As we already witnessed and what the annual crypto report for 2023 showed us, Bitcoin saw massive growth, whereby the crypto market altogether witnessed a year of recovery.

So, starting fresh, we are looking at some of the most notable events of Q1, 2024, which seemed to be a good start for many crypto contenders, leading to an increase of +64.5%, reaching $2.9 trillion on March 13.

Why is this important? First, this growth has nearly doubled compared to Q4, 2023. A noteworthy influence was the Bitcoin ETF approval earlier this year, and as a result, Bitcoin reached a new all-time high in March. But this was just the tip of the iceberg.

So, we can say that the start of 2024 was strong, but it could be better. Let’s see where it’s heading, and as Bobby Ong, the Co-Founder & COO at CoinGecko, marked:

Crypto is off to a strong start in 2024 on the back of US spot Bitcoin ETF approvals and anticipation for Bitcoin Halving.

While global geopolitical and macroeconomic risks are still present, we remain optimistic that the industry is continuing to innovate and bringing new offerings to the market.

Thanks to CoinGecko’s report, we are highlighting the most essential events and factors of Q1, 2024 so that you can prepare your trading strategies to get started on the right track.

5 Highlights of Q1 2024 Crypto Highlights

- Bitcoin reached a new all-time high in March, representing a growth of +68.8% in Q1;

- By April 2, US Spot Bitcoin ETFs had over $55.1B worth of assets under management;

- Ethereum’s restaking on EigenLayer has reached an impressive quarterly growth of 36%;

- Solana-based meme coins skyrocketed in Q1, and it’s top 10 reached a market cap of $8.32B;

- CEX’s spot trading volume reached $4.29T in Q1, the most increased since the end of 2021;

Let’s now delve into greater detail!

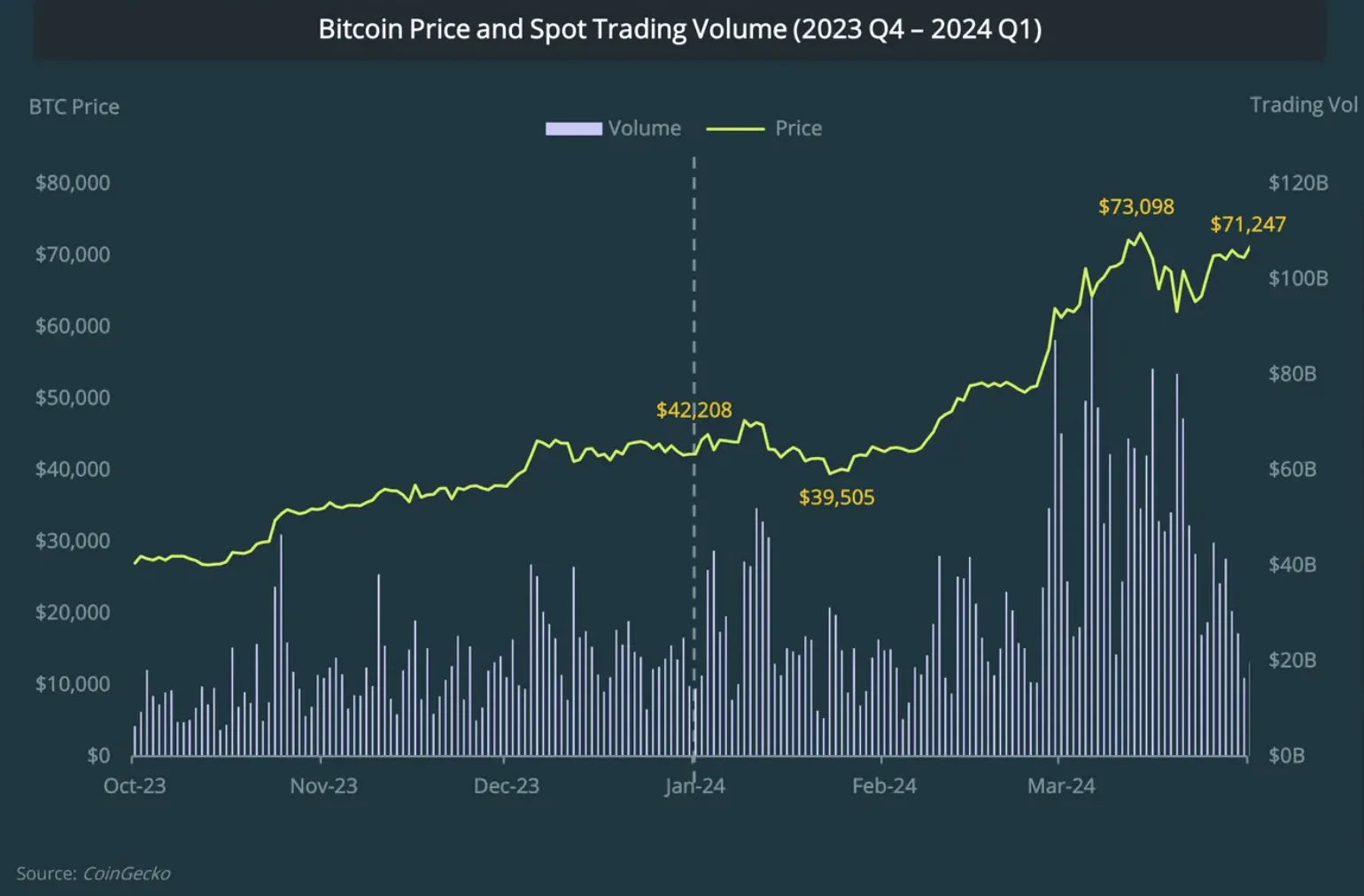

1. Bitcoin’s Massive Growth of +68.8% in Q1, 2024

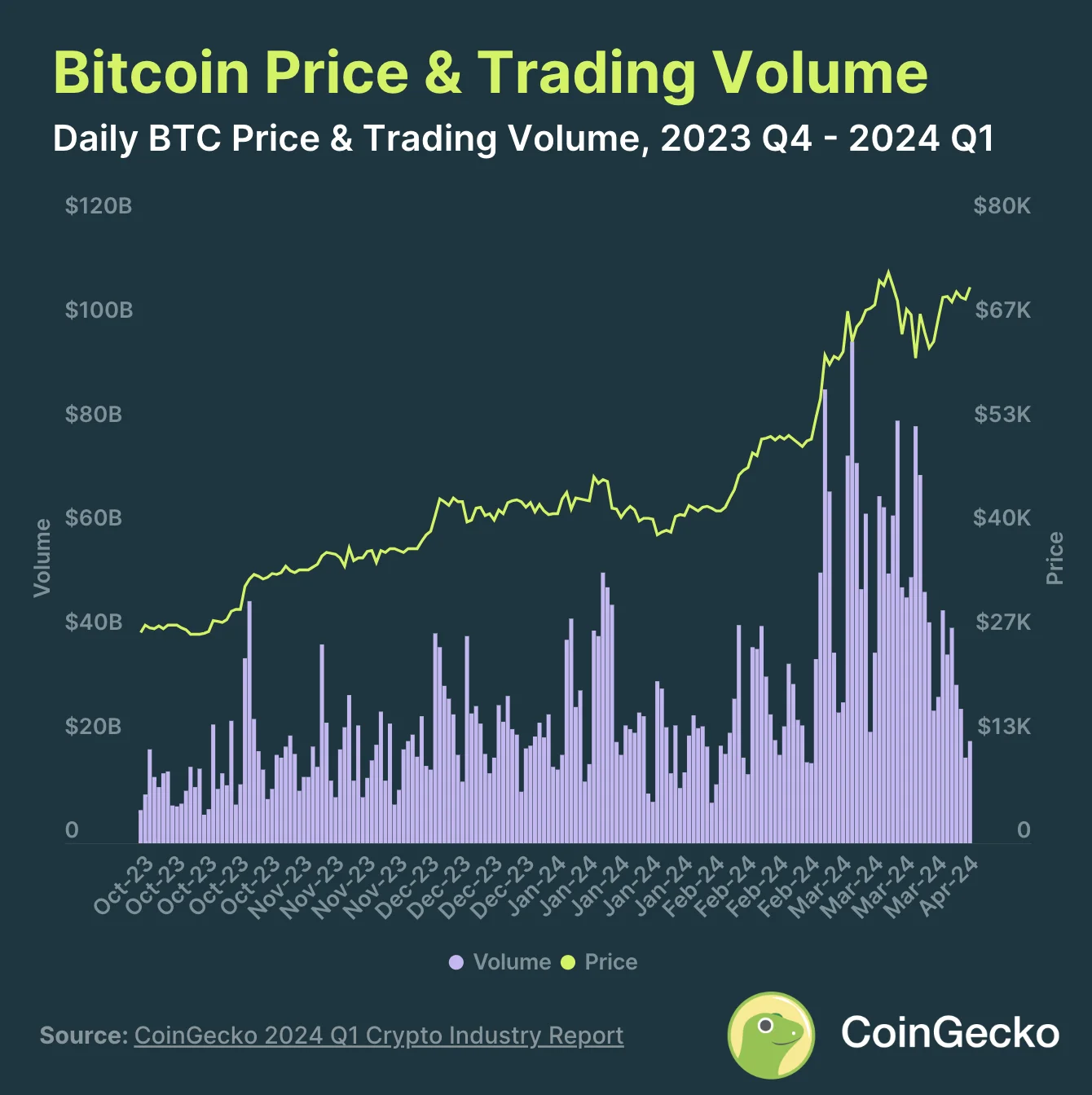

After Bitcoin’s resurrection in 2023, which brought a +155.2% increase in 2023, another growth wave pulled Bitcoin from its spot. As a result, in March 2024, Bitcoin reached its all-time high of $73,098, marking an increase of +68.8% in Q1, 2024.

But things weren’t always as good as they are now. So, after the extended-release and approval of the US Spot Bitcoin ETF approvals, BTC saw a downfall of -16.0%, leading to a quarterly low of $39,505.

Yet, it quickly grew by +85.0% when it reached ATH, only to hit another correction, which meant a drop of -18.0%, before recovering to close the quarter at $71,247.

On the other hand, in terms of trading volume, BTC has reached a new milestone, a daily average of $34.1B, a +89.8% gain from $18.0 billion in Q4, 2023.

2. The US Spot Bitcoin ETFs Held +$55.1B in AUM

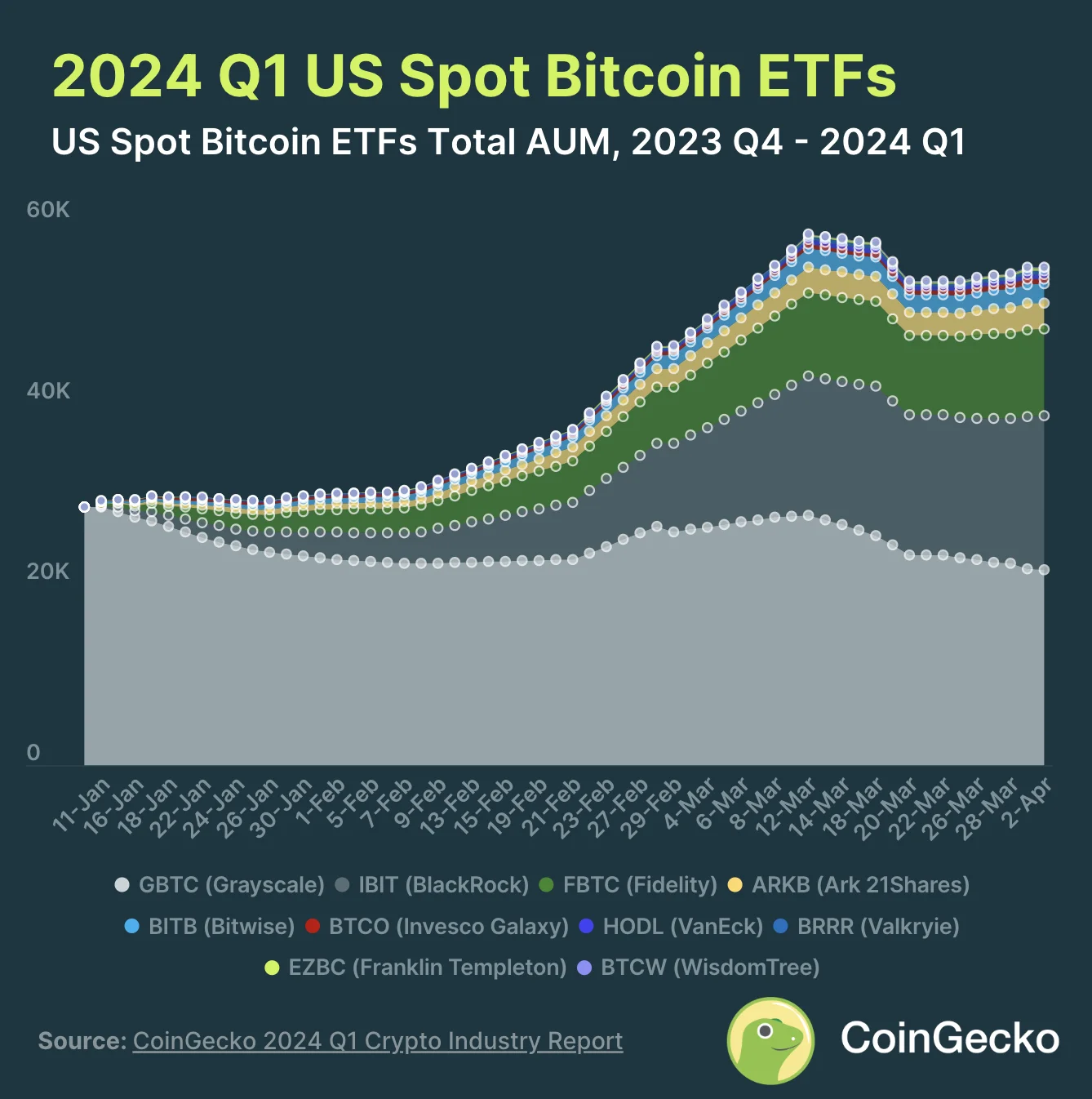

After the most awaited decision was concretized by the US Securities and Exchange Commission (SEC) regarding BTC ETFs, the results didn’t take too long to appear.

As a result, Grayscale’s ETF has seen +$21.7 billion in AUM, even though its investors took a -$6.9 billion in net outflows. As such, the GBTC ETF remained the largest BTC ETF in Q1 2024.

BlackRock’s ETF has earned over $17.0 billion in BTC, thus securing its place as the second most extensive Bitcoin ETF.

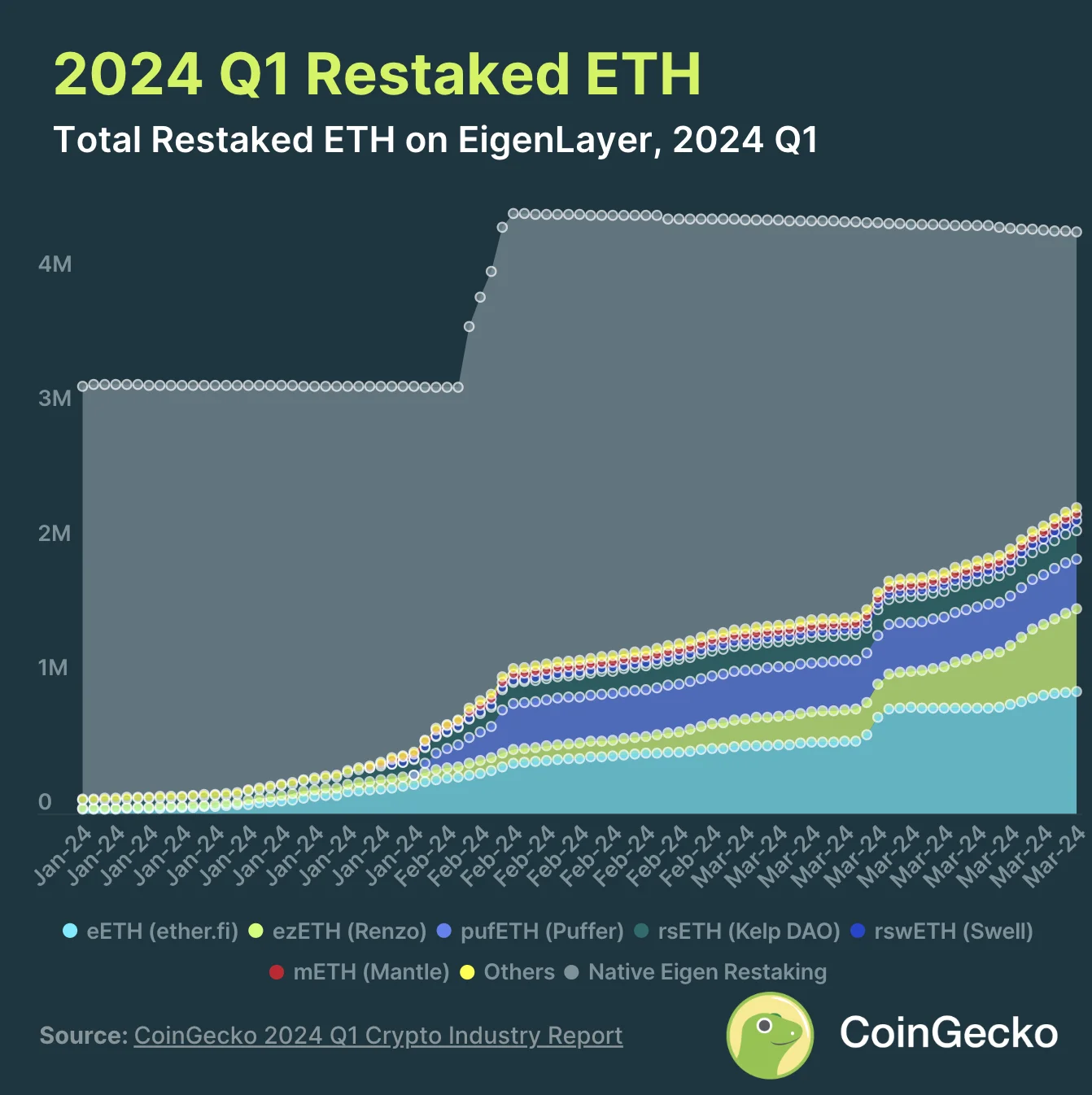

3. Ethereum’s EigenLayer Restaking Hit $4.3M

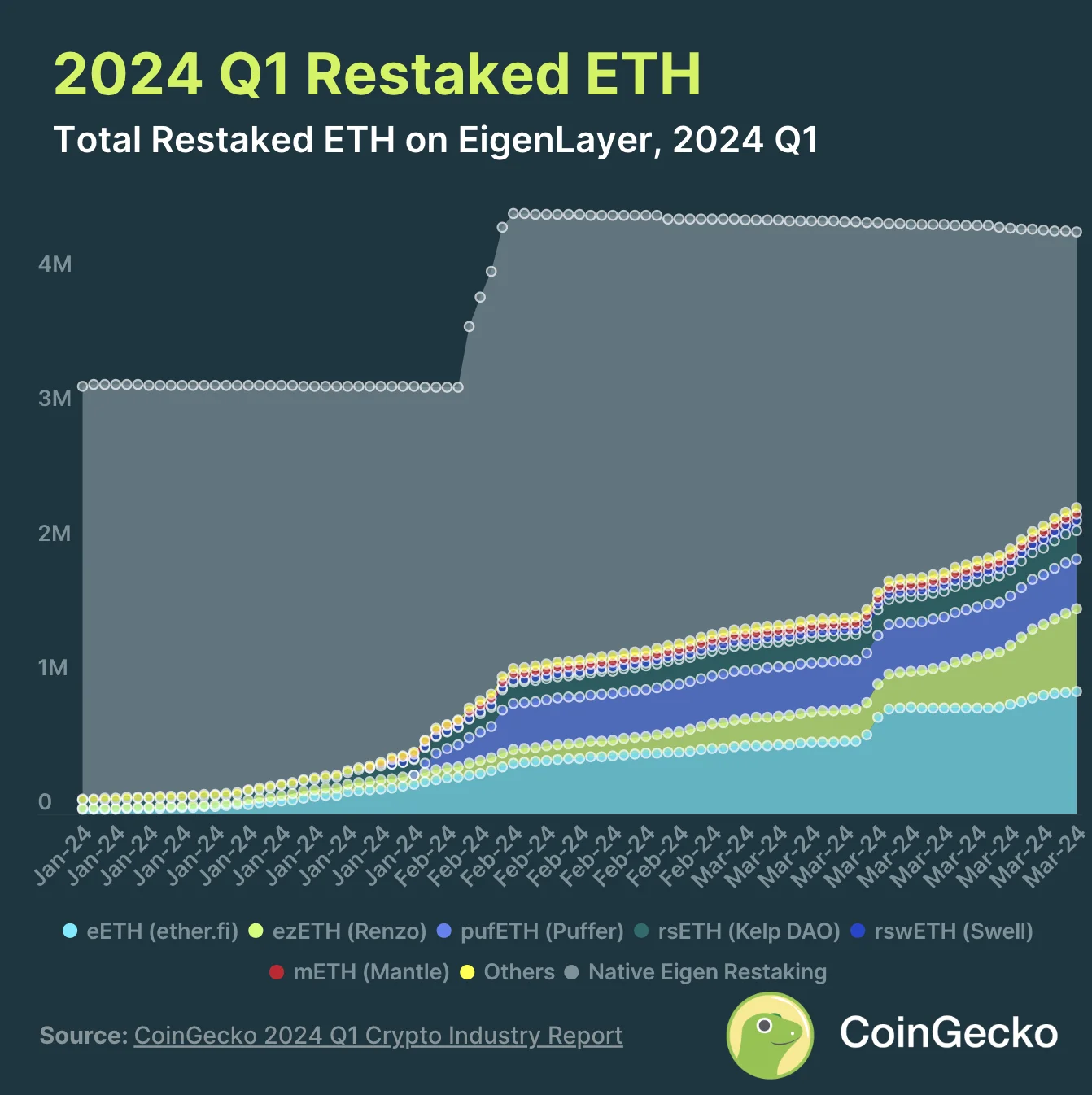

The number of restaked ETH grew considerably in Q1, 2024 due to EigenLayer, marking a growth of +36%, thus reaching $4.3M.

The most restaked ETH was held by Liquid Restaking Protocols (LRTs), with a 52.6% margin, totaling 2.28 million ETH.

EtherFi was the most extensive LRT protocol of Q1, which saw a 21.0% market share and skyrocketed to +2,616% throughout the quarter. Moreover, EtherFi held 0.91 million ETH by the end of March.

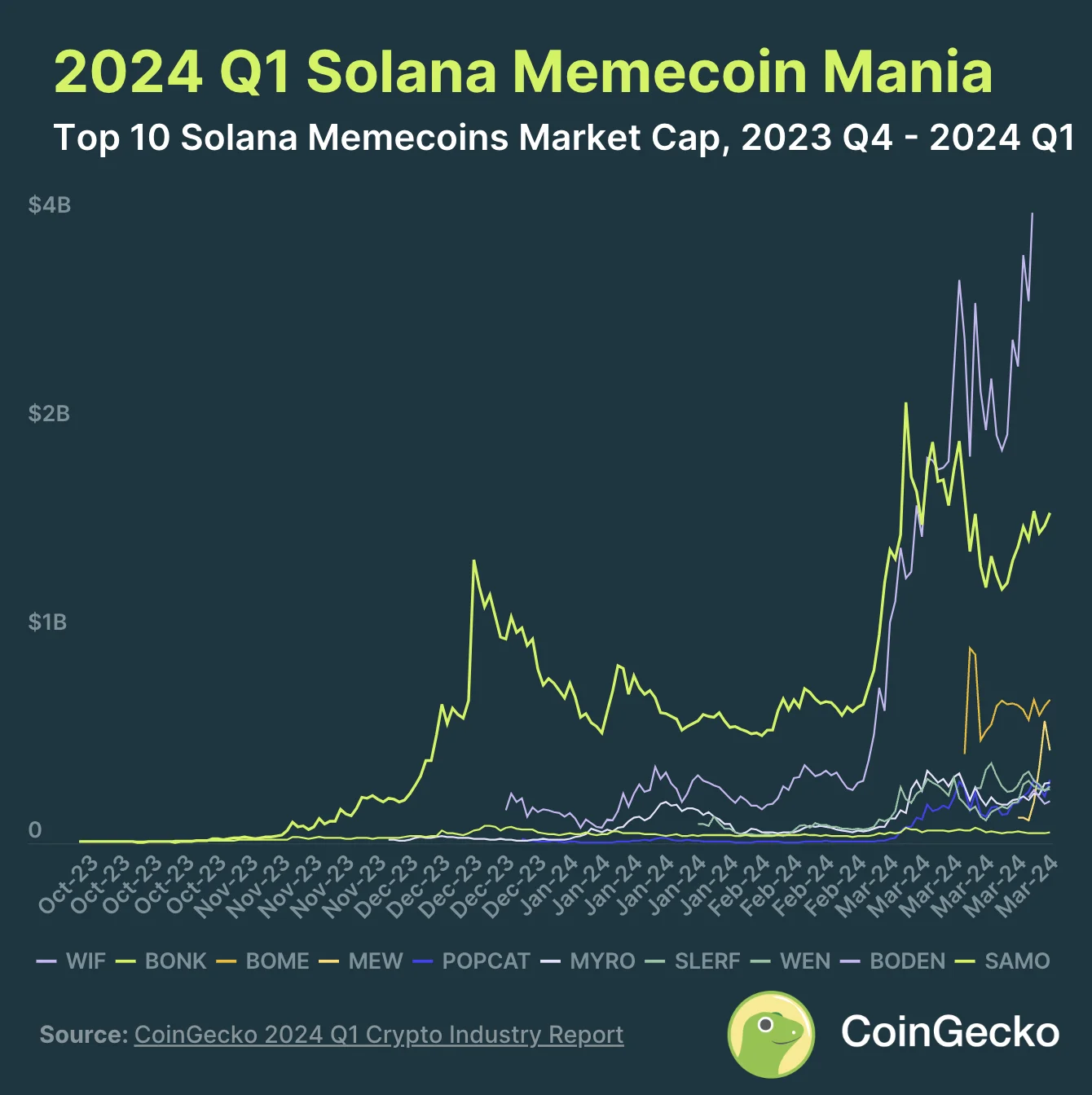

4. Solana-based Meme Coins Reached a Market Cap of $8.32B

When discussing Solana meme coins, the top 10, their market cap grew by +801.5% or $8.32 billion. Moreover, the quarter closed with a total market cap of $9.36 billion.

Top 10 Solana meme coins:

- Bonk (BONK);

- Samoyedcoin (SAMO);

- Dogwifhat (WIF);

- Book Of Memes (BOME);

- Mew Inu (MEW);

- Popcat (POPCAT);

- Myro (MYRO);

- SLERF;

- Wen (WEN);

- Jeo Boden (BODEN);

5. CEX: The Most Increased Spot Trading Volume Since 2021

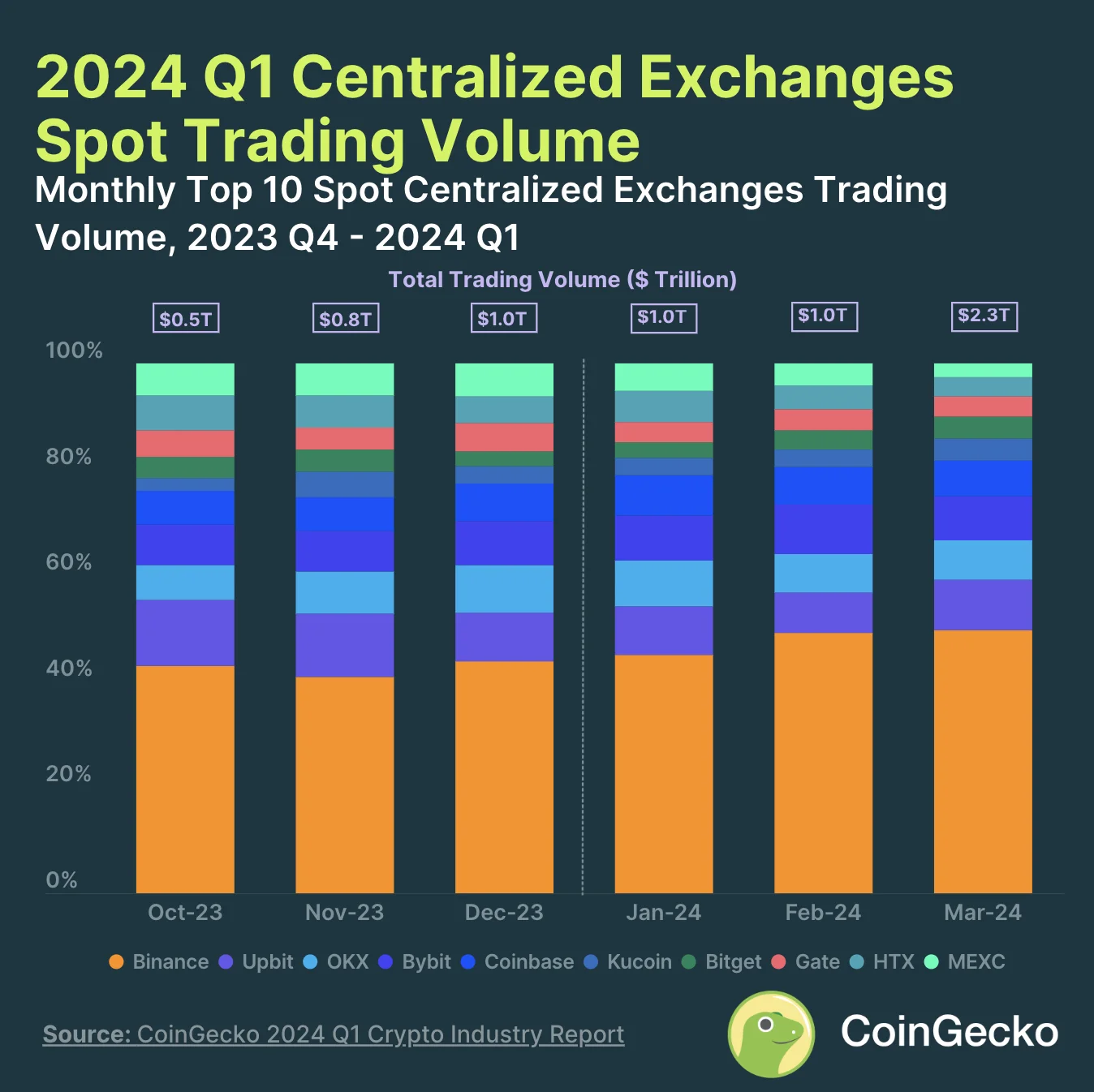

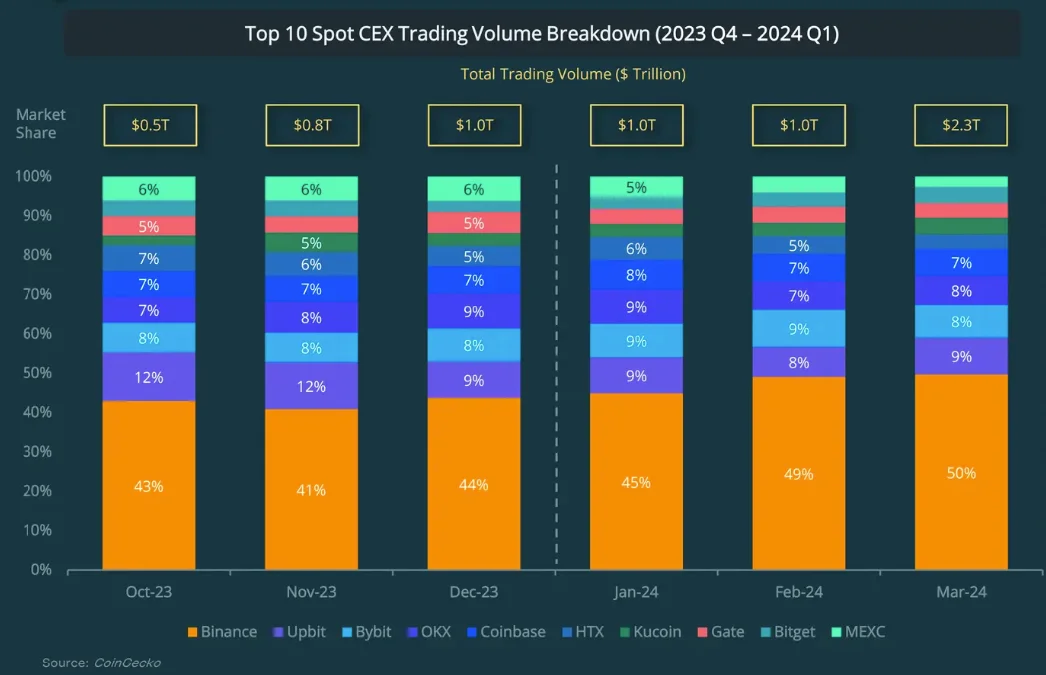

The good news is that the top 10 CEXs have seen a massive gain of +95.3% quarter-on-quarter, reaching $4.29T. This is spectacular, especially since such a milestone hasn’t been untouched since December 2021.

As expected, Binance remained the largest CEX, ending the quarter with a 50% market share, while MEXC saw a market share reduction as traders focused more on significant cryptos such as BTC, ETH, and SOL.

Q1, 2024 Crypto Market at a Glance

If 2023 was a bumpy ride and a full year of recovery for the whole crypto market. On the other hand, 2024 seemed to have a vigorous start, backed up by the US spot Bitcoin ETF approvals and one of the most awaited events of the season, Bitcoin halving.

But allow us to go into greater detail and uncover the state of the crypto market in Q1, 2024.

The Spot Trading Volume & Crypto Market in Q1

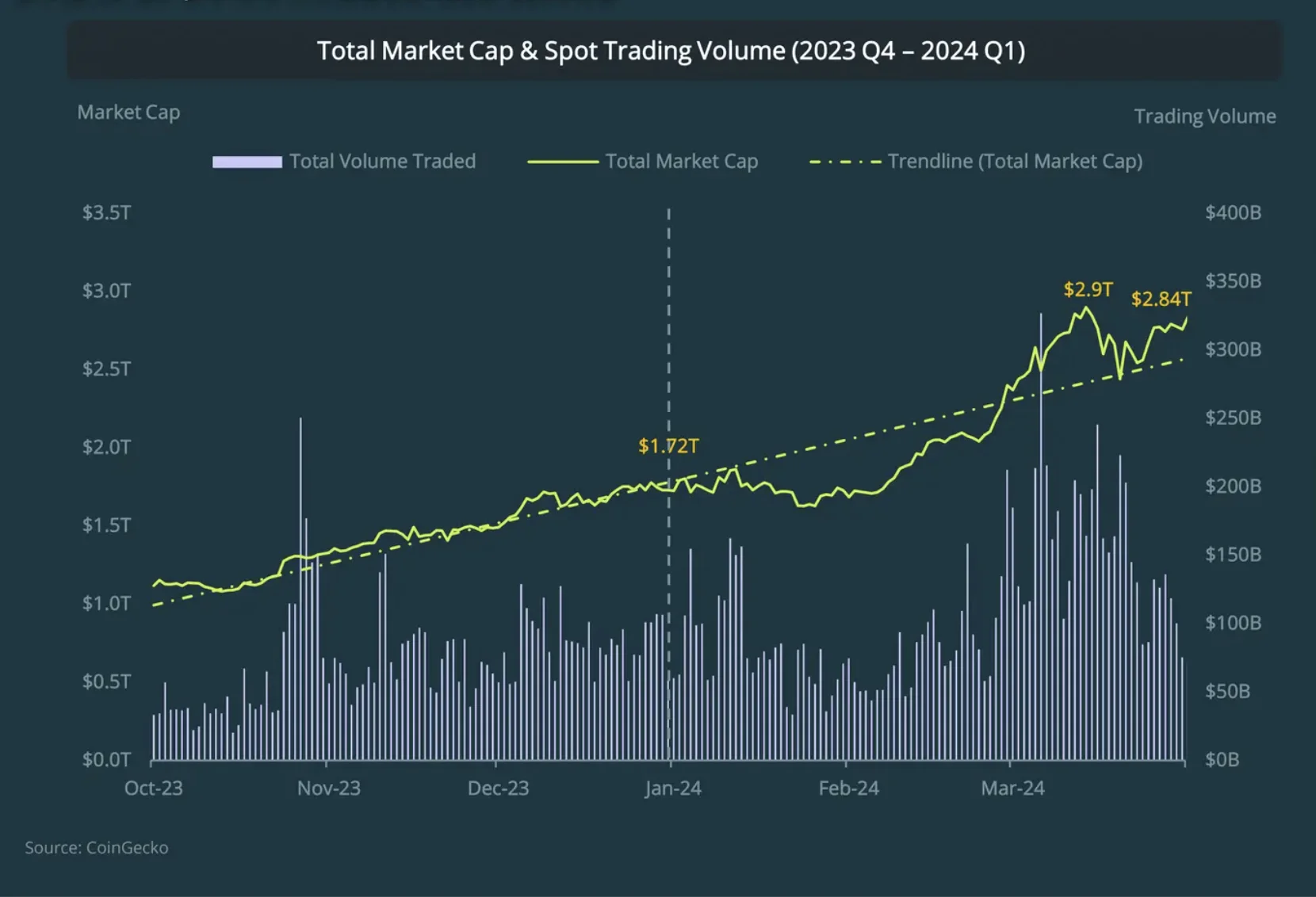

The total crypto market cap acquired a 64.5% growth, or $1.1T, in absolute terms, in Q1. The outcome has almost doubled compared to the previous quarter when they only reached $607B. As a result, on March 13, it reached $2.9T.

When discussing the trading volume, we could see that the average amount stood at $109.2B, a 45.4% QoQ increase.

Within the Top 30 Cryptos, we have:

- #11 TON, which claimed its spot from 15th place;

- #12 SHIB, shifted from 17th;

- #14 BCH secured its place from the 21st position;

Unfortunately, DAI and ATOM lost their places, thus reaching #27 and #28, from #20, respectively #22.

A surprising shift was marked by #22 APT, #25 STX, #29 WIF, and #30 ARB, replacing OP, INJ, OKB, and XLM.

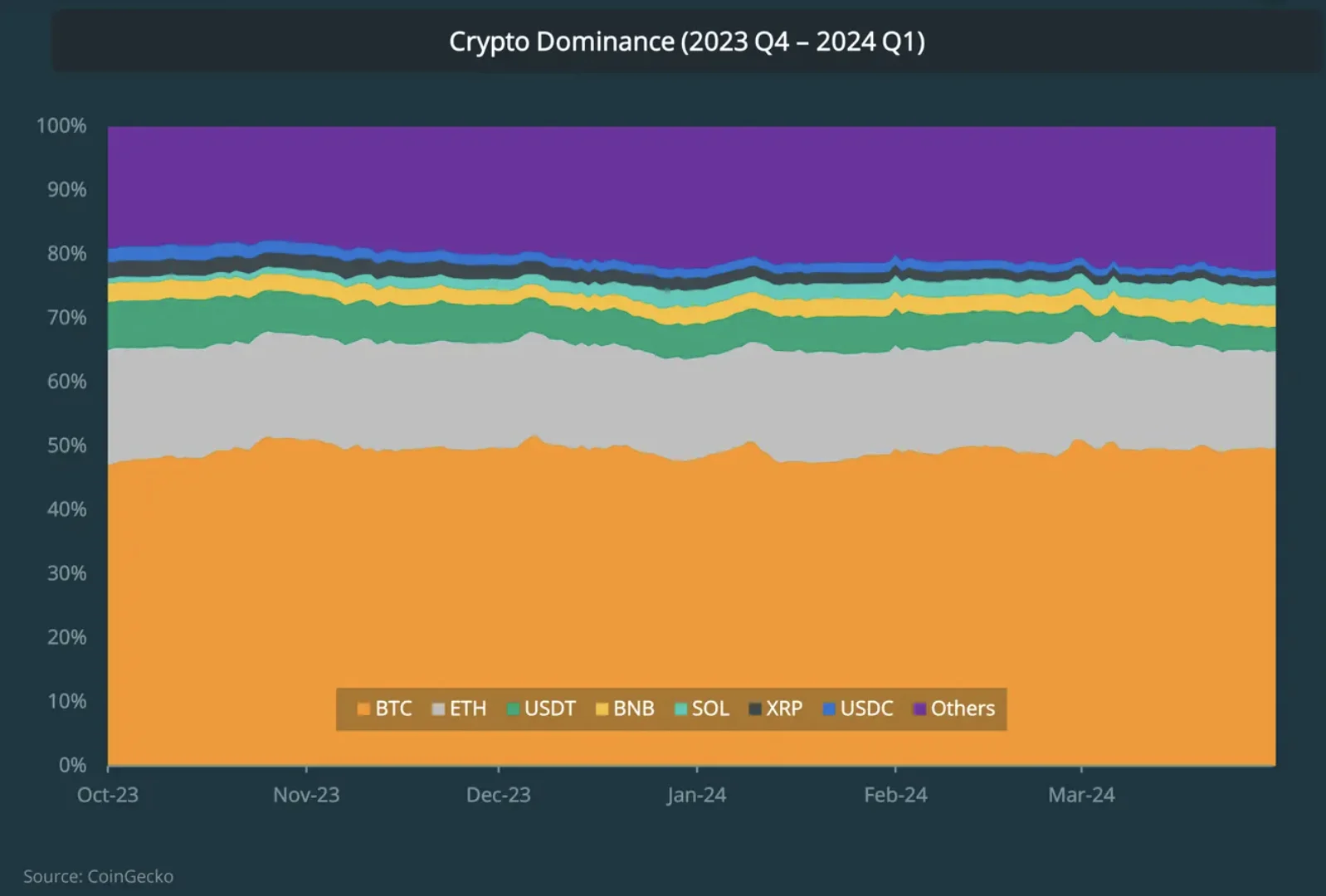

QoQ Crypto Market Dominance

As always, BTC maintained its spot, with a 1.4% increase, reaching 49.4%, followed by ETH, USDT, BNB, SOL, XRP, and USDC. Among these, BNB and SOL increased by 0.5% and 0.7%.

On the other hand, ETH suffered a 0.5% loss, XRP 0.7%, USDT 1.6%, and USDC 0.3%.

Q1, 2024 Crypto Price Performance Key Insights

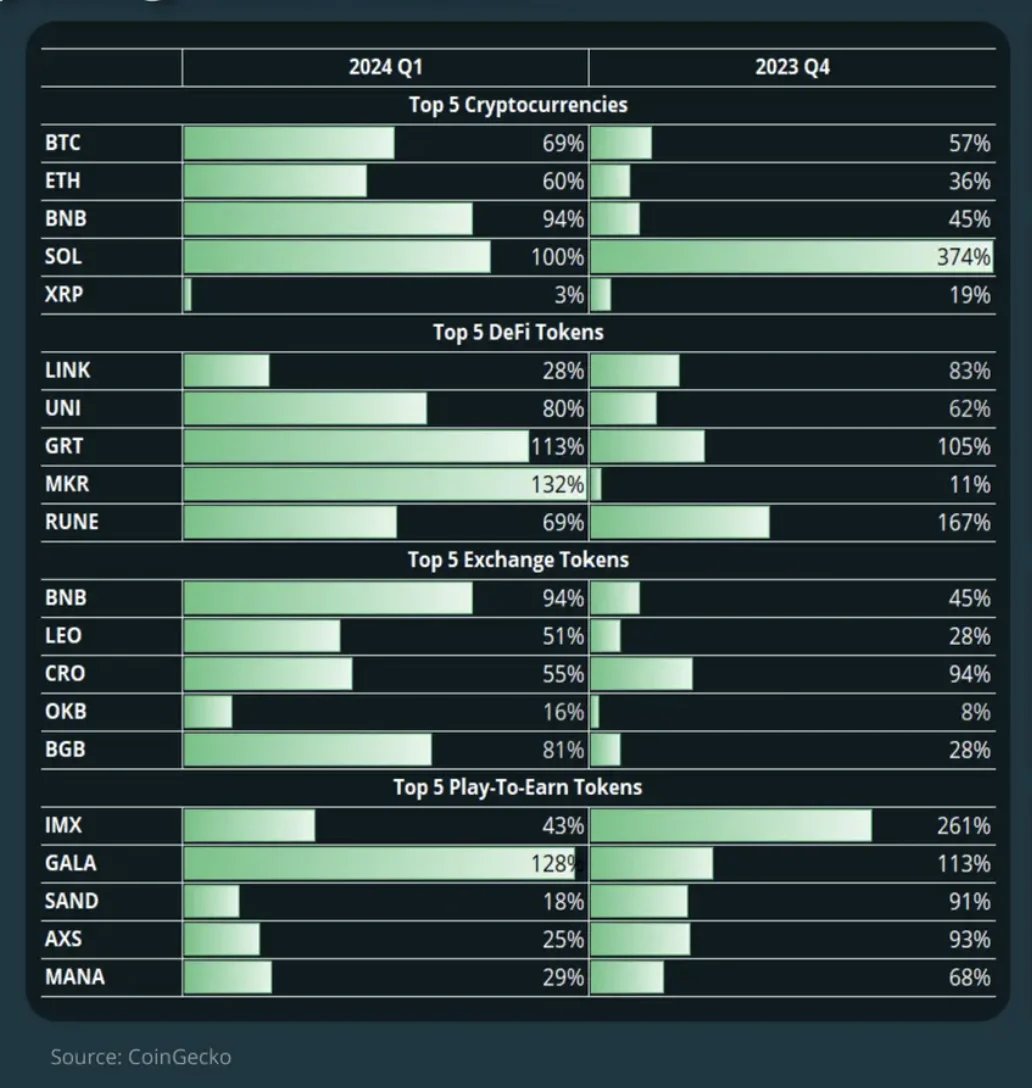

Undoubtedly, Solana was the gainer of the quarter, +100%, and the top performer within the top 5 cryptos for the 2nd time. BNB followed quickly with a 94% increase, whereas BTC came in 3rd place with 69%, outperforming ETH, which only witnessed +60%.

However, MKR outperformed the top 5 cryptos of any category with a staggering 132% increase, yet quickly followed by the GRT with a 113% growth, and UNI rallied by 80%.

When discussing exchange tokens, BNB has been the most prominent by far, with a net increase of 94%. However, a new contender in this top 5, BGB, replaced the KCS token.

On the P2E tokens, GALA was the top performer, with 128%, and just below, on 6th, is RON, with 114%.

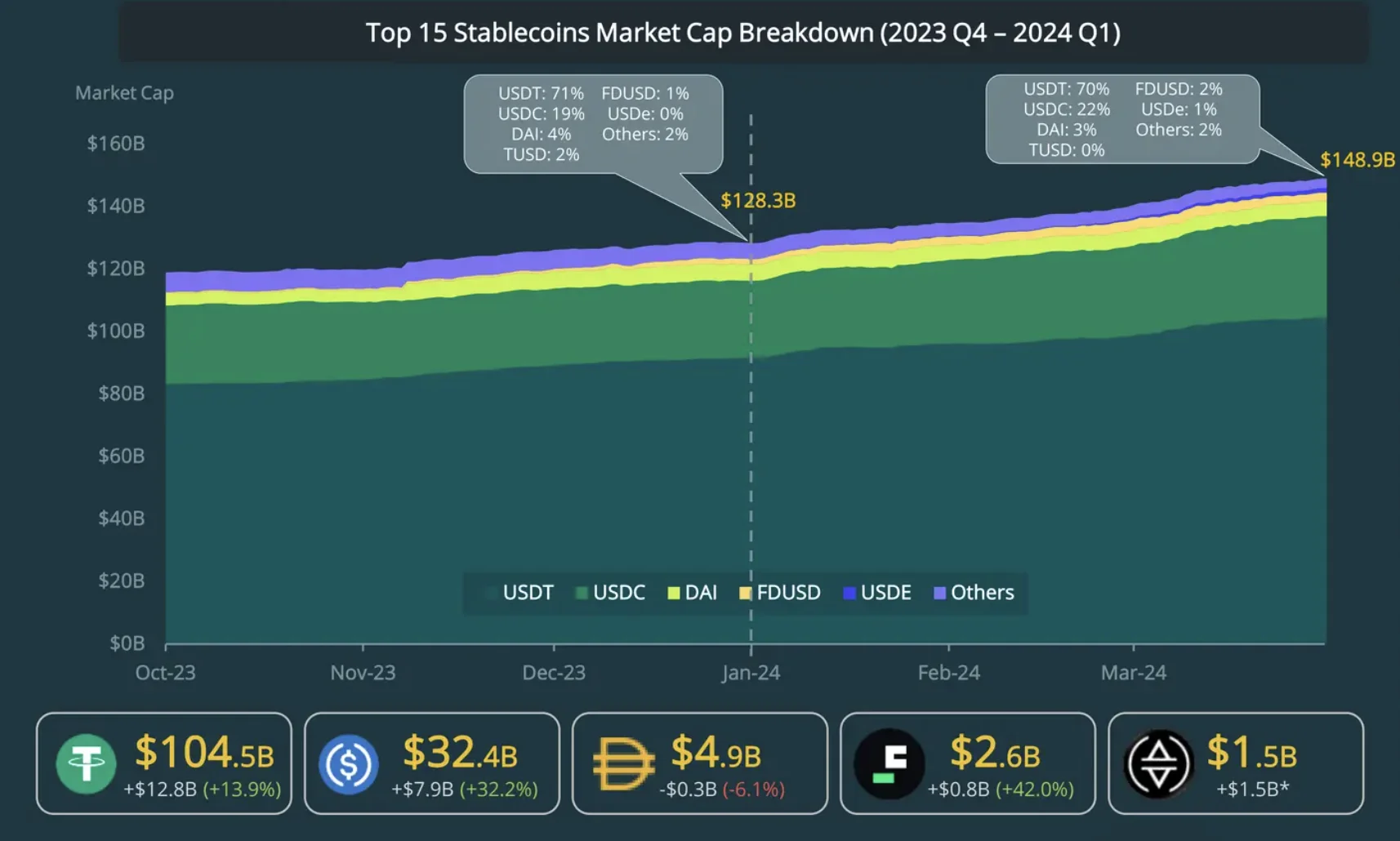

Top 15 Stablecoins of Q1, 2024

Q1, 2024, was a gainer for the stablecoin market, climbing to 15.1% or $20.6B in total terms. This is good news, as we all remember from our 2023 crypto report that the stablecoin market ended its Q4 with an 11.3% decrease.

Yet, let’s see a breakdown!

As seen in 2023, USDT solidified its position and market dominance; in Q1 2024, USDT witnessed the most significant increase of $12.8B, followed closely by the USDC with $7.9B.

TUSD didn’t maintain its position, and it was replaced by USDe, Ethena’s new synthetic stablecoin that raised a market cap of $2B in just 2 weeks.

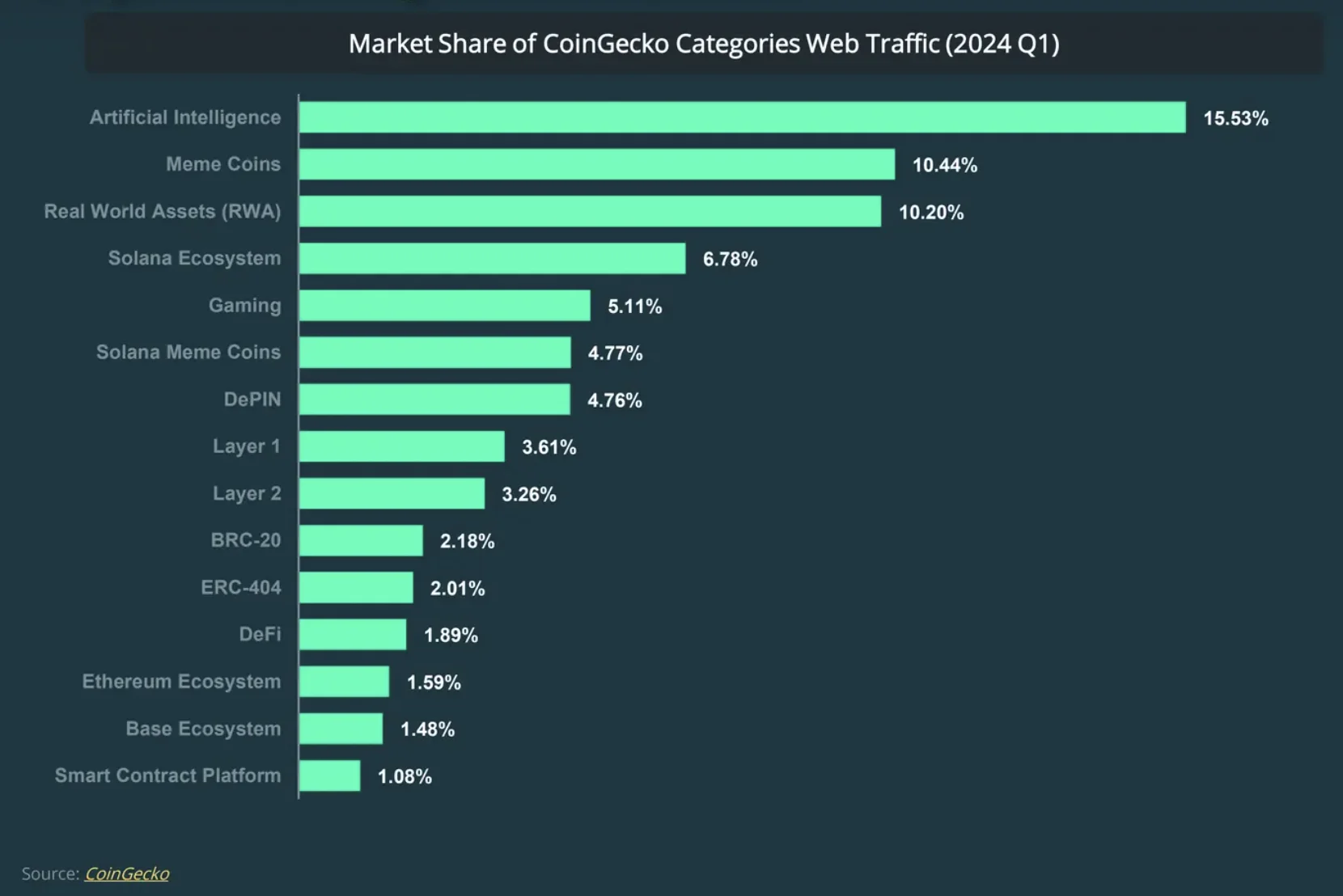

Q1, 2024 Crypto Trending Categories

Thanks to CoinGecko analysis, we can now delve into some of the most popular categories to better conclude and strategize your investment plan.

At the top of the list, AI (Artificial Intelligence), meme coins, and Real-World Assets (RWA) were the shining stars of the first quarter of 2024, capturing a third of investors’ attention.

The Solana ecosystem and the gaming landscape also position themselves in investors’ minds, with more than 5% interest, making space for newcomers like ERC-404.

On the blockchain side, only 3 out of 49 networks, Solana, Ethereum, and Base, managed to be in the top 15 narratives, while NFTs DeFi, Avalanche, FTX holdings, and BRC-20 lost interest.

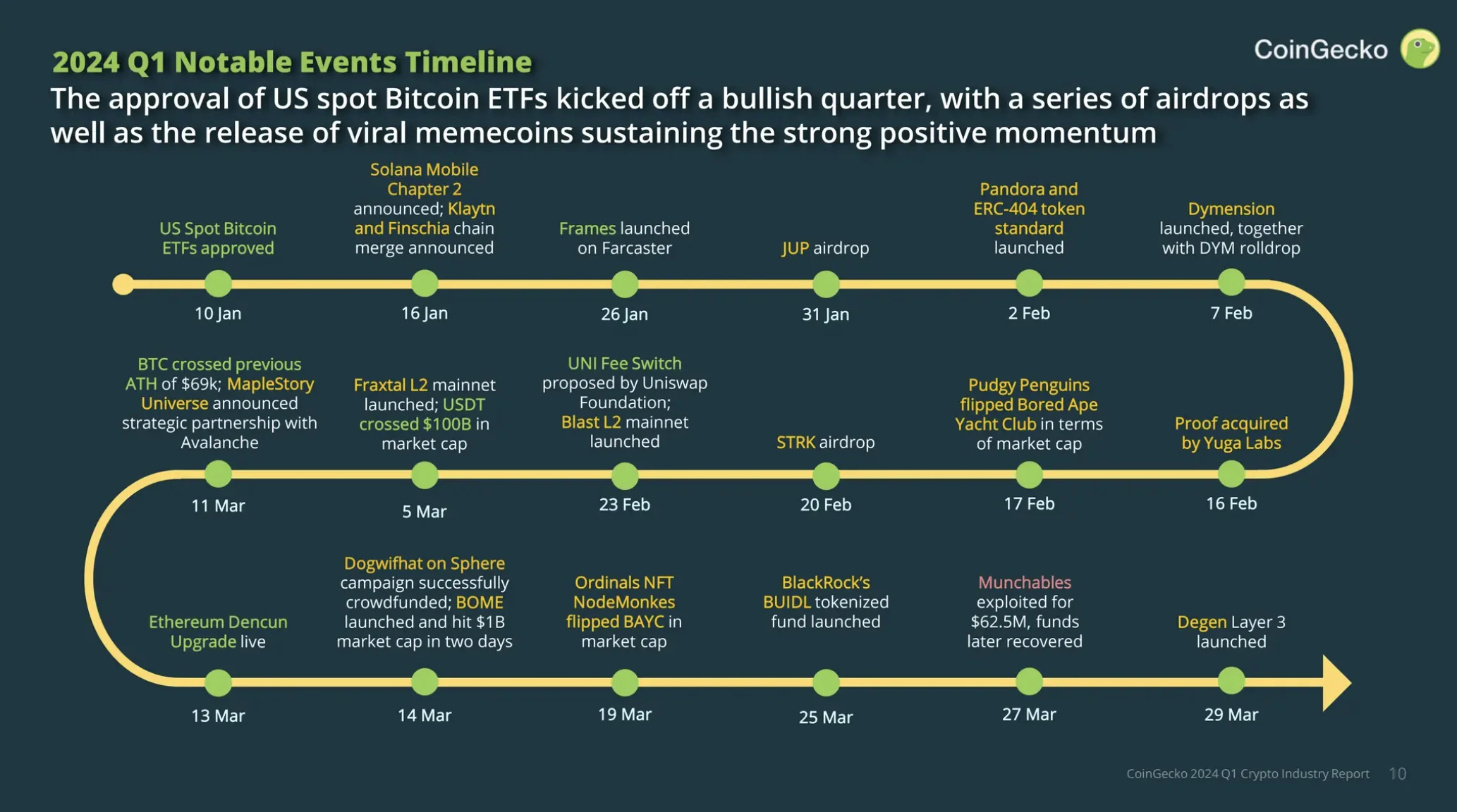

Top Significant Q1 2024 Crypto Events

When thinking about the latest quarter events, you’re probably thinking about the Spot BTC ETF, but that’s not all. So, let’s catch up on the key events!

1. January 10: US Spot BTC ETF Gets Approved;

- Bitcoin ETF enables investors to gain exposure to BTC’s price movements through 2 distinct types of ETFs: Spot ETF, in which Bitcoin is owned, and Futures ETF, whereby investors gain exposure by investing in crypto futures contracts.

2. January 16: Solana Mobile Chapter 2 Announcement, Klaytn & Finschia Get Merged;

- Solana Mobile Chapter 2 is a new crypto-focused phone with over 100,000 preorders within the first month.

- The Klaytn and Finschia merger constitutes Asia’s largest Web3 ecosystem, and it was approved through voting by holders and governance members of both parties.

3. January 26: Frames Gets Launched on Farcaster;

4. January 31: JUP Airdrop;

5. February 2: Pandora & ERC-404 Token Standard Just Launched;

- Pandora was the first ERC-404 token that reached as high as $32,000 from a low of $250 in just under a week. It has a supply of only 8,000 tokens and traded some $76 million in volumes in just 24 hours.

6. February 7: Dymension Launched & DYM Rolldrop;

- The Dymension network launched its mainnet and offered a token airdrop worth over $390 million.

7. February 16: PROOF Acquired by Yuga Labs;

8. February 17: Pudgy Penguins Outperformed BAYC as Market Cap;

9. February 20: STRK Airdrop;

10. February 23: UNI Fees Switch Proposal & Blast L2 Mainnet Was Launched;

- The UNI fee switch ensures that a part of the earned fees by the LPs gets distributed to $UNI token holders who have delegated and staked their tokens.

11. March 5: Fraxtal L2 Mainnet Launched & USDT Jumped Over The $100B Mark;

12. March 11: BTC Crossed Its ATH of $69K & MapleStory Universe Partners with Avalanche;

- MapleStory Universe plans to operate Avalanche’s ‘Subnet’ technology to expand the project’s blockchain-based game ecosystem.

13. March 13: ETH Dencun Update Was Live;

14. March 14: Dogwifhat on Sphere Crowdfunding & BOME Launches With $1B Market Cap In 2 Days;

15. March 19: Ordinals NFT NodeMonkes Outperformed BAYC In Market Cap;

16. March 25: BlackRock’s BUILD is Tokenized Fund Launch;

17. March 27: Munchables Gets Exploited – $62.5M Later on Recovered;

18. March 29: Degen Layer 3 is Launched;

Bitcoin Analysis in The Q1 2024

Bitcoin has seen some difficulties this quarter regarding its price movements. One influential factor was the Spot BTC ETF approval, which made BTC’s performance follow a 16% correction, reaching as low as $39.505, from which it rallied up 85%, and nonetheless, it has reached its all-time high of $73.098.

Also, Bitcoin’s trading volume has massively increased, with a QoQ rate of 89.8%, jumping from $18B in Q4 2023 to $34.1B in Q1 2024.

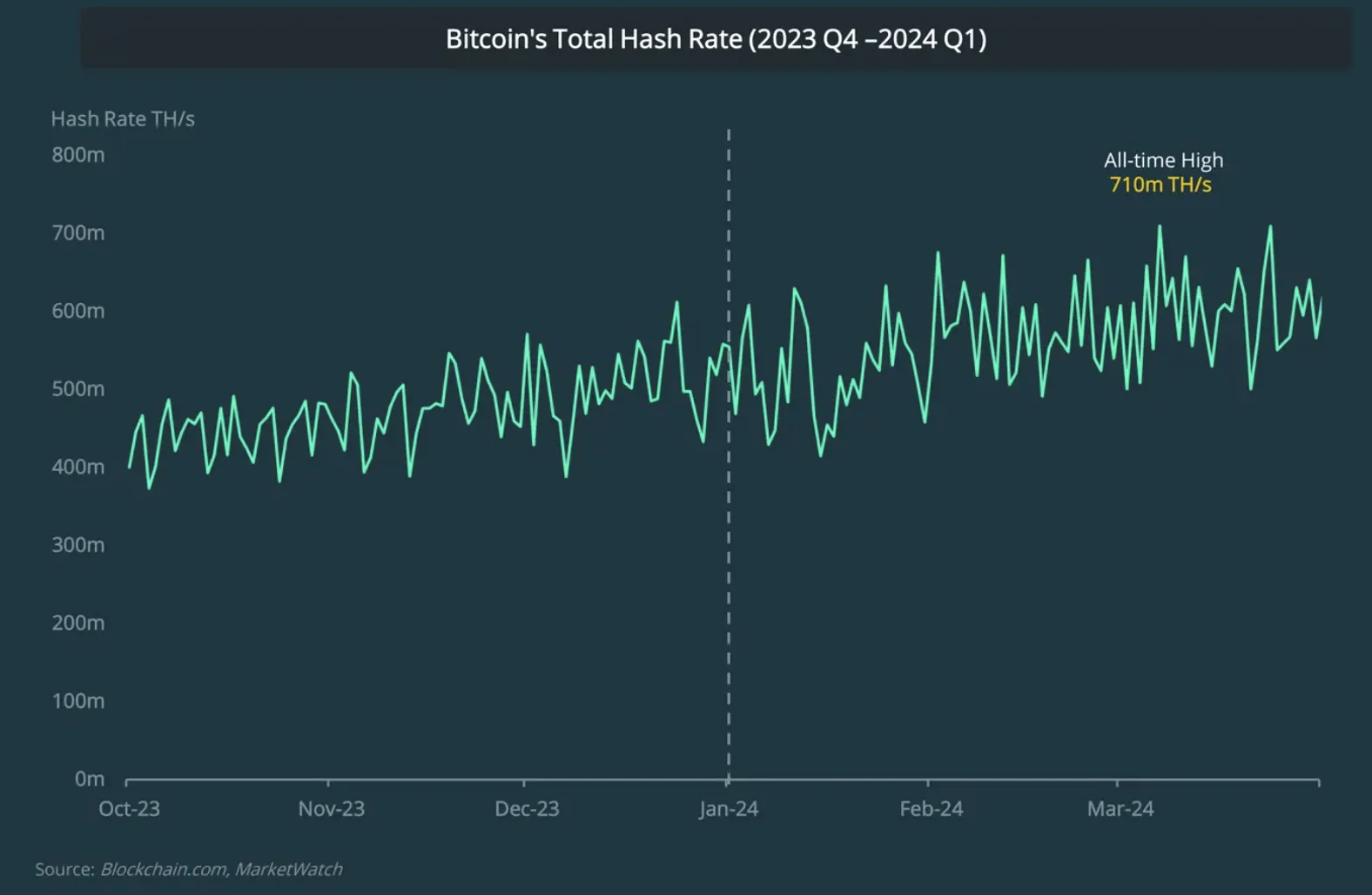

The Bitcoin Hash Rate in Q1 2024

When discussing the Bitcoin hash rate, one key aspect is that it reached its all-time high of 710m TH/S recorded on March 7, even though it’s only a 2% increase.

Notable Bitcoin Mining Events:

- Ethiopia is now the first African country to start BTC mining despite the crypto trading ban;

- Marathon Digital Holdings partnered up with Applied Digital to purchase a 200-MW Bitcoin mining facility for $87.3 million;

- Luxor Technology and Bitnomial are set to launch the first US Bitcoin mining hash rate futures;

- Swan Bitcoin debuts its mining operation with a total hash rate of 8EH/s.

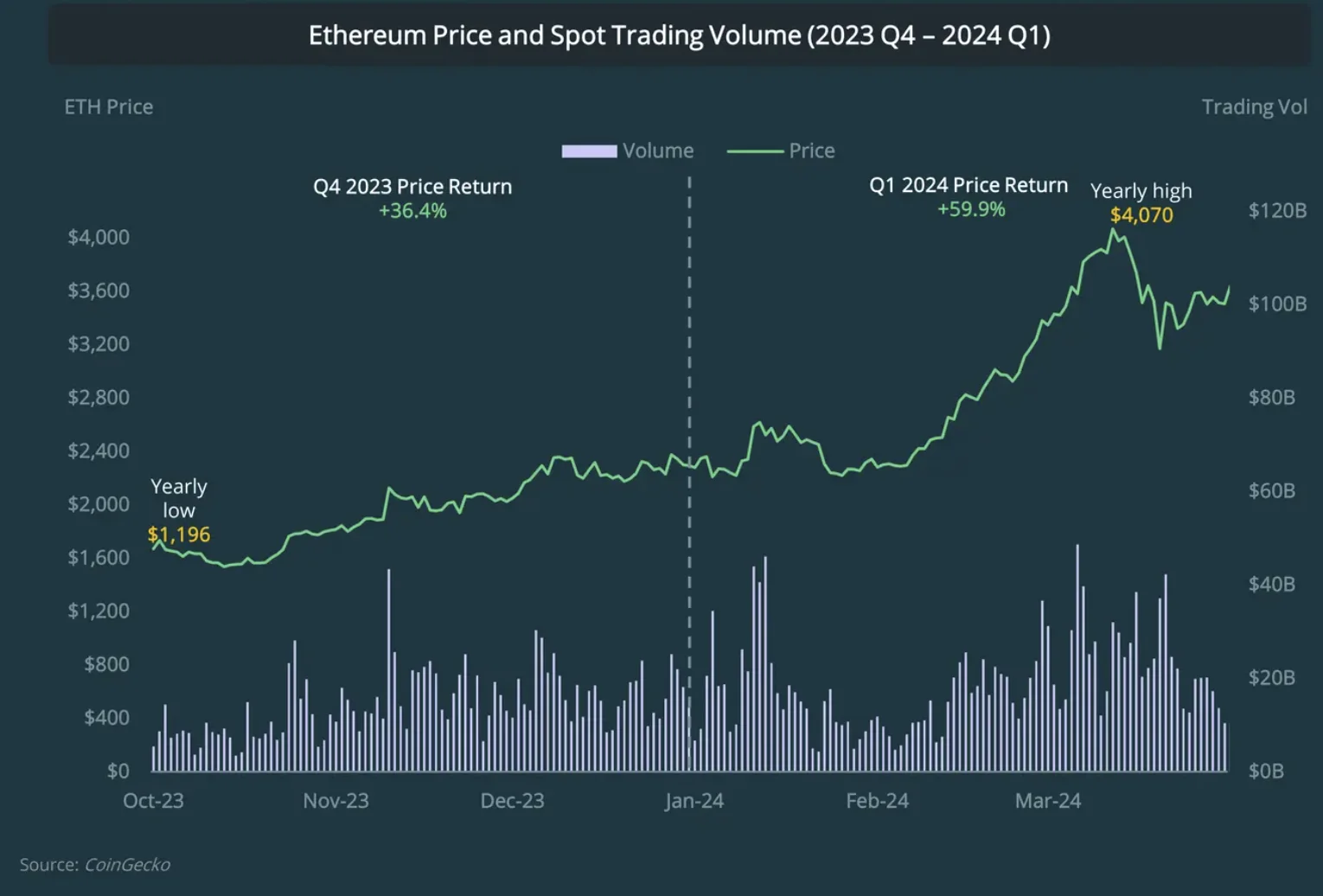

The State of Ethereum in Q1 2024

The good news is rolling on Ethereum, which saw a 59.9% increase in Q1, thus breaching the $4.000 mark in anticipation of the Dencun update and the wait-long approval of the US Spot ETH ETFs.

Given this good Q1 start, Ethereum’s triumph has been most awaited since 2021, when it reached its all-time high of $4.070 in December. Regarding the trading volume, Ethereum went up from $14.7B in Q4 2023 to $19.1B in Q1 2024.

Moreover, as the EIP was implemented as part of the Dencun update, it has significantly reduced gas fees across Layers 2, such as Arbitrum, Optimism, and Base, sustaining a higher usage.

Q1 2024 Ethereum Restaked

Increasingly more ETH Liquid Restaking protocols appear on the market, growing by 36% on Eigen Layer in Q1 and reaching 4.3 M restaked ETHs, whereas EthereFi is the most extensive LRT protocol, with 52.6%.

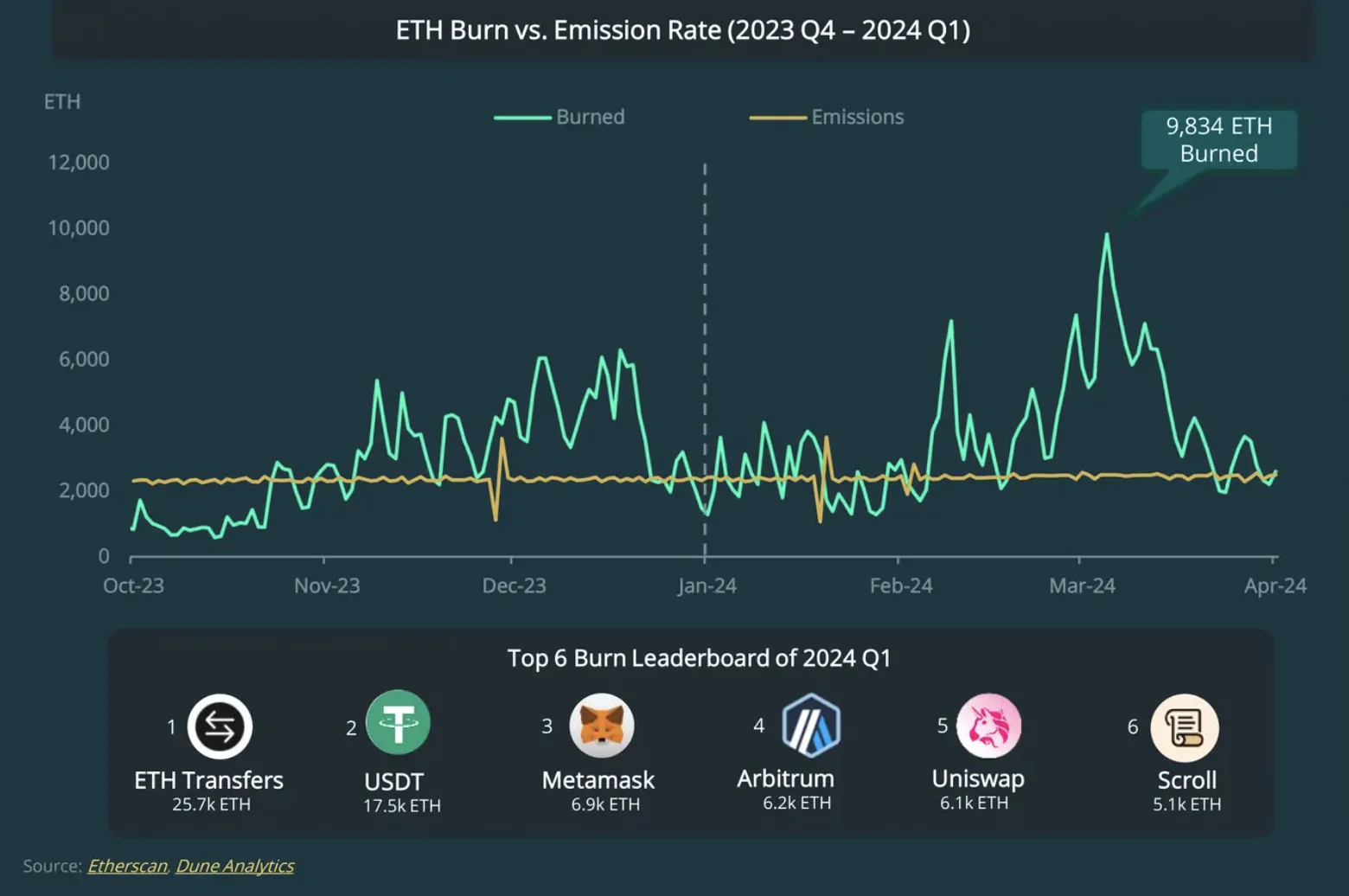

Ethereum Burn Rate in Q1 2024

The Ethereum network removed 113.1K ETH from circulation in Q1, whereby 333.6K were burned, and only 270.5K were emitted. Compared to Q4 2023, where 90.2K were burned in only one month, in Q1, things are different, where the average burning rate is 111,2K.

Moreover, the most significant one-day burn was registered on March 5, when 9.834 ETHs were burned. In the rest, the ETH transfers burned the most in Q1, at 25.7K ETH.

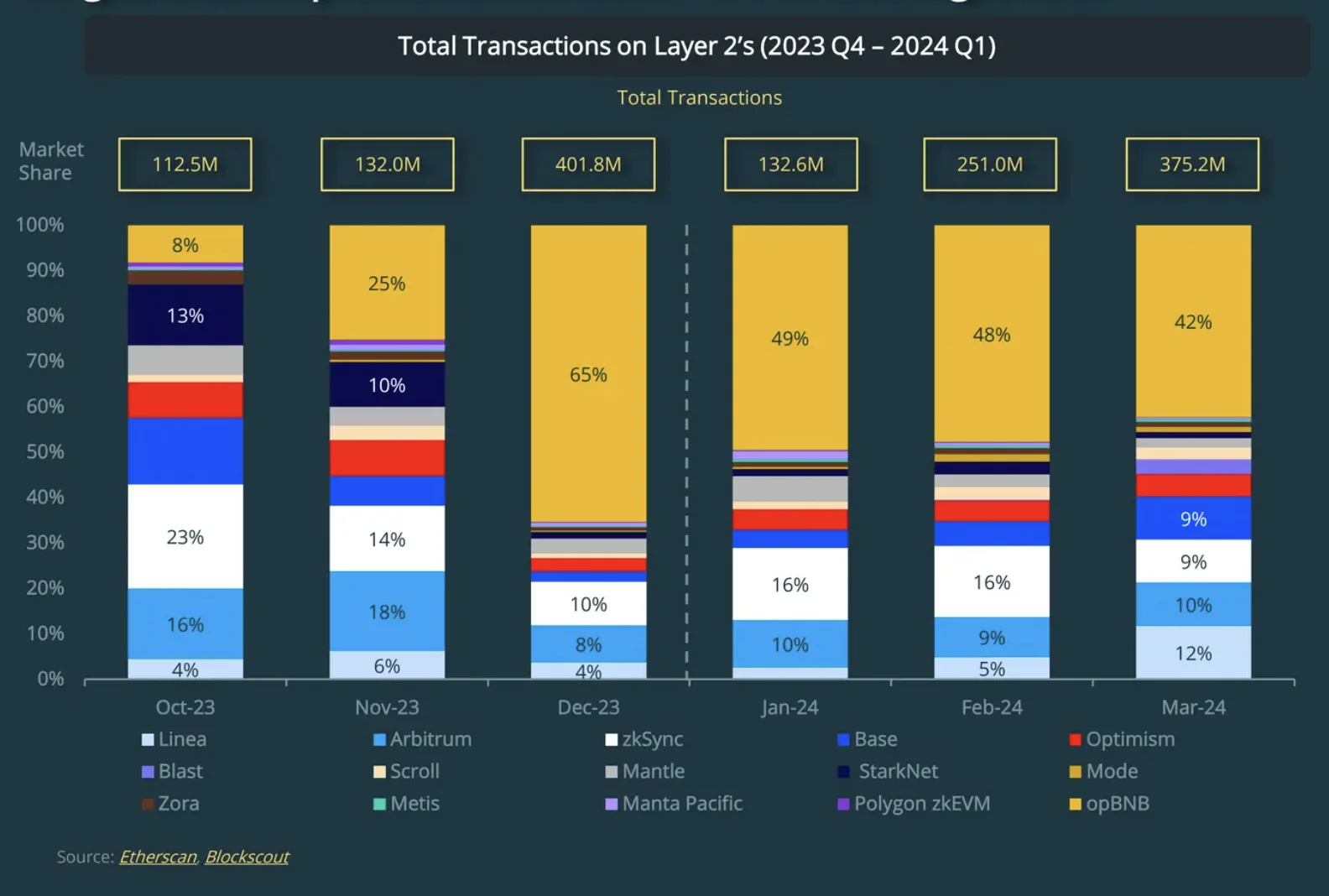

The Layer 2’s Adoption in Q1 2024

The Layer 2 network witnessed over 900.7M transactions in Q1, 2024, and opBNB was the largest L2, with 46% or 414.1M of all L2 transactions. On a Quarter-on-Quarter analysis, the L2 trades increased by 39.4%, meaning 900.7M, compared to 646.3M in Q4, 2023, as only 1.3B L2 trades were in total last year.

However, Linea overthrew Arbitrum, becoming the second most active Ethereum L2, with 125.5% growth on QoQ, or 63.3M transactions in Q1.

The State of Solana in Q1 2024

SOL Price vs. Trading Volume

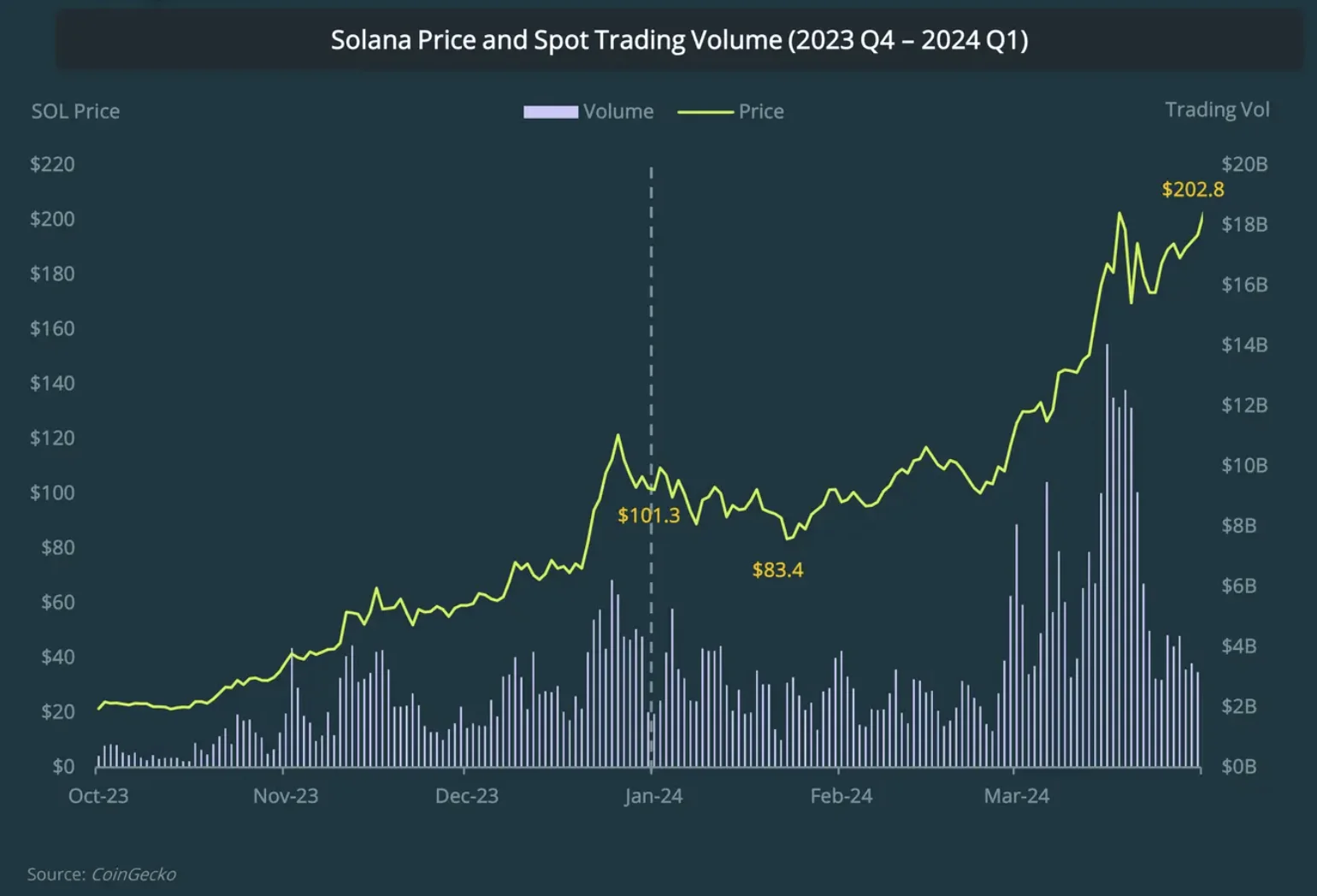

In the past year, we have witnessed Solana’s resurrection, from a 10x gain in 2023 and Q4 with a 374% price increase to 2x in Q1 2024, or 100.1%, skyrocketing above $200.

When discussing the average trading volume, it almost doubled, thus reaching $3.8B in Q1 from $2.0B in Q4 2023, marking a 92.8% on a QoQ analysis. One of the reasons behind Solana’s success is the memecoin hype and airdrops, besides the high on-chain activity, causing network congestion in March.

However, things were always this great, and in February this year, the Solana network faced a 5-hour outage, similar to what happened in February last year when the network was down for almost 19 hours. Luckily for the network, SOL’s price wasn’t impacted.

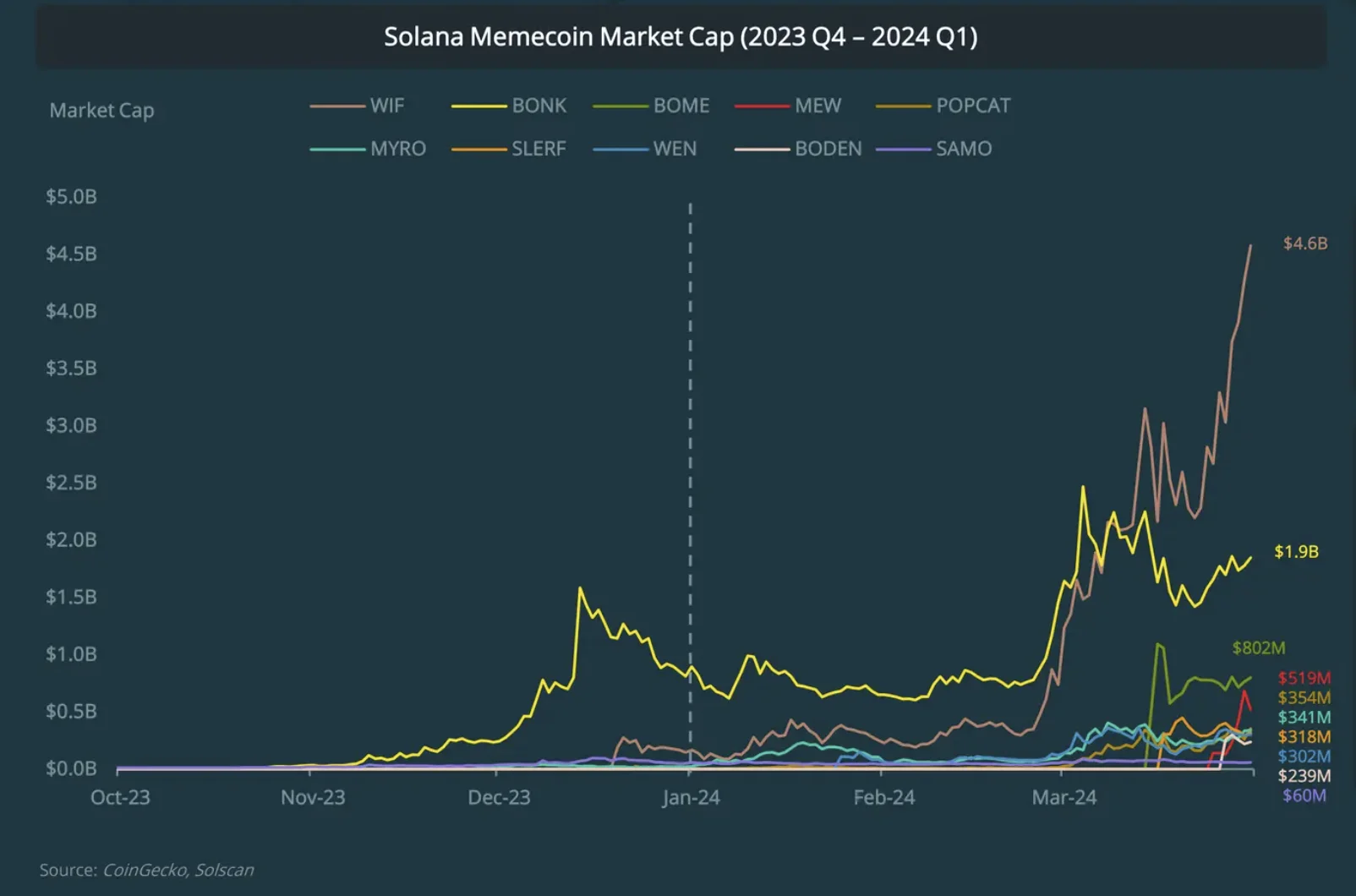

Solana Memecoin Hype in Q1 2024

For naysayers, the memecoin craze is real and has the results to prove it. As such, the market cap of 10 SOL memecoins increased by 801.5%, or $8.3B, ending the first quarter of 2024 at $9.36B.

Moreover, WIF overthrew BONK, becoming one of the largest SOL memecoins. As such, only BONK and SAMO existed before Q4 2023. If you didn’t know, BONK was quickly endorsed, thus becoming the number 1 memecoin by market cap after its December 2022 launch, which WIF flipped in March.

The DeFi Analysis in Q1 2024

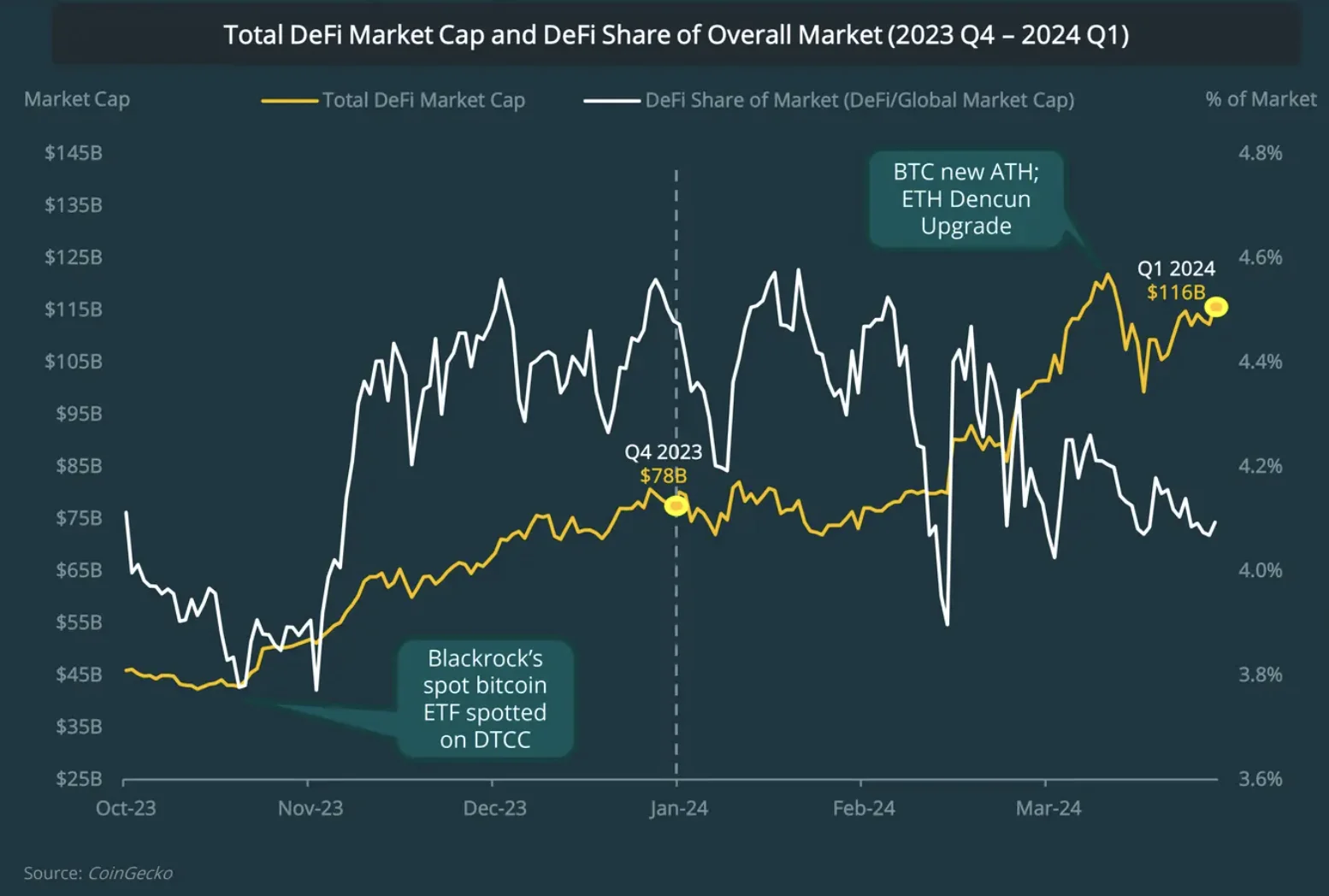

Let’s see what we knew about the DeFi market in 2023: the first three-quarters of the market cap stagnated to change in Q4 due to bullish market sentiment, overcoming the total crypto market cap by 128,8%.

The beginning of Q1 2024 seemed poised to a great start, yet Bitcoin and memecoin hype stole the thunder, yet it still had a 49.1% increase.

Furthermore, the DeFi market saw a spike in mid-February, reaching $90.3B, resulting in a rebound to 4.4% after a prior plunge of 4%. Afterward, it managed to reach its glorious peak at $122B. The coincidence is that BTC reached its all-time high before Ethereum’s Dencun update.

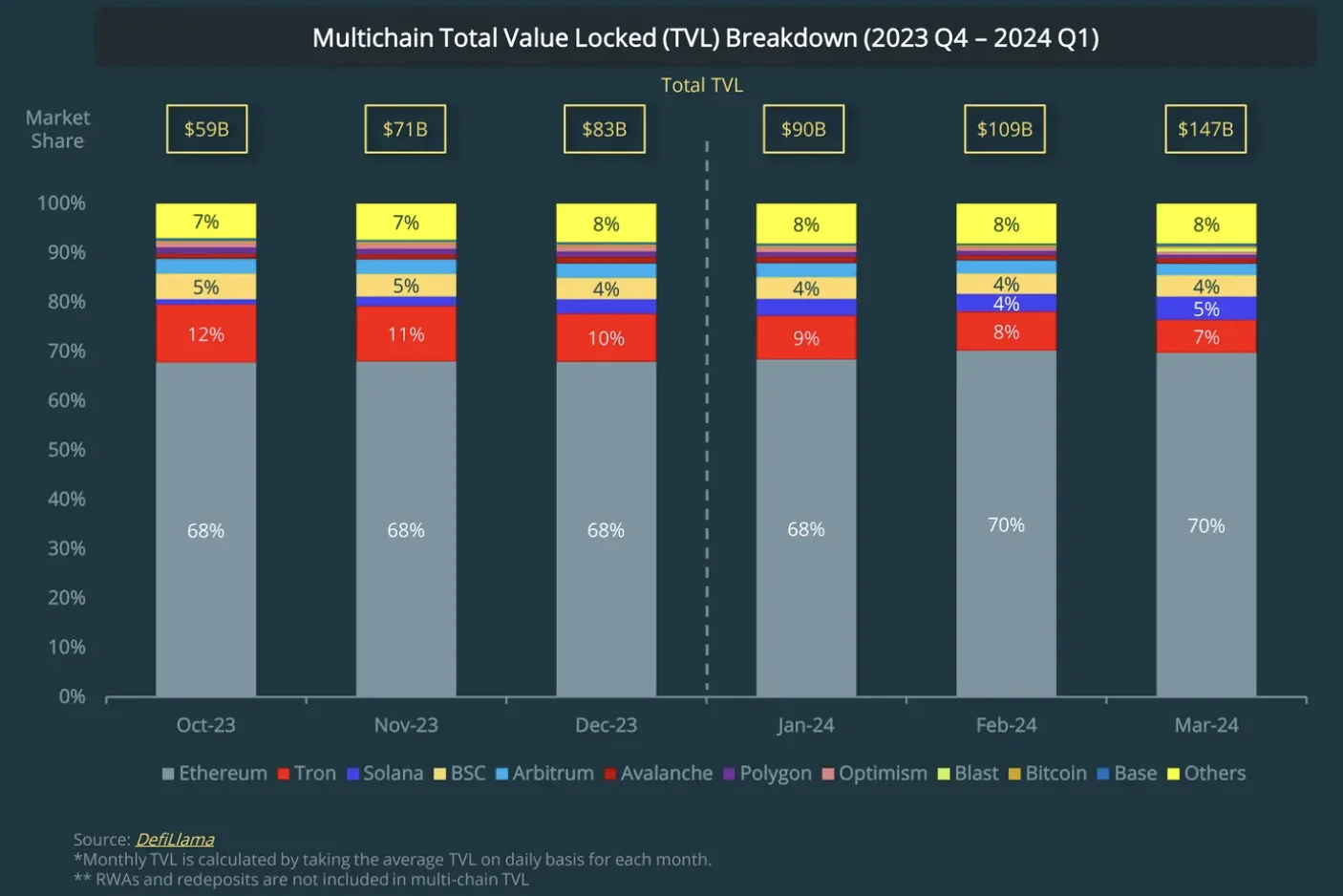

DeFi Multichain Market Share in Q1 2024

The DeFi multichain TVL continued to climb back up after last year’s surging by 78% or $83B to $147B in Q1, 2024, due to the increased interest in airdrop and memecoins. The Ethereum growth continued up to 70%, meaning an additional $47B due to its restaking narrative led by the EigenLayer.

Solana’s memecoin success pulled another 4% of the multichain TVL since last year’s 1%. As such, with a 5% TVL share, SOL managed to surpass BNB Smart Chain behind Tron and Ethereum.

As you can see, Base and Blast, the Layer-2 networks, managed to catch up with other L2s like Optimism and Arbitrum, closing the quarter with $1.2B and $1.4B.

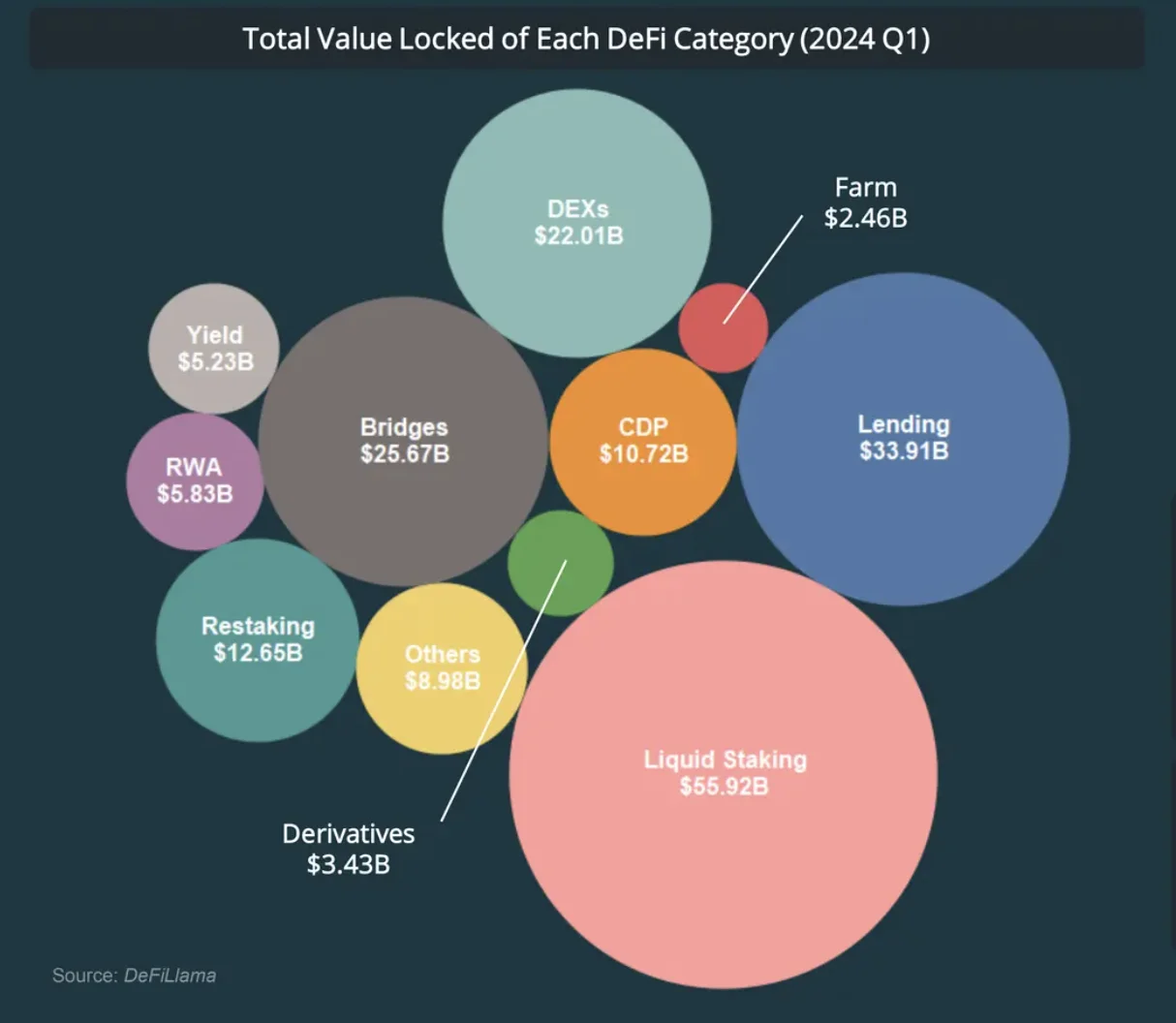

The DeFi Ecosystem in Q1 2024

Among the biggest winners of the first quarter of 2024 was the restocking protocol, which had a massive increase of 1.068% in TLV. Liquid staking was the prominent leader, despite the total staked ETH accounting for only 10.7% of the past quarter, as most of TLV gain came from ETH’s price appreciation of 59.8%.

The State of NFTs in Q1 2024

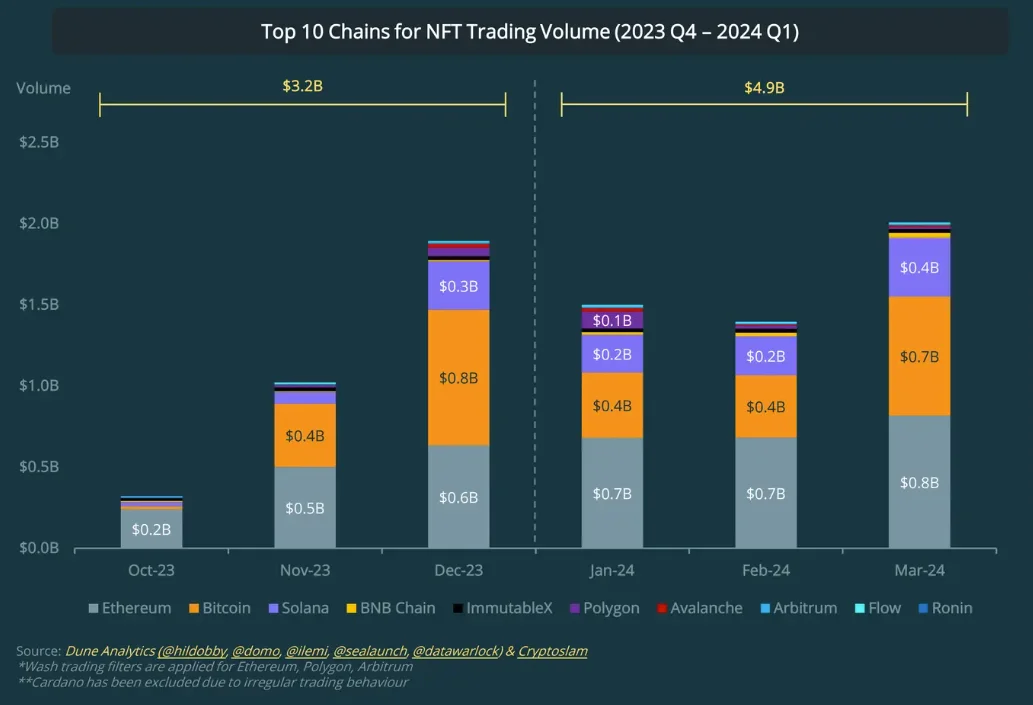

NFT Trading Volume Across 10 Chains in Q1 2024

In the past years, the NFT trading volume has fluctuated, and in Q4 2023, it has finally rebounded. However, in Q1 2024, the NFT market continued to recover due to Bitcoin’s and Solana’s NFT interest and its trading volume growing by 51.5%.

Even though January started with a 20.7% decrease in trading volume, the NFT trading volume rose by 51.5% across 10 chains by the end of the first quarter. Therefore, from $3.2B in Q4 2023, it climbed to $4.9B in Q1 2024.

The longstanding battle between Ethereum’s NFT and Bitcoin and Solana’s NFTs is still real, as ETH is still recovering with over $2.2B traded, while the other two are still lavished with great interest.

However, with the Bitcoin halving on our minds and the launch of Runes, BTC NFT share has reached 36.6% in March from 26.8% in January, again surpassing Ethereum by $735M trading volume.

Another gainer was Polygon, which impressively reached $105M in trading volume due to the launch of the NFT game Gas Hero. Yet, the trading volume plummeted by 88% to $12.7M at the end of Q1.

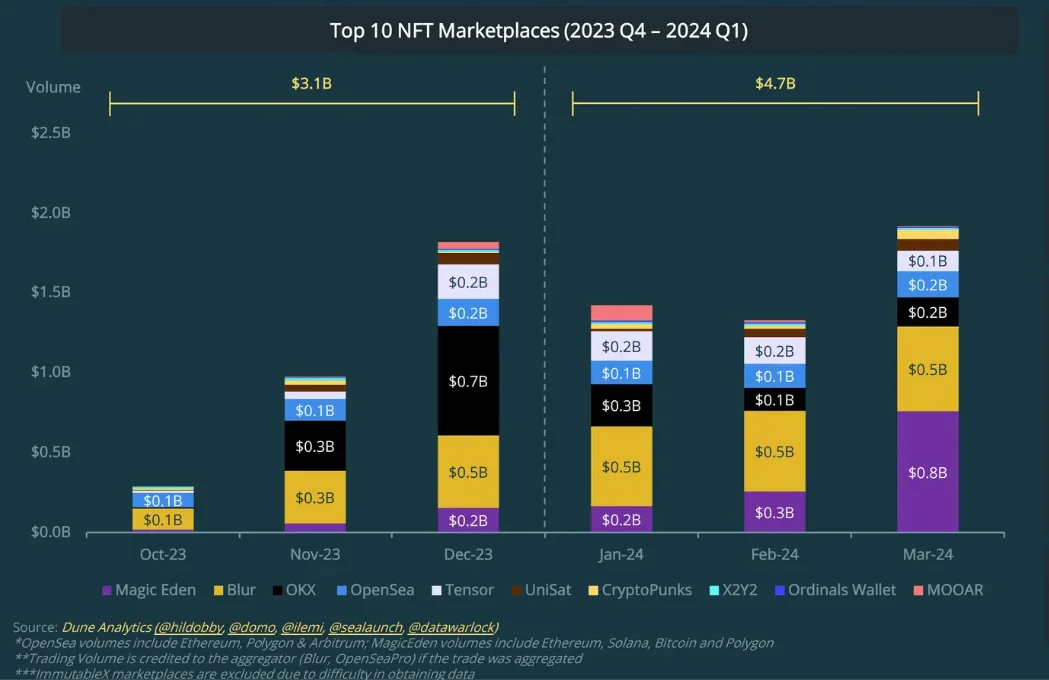

NFT Trading Volume by Platform in Q1 2024

Blur remained the leading marketplace in Q1 2024, with NFTs trading over $1.5B, thus increasing its market share by just a few points to 27.6%. Yet it was downthrown by the Magic Eden due to the introduction of Diamond rewards and the launch of a royalty-enforced ETH marketplace with Yuga Labs.

However, things weren’t so bright for the NFTs trading on OKX, and as a result, it dropped by 73.3%, barely reaching $128M at the end of Q1. Its monthly volume also decreased from 37.6% to 9.5%.

Among the NFT gainers was MOOAR, which became the top NFT marketplace on Polygon, with $97M in trading volume.

Top Crypto Exchanges Trading Volumes in Q1 2024

Q1 2024 10 Spot CEX Trading Volume

If, in the last two quarters of 2023, the crypto exchange trading volume increased by 53.1% on a QoQ analysis. In Q1 2024, the spot CEX trading volume hit $4.3T, the highest since 2021, and marks a 95.3% growth. Also, this growth coincides with the last BTC ATH.

As always, Binance remained dominant within the spot CEX sector, especially after a troubled 2023, increasing by 122.3%, or $1.4T. On the other hand, MEXC also suffered, mainly because crypto investors and traders focused more on BTC than smaller cap coins, which is MEXC’s specialty.

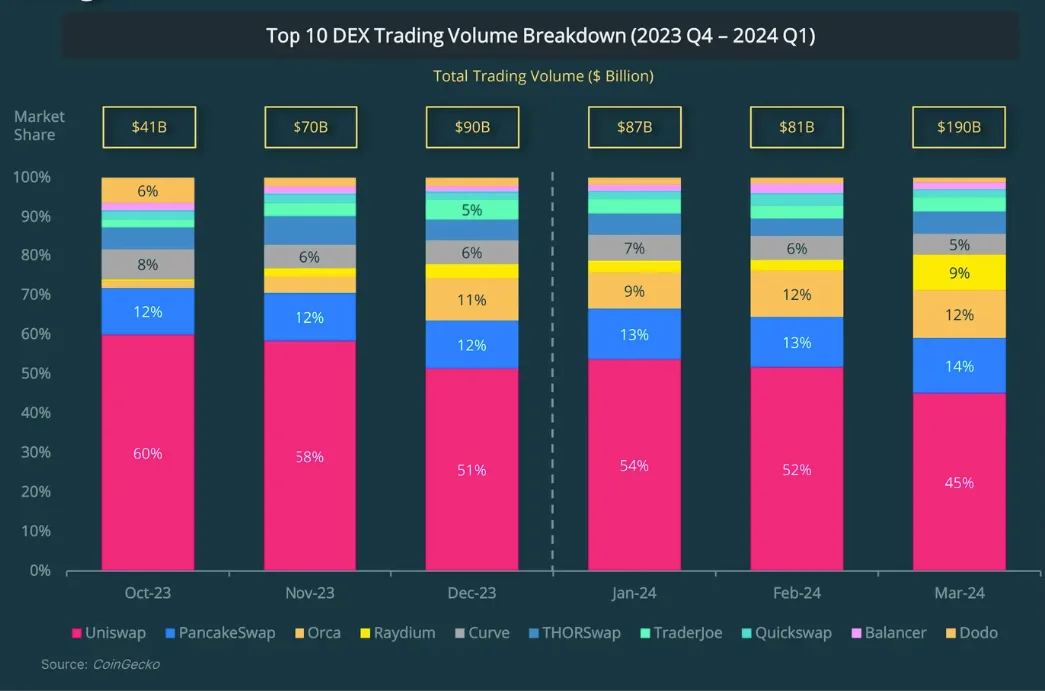

Q1 2024 10 Spot DEX Trading Volume

Solana DEXs led the first quarter of this year, which grew massively by 78.4% on QoQ, recording a total of $357.6B in spot trading. Moreover, March was the best month, which accounted for $190B in volume since November 2021.

When discussing Solana DEXs, Raydium was the most significant gainer, with 352.6% or $17.1B, grabbing a 9% market share in March. Followed closely, Orca grew by 202.9%, meaning $27.1B QoQ, with a 12% market share.

Challenges of The Crypto Market in 2024

Most notably, the crypto surge could be attributed to Bitcoin’s exceeding its ATH and reaching new grounds on top of the most awaited regulatory landmark, ETF approvals, and other tech advancements, leading to a 2024 crypto bubble.

On the bright side, the approval of spot BTC ETFs was anticipated by one of the year’s most meaningful events, the Bitcoin halving, which had the sole purpose of reducing the BTC supply, thus increasing its value.

But this isn’t all, as new crypto regulations are posing as disruptors within the market, which is understandable after a tumultuous 2022, which still lingered in 2023.

1. New Crypto Regulations

Let’s discover SEC’s regulatory agenda and some of the latest changes and proposals within the crypto space so that you can know what to expect.

Qualified Custodianship

Just as the name says, though qualified custodianship, the SEC requires financial investors and consultants to safeguard customers’ assets outside of the traditional crypto exchanges.

Regulated Exchanges

Here’s another spin that could put the crypto market in its head, especially the DeFi sector: SEC is expanding the definition of the fully regulated exchange to constrain crypto entities to reach a higher level of accountability.

New Stablecoin Regulation

The US Congress is pondering a new stablecoin regulation as part of a broader financial package.

2. Social and Romance Crypto Scams

As seen already, crypto thieves and bad actors are finding new ingenious ways of scamming users, and this time, they are using psychology through fake romances or emergency financial requests.

Besides these, there’s also the good old SMS scam, which these days is even enhanced by the power of AI to fake an emergency and create an excellent opportunity to ask for funds regarding any social encounter as a giveaway.

Moreover, brands could increase the identity verification layer, even though it could be daunting for users, as seen in some platforms that don’t require anything upon signing in.

3. Anti-Money Laundering Sanctions on Crypto Bridges

Here’s another aspect of crypto transactions, which are used to the geopolitical views of some. As a result, in 2023, the sanctioned companies accounted for $14.9 billion in transaction volume, meaning 61.5% of all illicit transactions measured during that year.

Therefore, you can understand the gravity of these actions within the crypto bridges, which could further deepen the challenges of many businesses operating within the crypto market.

How to Overcome the Challenges of 2024

2024 could be the year of a new collaboration between the crypto landscape and the financial regulatory bodies, which could tie things together and cater to the broader adoption of cryptocurrencies.

The Importance of Transparency and Education in Crypto

As always, crypto education and transparency are the main ingredients of bridging the gap between crypto regulatory bodies and users, and with the help of crypto educational guides and reviews, anyone can keep up-to-date and informed, which could only benefit both parties.

Crypto Asset Diversification

Be sure to diversify your asset portfolio from BTC to ETH or even other small-cap coins that could have the potential to break big. However, check out the market sentiment and mitigate potential downfalls before jumping into the water.

Embracing Crypto Tools

Embracing crypto tools could be the one-way ticket to safeguarding your assets and making informed decisions through crypto trading tools, tax software, DEX screeners, etc.

Final Thoughts

As we’ve reached the end of this comprehensive Q1 2024 crypto report, it has brought the light you much needed to navigate the stormy sea that the crypto market has become.

Of course, our advice will always be to check it for yourself and be a self-thought-out and eager learner, as there are so many facets of crypto you can discover daily.