Vitalik Buterin is a name that should be mentioned more often in the cryptocurrency industry, as he is one of the creative minds behind Ethereum, one of the most popular cryptocurrencies and the second-largest cryptocurrency by market capitalization after Bitcoin. For this reason, it is not surprising that crypto enthusiasts are interested in Vitalik Buterin’s net worth.

As of 2023, Buterin’s net worth is estimated at around $ 600 million from his on-chain Ethereum holdings and off-chain assets. Moreover, his financial status was influenced by his philanthropic endeavors and many charity donations. One notable example is the $1 billion SHIB donated to an India COVID relief fund, where he transferred the coins from his wallet as a gift. Isn’t this something rare that we hear?

Yet, despite his success, Vitalik Buterin wishes to remain involved in Ethereum’s evolution rather than as an investor, as he contributed immensely to developing the number-one platform for smart contracts and dApps, Ethereum.

In today’s article, we discuss Vitalik Buterin’s Net Worth in 2023, learning more about his achievements in the crypto space. Stay tuned and learn more about this brilliant mind that changed the landscape for the better.

Vitalik Buterin’s Early Life and Career Development

Born on January 31, 1994, in Kolomna, Russia, Vitalik is a Russian-Canadian programmer, considered one of the youngest cryptocurrency influencers in the crypto world, and a writer and developer in the Bitcoin community, being one of the co-founders of Bitcoin Magazine.

His interest in math and economics started around 6 or 7, when his parents moved to Canada, hoping for a better life. Indeed, this was the case, as Vitalik showed remarkable school results and was even transferred to a particular class for those with high achievements who needed a more challenging school system to sustain his interests further.

From a private high school to the University of Waterloo, Vitalik Buterin advanced his classes and became the research assistant for Ian Goldberg, a famous cryptographer. Moreover, Buterin won a bronze medal in the International Olympiad in Informatics in 2012.

Still, in 2014 he dropped out of college after receiving a substantial award, the $100,000 Thiel Fellowship, for his dedicated work on Ethereum. But his career could not be in vain, as he received an honorary doctorate from the University of Basel in 2018.

Vitalik Buterin Net Worth in 2023

Buterin has undoubtedly helped develop the cryptocurrency and blockchain space with the Ethereum project, being among the world’s top 15 most prosperous crypto traders and influencers.

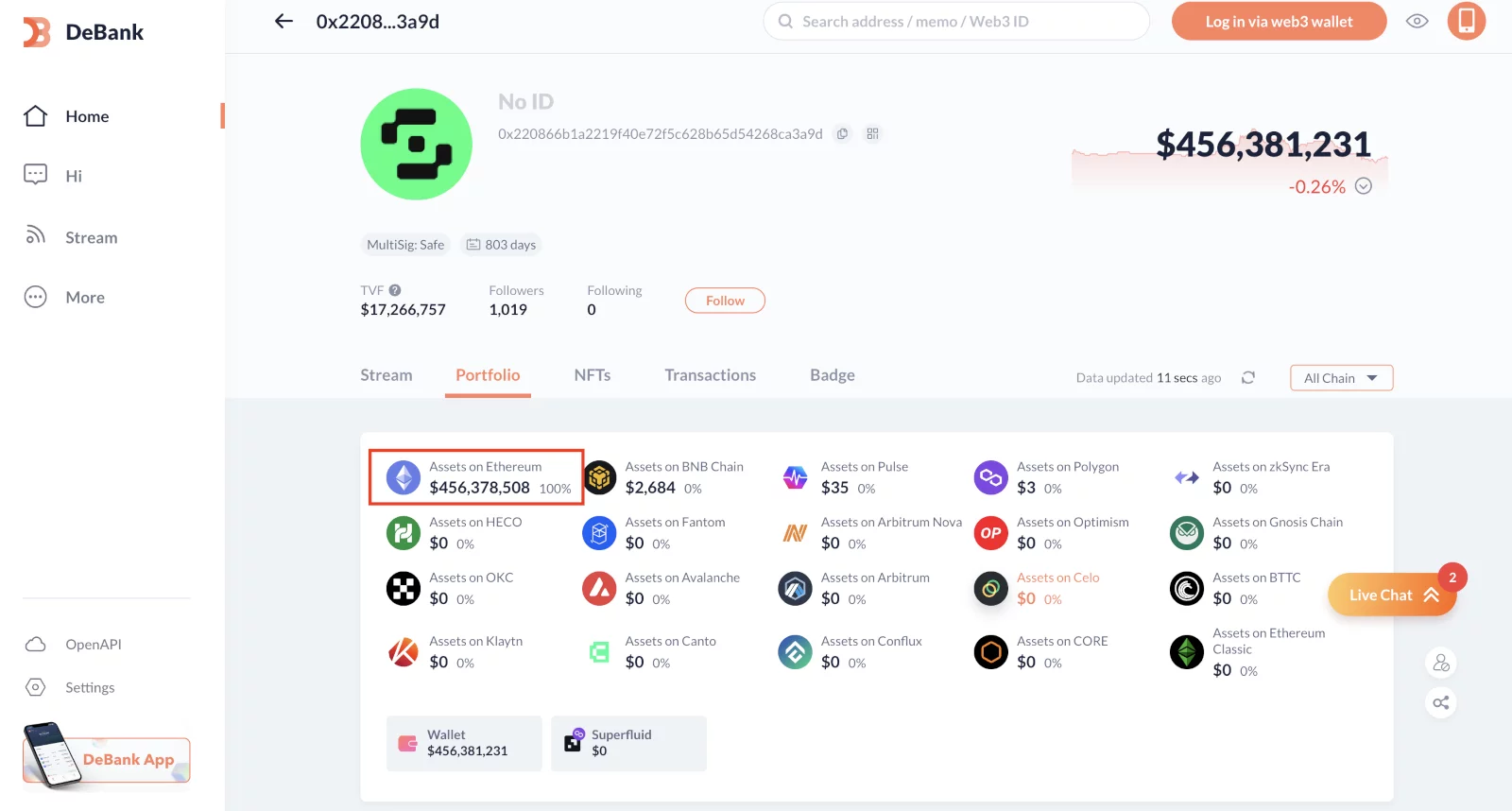

With a net worth of approximately $600 million, his allegedly crypto wallet shows a value of around $500 million, and the rest in personal, off-chain assets. Furthermore, his wealth fluctuates as there is a constant dynamic shift in the market and his donations to various causes.

His fair share of Ethereum is speculated to be around 244,001 ETH, and many would think this is a small number of coins for an Ethereum co-founder. Considering that Satoshi Nakamoto, the creator of Bitcoin, took a million of the 21 million coins for himself, there is no doubt that Buterin’s interest in developing the technology is driving Ethereum to be a highly successful crypto project.

Ethereum 2.0

The cryptocurrency space has long anticipated the launch of Ethereum 2.0, as this is a 3-phase long-term process that aims to significantly increase the number of transactions, improve smart contracts’ stability, and reduce network fees.

The Beacon Chain introduced us to the PoS (Proof of Stake) mechanism, and the Merge in 2022 pushed the Ethereum network to be substantially more energy efficient. The last phase, the Sharding, would handle the large amounts of data into two rollups, also known as layer 2, and is estimated to be released in 2024.

But How Did Ethereum 2.0 Change Things?

As in the past, the gas fees reached incredibly high levels, and the 2.0 shift made it possible to move from a Pow to a PoS, where there is no need for crypto miners, as seen in Bitcoin. Instead, users are staking their Ethereum by joining a pool. In the end, Proof-of-Stake is a more sustainable mechanism that uses less energetic power, thus becoming much faster.

Fun fact: The energy usage dropped by roughly 99.95% and decreased average block times after switching to Proof-of-Stake.

The Ethereum Shanghai Upgrade

In April 2023, the Shanghai or EIP 1559 upgrade was the most awaited update of the year. This update addressed the issues related to the transaction fees and network congestion on the Ethereum blockchain, introducing a new fee structure, thus making ETH more deflationary.

This new fee structure included a base fee and priority fees that enhanced the efficiency of the transactions. However, the Shanghai upgrade has significant potential in the crypto world, making the transactions more user-approachable by reducing the fees volatility and increasing the network’s capacity.

Moreover, this will further help make the Ethereum ecosystem more scalable, sustainable, and user-friendly to grow its user base.

Ethereum Reached Record Highs

Ethereum has been at the forefront of market performance since late 2020, just like Bitcoin. Although many believe that ETH followed Bitcoin’s price trends, it is essential to know that cryptocurrencies get more valuable with increasing network engagement.

The staking of billions of dollars in ETH on the network is likely a significant factor influencing the price and the use of DeFi (Decentralized Finance) and the smart contract and dApps infrastructure. Moreover, many analysts have mentioned the overvaluation of Ethereum several times due to the infrastructure.

As of July 2023, Ethereum trades at $1,871.76 after breaching an all-time high of $4,800 in 2021.

Final Thoughts

Vitalik Buterin’s journey from a young programmer to a key figure in the crypto world is truly remarkable, and undoubtedly, his contributions could not go without being noticed. From revolutionizing the blockchain space to introducing smart contracts and decentralized applications, Buterin has reshaped how we interact with technology.

As the cryptocurrency landscape continues to evolve, Vitalik Buterin’s story still influences many, as his vision, perseverance, and commitment led to the creation of one of the most well-known cryptos that are changing things for good.

As we stay tuned to what lies ahead, one thing is sure – the journey of Ethereum and its co-founder is far from over, and the potential for positive change in the world remains boundless.