Cryptocurrencies have disrupted traditional finance and traditional financial systems, and with it, new opportunities for earning passive income have emerged, and we can see that with the naked eye now, in 2024. One such opportunity is liquidity mining, a method that enables you to earn rewards by lending your digital assets to decentralized exchanges. But what is liquidity mining, more specifically?

In this guide, we’ll explore liquidity mining in detail, starting with the basics of what it is and how it works. We’ll also discuss the benefits of using this investment approach and provide you with the necessary knowledge to participate in liquidity mining effectively.

So, if you’re ready to dive into liquidity mining and discover its possibilities, let’s get started!

What is Liquidity Mining?

Liquidity mining is a way to earn rewards by lending crypto assets to DeFi platforms (Decentralized Finance Platforms). To participate, you simply contribute your cryptocurrencies to a liquidity pool on a decentralized exchange. You will receive tokens and fees as incentives based on the quantity of crypto you provide.

These liquidity pools typically hold a variety of tokens or currencies and are only available on Decentralized Exchanges (DEXs).

Decentralized exchanges, or DEXes like Uniswap and SushiSwap, connect buyers and sellers of different cryptocurrencies without needing a third-party trading platform. They utilize smart contracts on platforms like Ethereum and Binance Coin, bypassing external servers and databases.

Transactions on DEXes can be completely anonymous and avoid profit-seeking intermediaries like banks or financial services companies. They are a critical part of truly decentralized finance (DeFi) systems.

As a liquidity provider, you will be compensated based on the money you contribute to the pool. These pools allow investors to lock in their crypto assets and receive rewards through tokens or interest payments. The locked-in funds are the lifeblood of the DEX; without them, trading systems would quickly halt.

How Does Liquidity Mining Work?

Here’s how liquidity mining works:

- Users deposit their cryptocurrency assets into a crypto liquidity pool on DEXs or AMMs (Automated Market Makers).

- The liquidity pool is used to facilitate trades between different cryptocurrency pairs.

- When trades occur, a small percentage of the trading fees are distributed to the liquidity providers proportional to their pool share.

- Besides trading fees, some DEXs or AMMs also distribute reward tokens to liquidity providers as an incentive for providing liquidity to the platform.

- The reward tokens can be sold on the open market or used to participate in platform governance, such as voting on proposals.

In order to understand more easily how any liquidity mining works, let’s take a practical example starting from the premise that you want to join a liquidity pool of the Uniswap decentralized exchange (DEX). You’ll need to follow a few steps and use various apps or websites to do this.

First, you need to have some digital coins (existing assets), such as Ethereum and USD Coin. You can’t keep these coins in your regular crypto trading wallet. You’ll need to transfer them to a self-custody wallet where you have full control over your digital assets. A good example of a self-custody wallet is MetaMask or Ledger Nano X.

Next, you’ll need to connect your wallet to Uniswap’s mobile app or browser portal and add your cryptocurrency tokens to the liquidity pool (of course, you can choose another DEX). Click the “pool” button and then the “new position” link to select the Uniswap trading pair you want to use.

Once you’ve selected your trading pair, you can choose from several reward tiers with different interest rates. The transaction fees for more commonly used cryptocurrencies and stablecoins tend to be lower, while rare or exotic coins often carry higher fees.

Most Ethereum liquidity miners on Uniswap choose the middle fee tier of 0.3%. However, the exact value can fluctuate over time, and the payout depends on how active that tier is on the Uniswap platform. Liquidity miners share the fees collected from traders on the DEX, and the more liquidity that’s locked in, the bigger the slice of the pie you’ll receive.

Yet, you’ll receive your liquidity tokens, and you can sit back and watch your rewards accumulate.

The Benefits of Liquidity Mining

After comprehending the concept of liquidity mining, it is essential to grasp the benefits of employing this investment approach. The main perks linked with DeFi liquidity mining are:

Higher Returns on Investment

Liquidity mining offers traders the opportunity to earn higher returns on their investments. Liquidity providers make a percentage of the trading fees generated on the exchange, which can be significantly higher than traditional savings accounts or even some investment vehicles. This means that traders can earn passive income while maximizing their returns on investment.

Lower Threshold for Entry

Liquidity mining offers a lower threshold for entry in addition to the equitable distribution of rewards among crypto investors. As noted earlier, this investment tactic is accessible to anyone. Suppose you have been interested in participating in the decentralized ecosystem but lacked the necessary funds to do so. In that case, cryptocurrency liquidity mining permits you to supply liquidity (any quantity) and receive substantial perks.

Diversification

Liquidity mining can be done on various decentralized exchanges and tokens, allowing traders to diversify their investments to reduce risks. By participating in liquidity mining, traders can invest in a wide range of cryptocurrencies and earn rewards from each investment, thereby reducing their overall risk exposure.

Opportunity for Passive Income

Once traders have provided liquidity to an exchange, they can earn rewards based on the volume of trades on that exchange without having to monitor market conditions or execute trades actively. This allows traders to earn income even when the market performs poorly or cannot actively trade.

Improved Market Liquidity

Liquidity mining benefits the entire cryptocurrency market by improving market liquidity. The increased liquidity provided by liquidity providers encourages more trading volume, which helps to reduce the spread between buy and sell orders, making it easier for traders to execute trades at a better price. This increased liquidity also helps to stabilize the market, reducing volatility and creating a more stable environment for traders.

Token Price Appreciation

By providing liquidity to a token, traders can increase the token’s liquidity, which can lead to increased demand and, ultimately, higher prices. This, coupled with the rewards earned from providing liquidity, can lead to significant profits for traders. Also, as more traders participate in liquidity mining and give liquidity to a particular token, its visibility and popularity can increase, leading to further price appreciation.

Risks of Liquidity Mining

Liquidity mining offers many benefits, but it also comes with inherent risks that you should be aware of before you engage in it:

Impermanent Loss

Impermanent loss is a risk you should know about before investing your crypto assets in liquidity pools. This occurs when the price of the tokens you’ve contributed changes compared to when you first invested. You may lose money if the tokens’ price is lower when you withdraw than when you initially placed them in the liquidity pool. However, trading fees can offset this risk. Nonetheless, the cryptocurrency market’s volatility means you should be cautious when depositing your money into DEXs.

Project Risk

Project risk is another technical liquidity mining risk you should consider. When a protocol is advanced, the source code it runs on is more complex, making it more susceptible to technical liquidity mining risks. Cybercriminals can exploit the protocol and the assets within if you don’t conduct an in-depth audit of the code. Hence, it’s crucial to research and conduct due diligence on a project and its platform before investing your assets in its liquidity pool. The research you perform should protect you against hacks and exploitation.

Potential Rug Pulls

Potential rug pulls are a risk that comes with the decentralized nature of liquidity mining. It’s a type of fraud that occurs when liquidity pool developers and protocol developers shut down the protocol and take away all the money invested in the project. Since decentralized protocols offer anonymity, projects can be started without verification or registration. Thus, it’s essential to perform due diligence and research a project thoroughly before investing in it to avoid liquidity mining fraud.

Liquidity Mining vs. Other Passive Investment Strategies

Besides liquidity mining, other widely used and popular methods of passive income strategies are staking and yield farming. Let’s find out more about liquidity mining versus the other two:

Liquidity Mining vs. Staking

Before everything else, let’s explore staking.

Staking is a consensus algorithm that enables users to pledge their crypto assets as collateral in proof-of-stake (PoS) algorithms. In contrast to proof-of-work (PoW) blockchains, stakers don’t need to use computational power to validate blockchain transactions; they invest their crypto assets instead. This method has numerous benefits, including increased energy efficiency compared to PoW blockchains. In staking, rewards are generally based on the amount staked and the length of time the stake is locked. For example, someone staking ADA on Cardano might earn a higher reward for staking for a longer period.

Staking mainly focuses on obtaining rewards for holding and validating transactions on a blockchain network, whereas liquidity mining focuses on providing liquidity to decentralized exchanges and liquidity pools to earn rewards.

Speaking of advantages, one advantage of liquidity mining is the ability to generate a consistent income stream. Unlike staking, where rewards depend on the stake size, liquidity mining rewards depend on the amount of liquidity provided. As a result, even small investors can participate and earn rewards.

However, compared to liquidity mining, staking carries lower risks. Although staking poses potential liquidity and project failure risks, liquidity mining risks are far more severe. For instance, rug-pull fraud is possible with DeFi liquidity mining.

Liquidity Mining vs. Yield Farming

Some investors often use the terms “liquidity mining” and “yield farming” interchangeably, but we can’t judge them because it’s neither necessarily right nor necessarily wrong. However, you need to know that liquidity mining and yield farming may sound interchangeable. Still, the most significant difference between them is related to the fact that they have different objectives.

Liquidity mining is a passive strategy where you provide liquidity to exchanges or pools to earn rewards in native tokens.

Yield farming, on the flip side, involves actively locking up your assets in blockchain protocols to earn interest.

To make it more tangible, imagine you have 100 units of cryptocurrency and want to earn passive income. Liquidity mining would involve providing your tokens to an exchange or pool to earn rewards based on the liquidity you provide. In discrepancy, yield farming would require you to lock up your tokens in a lending or borrowing platform and earn interest based on factors such as the lock-up period and supply and demand.

Top Platforms for Liquidity Mining

1. Uniswap

UniSwap stands out as a premier contender in the list of liquidity pools, owing to its high trading volume and reputation in the decentralized ERC-20 token exchange market. This platform offers seamless support for pairing Ethereum contracts and ERC-20 token contracts in a 1:1 ratio, thereby decentralizing trade between ETH and any other type of ERC-20 token.

UniSwap gains an edge over its competitors by operating as an open-source exchange. This feature allows individuals to launch new liquidity pools for any token without incurring any fees, thereby promoting a more decentralized and democratic market.

Popular liquidity pools on UniSwap

- USDC/ETH;

- WBTC/ETH;

- DAI/USDC;

- WBTC/ETH;

- USDC/ETH.

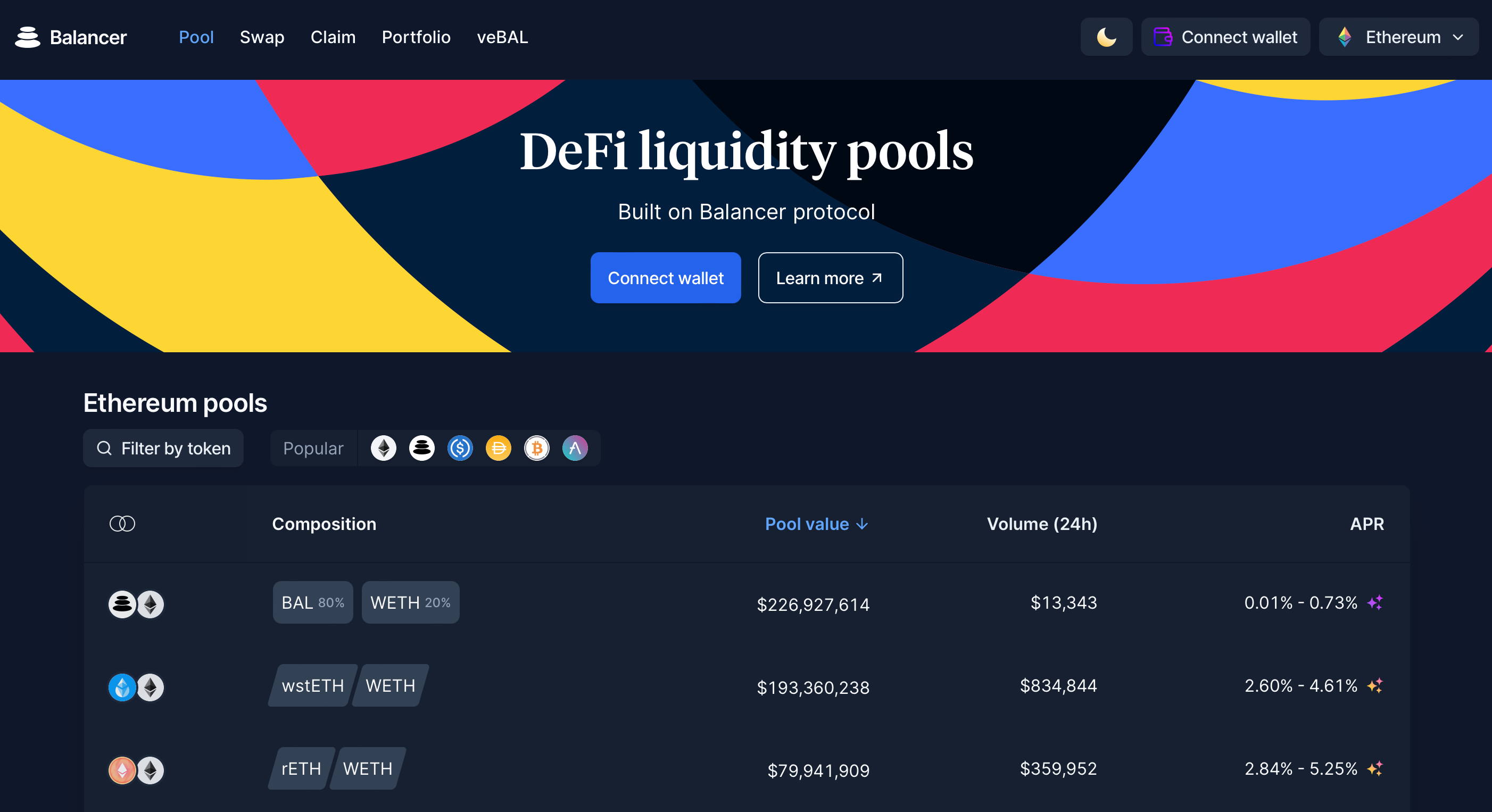

2. Balancer

Balancer is another top contender for the best liquidity pools in the crypto market. This Ethereum-based pool offers liquidity services and functions as a non-custodial portfolio manager and price sensor. The platform’s main strength lies in its modular pooling protocol, which allows for the customization of pools and earning trading fees by adjusting liquidity.

Users can choose from private, smart, or shared pools, each with their own unique features.

Private pool owners have complete authority over liquidity provision and can adjust parameters as they see fit, while shared pool settings are fixed.

Balancer also offers a liquidity mining program that rewards liquidity providers with BAL governance tokens. This program was introduced in March 2020 and has proven to be a popular feature among users.

Popular liquidity pools on Balancer

- BAL/WETH;

- wstETH/WETH;

- rETH/WETH;

- wstETH/cbETH;

- OHM/DAI.

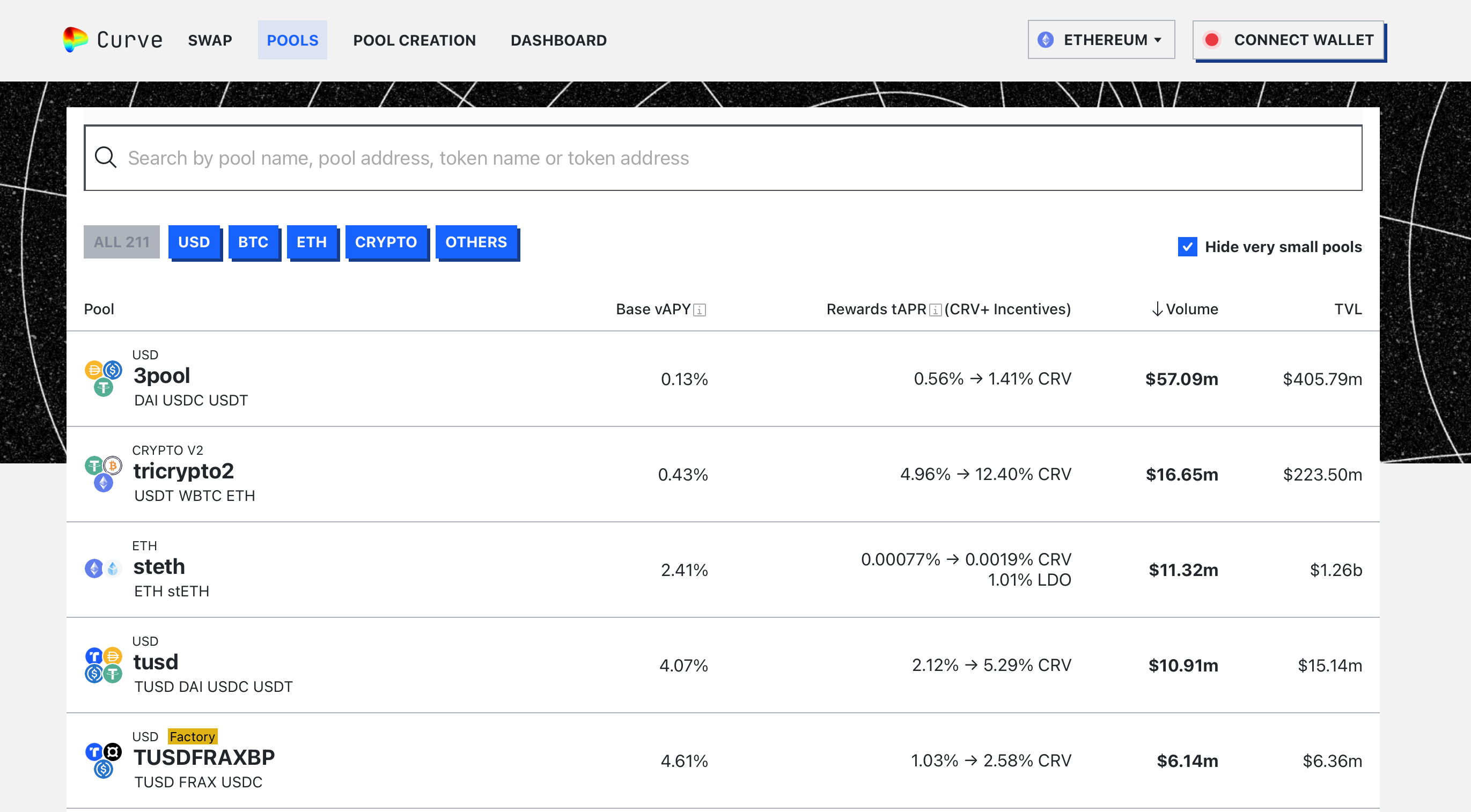

3. Curve Finance

This decentralized liquidity pool is built on the Ethereum blockchain and provides excellent opportunities, especially for stablecoin trading. One of the major advantages of Curve Finance is the assurance of reduced slippage due to using non-volatile stablecoins.

The platform features different pools, each with a unique ERC-20 pool pair. This allows for swapping between different pools of crypto assets and stablecoins, including Compound, sBTC, PAX, BUSD, and more.

Popular liquidity pools on Curve Finance

- DAI/USDC/USDT;

- USDT/WBTC/ETH;

- ETH/stETH;

- TUSD/DAI/USDC/USDT;

- TUSD/FRAX/USDC.

While UniSwap, Balancer, and Curve Finance are popular DEX options, there are numerous other DEXs available in the market, each with its own unique features and benefits. While we have listed some of the top DEXs available, it’s always a good practice to stay informed about the latest developments in the industry and choose the platform that best aligns with your trading goals and preferences. Also, conducting your own thorough research before making any investment decisions is crucial.

FAQ

What is a Liquidity Pool?

A liquidity pool is a decentralized trading mechanism that allows users to contribute their cryptocurrencies to a pool, which is then used to facilitate trading activities on a platform. These liquidity pools provide liquidity to traders, enabling them to trade cryptocurrencies without finding a counterparty to trade with.

What is a Liquidity Provider?

A liquidity provider is an individual or entity that deposits funds into a liquidity pool on a decentralized exchange (DEX) to facilitate trades. They earn a portion of the trading fees generated on the DEX because they provide liquidity. Liquidity providers typically deposit an equal value of two different tokens into a liquidity pool and, in exchange, receive liquidity provider tokens representing their share of the pool.

What are the Risks of Liquidity Mining?

Liquidity mining can come with significant risks that investors must be aware of, including impermanent loss, project risk, and potential rug pull. Impermanent loss can occur if token prices change compared to when they were first invested, project risk involves technical vulnerabilities, and potential rug pulls refer to the risk of developers shutting down a protocol and stealing investors’ money. Due diligence and research can mitigate these risks.

Can You Make Money with Liquidity Mining?

Yes, it is possible to make money with liquidity mining by providing liquidity to DEXs or liquidity pools in exchange for rewards in the form of native tokens. The potential profits from liquidity mining will depend on market conditions, the amount of liquidity provided, and the fees generated by the platform.

What is a Liquidity Mining Example?

Let’s say that you decide to add your 100 units of cryptocurrency to a liquidity pool on a decentralized exchange. The exchange uses your tokens to provide liquidity for trading pairs on the platform. In exchange for providing liquidity, you receive rewards in the form of the exchange’s native tokens. If the exchange’s trading volume is high and generates significant fees, you could earn a substantial number of tokens as a reward. You could then hold onto those tokens or sell them on a cryptocurrency exchange for a profit.

What are The Risks Associated with Liquidity Mining, Staking, and Yield Farming in DeFi?

The risks associated with these activities include impermanent loss, project risk, and potential rug pulls. Impermanent loss occurs when the price of tokens in the liquidity pool changes, causing the value of the liquidity provider’s tokens to fluctuate. Project risk refers to the possibility of the DeFi project failing or being exploited by bad actors, resulting in a loss of funds. Rug pulls occur when the developers of a DeFi project exit scams and steal the funds users invest.

Which Platforms Support Liquidity Mining?

Several decentralized exchanges (DEX) incentivize liquidity providers to participate in their platforms. The most popular among them are UniSwap, Balancer, and Curve Finance. These platforms support Ethereum and Ether-related tokens on the ERC-20 standard.

Is Liquidity Mining Worth It?

Depending on your investment strategy and risk tolerance, liquidity mining may or may not be worth it. While it offers high yields and is easy to get started with, there are some risks, such as hacking and rug-pull fraud. To minimize these risks, it’s essential to do thorough research and start with smaller transactions. If you’re willing to take on the risks, liquidity mining can be a sound investment strategy for crypto assets in the long run.

Final Thoughts

In summary, related to the question “What is liquidity mining?” you understand that it is a creative and exciting way for crypto enthusiasts to earn rewards by lending their crypto assets to a decentralized exchange. It’s a puzzle you need to solve, and the rewards are like hidden gems waiting to be discovered.

By participating in liquidity mining, you’re supporting the growth of the decentralized finance ecosystem while also earning passive income. Anyone can participate, regardless of their expertise, making it an accessible and inclusive opportunity for all.

So, if you’re up for the challenge, let’s start the hunt and unlock the prospect of liquidity mining.

So, if you’re up for the challenge, let’s start the hunt and unlock the prospect of liquidity mining.