CashApp vs Robinhood – Which Is Better for Beginners?

Investing can be overwhelming, especially for beginners. With so many platforms, knowing where to start or which will truly fit your needs is complicated.

The confusion grows with apps like CashApp vs. Robinhood, which offer similar features. Without a clear guide, you might pick the wrong one, which could limit your investing potential.

In this article, we’ll break down the pros and cons of CashApp and Robinhood, helping you decide on the best platform for your investment journey. Whether you’re just starting or considering a switch, we’ve got you covered!

What is a Cash App?

Or rather, what is CashApp? Well, Cash App is a financial tool brought to you by Square, a company that focuses on making financial services more accessible. Basically, CashApp is a leading financial services company that offers a mobile payment app and other financial products.

The app was designed with simplicity in mind, making it an ideal platform for those new to investing.

Since its launch in 2013, Cash App has become more than just a way to send money to loved ones or pay bills. Cash App introduced the option to buy stocks in late 2019. This added another layer of convenience for users, allowing them to manage their investments and make trades directly from the app. With commission-free trading and a user-friendly interface, Cash App has made it easy for beginner investors to get started in the stock market.

| Founded | 15 October 2013 |

| Headquarter | San Francisco, California |

| Key People | Jack Dorsey (CEO), Jim McKelvey (director), Amrita Ahuja (CFO) |

| Business Type | Division |

| Parent Company | Block Inc. (NYSE: SQ) |

| Industry | Finance |

| Revenue | $12.3 billion (2021) |

| Users | 44 million (2021) |

Here are the main features of the CashApp platform:

- Commission-Free Trading: Like Robinhood, CashApp allows users to buy and sell stocks, ETFs, and cryptocurrencies without paying any trading fees or commissions.

- User-Friendly Interface: The app has a simple and intuitive design, making it easy for users to manage their finances and investments from their smartphones or tablets.

- Mobile Payments: CashApp enables users to send and receive money, pay bills, and buy stocks or Bitcoin with ease.

- Cash Boosts: This feature allows CashApp users to save money instantly when they use their CashApp debit card to make purchases at selected merchants.

- Direct Deposit: CashApp enables users to receive their pay checks directly into their accounts, providing quick and convenient access to their funds.

- Free ATM Access: CashApp users have access to over 40,000 ATMs without paying any withdrawal fees.

- Investing: CashApp provides its users with a simple way to invest in stocks, ETFs, and cryptocurrencies with commission-free trades.

- Cash App Card: This is a debit card linked to the user’s Cash App account, allowing them to make purchases and withdraw cash from ATMs.

What is Robinhood?

Robinhood is an online brokerage platform that allows investors to trade stocks, options, exchange-traded funds (ETFs), and cryptocurrency, all commission-free.

Founded in 2013, Robinhood has quickly become a popular choice for beginner and seasoned investors alike due to its simplicity, user-friendly interface, and low barriers to entry.

| Founded | 18 April 2013 |

| Headquarter | Menlo Park, California |

| Key People | Vladimir Tenev and Baiju Bhatt (co-CEO’s) |

| Business Type | Public (NASDAQ: HOOD) |

| Industry | Stockbroker and Cryptocurrency |

| Revenue | $1.81 billion (2021) |

| Users | 15.9 million (2022) |

| Valuation | $7.7 billion (2022) |

Here are the main features of the Robinhood platform:

- Commission-Free Trading: Unlike other online brokerages that charge fees for every trade, Robinhood allows users to buy and sell stocks, ETFs, and options without additional fees. This makes it an attractive option for people just starting out with investing or those who want to trade frequently without having to worry about high transaction costs.

- User-Friendly Interface: The platform has a simple, easy-to-use interface, making it accessible for beginner investors.

- Mobile Trading: Robinhood has a mobile app that allows users to manage their investments and place trades from their smartphones or tablets.

- Educational Resources: The platform provides a range of educational resources, including market news, market data, and stock analysis, to help users learn about investing.

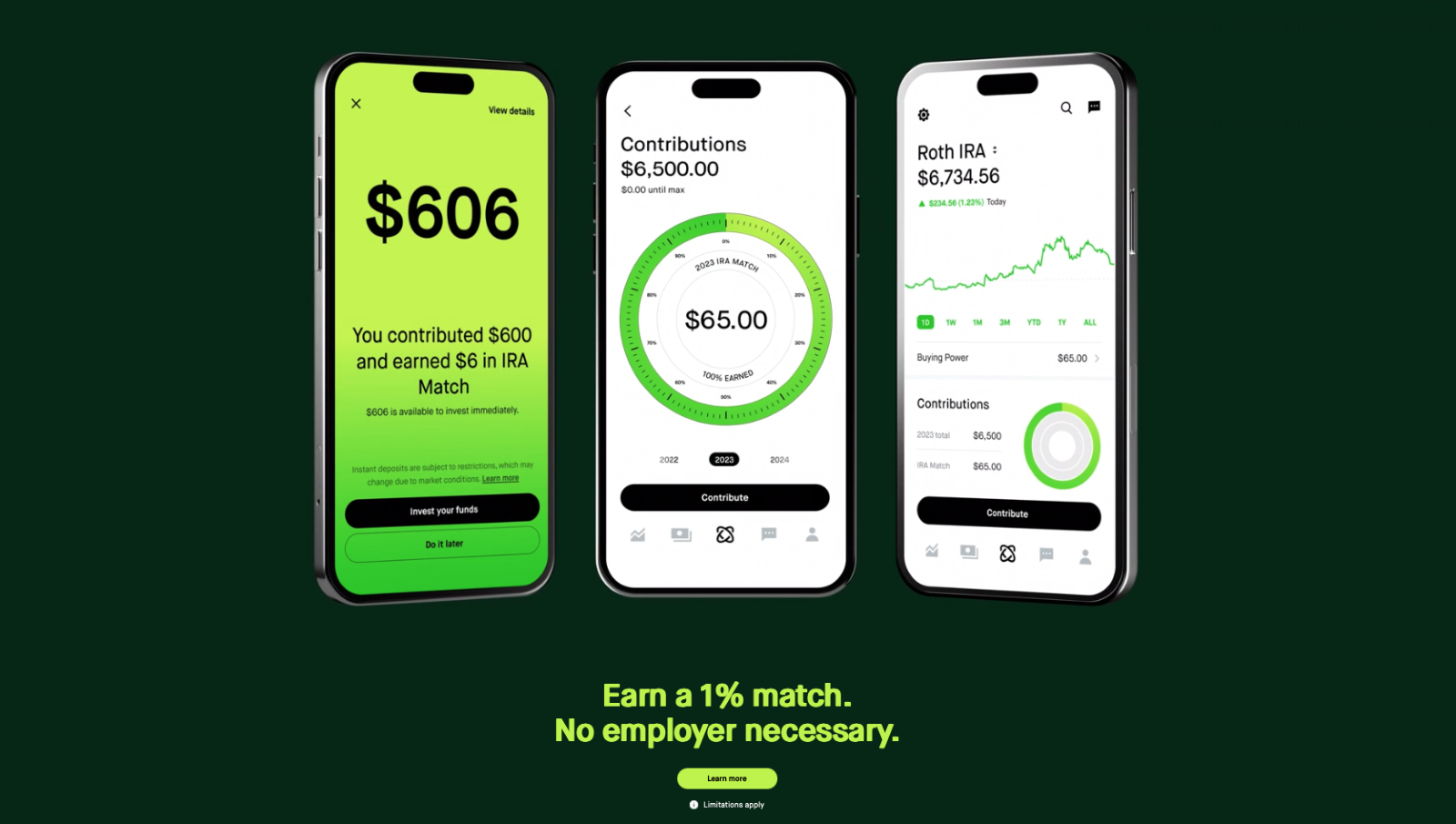

- Cash Management: Robinhood offers a cash management feature that pays interest on uninvested cash balances.

- Robinhood Gold: This is a premium service that offers users access to advanced features, such as margin trading and extended trading hours.

- Cryptocurrency Trading: Robinhood allows users to buy and sell cryptocurrencies, such as Bitcoin and Ethereum, on its platform.

- Options Trading: The platform also offers options trading, allowing users to buy and sell options contracts on stocks, ETFs, and cryptocurrencies.

- Easy Portfolio Management: Robinhood provides users with a comprehensive portfolio overview, allowing them to manage their investments and track their performance easily.

- Market Data and News: The platform provides real-time market data and news, allowing users to stay informed about market trends and events.

CashApp vs Robinhood

In order to find which of the CashApp vs Robinhood or Robinhood vs CashApp battle comes out on top, several criteria were established to evaluate these platforms, the results of which can be seen below:

Cash App vs. Robinhood: Security and Trust

When it comes to trust and security, both Robinhood and Cash App have earned a reputation for being reliable options. However, they approach security in slightly different ways.

Robinhood prioritizes safety by keeping the majority of customer cryptocurrency in cold storage and offering insurance against cybercrime. Robinhood also has good customer support, although there is no phone contact option.

User passwords are stored using the BCrypt hashing algorithm, sensitive information is protected through encryption, and the platform uses a trusted third party to access bank information. They also have Two-Factor Authentication for all new devices and all accounts on the platform.

On the other hand, Cash App has a range of measures in place to ensure a secure platform for its users, including security locks for payments, encryption through PCI-DSS level 1 certification, offline storage for Bitcoin balances, the ability to disable or pause card spending, and fraud protection.

In terms of security, both Cash App and Robinhood offer strong measures to protect their users’ information and assets. However, Cash App offers a range of features specifically designed for the security of Bitcoin, while Robinhood prioritizes the security of user information and passwords.

Cash App vs. Robinhood: Fees

Cash App does not impose any charges for buying or selling stocks or ETFs. However, for Bitcoin transactions, there may be some fees. These fees, if any, will be clearly displayed on the trade confirmation screen before the transaction is completed. The fees for Bitcoin transactions could include a service fee and an additional fee based on the price volatility across U.S. exchanges.

It’s important to note that regulatory agencies and the government may also impose additional fees, which are not unique to CashApp but are charged by all investment firms.

On the other hand, Robinhood has a clear and straightforward fee structure. They do not charge any commission fees for trading stocks, options, or ETFs. Further, they do not have any annual, inactivity, or transfer fees. However, certain circumstances could result in additional charges. For example, Robinhood Gold, a premium membership service, costs $5 per month and offers access to margin investing and extra features.

Also, some larger cryptocurrency transactions may incur a small fee to help cover the cost of processing the trade.

So, in a nutshell, the key differences are that Robinhood is one of the only platforms that offer commission-free options trading and cryptocurrency trading (CashApp doesn’t offer options at all). At the same time, Cash App only allows for fee-charging Bitcoin trading, having only the possibility to buy Bitcoin into the platform, not other cryptos.

Cash App vs. Robinhood: Assets Availability

When it comes to asset availability, Robinhood and Cash App are quite similar. However, there are a few key differences to keep in mind. Robinhood offers commission-free options trading, which is not available on Cash App. Robinhood also allows you to trade in 18 different cryptocurrencies, while Cash App only offers Bitcoin.

Both platforms are designed for individuals who want to be able to purchase and sell stocks, regardless of the dollar amount.

They both allow fractional share trading, meaning you can invest any amount, no matter how small.

Also, if your interest is increased towards investing in stocks, you should know that CashApp’s offer is currently much more limited than Robinhood’s. As an application that is, at its core, a payment system, CashApp has limited asset, account, and order types.

In conclusion

In conclusion, CashApp and Robinhood are both great options for beginner investors looking for a simple and accessible platform to manage their finances and investments.

While both apps offer commission-free trading, CashApp also provides users with a range of financial products, including mobile payments, cash boosts, direct deposit, and free ATM access. On the other hand, Robinhood has additional features such as educational resources, cash management, stock trading, cryptocurrency trading, options trading, and easy portfolio management.

Ultimately, the best platform for you will depend on your specific needs and preferences. For example, if your need is to have an app through which you can make various payments in everyday life, CashApp is ideal. Still, if you want a specific app for investing that democratizes the process, Robinhood is a very good option.

It’s essential to consider the features of each platform and weigh them against your personal investment goals before deciding. Remember that the money in your bank account loses its value over time.