Another year passed, and what a game-changer it was, especially with Black Rocks’ approval for the spot Bitcoin ETF, which seemed to put Bitcoin on a growth trajectory by +155.2% in 2023.

But this event was just the needle in a haystack, as 2023 was a full year that put the crypto landscape in the spotlight. As a result, the crypto market saw noteworthy growth, doubling its total market cap this year, mainly due to Bitcoin’s remarkable rebirth.

After a slow and challenging 2022 and analyzing the Q2 and Q3 2023 crypto reports, it’s time to move along and draw the finish line for this hectic year.

We can only say that 2023 was the year of recovery for the crypto industry, as Bobby Ong, the Co-Founder & COO at CoinGecko, marked:

“2023 turned out to be a strong year of recovery for the crypto industry, with regulatory concerns addressed and last cycle’s excesses purged.

Going into 2024, the projects that have been building during the bear market have strengthened crypto’s tech stack and launched new apps, and we’re excited to see what the next developments will be.”

Thanks to CoinGecko‘s report, in today’s article, we are striking some of the most critical insights for 2023 so that you can prep your trading strategies to get started in 2024.

Top 2023 Crypto Highlights to Get on the Right Track in 2024

- The global crypto market cap grew by 108.1%, reaching $1.72T;

- The total crypto trading volume reached $10.3T 2023 Q4;

- Bitcoin’s resurrection witnessed a +155.2% increase in 2023;

- Ethereum only saw a +90.5% increase in 2023;

- NFT Trading Volume reached $11.8b in 2023;

1. The Global Crypto Market Cap Grew by 108.1%, Reaching $1.72T

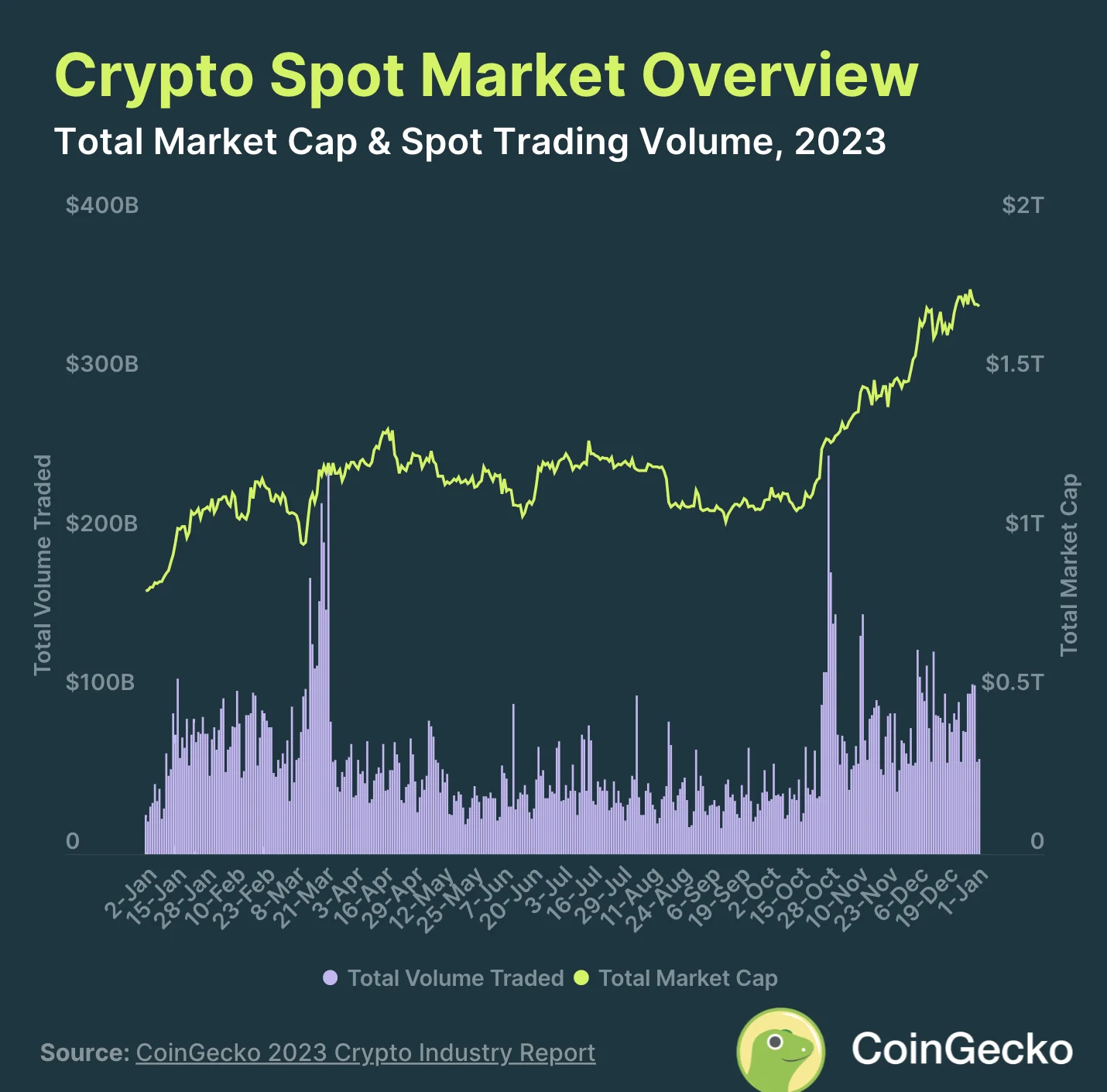

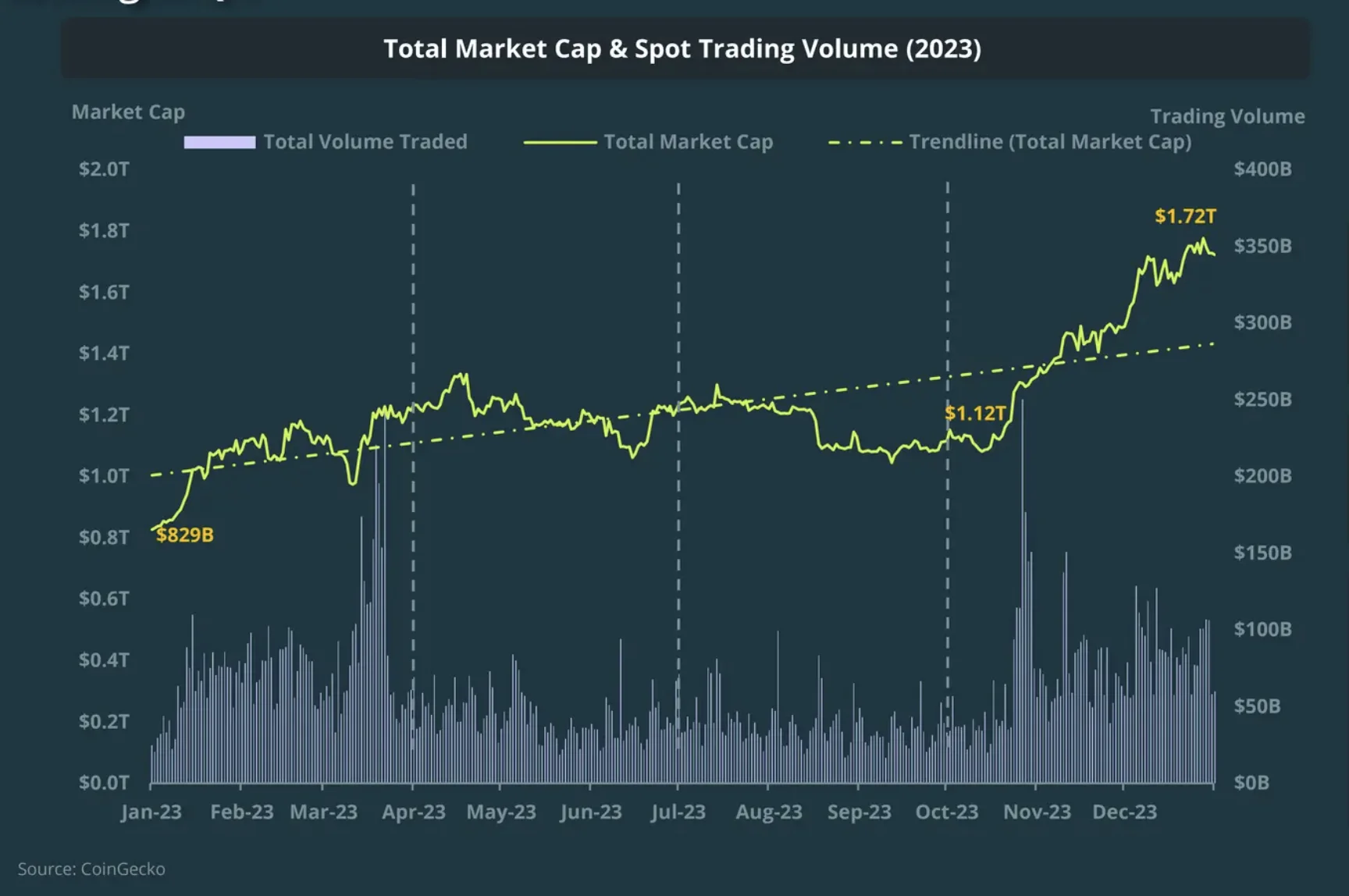

After we have witnessed a 10% pitfall compared to last year’s Q3, now is the time for a small but rewarding celebration, as the total crypto market rose by +108.1% in 2023, or better said, with $869.0 billion.

As for the trading volume, Q3 of 2023 ended with an 11.5% decline compared to Q2. However, everything is for the best, as the global trading volume climbed back up.

On a QoQ analysis, Q4 ended with a +91.9% increase, having an average daily trading volume of $75.1 billion, yet still in a deprecated state compared to 2022.

2. The Total Crypto Trading Volume Reached $10.3T 2023 Q4

Indeed, the crypto trading volume reached $36.6 trillion for the entire 2023 despite ending the last quarter with $10.3 trillion, a QoQ gain of +53.1%.

This staggering increase is attributed to the event of the year, the Bitcoin ETFs, which turned anyone on its head and led to a bullish market sentiment.

However, the CEXs dominated the run despite FTX’s decline in 2022 and Binance’s regulatory battle throughout 2023.

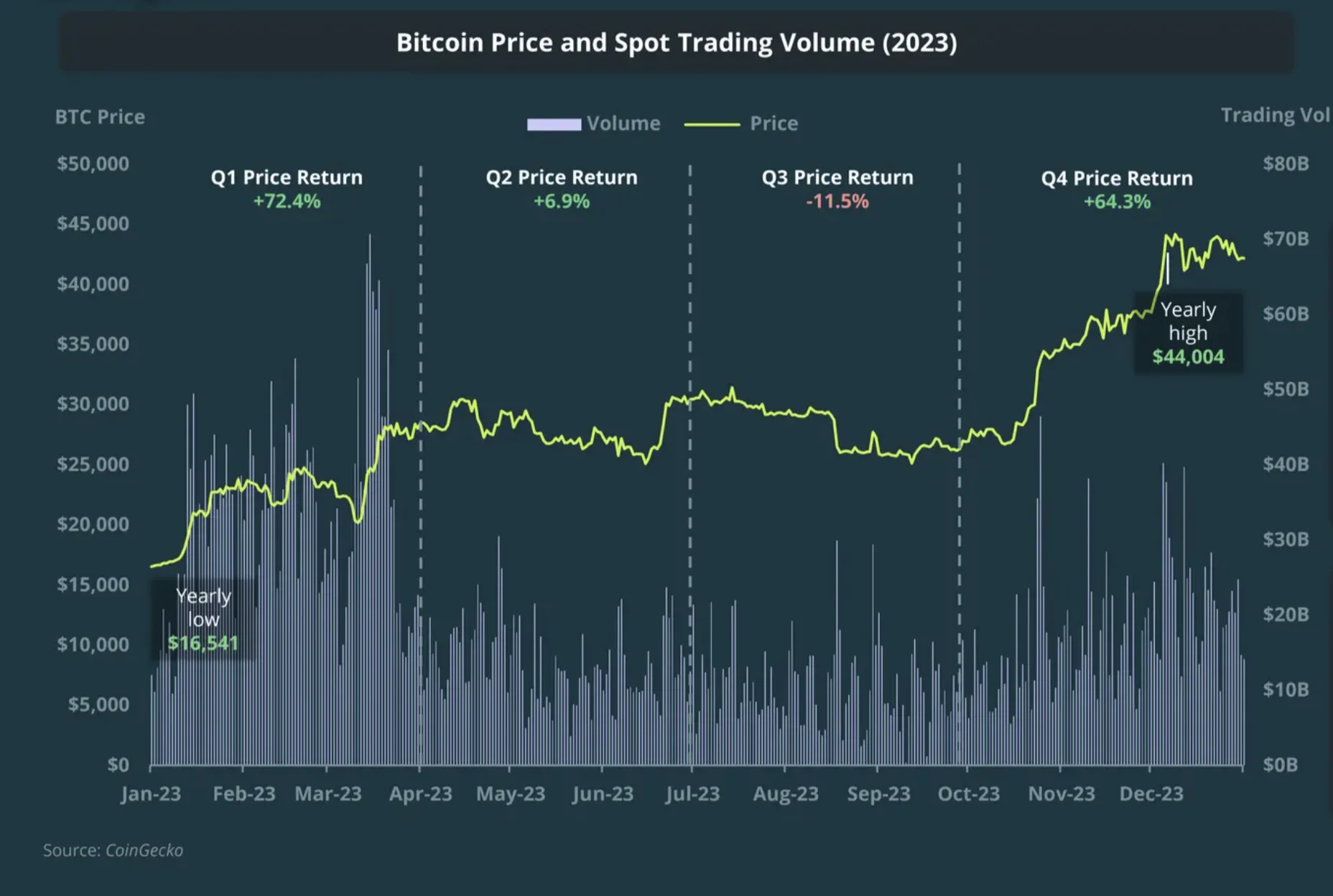

3. Bitcoin’s Resurrection Witnessed a +155.2% Increase in 2023

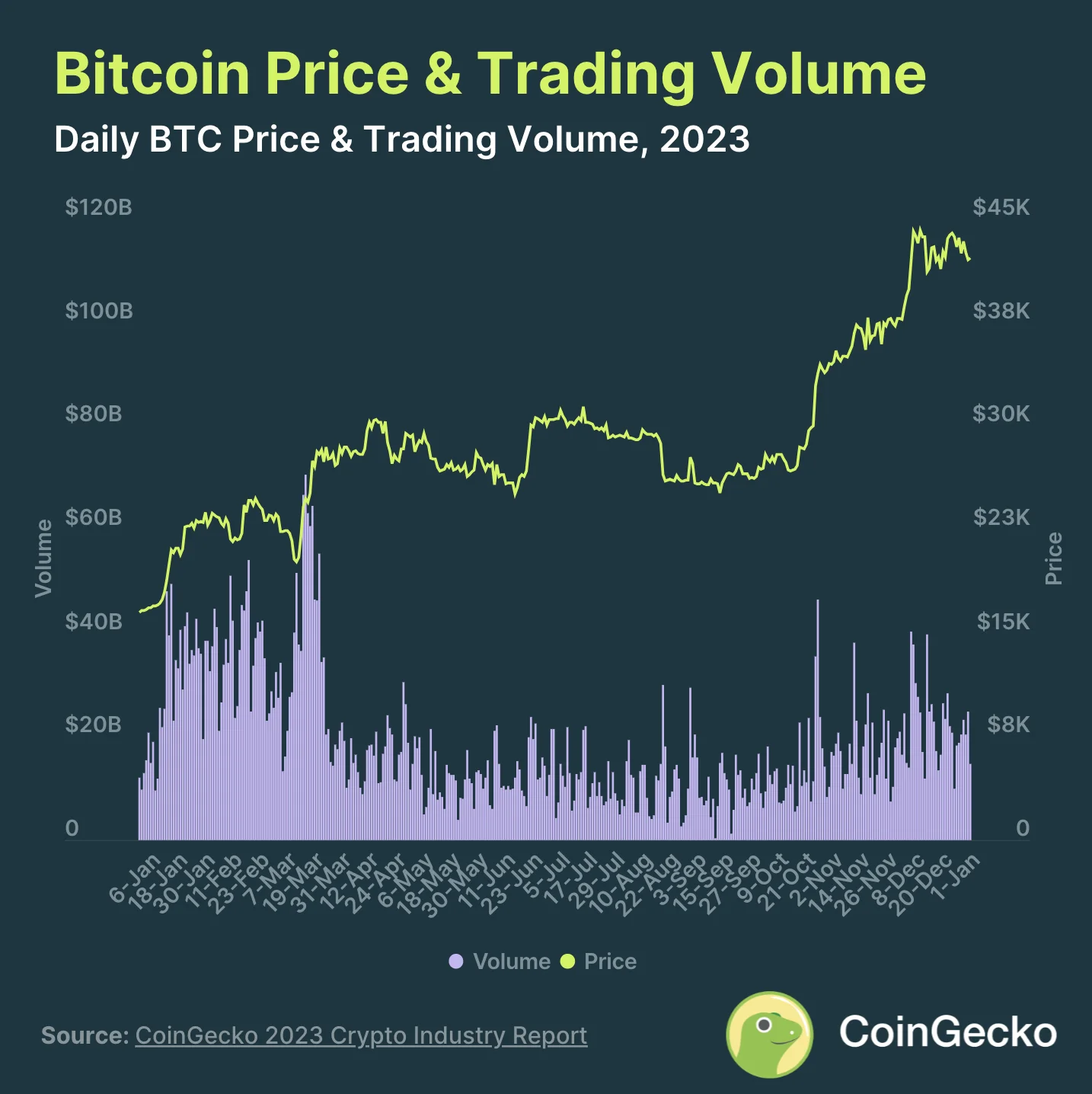

Bitcoin had a surprising road trip last year. Even though it finished Q1 with a growth of +72.4%, followed by a fruitful Q2 and a drastic drop of 11.5%, it still managed to end Q4 alone with a massive increase of +64.3%. As a result, BTC topped 2023, hitting a yearly high of $44,004.

Regarding the trading volume, BTC had a similar path, whereas the first three quarters have gradually declined, pegging up at $18.0 billion, a gain of +64.3% QoQ.

4. Ethereum Only Saw a +90.5% Increase in 2023

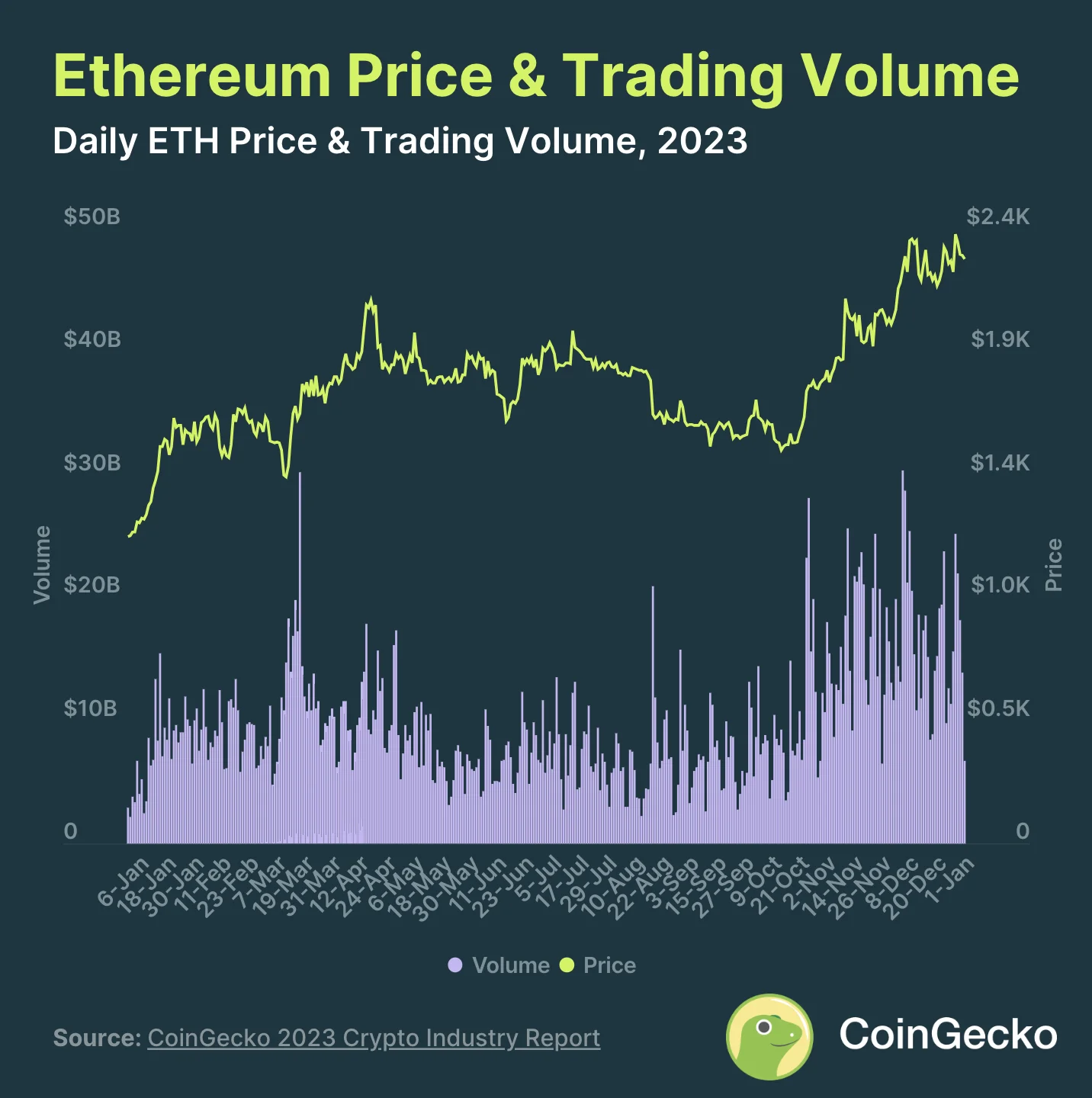

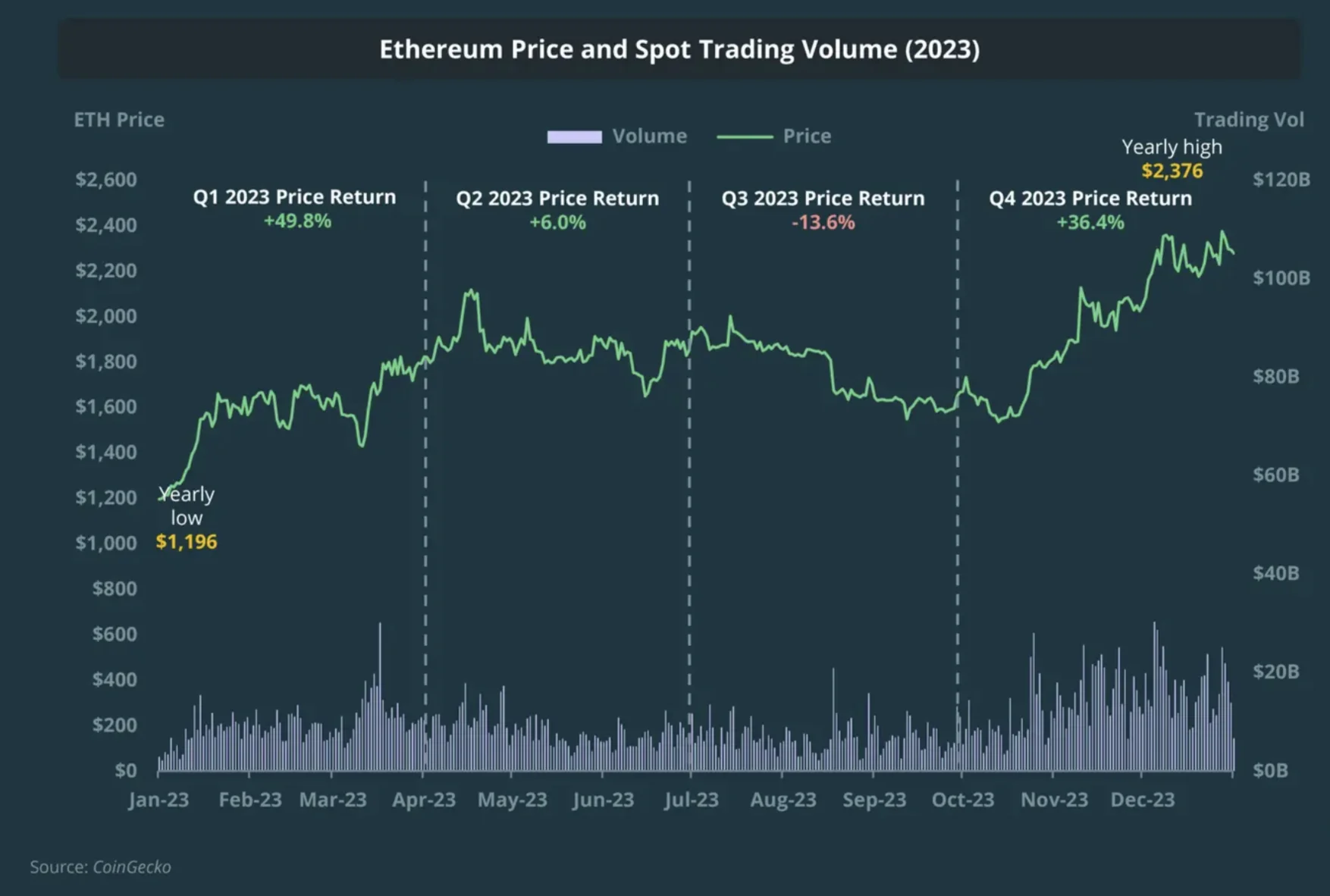

2023 was the year of growth for Ethereum, which had a massive +90.5% gain, closing at $2,294. Moreover, if we put these insights into perspective from one quarter to another, we have a consolidated path ahead.

So, in Q1, ETH increased by +49.8%, followed by a much-needed consolidation in the second and third quarters, creating space for a +36.4% spike in Q4. As a result, Ethereum reached its yearly high of $2,376 in December 2023.

The average trading volume has been somewhat stagnant, at least for the first three quarters of 2023, until Q4, when it had a massive gain of 100%. As such, the trading volume moved from $7.2 billion to $14.4 billion.

Contrary to popular belief, the Shanghai Upgrade in April hasn’t changed things for the better, as there weren’t any significant price movements in that time frame.

5. NFT Trading Volume Reached $11.8B in 2023

Indeed, the NFT market had its glory time in 2022, where the total trading volume accounted for $26.3 billion, yet 2023 ended by almost half, $11.8 billion.

However, the NFT market reached $3.2 billion in Q4 thanks to the Bitcoin Ordinals trading volume, although Ethereum continued to dominate the 2023 NFT chain with 72.3% of the trading volume.

2023 Crypto Market at a Glance

To better understand the crypto market and prepare for 2024’s eventful year, it is best to look at the landscape from a yearly point of view to have an objective overview.

The year has been marked by multiple disruptive events, from lawsuits to new crypto regulations and a bumpy 2023 ride. In this case, please allow us the time to break it down and discuss it further.

Key Insights of 2023’s Crypto Market

- In Q1, the total crypto market cap was $1.238;

- The Q2 gains accounted for 0.14%, ending at $1.240 trillion;

- A 10% decline marked Q3 of 2023;

- Q4 had an increased market cap of 54,3%, meaning +607B;

As you can already pinpoint, the turbulent ride of 2023 in the crypto realm has ended on a profitable note despite having some rough quarters. However, on a year-to-year comparison, even the trading volume was $58.9B, with a 31,6% decrease.

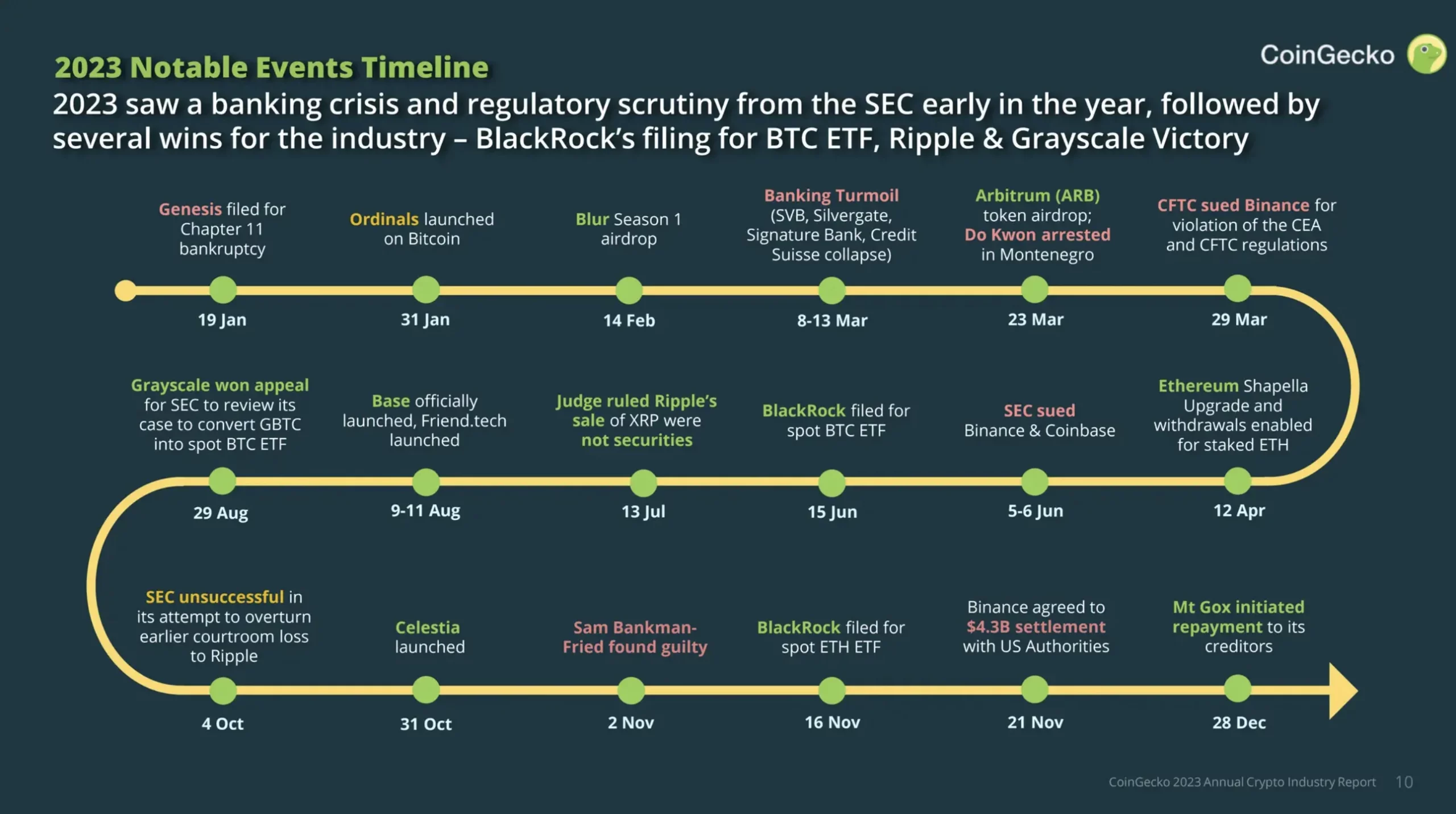

Top Significant 2023 Crypto Events

Until now, we have discovered the consequences of a bumpy 2023. However, it is wise to look at some of the most notable events that led to these results, and just as the saying goes, history is a wheel that keeps turning.

So, let’s catch up on the key events!

1. Genesis Filed for Chapter 11 Bankruptcy

The last victim of the 2022 FTX collapse, Genesis, filed for Chapter 11 bankruptcy protection in the US after owning over $3.5 billion to its top 50 creditors.

Some key creditors include the crypto exchange Gemini, Cumberland, MoonAlpha Finance, and others.

2. Bitcoin Ordinals Launched on January 31

3. The Blur Season 1 Airdrop on February 14 Distributed the $BLUR Token to Its Users

4. The Banking Crisis Unfolded

In March last year, a trigger manifested when SVB, a central US bank, announced a short capital due to unexpected losses. As you probably remember, this led to a series of events in just a few days, whereby the other two key players, Signature Bank & Citizens Trust Bank, also failed.

Consequently, the global bank stocks dropped, and the regulatory organizations turned the page and ran to stricter capital requirements.

The 2023 banking crisis has been the first central bank failure since 2017. Is history doomed to repeat itself?

5. Arbitrum Token Airdrop and Do Kwon Was Indicted in the US Following His Arrest in Montenegro in March 2023

6. CFTC Sued Binance for Regulatory Violations

7. Ethereum Shapella Upgrade and Staked ETH Withdrawals Being Possible

8. SEC Sued Binance and Coinbase

9. BlackRock Filled for Bitcoin Spot ETF

10. The Court Ruling in Ripple’s Case with the SEC Indicated That the Digital Asset XRP Is Not a Security

11. The Blockchain Social Media Platform Friend.tech Was Launched on the Base Network

12. Grayscale Wins Appeal Against SEC to Convert Bitcoin Trust to ETF

13. SEC’s Appeal to Overturn the Ripple Ruling Has Been Denied

14. Celestia Was Launched

15. FTX Founder Sam Bankman-Fried Has Been Found Guilty on All Seven Counts of Defrauding

16. BlackRock Filled for ETH ETF After Winning on the BTC Spot ETF

17. Binance Agrees to a $4.3 Billion Settlement with U.S. Authorities

18. MT. Gox Appears to Have Started the Repayments Tied to 2014 Bitcoin Hack

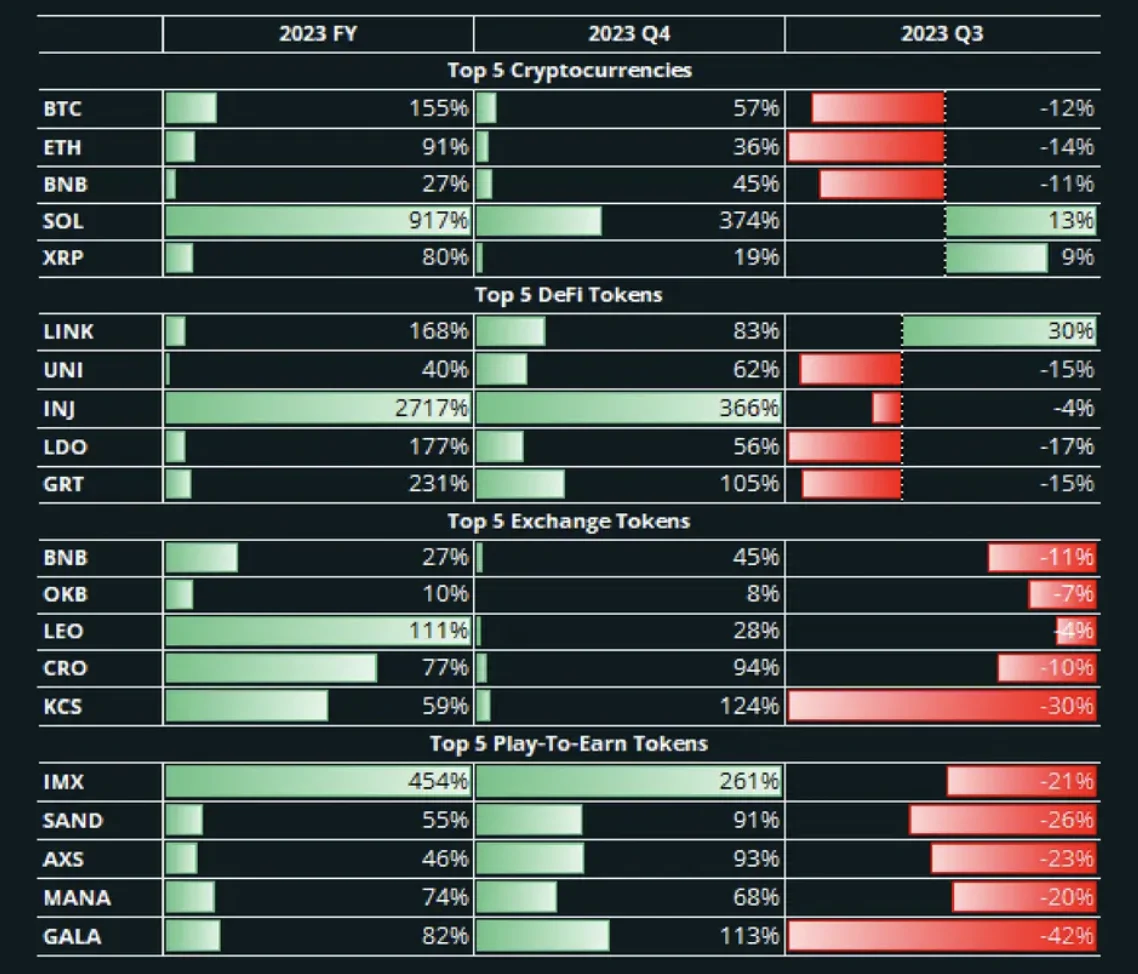

2023 Crypto Price Performance Key Insights

As last year was filled with multiple impactful events, the most notable cryptocurrencies have ended the year positively. SOL was the first crypto to end Q4 as a top performer with a 374% gain, which led to a 10x price increase, gaining 917% for the year.

Bitcoin was in 2nd place with a 155% gain, thus outperforming ETH with a 91% increase, XRP with +80%, and BNB with only a 27% gain. This increase comes perfectly, especially after, in Q3, these cryptos saw a price decline.

When discussing DeFi cryptos, INJ made it to the spotlight, breaking into the top 5 DeFi cryptos for the first time with a 366% increase in Q4. Then the list goes on as follows:

- GRT with 231%;

- LDO with 177%;

- LINK with 168%;

- UNI with 40%;

The Top 5 Exchange Tokens

- BNB: 27%;

- OKB: 10%;

- LEO: 111%;

- CRO: 77%;

- KCS: 59%;

Top 5 P2E Cryptos

- SAND: 55%;

- AXS: 46%;

- MANA: 74%;

- GALA: 82%;

- IMX: 454%, outperforming BTC;

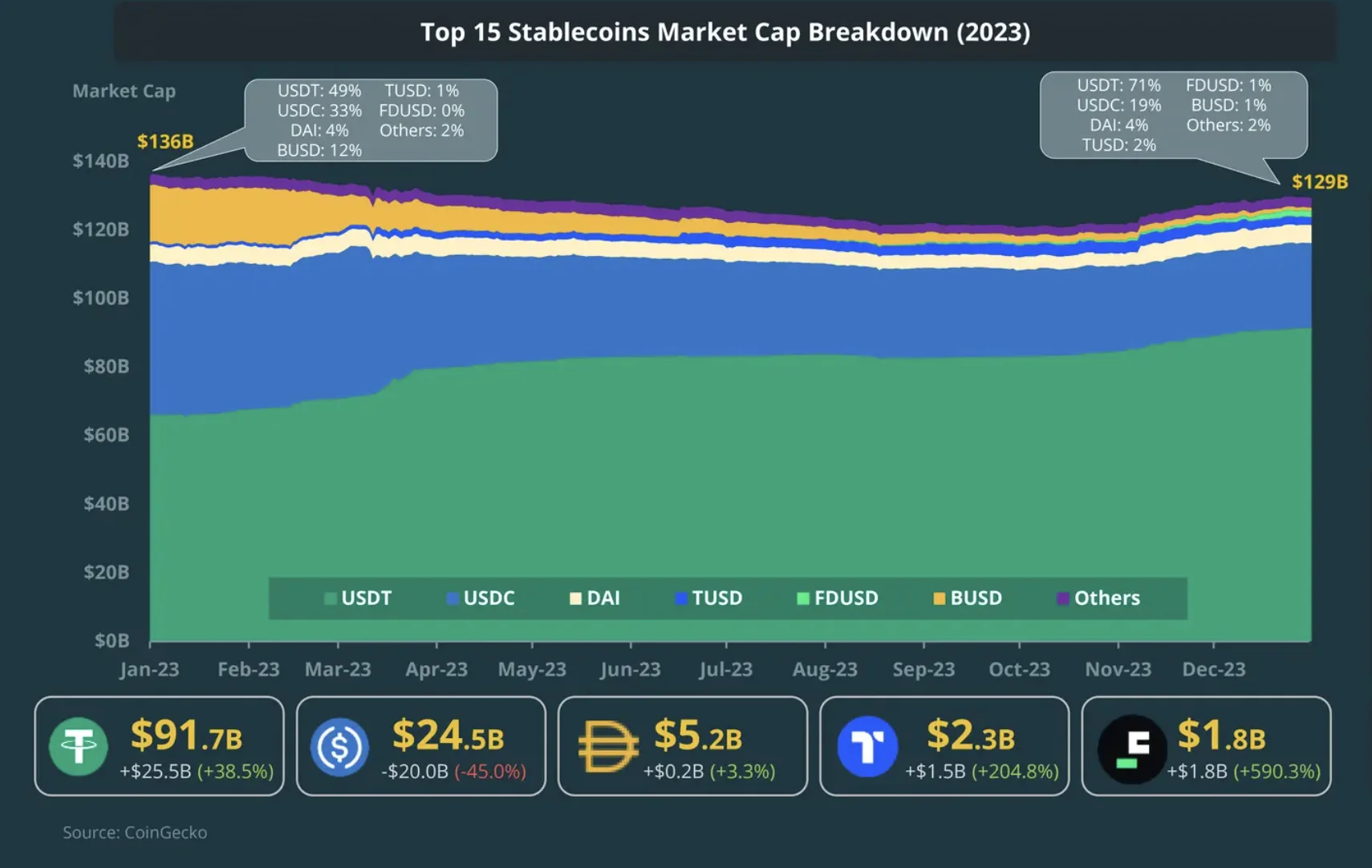

Top 15 Stablecoins of 2023

If, in Q3, the top 15 stablecoin market cap decreased by 11.3%, in Q4, it managed to climb up slowly, but only by 7,1%. As a result, the stablecoin market cap ended 2023 with an overall 5,6% decline on a YoY analysis.

USDT solidified its position with a 71% market dominance. Moreover, it gained 38.5% or $25.5B in market cap and 22% in market share.

- FDUSD entered the top 5 stablecoins with a $1.8B gain;

- TUSD follows closely with a $1.5B gain;

- DAI stagnated throughout the entire year;

- USDC experienced the most considerable loss, with a 45% decline or $20B;

- eUSD hit the top 15 spotlights, while GUSD and crvUSD fell off the podium;

Bitcoin Analysis in The Q4 2023

As briefly mentioned, BTC reached its yearly high in the last quarter of 2023 at $44,004.

Anticipating the spot BTC ETF approval, the market rallied strongly in Q4, and this is fantastic news, especially since 2023 is a rocky road, whereby the first two quarters have seen growth, yet Q3 declined by 11.5%, dropping to $26,969.

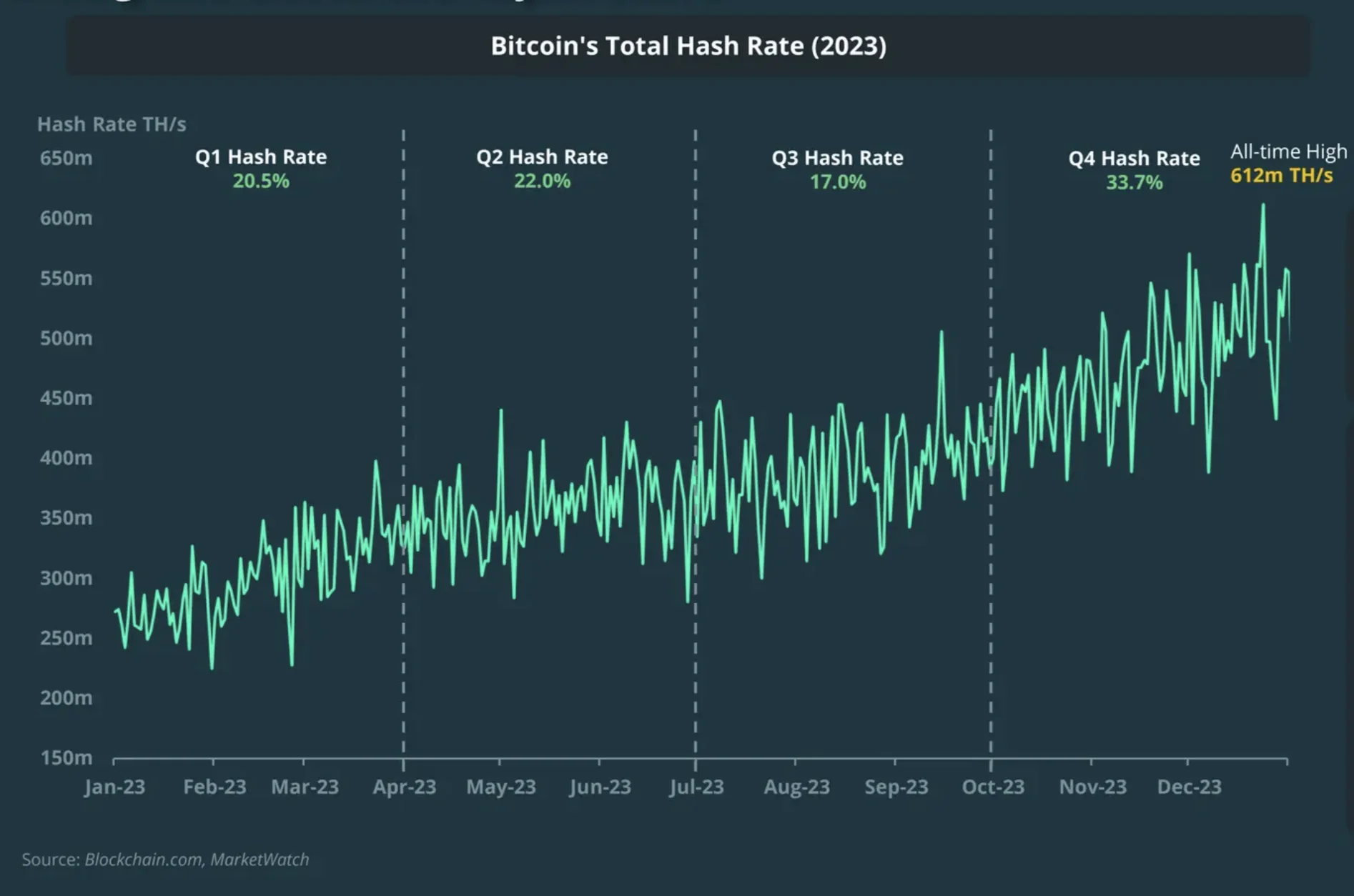

The Bitcoin Hash Rate in Q4 2023

Bitcoin’s mining hash rate staggers impressive new all-time highs, 612 m TH/s, from one quarter to another. As such, in 2023, the BTC hash rate increased by 104.9%.

Among the most influential factors is the expansion of multiple mining companies like Marathon Digital and Bit Origin, which acquire new mining sites.

The State of Ethereum in Q4 2023

We know that last quarter, the price fell by -13.6%; overall, 2023 was a good year for Ethereum, closing down to a price surge of 90,5%. Moreover, Ethereum had a yearly high of $2,376 in December 2023. The trading volumes have also seen an increase of a daily average of $14,4B, compared to Q3 of $7,2B.

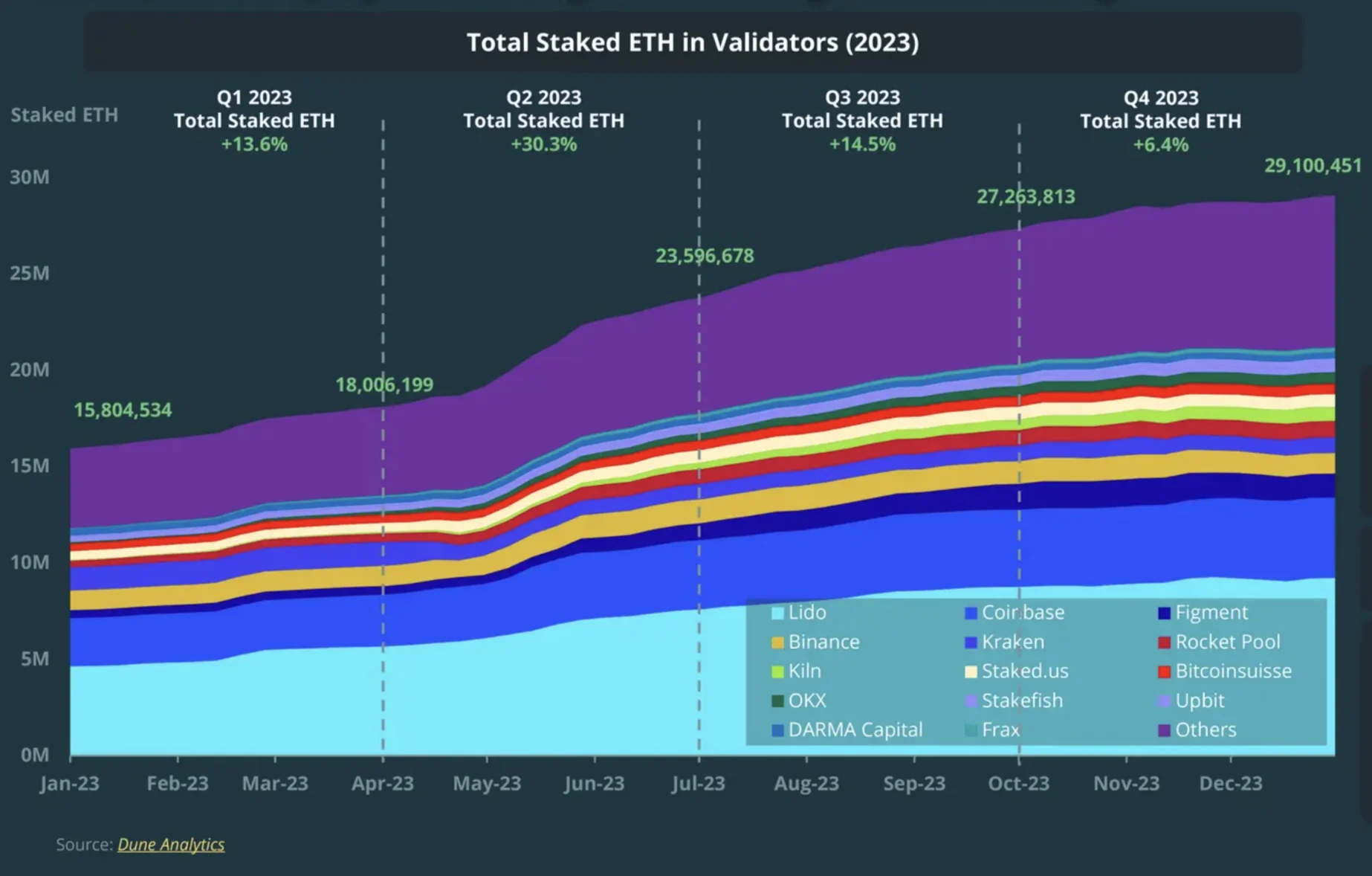

Q4 2023 Ethereum Consensus Layer Staking

Compared to Q3, ETH staking grew by 6,4%, hitting $29,1M. However, despite being a positive outcome, it has been a slow process, especially since the Celsius Network bankruptcy unstaked their ETH holdings.

Not to mention that in Q3, Lido was dominant, yet all things end? Lido has reached the ceiling at a 30% mark.

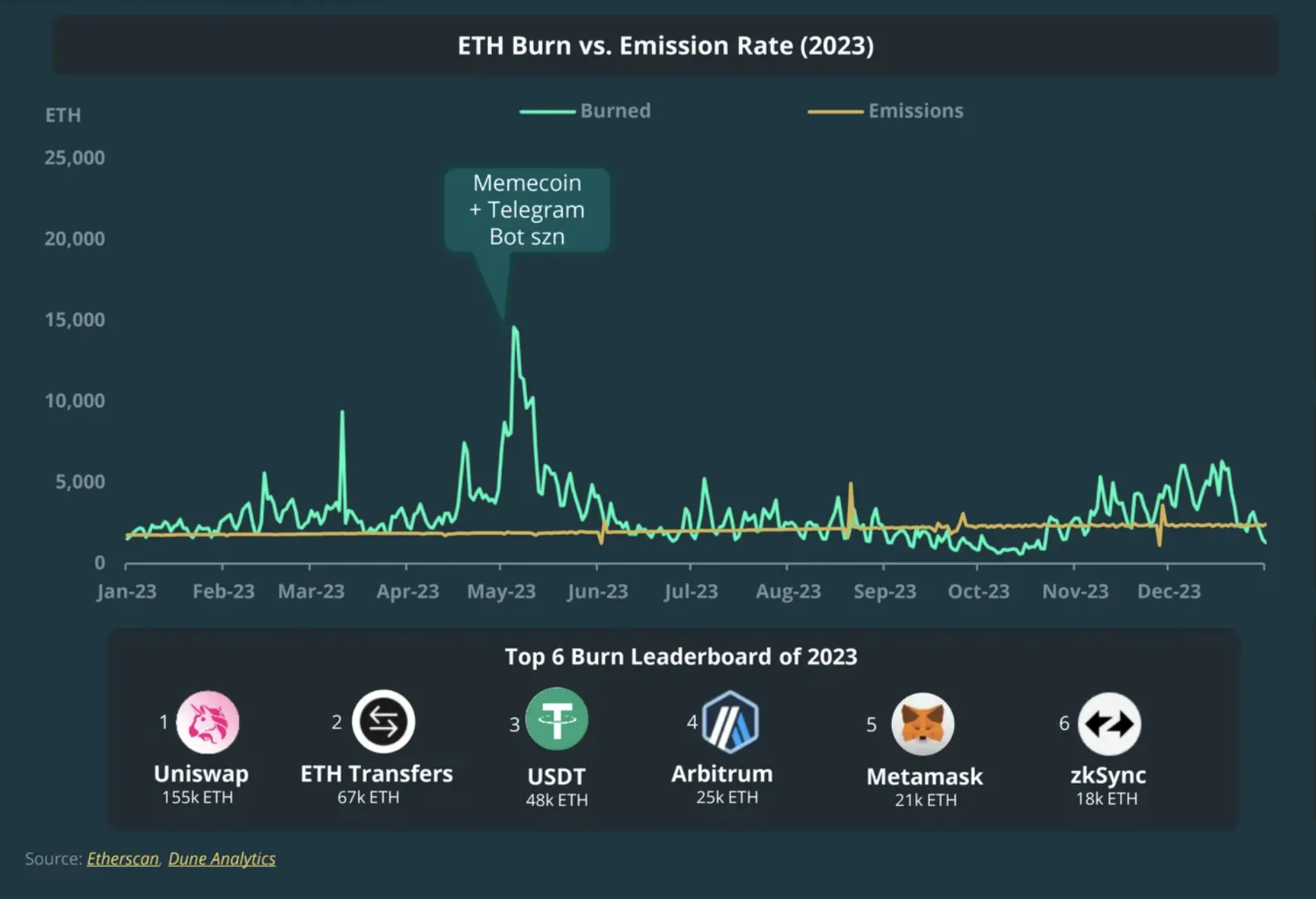

Ethereum Burn Rate in Q4

2023 was a deflationary year for Ethereum, whereby 1,09M ETH were burned, and the network removed 342,000 ETH from circulation. Additionally, only 0,75M ETH was emitted.

But if it were only to discuss the last quarter of 2023, 270,000 ETH were burned, 216,000 emitted, and a net burn of 54,000 ETH.

Fun fact: The most significant one-day burn was on December 18, when 6,303 ETH was burned. However, we could not remember May 5, when 14.6K were burnt in a single day.

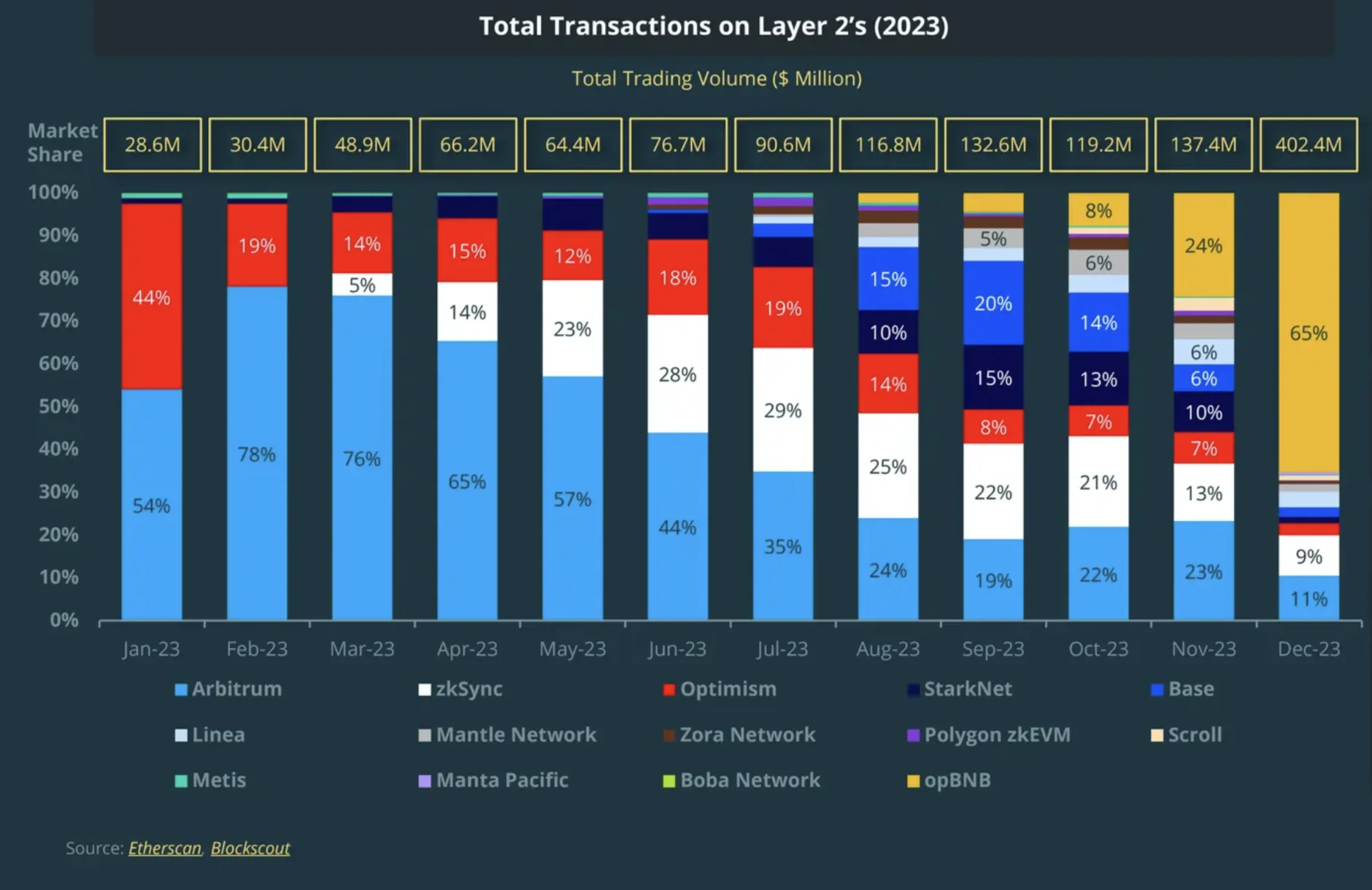

The Layer 2’s Performance in 2023

Layer 2 reached 1.31B transactions in 2023, whereas Arbitrum achieved 375,2M transactions, more than a third, 37,5%, of all transactions on Ethereum Layer 2. However, opBNB had the most transactions in Q4, with 304,8M, meaning 47,6%.

On a QoQ analysis, the number of transactions on L2 increased by 93,8%, more specifically with 659M in Q4 alone, compared to 340M in Q3.

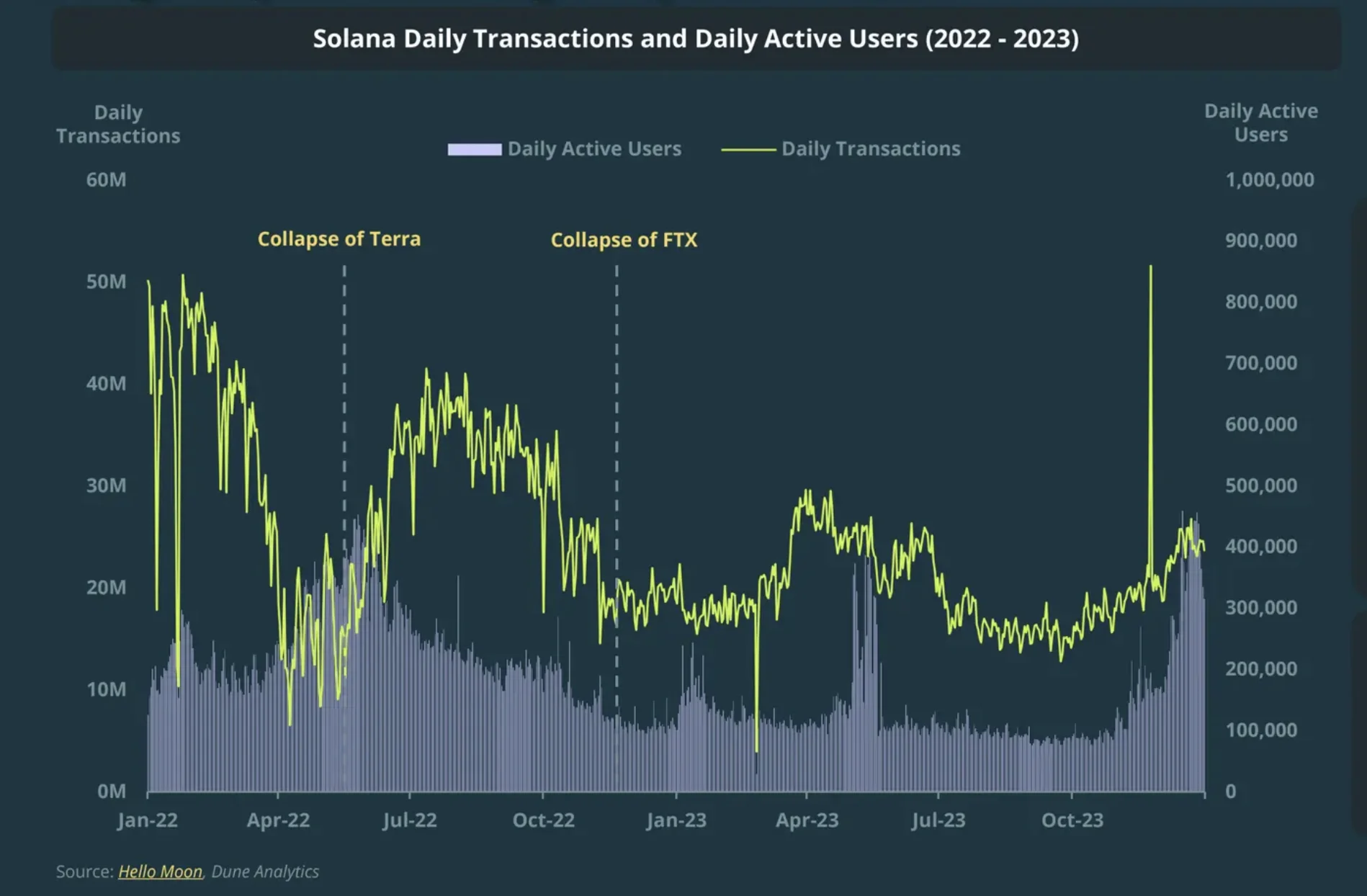

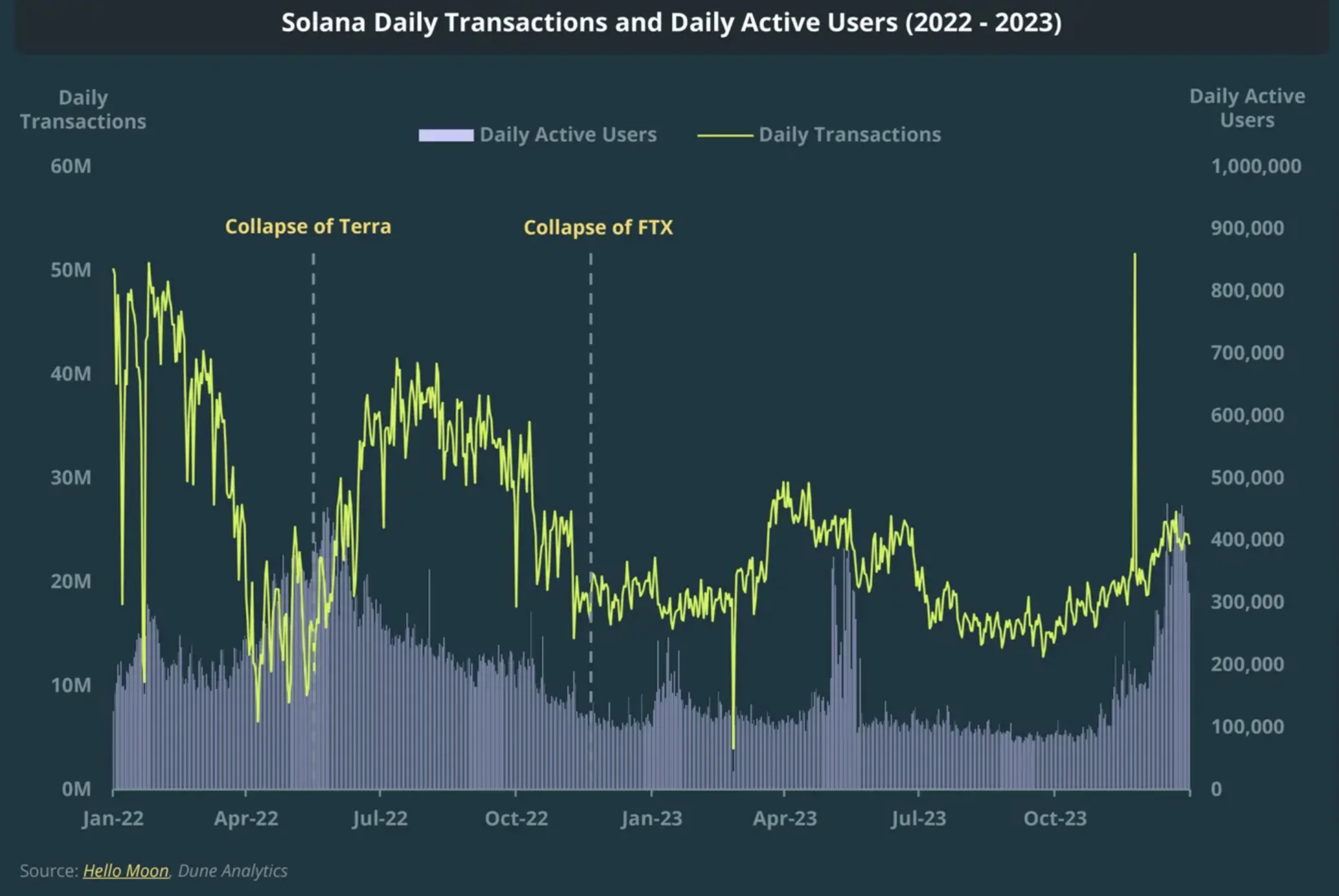

The State of Solana in 2023

SOL Price vs. Trading Volume

Of course, we could only go further by discussing Solana’s resurrection, which had a 10x gain in 2023 after ending Q4 with a 374% price increase. Moreover, Solana climbed higher than ever in the past year, presenting a 917.3% price increase, and reaching its yearly high of $121.45, which was then due to correction.

Regarding the daily trading volume, in Q1, we witnessed an average of $827M, then Q2 and Q3 came with a significant drop to $400M, followed by a surprising growth of 379%, thus reaching $2B QoQ.

Solana Onchain Metrices

We all know that 2022 was a rocky road, yet in 2023, Solana witnessed a 536% increase in the average daily transaction of users’ activities.

Also, the motif behind users’ return was Solana’s NFT season, which reached 453K in May 2022.

What is striking is that even though the number of daily users slightly fell, the average daily transactions increased from 20M to 40M from May to July 2023.

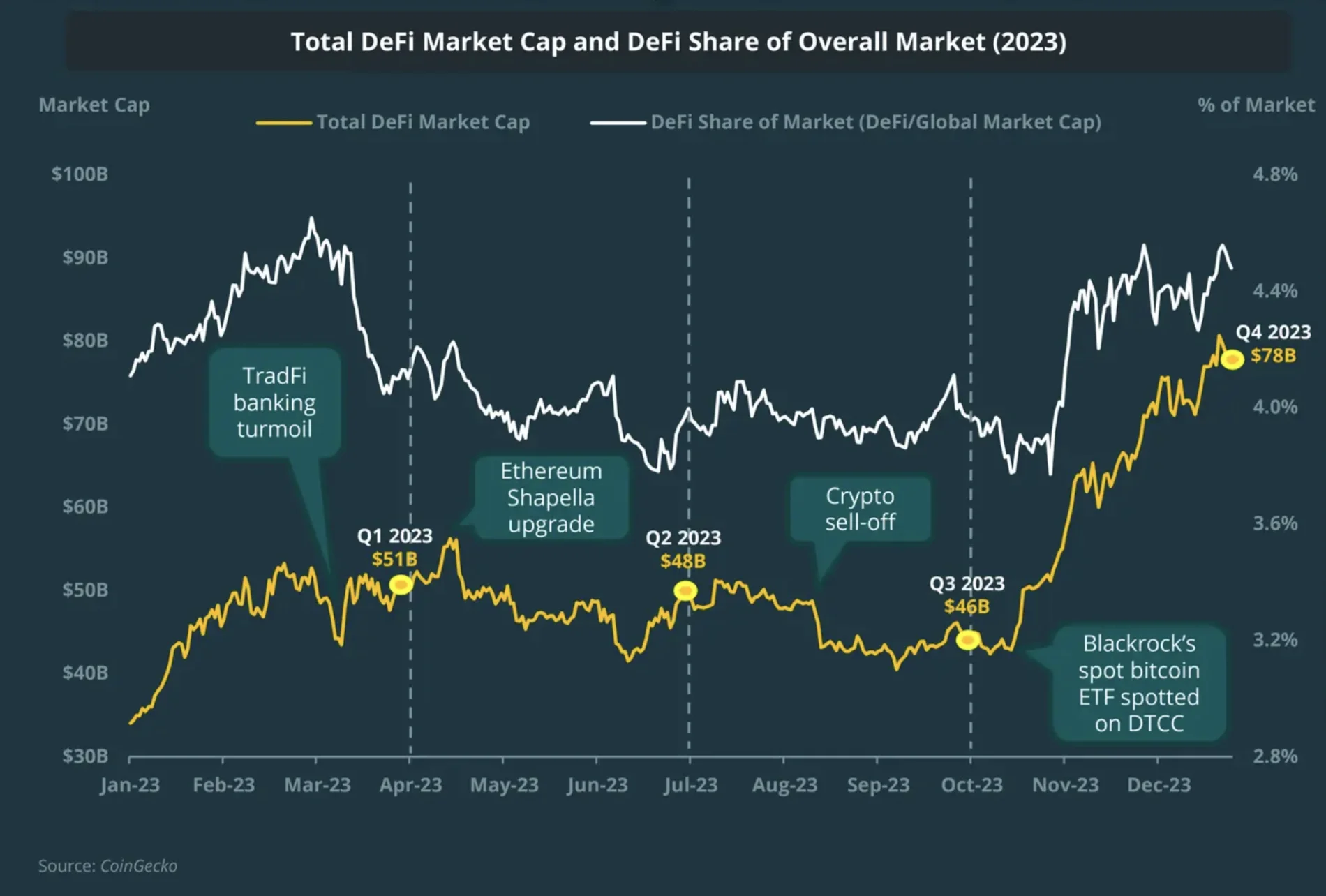

DeFi Analysis in Q4 2023

The DeFi market capital has stagnated for the first three quarters of 2023. However, the landscape changed for good in Q4 due to a bullish market sentiment. If, at the beginning of 2023, the DeFi market cap was $34B, by the end of 2023, it acquired an additional $44B, thus overcoming the total crypto market cap by 128,8%.

One influential factor could be the approval of spot Bitcoin ETF that pushed the DeFi market to new yearly highs of $78B at the end of 2023 and increased the dominance in Q4 with 4,5%.

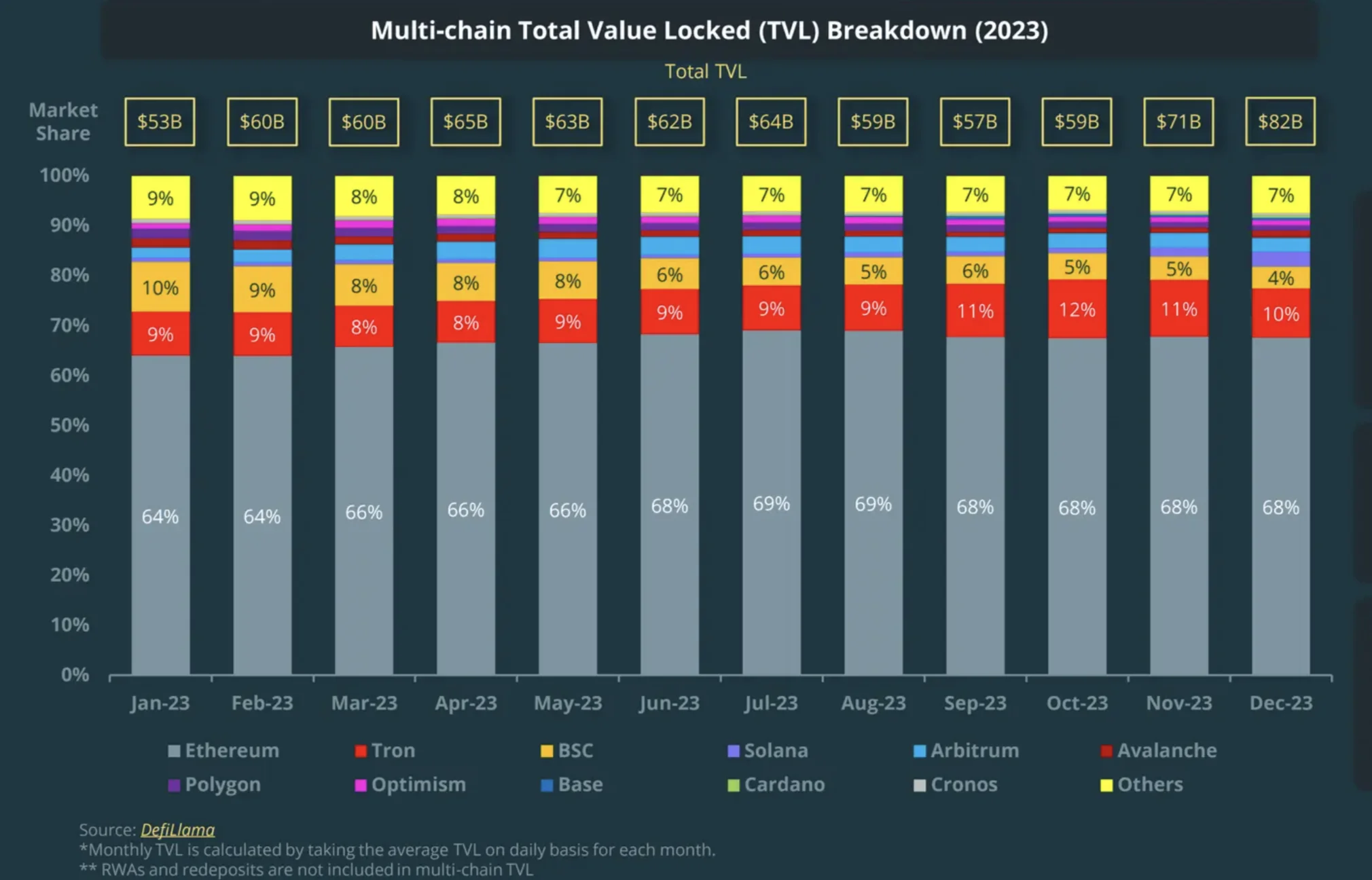

DeFi Multichain Market Share in Q4 2023

Multichain’s TLV fluctuated for the first three quarters of 2023, yet things changed for the better in Q4, when it significantly increased by $25B. As a result, the DeFi multichain market witnessed an increase of 55,6%.

- Ethereum managed to maintain its position and dominance, increasing its market share by 68% by the end of last year.

- Tron outperformed the Smart Chain BNB, handling 10% of the market share, surging by 74,8% in TLV.

- BSC has dropped considerably by 31%.

- Solana’s resurgence kicks off 2023 by 441.1%, reaching $2.4B.

The State of NFTs in 2023

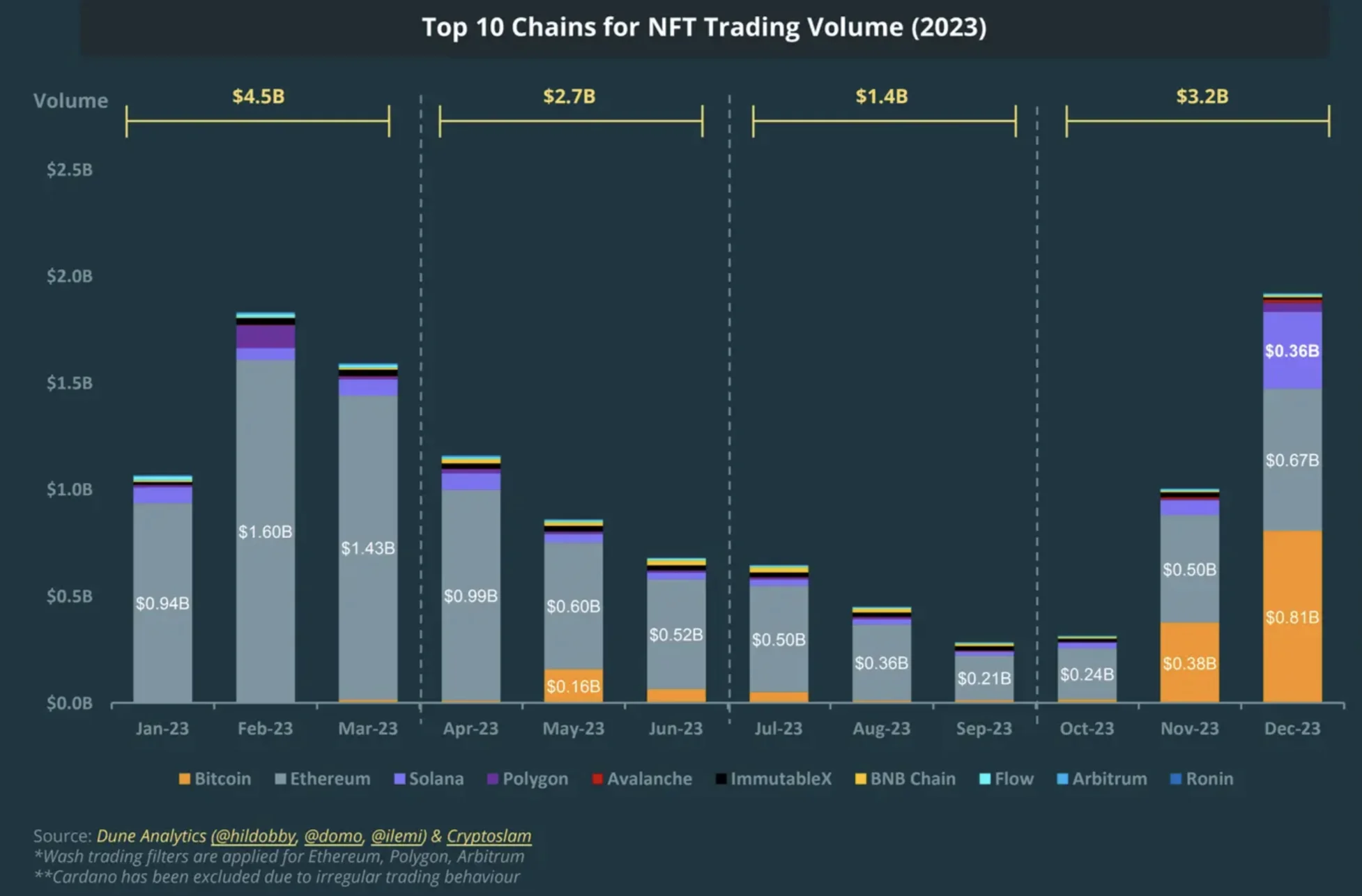

NFT Trading Volume Across 10 Chains in 2023

Indeed, the NFT trading volume has constantly fluctuated for most of 2023; however, in Q4, it rebounded. Please note that this is half of the NFT trading volume of 2022.

In 2023, Ethereum-based NFTs remained the main chain with 72.3% trading volume, yet it doesn’t compare to its year of glory, 2022, when it had over 90% dominance. Last year, it lost ground to Bitcoin and Solana.

Bitcoin surpassed Ethereum’s trading volume by $808M in December last year, partly due to the introduction of Bitcoin Ordinals.

However, Solana stole the thunder with an outstanding 2023 comeback, increasing its trading volume by four times, acquiring $359M in the entire year.

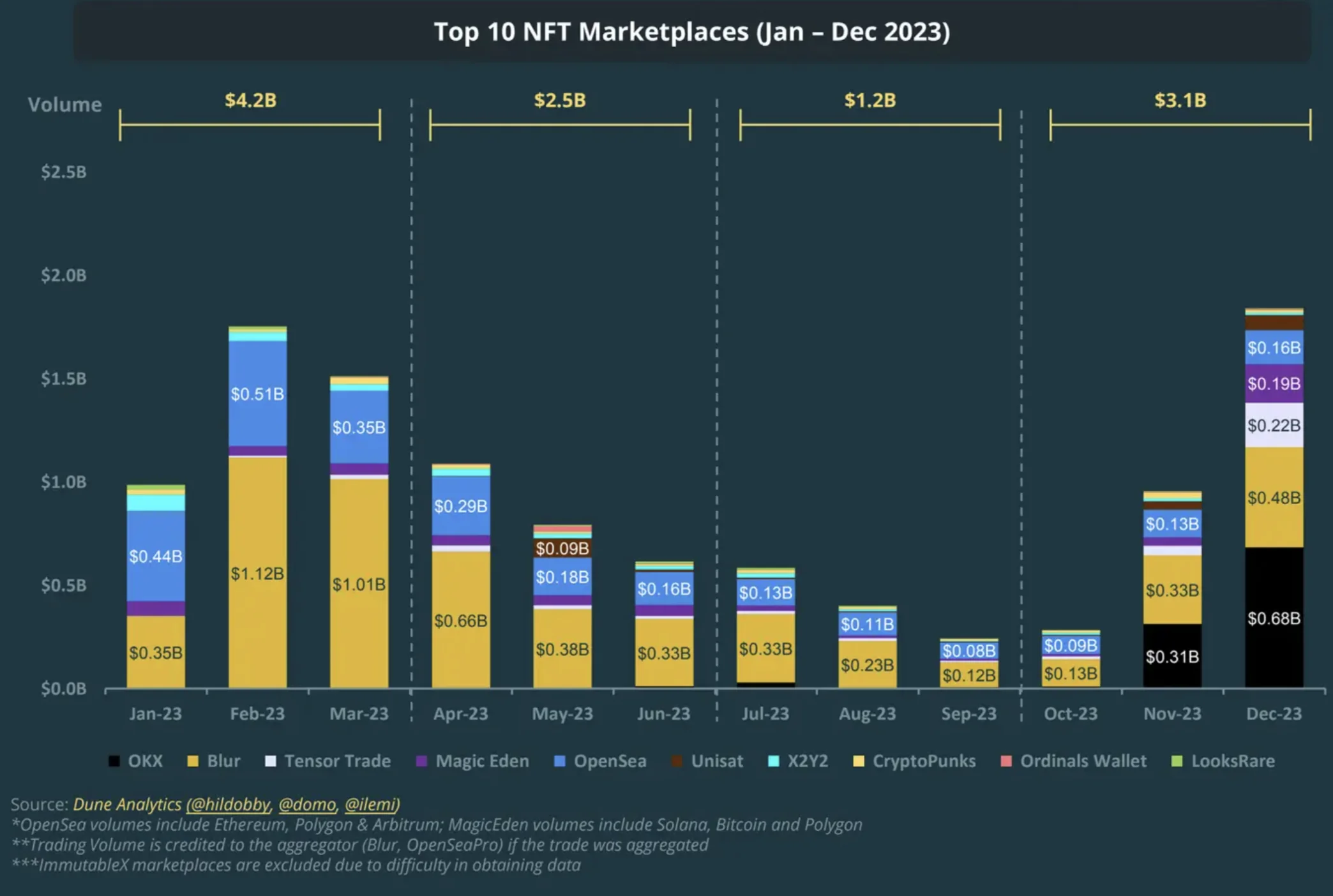

NFT Trading Volume by Platform in 2023

It becomes more precise that the introduction of BTC Ordinals and Solana’s comeback opened new doors to new NFT marketplaces.

- Blur defeated OpenSea, leading the 2023 NFT marketplace by 49.6% trading volume.

- OKX became a leading Bitcoin Ordinals marketplace and, in December 2023, had the highest trading volume across all NFT marketplaces.

- Tensor Trade was the third largest NFT marketplace in December 2023.

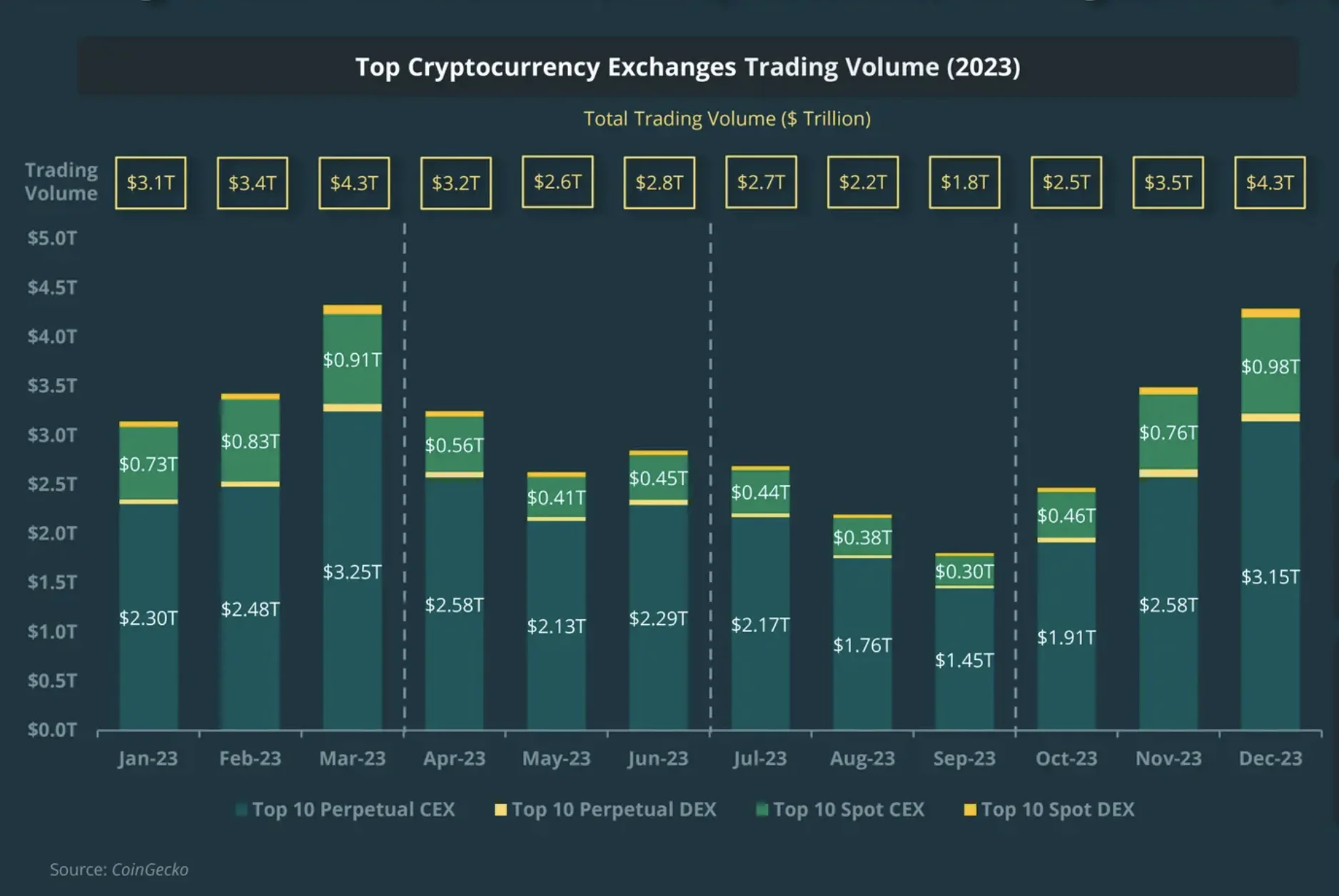

Top Crypto Exchanges Trading Volumes in 2023

The last quarter of 2023 showed us a positive spin on the trading volumes of exchanges after Q3 displayed a 23.9% decrease compared to Q2 2023. As a result, on a QoQ analysis, Q4 ended well, with a 53.1% increase.

- Once, with the anticipation of Bitcoin ETF, the trading volume skyrocketed to $4.3T.

- The CEX : DEX spot trading volume reached 91.5%.

- The CEX : DEX derivatives trading volume dropped by 1.2% to 97.3%.

- Despite the FTX collapse, CEXs dominated 2023.

Challenges of The Crypto Market in 2024

Given that many events happened in 2023, the repercussions still linger in 2024, while some are still waiting for legal battles to end a decision. As a result, the crypto market volatility makes it difficult for investors to make informed decisions and predict future movements and strategies.

On the crypto regulation side, we enjoyed approval for 11 spots in Bitcoin ETFs as of January 2024. However, the Securities and Exchange Commission (SEC) is still reluctant over market manipulation and fraud concerns, especially with applying BlackRock for ETH ETF, which may face regulatory hurdles.

Bloomberg ETF analyst Eric Balchunas sees a high chance for a spot in Ethereum ETF, estimating a 70% possibility of approval by May. This aligns with the May 23 deadline for some ETF applications.

Additionally, as SEC lost two crucial battles with Ripple and Grayscale, it is safe to hope that this new year will be the year of greater collaboration between regulatory bodies and crypto entities. If you can’t beat them, join them, right?

On the other hand, when discussing security and digital asset safety, in 2023, we witnessed countless bugs and other breaches where $2B was lost in at least 463 exploits. By far, the most considerable exploit in 2023 was the Multichain bridge hack, which resulted in a loss of $231M in July.

How to Overcome the Challenges of 2024

As mentioned, 2024 could be the year of greater collaboration between crypto and financial regulatory bodies and crypto representants, yet, on a macro level, it all starts with education, enhanced security benchmarks,

1. Transparency and Education

It is known that increased transparency, along with educational resources, such as crypto educational guides and reviews, can only foster a medium of trust and informed decisions for many investors and crypto enthusiasts.

Moreover, if we hope for an even greater adoption of the crypto landscape, these two aspects could open the gate for anyone who wishes to achieve financial freedom and hold their future in their hands.

2. Digital Asset Diversification

Don’t put all your eggs in one basket. Investors should diversify their asset portfolio following the market sentiment while mitigating the potential risks, as the crypto market is known for its volatility.

3. Greater Adoption of Crypto Tools

Developing or utilizing crypto tools could be safe and empowering as they can alleviate hurdles, predict the crypto market movements, identify trends, and help make informed decisions.

As such, crypto investors could use crypto trading tools, tax software, DEX screeners, etc.

4. Crypto Regulations

With open communication and collaboration between key industry players, regulatory bodies can develop straightforward, adaptable, and safer regulations to protect investors without limiting innovation.

Moreover, by establishing global crypto frameworks, businesses and investors can cooperate in a more predictable, stable, and mature environment.

Final Thoughts on the 2023 Crypto Analysis Report

The crypto market has faced multiple challenges and obstacles, yet investors and crypto enthusiasts continue to support the landscape, showing tremendous growth potential.

For anyone wishing to succeed in this competitive and dynamic environment, investors, enthusiasts, and businesses should invest time and dedication into crypto educational resources, staying informed on regulatory developments and focusing on implementing different security measures to strengthen their gains.