Table of contents

- The Process of Mining a Block

- What was Bitcoin Mining at the Beginning?

- Mining Speed

- The Role of Mining Hardware and Competition

- How Much Does It Cost to Mine One Bitcoin?

- How Much Power Is Needed to Mine 1 Bitcoin a Day?

- How Long Does It Take to Mine 1 Bitcoin Using a PC?

- How Many Bitcoins Are Left to Mine?

- What Happens After All the Bitcoins Have Been Mined?

- Is Bitcoin Mining Profitable in 2023?

- How Long Does It Take to Mine 1 Bitcoin – Conclusion

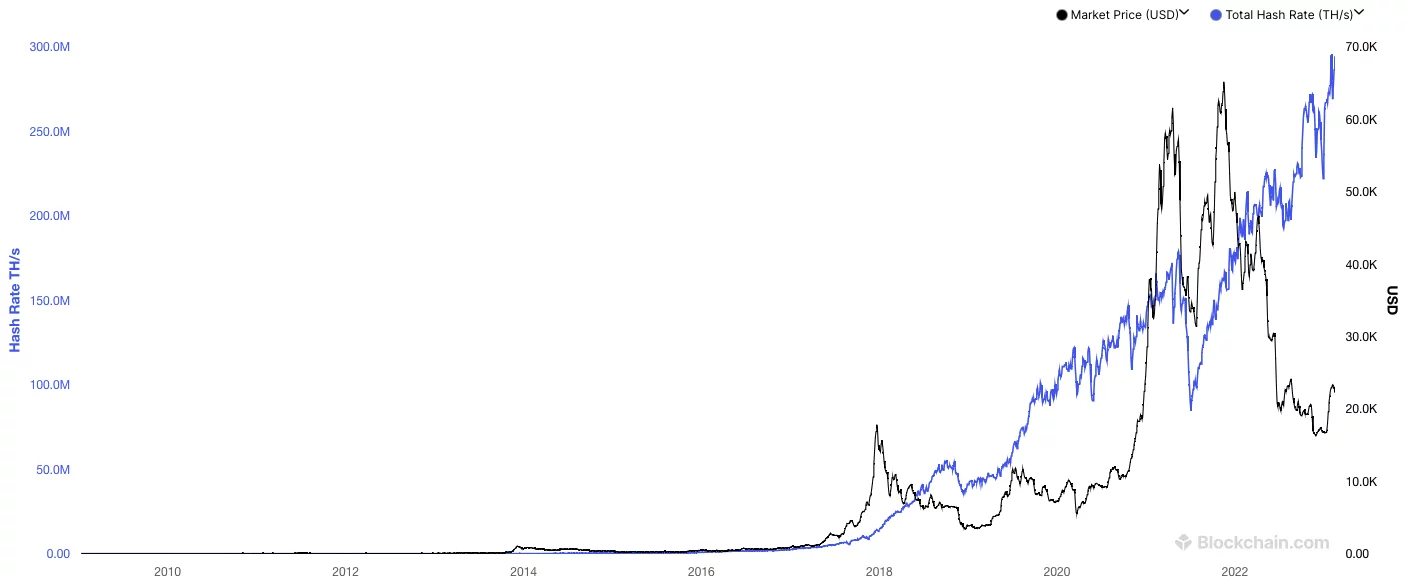

Despite Bitcoin’s latest rallies, we can see that the broader market took a beating in 2022, and 2023 doesn’t seem much better.

Yet, over the past few months, since the price of Bitcoin continued to seesaw between bullish and bearish candlestick patterns, today, we can see the bigger picture and realize the bearish trend.

Still, even in this situation, one question resonates with people who can’t afford to buy Bitcoin: How long does it take to mine 1 Bitcoin?

We have good news for you because we will try to answer this question in this article based on more Bitcoin miners’ answers.

First, we must consider that Bitcoin mining is no longer what it used to be 10 years ago when anyone with a PC could mine it. However, nowadays, it is almost impossible to mine Bitcoin because of many factors. Bitcoin faucet games are also a good choice in mining instead of PC cloud mining.

To get a clear view of why things have changed, let’s start by analyzing the mining process.

TL; DR? Here is the short answer:

On average, it takes around 10 minutes to mine 1 Bitcoin with ideal hardware. However, the time for mining 1 BTC depends on the hardware and software you use, especially on the mining power. But if you want to mine BTC with an average PC, you will make 0.00000058/year.

Read further for a deeper understanding.

The Process of Mining a Block

Unlike earlier years, nowadays, the process of mining Bitcoin can be best explored in terms of mining cryptocurrency blocks, as opposed to single units, such as 1 Bitcoin (BTC). The reason is simple: new Bitcoins are only mined whenever a new block on the Bitcoin blockchain is validated.

Block mining requires solving complex encrypted functions, also known as a hash. The first miner to validate a new block will get a reward (also known as block reward) – which is currently 6.25 BTC, down from 12.5 BTC.

What was Bitcoin Mining at the Beginning?

Starting with CPU mining

During the initial phase of Bitcoin in 2009, the first miners used ordinary multi-core CPUs as there was no other mining software available at that time to generate BTC at a rate of 50 per block. Satoshi’s idea of “one CPU – one vote” was practical because only CPUs were being used for mining.

Users could earn up to $5 daily with a few computers with decent specifications. The mining difficulty was low then, making it feasible for enthusiasts and cryptocurrency enthusiasts to participate. In other words, anyone with a passion for a crypto casino and some spare computational power resources could make a small profit by mining Bitcoin in their free time.

The first official Bitcoin miner was Bitcoin Core, which used CPUs for mining.

Introducing GPU mining

After a while, the first GPU miner was developed, which increased the mining speed significantly. Consequently, GPU mining became more popular than CPU mining.

ArtForz is believed to have developed the first GPU miner and mined the first block with his GPU farm on July 18, 2010. Later, BitcoinTalk member Puddinpop released the first publicly available GPU mining software.

In 2012, the first ASIC projects appeared, and ASIC miners took over the Bitcoin blockchain, making GPU mining outdated and counterproductive.

Mining Speed

It takes a lot of work to determine how long it takes to mine 1 Bitcoin because it depends on several factors. Notably, computational power, competition, and hardware are significant determinants. Nonetheless, the hashing difficulty algorithm consistently determines how long it takes to mine 1 BTC. It is designed to ensure it self-adjusts to yield a block verification time of 10 minutes.

Therefore, it takes around 10 minutes to mine BTC in an ideal situation. However, most mining conditions and environments are far from perfect. For example, while it was possible to mine BTC alone using your computer, things have changed because of recent technological developments.

Mining now requires a lot of electricity and hardware far beyond most of us. This ultimately affects your mining speed. So, if you are mining solo, your mining duration will likely be more than 10 minutes.

The Role of Mining Hardware and Competition

Bitcoin Mining Pools

As already mentioned, operating a solo mining enterprise may be not only expensive but also time-consuming. The best approach to Bitcoin mining is to use mining pools. Any mining pool that adopts the latest hardware (and the best mining pools adopt the newest hardware) has the highest chance of being the first to mine a block of BTC within the ideal time frame of 10 minutes.

A mining pool refers to a collaborative effort of cryptocurrency miners who pool their computing resources together via a network to enhance their chances of successfully mining for cryptocurrency, such as finding a block. Also, in some cases regarding a Bitcoin mining pool, you will sometimes notice that there are specific Bitcoin mining pool fees.

About Mining Rigs

Also, a new Bitcoin mining rig with higher performance and computing abilities can significantly expedite the process of mining Bitcoin. As a result, they are making it difficult for solo miners to match the competition. The notable mining rigs are CPU, GPU, FPGA, and ASIC.

A mining rig is a computer that is customized for cryptocurrency mining. Also, the most commonly used mining rig is for Bitcoin mining, the largest network worldwide.

CPUs are easy to install and configure. However, you have to get multi-core processors or CPUs with several motherboards for enhanced performance. CPUs were initially used for Bitcoin mining, but the emergence of GPUs, FPGAs, and ASICs relegated them to certain mining altcoins. Subsequently, technological advancements have made even the GPU and FPGA irrelevant in mining Bitcoin.

Currently, miners use ASIC hardware devices for mining Bitcoin. These chips are specially tailored to mine BTC based on Bitcoin’s SHA-256 hashing algorithm. Therefore, using other less optimized hardware will make competing with mining pools that use ASIC technology very difficult.

How Much Does It Cost to Mine One Bitcoin?

At the time of writing, the average cost of mining a single Bitcoin is about $46,291.24, according to CoinGecko. Of course, this cost can vary depending on several aspects, the most common cost implied being the price of energy in the region where it is mined. For instance, in Italy, you will find the highest costs, mining 1 BTC requiring around $208,560.33. On the other hand, Lebanon has the lowest costs of approximately $266.2.

How Much Power Is Needed to Mine 1 Bitcoin a Day?

It’s pretty hard to say how much power you would need to mine 1 BTC a day. But thanks to a Bitcoin mining calculator, we can approximate that you would need 502,000 TH/s in computing power. That translates into around 1,968.6 Bitmain Antminer S19 XP Hyd (255Th). And as this ASIC’s power consumption is 5,304W, you would need 10,441,600W (10.4416MW) to power the setup.

How Long Does It Take to Mine 1 Bitcoin Using a PC?

The short answer is that it would probably take roughly 2 million years to mine 1 Bitcoin with a PC. And that is if you manage to squeeze 500 MH/s out of it in a Bitcoin mining pool without any network condition changes.

How is that so? Well, the average block generation time for the Bitcoin network is 10 minutes, and the block reward is 6.25 BTC. However, remember there are huge mining farms currently that mine for BTC.

The mining speed depends on the type of Bitcoin mining hardware you use. Suppose you use a high-end gaming computer to mine Bitcoin with today’s computing requirements and can squeeze out 500 MH/s. In that case, you might earn BTC 0.00000058/year in perfect conditions.

So, realistically speaking, the honest answer to the “How long does it take to mine 1 Bitcoin?” the question is that you will never be able to do that. Remember that the block rewards are constantly halving, and the mining difficulty is increasing.

How Long Does It Take to Mine 1 Bitcoin Using a Smartphone?

Calculating the hash rate of a smartphone is especially tricky as they’re not designed for mobile cryptocurrency mining. Yet, the iPhone 14Pro Max may reach around 100 H/s. And by using a Bitcoin mining calculator, we can estimate a BTC 0.0000000000001/year. Following this train of thought, it would take around 10 trillion years to mine 1 Bitcoin using a smartphone, and that’s in lab conditions. So, the honest answer is still “not going to happen.”

However, even if you have decided to mine Bitcoin solo on your smartphone, the process is relatively tricky. Besides the tremendous amount of processing power required to mine the coin, Apple and Google have restricted on-device mining on iOS and Android. In fact, the latest Developer Program Policy shared by Google is very definite on cryptocurrency mining. It reads: “We don’t allow apps that mine cryptocurrency on devices. We permit apps that remotely manage the mining of cryptocurrency.”

Clearly, from the policy, Google only permits apps that enable remote monitoring of the mining process. So, what made Google ban the crypto mining apps? Or rather, why did Apple ban the crypto-mining apps from their store?

While Google doesn’t explicitly explain the ban’s reasons, Apple clearly states that “Apps should not rapidly drain battery, generate excessive heat, or put unnecessary strain on device resources.” Deductively, this is the same reason that caused Google to ban these apps from their store.

Bitcoin Mining Apps

Of course, if you’ve been looking for mining apps on Play Store, you will find some of them. Notably, you will discover Mining Monitor, which doesn’t mine cryptocurrency but only helps you manage the process remotely.

If you decide to be crafty, you can download mining apps from the web. Although this is possible, the repercussions can affect you, as you risk infecting your smartphone with malware. And if you’re lucky and don’t get your phone infected with malware, it will still burn out quickly.

How Many Bitcoins Are Left to Mine?

At the time of writing, the remaining number of Bitcoins (BTC) available for mining is approximately 1,496,194 (almost 1.5 million), indicating that about 19.5 million are already in circulation.

What Happens After All the Bitcoins Have Been Mined?

Once the maximum supply of 21 million Bitcoin is reached, there will be no more newly issued BTC, regardless of whether the number of available coins ultimately falls slightly below this threshold. However, Bitcoin transactions will continue to be verified and grouped into blocks, and miners will continue to receive compensation, mainly from transaction processing fees.

The last Bitcoin is expected to be mined sometime near 2140.

The impact of Bitcoin reaching its upper supply limit on miners will depend on the cryptocurrency’s evolution. If the Bitcoin blockchain processes a large number of transactions in 2140, miners may still be able to generate revenue by collecting transaction fees. On the other hand, if Bitcoin is mainly used as a store of value rather than for daily transactions, miners can still profit by charging high fees to process high-value or large batches of transactions.

Is Bitcoin Mining Profitable in 2023?

Yes, Bitcoin can still be profitable if you invest in the right tools and join a mining pool. But still, Bitcoin mining is not easy. We’re not saying that you can mine 1 Bitcoin (or 1 block) yourself easily or that you’ll manage to get yourself 1 Bitcoin a day. Although it’s possible to mine 1 Bitcoin daily, you need a colossal hardware infrastructure, bringing a huge electricity cost.

How Long Does It Take to Mine 1 Bitcoin – Conclusion

As Bitcoin mining becomes very competitive and less lucrative, no miner has the guarantee that they will be the one to receive the block, especially if they lack the computational resources required to outperform the other miners.

Therefore, calculating the reward time for successfully mining a block is complex. Even with all the factors at hand, there is no easy, precise way of answering how long it takes to mine 1 Bitcoin.

The answer gets even more confusing if you use a PC or smartphone when your competitors use ASICs and Bitcoin mining rigs.