Wallet is free to get and use. Nevertheless, the platform has some fees, the standard fee (for crypto purchases) being 5.5%. In general, fees vary depending on the action, the networks, the coins/tokens involved, and the amount transacted.

Pros & Cons

| Over 400,000 cryptocurrencies supported | In-app fees can get pretty high |

| Great customer support | |

| High level of security | |

| It is a non-custodial wallet |

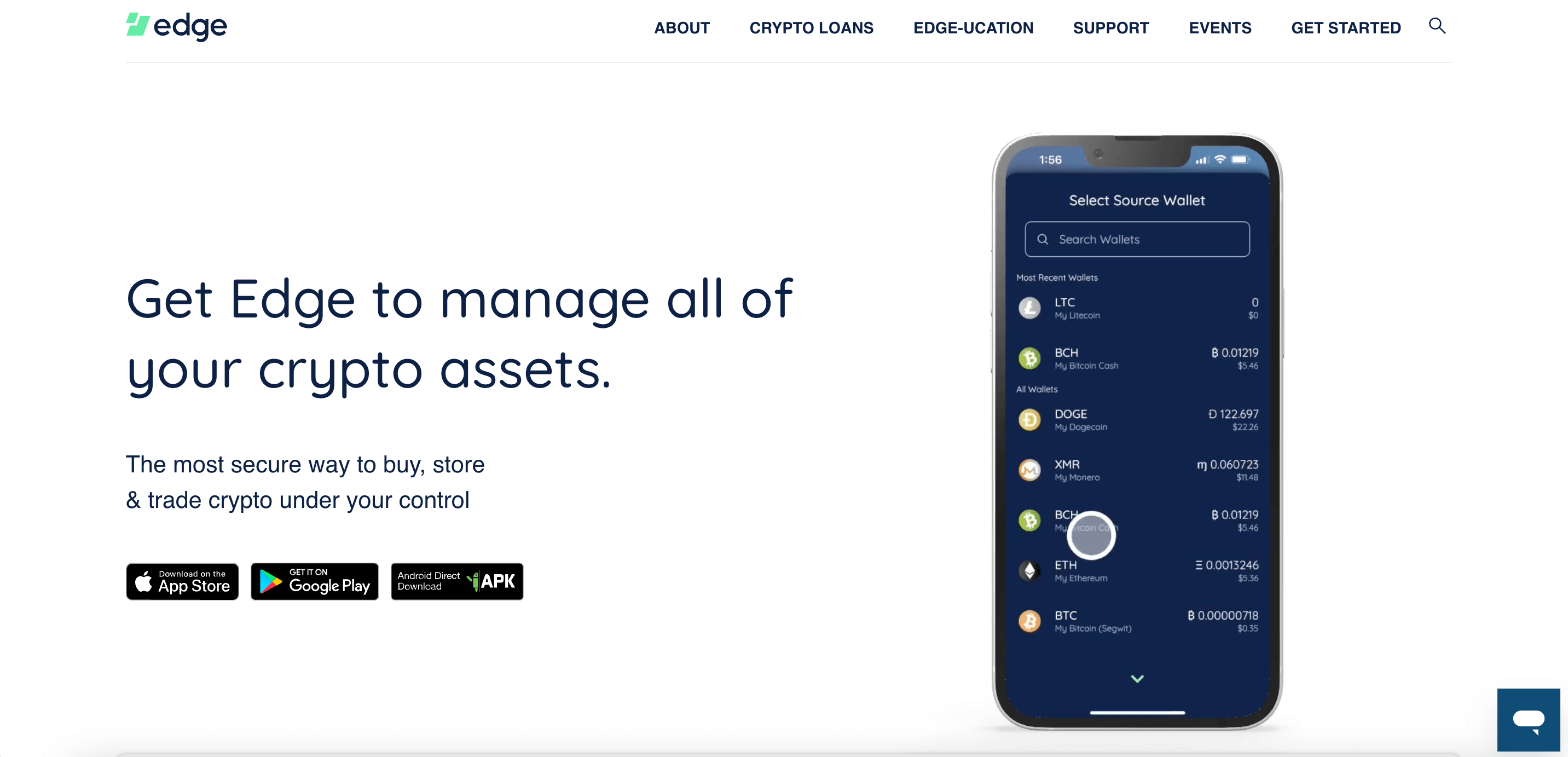

4. Edge Wallet

Edge is one of the most sorted-out cryptocurrency wallets on the market. It runs as a mobile application and is currently available for Android and iOS users. The wallet supports over 130 popular assets, including Bitcoin, Ethereum, Litecoin, Monero, Ripple, and many more.

If you use Edge, you are not only signing up for a user-friendly experience but also a safe platform because all your information is known and handled only by you.

The company or any third-party site will never have access to your account information. Along with that, you don’t even need to provide them with any of your personal data for verification, like phone number, email address, or any ID photo. So, all your information remains with you safely.

Edge also follows the strict transparency rule, so its code is open source. The code has been attested by the Open Bitcoin Privacy Project, which sets the standards of privacy in the world of digital money.

With its super accessible features and robust safety protocols, it surely is one of the most trusted anonymous wallets.

Main Features

Edge Wallet is extremely easy to set up and use, and one of its key advantages is the in-app features. Furthermore, the fact that it can be used on mobile devices (both iOS and Android) makes it even more accessible.

Regarding customer support, Edge Wallet offers a detailed FAQ section, email and phone support, and a live chat. Moreover, the platform has recently introduced in-person support in San Diego and has launched a Discord channel where users can meet and find out more about the product.

Security

At the moment, Edge Wallet is considered to be one of the safest crypto storage solutions on the market. And considering that it is a mobile wallet, it is quite surprising that it comes with such high security.

Edge users can store their keys on their devices, and it is important to note that these will not be stored on the company’s servers. Thus, your digital assets’ security depends on you only. Moreso, Edge Wallet allows for 2FA (two-factor authentication), which is one of the most effective ways of protecting your assets.

Supported Assets

Edge Wallet supports over 130 assets, including some of the most popular, such as Bitcoin, Ethereum, Litecoin, Solana, Polkadot, and Dogecoin. Furthermore, Edge supports all ERC tokens.

Costs

Edge Wallet is free to install, set up, and use. In what concerns fees, Edge requires a 1% fee for every transaction.

Pros & Cons

| Easy to set up and use | Cannot provide the security level of cold wallets (it still is a mobile wallet) |

| Extremely accessible (mobile storage solution) | Available only on mobile devices |

| Allows 2FA | Quite limited number of assets supported |

5. SafePal Wallet

If you have been a part of the cryptocurrency world for some time, then you have heard that Binance is one of the most trusted crypto exchange platforms. Binance invested in SafePal in 2018, and since then, they have collaborated with Binance on multiple occasions. Besides, SafePal’s partnership extends to Dogecoin, Litecoin, Ripple, Simplex, and more.

One can try out this anonymous Bitcoin hardware wallet because of its dynamic interface and multiple extraordinary features. SafePal comes with an air tracking system, meaning that you just have to scan your device barcode and sign in.

So, you do not have to worry about using your network data, Bluetooth, WiFi, or anything that will leave a trace of your account details or transactions to a third party.

It also comes with an EAL 5+ certified secure element, which protects the system from an unexpected attack or malfunction.

So, if you are looking for a safe and secure hardware wallet, then you must try SafePal.

Main Features

SafePal is a hardware wallet that comes with a USB-C cable and a camera. It does not need USB, WiFi, or Bluetooth connectivity, nor is it designed to have NFC. SafePal Wallet has a 400mAh battery and can last for up to 20 days (with 10 minutes of daily use).

Security

SafePal is equipped with a true random number generator that has been assessed by AIS31 Standard Germany BSI and FIPS PUB 140-2 from the US, considered the topmost standard of encryption and information security. Furthermore, it is important to note that SafePal has a true random number generator and an EAL 5+ certification. The fact that it does not require USB, WiFI, or Bluetooth connectivity can be another remarkable advantage.

Supported Assets

SafePal supports approximately 30,000 coins and tokens, including ERC-721 tokens and the most popular cryptocurrencies, such as Bitcoin, Ethereum, Dogecoin, Solana, Polkadot, Binance, or Litecoin. However, SafePal does not support Monero, for example.

Costs

SafePal Wallet can be purchased for around $50. The company also offers a leather case and a Cypher Seed Protection board. The whole package has a price of approximately $105.

Pros & Cons

| Increased Security | Does not support all important assets (e.g., Monero) |

| Supports over 30,000 assets | |

| Supports NFTs | |

| Has a price lower than other similar products ($49.99) |

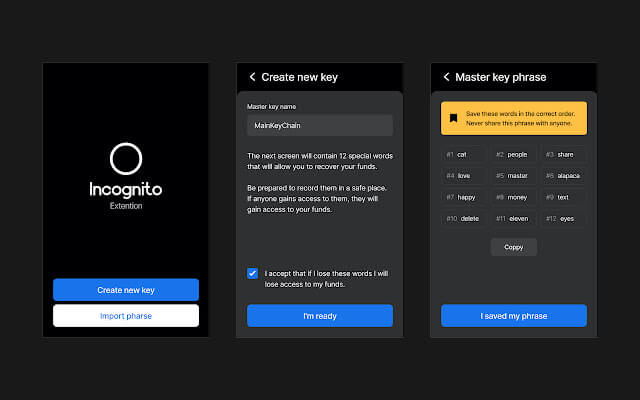

6. Incognito Wallet

The Incognito Wallet is a multipurpose wallet that anonymizes BTC.

Users can send, receive, buy, sell, or invest in BTC in full privacy. Through the use of stealth addresses, ring signatures, and zero-knowledge range proofs, your transactions leave no trace and record. It is also a non-custodial wallet, meaning you fully control your keys and funds.

Its cross-chain bridges also allow users to trade pairs like XMR and BTC. Beyond the latter, Incognito digital wallets also support multiple other currencies from a growing list of over 100. If you wish to buy or hold BTC anonymously, without any KYC or registration, this is an ideal option for you.

Main Features

Incognito is one of the few crypto wallets that protects users’ privacy the most. It can be downloaded as an app (available on iOS and Android) or a Chrome extension.

One of the most interesting facts about the Incognito mobile wallet is that users are allowed to shield coins from other arbitrary networks. This way, Incognito ensures once more that they maintain users’ anonymity.

Security

Thanks to its way of working, the Incognito wallet makes users’ transactions entirely untraceable. Furthermore, users are not required to complete any KYC verification, thus increasing user privacy even more.

Supported Assets

At the moment, Incognito Wallet supports approximately 100 coins, including the most popular, such as Bitcoin, Ethereum, Binance, and Litecoin. Besides, Incognito Wallet supports several BEP2 and ERC-20 tokens.

Costs

Incognito Wallet is free to install and set up. However, there are some fees required when completing specific actions. For instance, according to the platform’s forum, Ethereum-based withdrawals have a fee of almost 25 PRV (Incognito’s native cryptocurrency) or around $70.

Pros & Cons

| Entirely anonymous wallet | Pretty high withdrawal fees |

| Supports over 100 cryptocurrencies | |

| Available as a Chrome extension and a mobile app |

7. Samourai Wallet

Samourai Wallet is a mobile cryptocurrency wallet that aims to provide users with a high degree of privacy and security.

Samourai Wallet only supports Bitcoin and has a high level of privacy, using a variety of privacy-enhancing features, such as Tor integration, VPN support, and coin control.

Besides, Samourai Wallet uses multiple security features to protect your funds, such as 2FA, seed phrases, and password protection.

The wallet has a user-friendly interface that makes it easy to manage your cryptocurrency holdings and make transactions.

Moreover, Samourai Wallet is open source, meaning that the code is publicly available and can be audited by anyone. This helps ensure that the wallet is secure and transparent.

Main Features

Samourai Wallet is a hot storage solution that focuses on Bitcoin and offers multiple advanced features that are compatible with cryptocurrency. The wallet is only available on Android devices. Still, besides having a Google Play app, Samourai is also available on F-Droid, which is an open-source and privacy-oriented repository for Android applications.

Security

Samourai wallet provides multiple security features, such as 2FA and seed phrases. Besides, the platform protects users’ wallet data with AES-256 encryption, thus ensuring that the wallet is safe and cannot be attacked. Users have full control over their private keys. Furthermore, the private keys are fully encrypted and stored on the user’s phone.

Supported Assets

Samourai Wallet only supports Bitcoin.

Costs

Samourai Wallet is a free hot wallet. However, there are some fees that users may experience. For instance, if they want to open a private payment channel between 2 crypto wallets, users will be required to pay a fee of 0.00015 BTC.

Pros & Cons

| Highly secure | Only supports BTC |

| Mobile hot storage solution | Only available on Android |

| Provides several BTC-only advanced features |

8. Electrum

Electrum is a hot Bitcoin wallet that was launched in 2011, with its code being open-source under an MIT license. By using the Electrum wallet, users can stay anonymous while transacting through the wallet, as it is an operating system that was designed to protect internet privacy.

Electrum is a non-custodial wallet that does not store users’ private keys. Instead, they are stored on Electrum Wallet users’ devices. It is compatible with Windows, Mac OS X, Linux operating systems, and Android mobile devices. It also supports Ledger, Trezor, and Keepkey integration but is not an anonymous Bitcoin wallet by default.

Moreover, the Electrum wallet generates a recovery seed for backup. It does not require personal information upon signup and is also Hierarchical deterministic.

Main Features

Electrum Wallet is a hot wallet compatible with Windows, Mac OS X, Linux operating systems, and Android mobile devices. It also supports Ledger, Trezor, and Keepkey.

The wallet features the SPV (Simple Payment Verification) method to verify all transactions, and this is why Electrum is pretty lightweight, as it does not require users to download an entire Bitcoin blockchain. Furthermore, Electrum supports Lighting Network, thus offering an even greater transaction speed and lower costs.

Security

Firstly, Electrum is a non-custodial wallet. Thus, only users control their private keys. Furthermore, the platform offers 2FA and multisig (multisignature), adding more protection layers for users’ assets.

Assets Supported

Electrum is a Bitcoin-only wallet.

Costs

The Electrum Wallet is free to run on all supported operating systems. However, the default transaction fee is 0.2mBTC (1 mBTC=1/1,000 BTC).

Pros & Cons

| Easy to set up | Bitcoin-only |

| Compatible with hardware wallets | Not available on iOS devices |

| Open-source | |

| Multiple security features |

9. Paper Wallet

Bitcoin paper wallets are a great opportunity for those aiming to have full control over their assets’ safety. Bitaddress, for instance, is a website that helps users create a paper wallet. All you have to do is generate a private and a public key and click on “Paper Wallet” and print your wallet. However, it is essential to keep in mind that those using such a website may lose their assets if the website is hacked.

Fortunately, there is one more way of creating a Bitcoin paper wallet. And even if it may seem a little bit more complicated, it is still the safest way of storing your digital assets. This process implies creating a wallet after disabling all online connections and while using Ubuntu, LiLi (Linux Live USB creator), and Bitaddress (offline). You can find the whole process here.

This option is well-known because by printing out a paper wallet, users can physically store their Bitcoin wallet keys offline, which makes it much more difficult for hackers to steal them. Also, because paper wallets are not connected to the internet, they are less vulnerable to hacking and other types of cyber-attacks.

Main Features

Bitcoin paper wallets only consist of a piece of paper where you can store the private and public keys and 2 QR codes that can help you complete transactions.

Security

Considering the fact that it is a cold wallet and is not linked to any device at all, a paper wallet is considered the safest way of storing crypto. However, the process of generating this wallet can get a little complicated, and if not done right, a user’s assets can be compromised.

Assets Supported

Paper wallets can support various cryptocurrencies, including Bitcoin and Ethereum. Our example is a Bitcoin paper wallet.

Costs

Such wallets are completely free.

Pros & Cons

| One of the safest storage options, especially when done offline | Users can easily misuse paper wallet generators, as the process is a little complicated |

| It is not linked to any device | An online generated paper wallet’s keys may be leaked if the website is exploited by a hacker |

| It cannot compromise a user’s assets (if done right) |

10. PINT Wallet

One of the best anonymous Bitcoin wallets is PINT Wallet. It is a highly intuitive wallet that allows its users to store, manage, send, and receive blockchain assets, including Dash, Litecoin, Bitcoin Cash, and Ether. Since it’s a multi-currency HD wallet, users can easily transact in different currencies.

The security features of the PINT wallet are also very impressive. Being a self-hosted wallet, PINT allows its users to control their private keys. This is done by enabling the user to back up their seed with them.

Another security feature of this anonymous crypto wallet is that the user does not need to disclose any of their personal information, such as email or phone number, while using the wallet.

The security of PINT can be attributed to the fact that it is integrated with the TOR feature that ensures that information from those using it stays anonymous while transacting crypto and other digital assets.

All the transactions conducted within the PINT wallet run through an AES256 encryption status. If you wish to make a purchase or exchange in the darknet, the PINT wallet is an anonymous Bitcoin wallet to consider.

Main Features

PINT Wallet is a mobile app available on Android devices. It also integrated a SWAP functionality provided by Shapeshift. This way, users can swap coins without the need for an exchange. PINT Wallet can easily be downloaded and set up and has a user-friendly interface suitable for both beginners and experienced users.

Security

Besides requiring users to create a PIN, PINT generates a 12-word seed phrase that users have to store safely. Furthermore, PINT is also an HD (Hierarchical Deterministic) wallet.

Assets Supported

PINT Wallet supports various coins, such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Dash, Dogecoin, and various ERC-20 tokens.

Costs

PINT Wallet is free to download and set up.

Pros & Cons

| Provides a high security level | It is available only on Android |

| It is a HD wallet | |

| Supports multiple cryptocurrencies |

In Conclusion

These anonymous Bitcoin wallets have different security modes to ensure that crypto transactions performed by crypto users remain anonymous and secure. They can be used in areas where there is an extreme threat to security, such as in the dark web, where anonymity is paramount.

An anonymous Bitcoin wallet must have adequate features that shield it from hawk-eyed individuals who may want to harvest the information of others or hack their accounts. We are all living in a time when data espionage and surveillance threaten personal freedom. In that case, you will be one step ahead of achieving financial sovereignty by using these top-notch applications.