PoS cryptocurrencies have become some of the most widely used digital assets thanks to the advantages they have and the rapid growth and evolution of proof of stake (POS) networks. Among them, Polygon is probably the crypto project that has come with some of the most significant changes in the crypto industry besides the two major cryptocurrencies that lead the way.

Thus, this article will explain what Polygon is, how it works, and how to stake MATIC tokens as effectively as possible.

About Polygon

Polygon, formerly called MATIC Networks, is a scaling solution that aims to improve speed and reduce the cost of transactions and complexities associated with blockchain networks.

Basically, Polygon acts as a layer-2 network on the Ethereum network, meaning it does not seek to substitute the existing blockchain layer. With its many sides and shapes, Polygon promises a less complicated framework for creating interconnected networks.

Polygon mainly aims to help Ethereum expand in size and efficiency, thus ensuring utility and, as a result, encouraging developers to bring attractive products to the platform.

What Is MATIC?

MATIC is Polygon’s utility token used as the payment unit between the platform participants. That means the more developers use the Polygon network for scaling solutions, the higher the demand for MATIC.

Polygon uses Proof of Stake, allowing users to earn rewards for locking their tokens to support the operation of the network.

MATIC serves as the governance token of the Polygon network. Hence, it grants its holders voting rights in various changes affecting the network. In other words, if Polygon intends to roll out a new scaling solution, MATIC holders can accept or reject it through voting.

How Does the Polygon Network Work?

The sidechains handle transactions separately before returning them to the main blockchain. And this way, they lower the network load on Ethereum, increasing transaction speed and lowering transaction costs.

Simply put, Polygon provides an easy framework for developers to build on Ethereum without facing the scalability problem. Ethereum users can also interact with several dApps without worrying about network congestion.

However, Polygon is not in competition with Ethereum; instead, it depends on it and vice versa. But while its mission is to leverage its network to build an infrastructure that can handle the Ethereum mass adoption, Polygon depends more on Ethereum than the other way around.

The Polygon network aims to scale Ethereum to over a billion users without affecting security or decentralization. Unlike other L2 scaling solutions, Polygon offers developers a wide range of capabilities on a single network.

Besides, Polygon is the only L2 network that allows its token “MATIC” to be staked on its blockchain.

Is MATIC a Good Investment?

Cryptocurrency experts consider MATIC a good investment for various reasons. First, the Polygon network has the potential to become Ethereum’s primary layer-2 solution, given that it has increased the platform’s performance surprisingly.

Additionally, the Polygon team is solid and aggressive in pursuing partnership opportunities. Having solved Ethereum’s problem after the users had complained for years, Polygon has proved to be reliable, thus giving it an upper hand in securing exceptional partnerships.

With a market cap of around $12 billion, MATIC is among the top 15 cryptocurrencies, with its maximum supply capped at 10 billion MATIC. Out of these 10 billion MATIC tokens, 9 billion are already in circulation.

Considering such data, there are possibilities that the MATIC demand will exceed its supply, thus leading to upward price action.

How to Stake MATIC

Before learning how to stake the MATIC token, it is worth knowing where to stake the MATIC crypto for rewards in 2024. The following are the most popular platforms that support MATIC staking:

- MetaMask;

- Coinbase;

- ByBit;

- Kraken;

- OKX;

- Upbit;

- HTX;

- Crypto.com;

- KuCoin;

- Lido Finance.

Before selecting a staking platform for the MATIC token, it is prudent to understand how each platform works. For example, Crypto.com and KuCoin offer high APY rewards of up to 7.29%, 12.5%, and 2.1%, respectively. But while most Polygon staking platforms offer free staking, KuCoin and Lido Finance charge a staking fee of 8% and 10%, respectively.

How to stake MATIC on the MetaMask wallet

1. Download and set up your MetaMask wallet

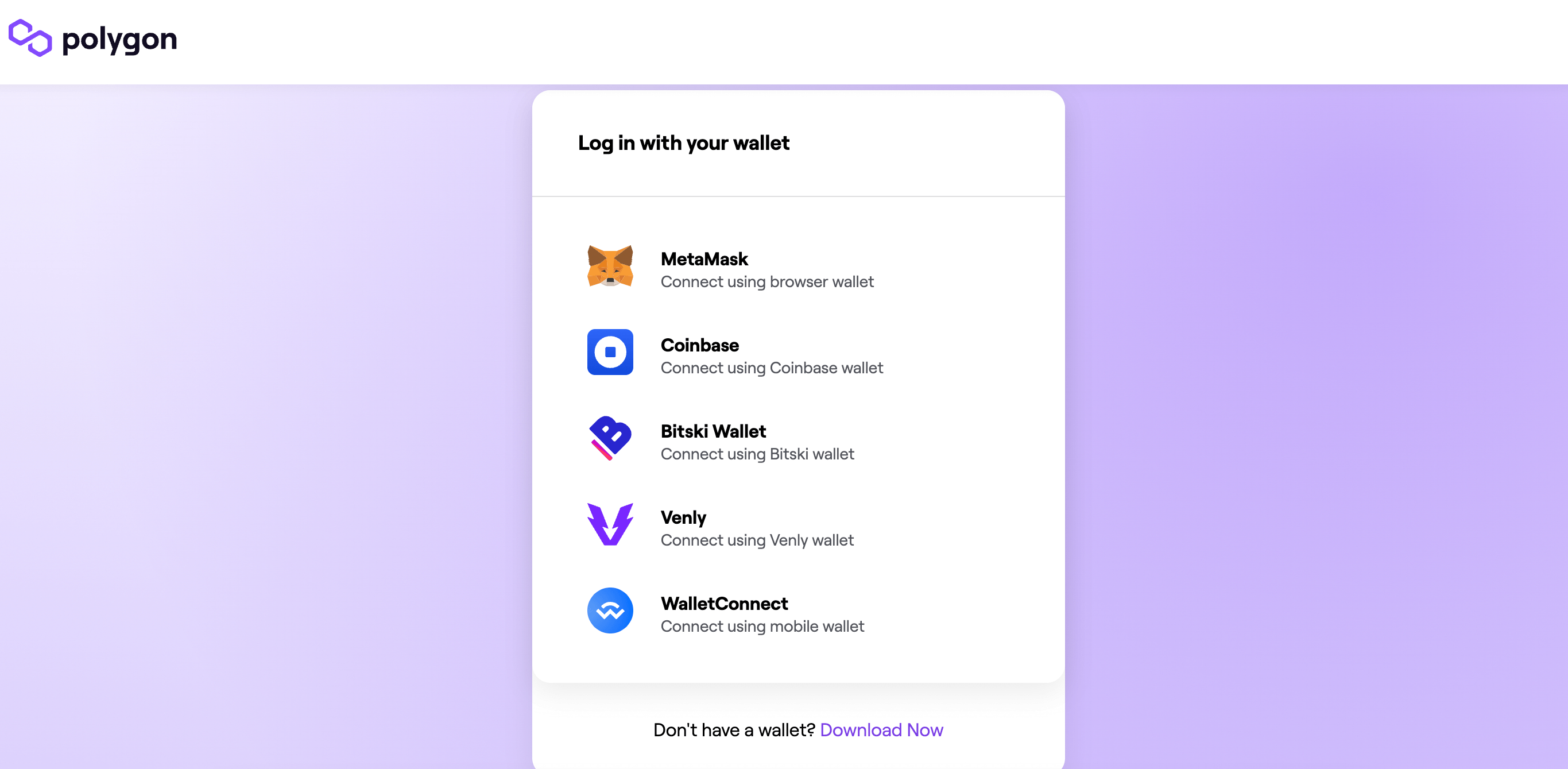

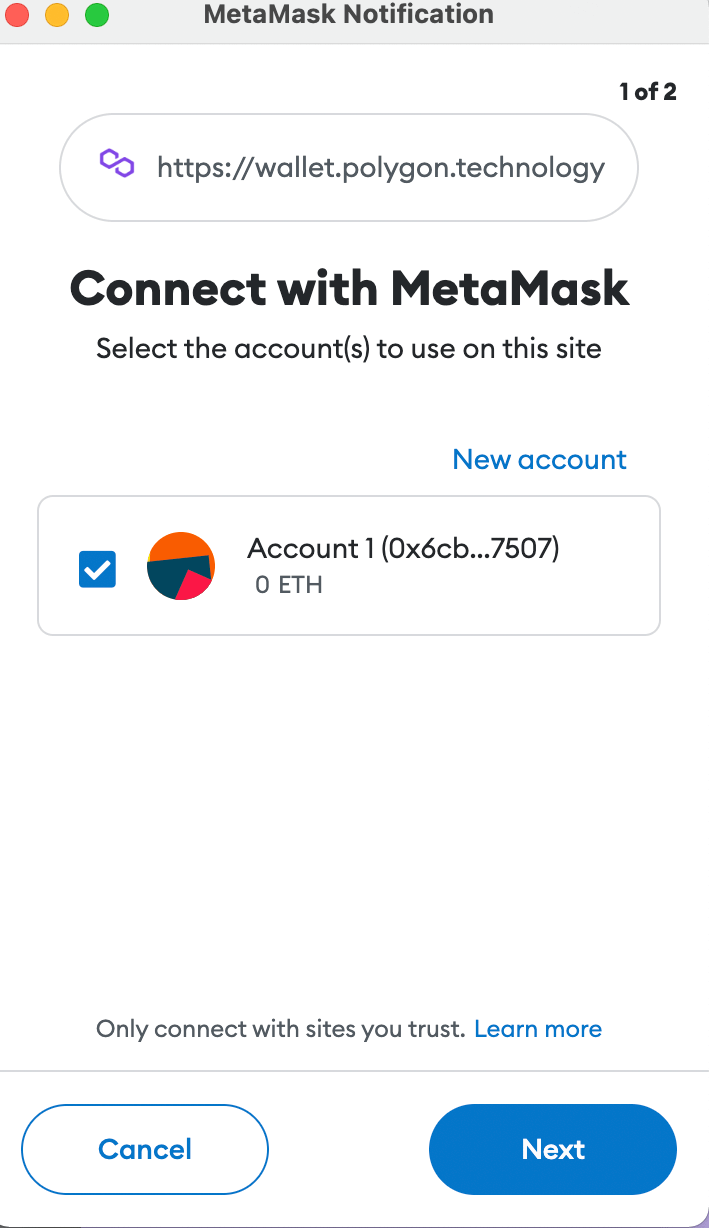

To access the MetaMask wallet, go to your Polygon dashboard and select “Polygon Staking”. Proceed to the login option and choose your preferred wallet, in this case, MetaMask. You will see a message requesting you to connect with MetaMask; click ‘next’, then ‘connect’.

2. Swap ETH for MATIC

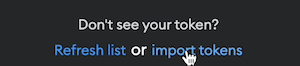

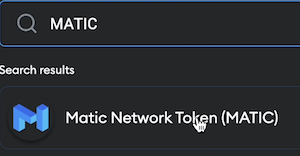

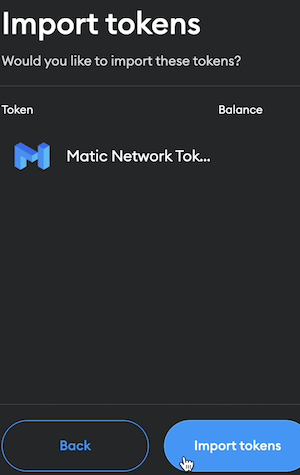

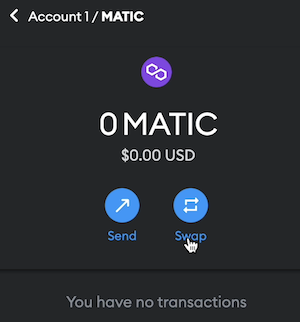

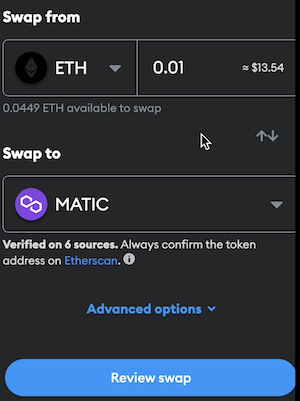

You must have some ETH in your Ethereum Mainnet to proceed with this step. On the Ethereum Mainnet, click “import tokens” and enter “MATIC” in the search field. Select “MATIC Network Token (MATIC)” from the options and click “next”. On the “MATIC network tokens”, click “import tokens”, then click “swap” to swap the ETH to MATIC.

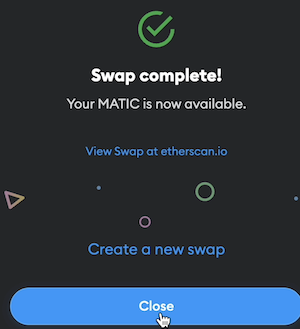

On the “swap from” page, enter the amount of ETH you would like to swap to MATIC, and then click “review”. Note that you will need some ETH to pay for the gas fee. Next, verify the amount you have entered and click “swap”. Once you see the message “Your MATIC is now available”, close and go back to the Polygon dashboard.

3. Choose a Validator

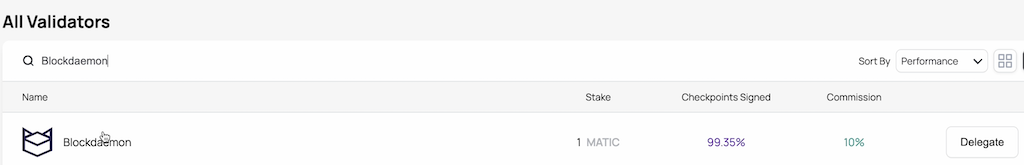

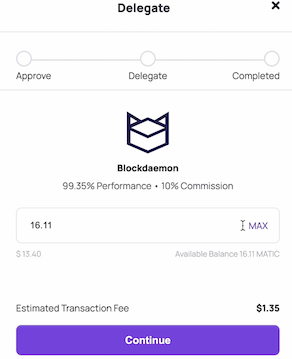

Polygon has hundreds of active validators that validate transactions on the platform. So, once you have chosen a preferred validator, click “delegate”. Enter the amount of MATIC you want to delegate, and click “Continue”.

4. Confirm Transaction

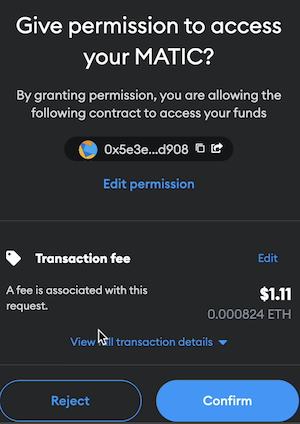

On the MetaMask page, you will see “Give permission to access your MATIC.” You should click “confirm” to allow access.

Note: you will be charged a gas fee for the transaction.

Once you have confirmed the transaction, you will see “transaction in progress.” Then, click “Delegate” to continue the staking process, and you will see “delegation complete.”

5. Check Your Expected Rewards (optional)

If you want to know your expected rewards, log in to polygon staking and connect your wallet. You can see your stake, validator, and unclaimed reward on the staking overview.

It is also worth knowing that Matic staking is non-custodial, meaning your Matic tokens never leave your wallet.

How to Stake MATIC on Coinbase

Staking MATIC on Coinbase is pretty straightforward, especially thanks to the user-friendliness of the platform. Coinbase is suitable for both beginners and experienced traders, but the former might find it more useful.

Fortunately, Coinbase also developed an advanced platform especially designed for established traders.

To stake MATIC on Coinbase, you should have an active account and access your Coinbase wallet.

Then, all you have to do is:

- Buy some MATIC if you don’t have some already. You can also swap some tokens to get MATIC. It all depends on your funds and plans;

- Ensure that you also hold a small amount of ETH, as it will be required to pay for gas fees;

- Click the “Browser” button and look for the Polygon staking dashboard;

- Click “Login” and select “Coinbase Wallet”;

- Select “All validators”;

- Choose a validator and click on “Become a Delegator”;

- Choose the amount of MATIC you want to stake and confirm the transaction.

Once you start staking MATIC, you will have to keep your staked tokens locked up for as long as you decided in the first place. Furthermore, once you get your first rewards, try to keep them as safe as possible.

Thus, try to find a trustworthy Polygon web wallet app to store your rewards along with the tokens you did not lock up. You can also opt for a Ledger device, as it is one of the safest ways to store crypto.

How to Stake MATIC on Crypto.com

Crypto.com is one of the top cryptocurrency exchanges in the market, and this is not the only thing that helped it make it to our top platforms where to stake tokens such as MATIC. Binance has pretty low fees, and the APY for MATIC staking can reach surprising percentages of 14.5%.

The MATIC staked on Crypto.com can be safely stored on the platform, as it always ensures that its security is bright and there are no security breaches.

To stake MATIC on Crypto.com, you should:

- Download the Crypto.com app and log in or sign up;

- Open the app and tap on “Staking” from the upper left side of the screen;

- Scroll until you find Polygon and click on “Stake”;

- Enter the staking amount;

- Agree to the staking terms and conditions and privacy notice;

- Confirm the staking process;

- Enter the passcode.

Once you finish the staking process, the staked MATIC tokens will be locked up and you will start earning rewards based on the amount you stake.

Staking MATIC on KuCoin

KuCoin is well known for prioritizing security and having competitive fees, and these can represent significant advantages for many crypto enthusiasts.

Staking Polygon on KuCoin is pretty straightforward thanks to the platform’s user-friendliness. The ROI for MATIC staking stands around 4%, depending on the amount staked and the lockup periods. Furthermore, KuCoin also organizes various promotions that can increase the staking rewards.

Staking MATIC on KuCoin has a flexible term, while the redemption period is set at 21 days.

To stake MATIC on KuCoin, you should:

- Navigate to KuCoin Earn;

- Select the staking option;

- Select MATIC and enter the details required;

- Review the process and subscribe to the staking service.

FAQ

Does MATIC allow staking?

Yes, MATIC allows staking, as Polygon uses a PoS (Proof-of-Stake) consensus mechanism.

Where is the best place to stake MATIC?

There are multiple crypto-related platforms that support and allow for Polygon staking. At the moment, some of the most popular include Coinbase, Kraken, KuCoin, OKX, MetaMask, and Lido Finance.

However, many crypto exchanges start diversifying their features by introducing new cryptocurrencies for staking, so you should always research all the options available.

How much do you make staking MATIC?

The staking rewards strongly depend on the amount of MATIC tokens locked up for staking and the APY the platform you chose works with. For instance, while some platforms may have APYs of 4-5%, others can reach even close to 15%.

Can I stake MATIC on MetaMask?

Yes, you can stake MATIC on MetaMask, as MetaMask offers this feature for multiple cryptocurrencies, including Polygon. All you have to do is hold some MATIC and some ETH (for gas fees).

In Conclusion

Polygon has become increasingly popular thanks to its features and the major upgrades it comes with for Ethereum. Built as a scaling solution for the 2nd largest blockchain in the world, Polygon managed to make a name for itself and is now among the top 15 cryptocurrencies in the market.

Having understood how the Polygon network works and its potential in promoting the Ethereum blockchain, it is no doubt that it makes a good investment. While it is as volatile as many other cryptocurrencies, staking MATIC tokens is one of the safest ways to earn some extra rewards.

If you decide to stake MATIC, don’t forget to secure your accounts as well as possible and keep the tokens you earn in your Polygon wallet app. You can also try to add them to your Ledger Ethereum account, if you have one, as Ledger is one of the safest ways to store crypto in general.