If you’re a seasoned crypto investor and trader looking for new ways to boost your gains, you’ve landed on the right page!

Today’s article discusses the crypto derivatives market by profoundly diving into the subject and analyzing the influential factors that could make or break your future trading strategies.

As we know, crypto derivatives are complex financial instruments that have become highly popular within the crypto landscape. You could think of derivatives trading as an integral part of the crypto economy since it is part of a mature financial system.

Moreover, remember that derivative trading strategies help investors gain exposure to the asset’s price movement without owning it. Understanding the complexity and unique features of crypto derivatives allows you to navigate the crypto market to maximize your potential success.

As such, are you eager to unlock the potential of what is crypto derivatives and discover new, exciting, golden opportunities for your trading endeavors?

Key Takeaways:

- A crypto derivative is a tradable financial instrument that analyzes the price movements of cryptocurrencies or other digital assets without owning them.

- Crypto derivatives can be traded in 2 ways: via exchanges or customer-to-customer (C2C). The latter method is different when it comes to regulation and trading.

- An increased trading volume indicates a stable yet growing liquidity, meaning there are earning opportunities for market participants.

Please note that this article does not constitute any financial or investment advice, and it is essential to do your due diligence to research crypto derivatives and decide whether to jump on the train.

What Are Derivatives and How Do They Work?

Crypto derivates are a tradeable financial instrument that analyzes the value of an underlying crypto asset, such as cryptocurrencies, commodities, stocks, bonds, market indexes, and interest rates.

It is essential to understand that crypto derivatives depend on the underlying asset’s value, as they don’t have a standalone value. Instead, the derivative contract is based on the expected future price movements of the underlying asset.

Furthermore, crypto derivatives are financial contracts between two or more parties that want to buy or sell an underlying asset for a set price in the future. Thus, the value of the contract will be given by the changes in the underlying asset’s strike price.

With the help of derivates, seasoned traders can acquire different financial opportunities and capitalize their gains on certain market events, such as the price movements of cryptocurrencies, without actually owning the underlying assets.

How Do Crypto Derivates Work?

Crypto derivatives work just like traditional financial markets, whereby market participants use a contract to buy or sell the underlying asset, and they have a predetermined price and time.

There are three simple steps:

- Two or more parties agree on a contract based on the future price movements of the underlying asset to gain exposure to the asset’s price movements.

- This agreement outlines the contract size, expiration date, and settlement terms.

- The derivative’s value fluctuates based on changes in the underlying asset’s price, such as market volatility, market sentiment, and others.

Please note that traders do not hold nor own the underlying asset within the crypto derivatives market.

Types of Crypto Derivatives

There are many types of crypto derivatives, yet three of them, futures contracts, crypto options, and perpetual futures contracts, are some of the most used.

Read further to discover the crypto derivatives types and contracts and how to swing them to your advantage.

1. Crypto Futures Contract

A futures contract is a financial contract between two or more parties using an underlying cryptocurrency asset. For example, Bitcoin is sold or bought at a decided date in the future with a predetermined price.

You could use the futures contract for hedging positions and speculating the underlying asset’s price movement. However, it is essential to understand that crypto futures contracts have a predetermined set price and expiration date and can be settled through physical delivery or cash settlement.

For example, when you trade Bitcoin futures contracts, you must first decide the contract duration, as some of the most popular exchanges offer a predetermined timeframe. These Bitcoin futures are agreements between a buyer and a seller to buy and sell Bitcoin at a given price at a specific date in the future.

Let’s take the current price of Bitcoin, which is $42,934.68 – a trader may either buy or sell the Bitcoin futures contract in anticipation of either a price decline or an increase. Depending on your stance on the price of Bitcoin, the exchange platform will match the trader with someone who went the opposite direction in terms of betting.

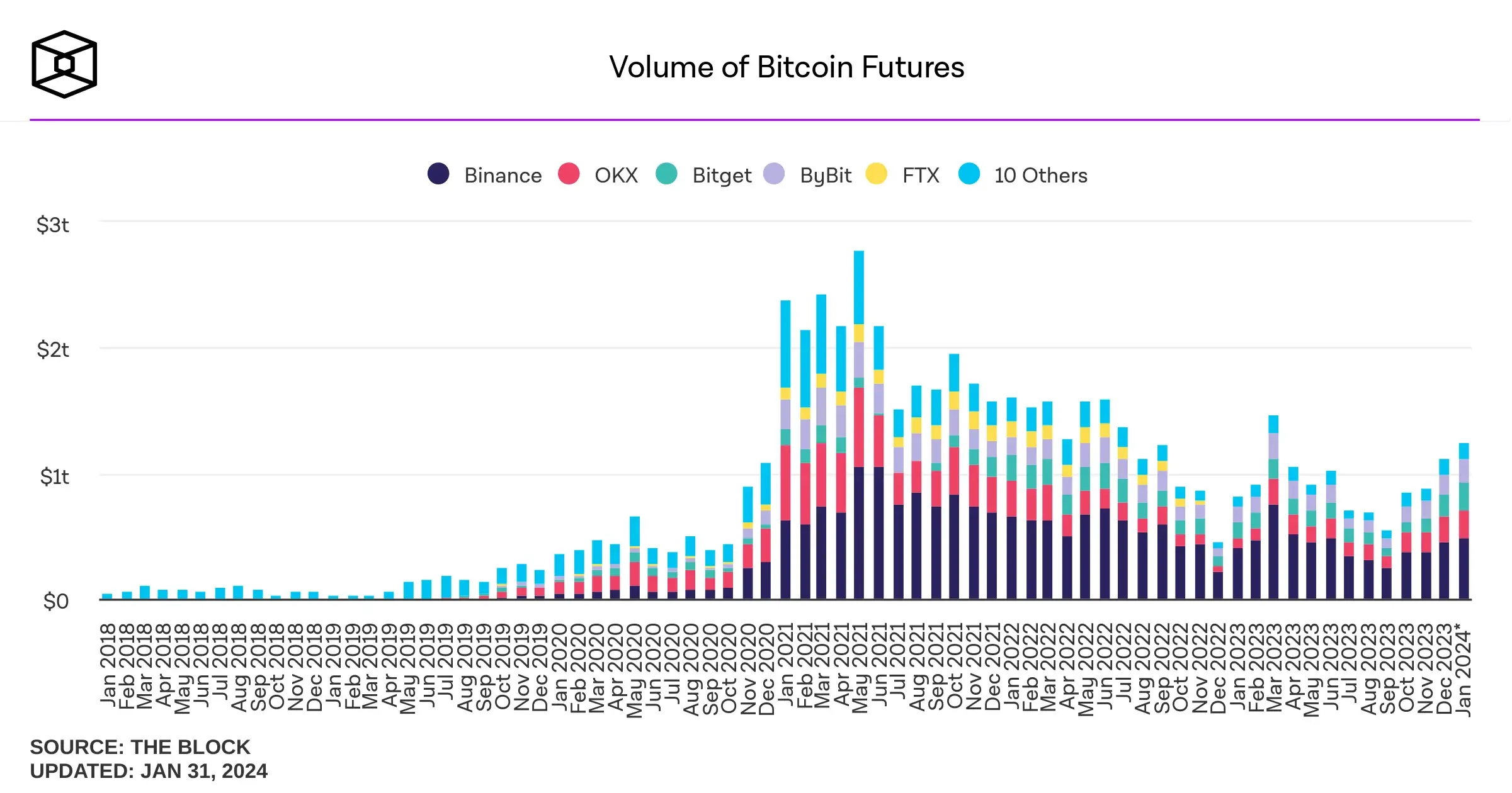

Also, by looking at historical data and analyzing the volumes of BTC futures contracts, you can know where the market is heading and how to position yourself better.

A traditional exchange that currently offers Bitcoin futures is the CME Group, as CBOE has yet to add new contracts since March 2019. However, in June 2023, CBOE received the CFTC’s (Commodity Futures Trading Commission) approval to launch margined futures contracts for Bitcoin and Ethereum.

2. Options Contracts

Options contracts offer traders a right, not an obligation, to buy or sell an underlying asset at a predetermined price before the contract’s expiration date.

The options contract is an asymmetrical derivative that binds one party while the other is decided later, i.e., when the option expires. This means that one party is obligated to either buy or sell at a later date, whereas the other party can make his choice. The one who makes the choice has to pay a premium for the privilege.

In options trading, traders can choose between a call and put options.

The call option gives you the right but not the obligation to purchase the crypto at a later date at a given price, while the put option gives you the right but not the obligation to sell something at a later date at a given price.

Therefore, this derivative contract has four options, and the contract’s owner can be on the long side or the short side of either the put or call option, as seen in the image below.

Understanding these intricacies along with a robust risk management strategy, you can trade effectively and surf on the market to ensure a tremendous successful potential.

3. Perpetual Futures

Perpetual futures or contracts are futures contracts that work without an expiry date, allowing constant trading and price speculation. However, there is a difference compared to traditional futures contracts, which cater to ongoing trading, thus adaptability.

Moreover, perpetual contracts are settled through a funding mechanism that keeps a constant price with the underlying asset’s market value, such as the spot price of the said asset.

As a result, traders can indefinitely maintain their strategic position, making perpetual contracts suitable for both experienced investors and short-term traders. Depending on your trading strategy, you can go long or short, whereby the index price compensates for the price difference.

For example, if the perpetual futures contract price exceeds the index price, long traders will compensate for the price difference, and vice versa, where short traders pay the funding rate.

4. Swaps

Swaps are crypto derivatives that enable the involved parties to exchange their cash flows from two different financial assets.

These contracts are not traded on an exchange, as they are usually negotiated between two parties in private and mediated by an investment banker. Unlike traditional futures contracts, perpetual swaps don’t have expiration dates.

For instance, at some point, one party may switch an uncertain cash flow, such as a floating interest rate or, for a certain one, a fixed interest rate. The interest rates or the underlying currency can be swapped as well.

The contracts can be made with several crypto assets, including:

- Bitcoin (BTC);

- Ethereum (ETH);

- Litecoin (LTC);

- Ripple (XRP);

- Bitcoin Cash (BCH);

- Solana (SOL);

- 1INCH;

- Avalanche (AAVE);

- many more;

The first regulated institutional exchange to introduce Bitcoin swaps was LedgerX, which added the derivate contracts in October 2017. LedgerX’s trading platform can only be accessed by accredited investors and institutional clients.

5. Contracts for Difference

A crypto contract for difference, or CFD, is an agreement between two or more parties based on the speculating price of certain crypto coins and tokens and whether it will go up or down.

If the contract is liquidated and your future price speculation is incorrect, you will have to sustain higher losses, as this is a leveraged product. However, if you are right, you can make significant profits.

Usually, crypto CFDs are traded in pairs, but not limited to only these:

- ETH / BTC;

- LTC / USDT;

- XLM / BTC;

- XRM / BTC;

Similarly, you can find trading pairs made of one crypto and a fiat currency, such as:

- BTC / USD;

- ETH / USD;

- LTC / USD;

- BTC / EUR;

- ETH / EUR;

- LTC / EUR;

When you trade CFDs, you bid on how the 1st part of the trading pair, e.g., BTC, will move against the 2nd, e.g., USD. Additionally, based on your crypto knowledge, you can speculate on an increase or decrease in price.

Regarding trading tools and platforms that offer crypto CFDs, there are two big players: Plus500 and IG Option.

The Crypto Derivatives Substitute: Exchange-Traded Funds

ETFs aren’t crypto derivatives; however, a multifaceted relationship depends on the specific type of ETF.

Let’s quickly look at a concise breakdown:

- Derivatives-based ETFs rely on crypto derivatives like futures contracts for their price movement. The ETF issuer enters into these contracts to replicate the underlying crypto’s performance.

- Spot ETFs don’t directly use derivatives but can indirectly influence their performance. The price of the underlying crypto itself is affected by the trading activity in its derivatives markets.

An ETF is a contract that tracks the price evolution of a particular crypto or group of cryptos. Traders can diversify their portfolios with ETFs without having to buy and own the assets they track.

The main benefit of crypto ETFs was mentioned: you can enter the crypto world and diversify your investment portfolio without buying any crypto. As a result, you don’t need to pay for other products or services implied in the crypto-buying process.

When you buy crypto ETFs, you are not required to sign up or buy a digital wallet for them, and this can reduce the fees or subscriptions you have to pay to hold some funds.

Besides, crypto ETFs can follow the evolution of multiple cryptocurrencies, which may be more profitable.

Best Exchanges For Crypto ETFs

- Bitwise Crypto Industry Innovators ETF (BITQ);

- Amplify Transformational Data Sharing ETF (BLOK);

- Global X Blockchain ETF (BKCH);

- Siren Nasdaq NexGen Economy ETF (BLCN);

- VanEck Digital Transformation ETF (DAPP);

Best ETFs

- Huobi;

- OKX;

- Coinbase;

- Robinhood;

On June 15, 2023, BlackRock, one of the largest investment companies, filed for a Bitcoin ETF. Although over 20 companies have done this before, the SEC rejected all applications. However, BlackRock’s only application made quite a buzz in the crypto market and was approved by the SEC as of January 2024, along with ten other Bitcoin ETFs.

The Benefits of Trading Crypto Derivatives

Let’s take a deeper dive and analyze some of the most beneficial aspects that crypto derivatives bring to the crypto market.

1. Derivatives Trading Facilitates Market Liquidity

It is known that market liquidity attracts investors and traders, and as such, crypto derivatives are an integral part. Trading crypto derivatives facilitates the ease with which traders create investment opportunities, providing ways to hedge their positions.

2. Portfolio Assets Diversification

Derivatives can offer a way for traders to diversify their portfolios, maximizing returns and effectively managing the risks. Trading crypto derivatives on different assets can offer a more balanced portfolio by reducing individual market risks.

3. The Accessibility of the Crypto Markets

Trading derivatives allows market participants with limited capital to invest and hold crypto assets without owning those assets. As such, the market efficiency and accessibility are improved, primarily when some derivatives are traded on regulated exchanges with transparent rules and investor protections.

The Disadvantages of Trading Derivatives

Of course, there are no rewards without potential pitfalls. As such, let’s look at some of the most common downfalls of trading crypto derivatives.

1. Increase Risk Management

All trading strategies are based on the market price movement, which requires a certain degree of risk management. As seen in spot trading, market volatility is a significant factor in the outcome of crypto derivatives trading, and the values of derivative contracts are inherently tied to underlying assets.

2. The Complexity of Derivatives Trading Strategies

As we all know, the crypto markets are notoriously volatile, and derivatives magnify this volatility. As a result, trading derivatives require more complex strategies and contracts, thus making them unsuitable for beginners.

3. Limited Derivatives Trading Regulations

The regulatory aspect is another issue with crypto derivatives, especially since regulators from various countries have different legislation regarding derivatives trading. As a result, it is essential to check that specific country’s laws and regulations, meaning that the contract must also be within the same geographical area.

Top 2024 Trading Strategies for Crypto Derivatives

If you’re on the hunt for some of the most well-known strategies to trade crypto derivatives, explore proven strategies in this guide, but remember: critical evaluation and thorough research are essential before putting anything into practice.

Additionally, it is said that if the crypto market is bullish, you could go for an option contract, analyzing the price movements. On the contrary, futures contracts could be the way to go in a bearish crypto market.

Speculation

This trading strategy seeks to predict price movements regarding market volatility, whereby traders could profit from even a small change. Simply asking yourself why crypto is so volatile isn’t enough, and some of the techniques that could be a lifesaver when predicting price fluctuations include:

- Volatility Analysis;

- Price Action Trading;

- Machine Learning Algorithms (MLAs);

- Linear Regression;

- Moving Average Method;

- Volatility Analysis;

Hedging

At its core, hedging is a risk management strategy that takes the opposite stances to balance potential pitfalls. As such, you enter a particular position but perform in the opposite direction, hedging potential losses.

Some of the most common hedging strategies for crypto derivatives include the following:

- Hedging with options and futures contracts;

- Taking a different stance, then action in the opposite trajectory;

- By using derivative contracts to track the value of the assets to balance potential losses;

Leverage

Leveraging trading derivatives is another essential workflow that allows you to control more with less, amplifying profits and losses. In our case, derivatives will enable you to enter a more significant position than your capital allows for the spot market.

Conclusion

Crypto derivatives can be a very profitable way of gaining exposure to the digital asset market and amplifying your profits. Still, rookie traders should grasp trading and investment well before getting into these financial contracts.

However, suppose you pay attention to some essential tips and always consider the risks implied by crypto derivatives, such as regulatory concerns or volatility. In that case, your trading experience should be pretty positive.

If you’re interested in trading crypto derivatives, researching and developing trading strategies aligned with your risk tolerance is essential.

FAQ

What are the 5 examples of derivatives?

There are many types of crypto derivatives. However, five are the most common: Futures Contracts, Options Contracts, Perpetual Futures, Swaps, and Contracts for Difference.

Yet, the most used ones are Futures Contracts, Crypto Options, and Perpetual Futures Contracts.

Why trade crypto derivatives?

The first benefit is that all traders can speculate on and profit from the underlying assets’ future price movements. As such, it can help you leverage, hedge, diversify, and speculate on price movements.

However, as with any trading strategy, mitigating the risks could be the best strategy for anything. It is known that some of the drawbacks come with high risks, volatility, and crypto regulations.

Who Uses Crypto Derivatives?

Crypto derivatives can appeal to many participants, each with its own motivations. Still, some key players are institutional investors, which dominate trading volume, while retail traders have broader participation rates.

Are crypto derivatives safe?

It is essential to understand that crypto derivatives are not good or bad, as their use cases depend on your circumstances and risk tolerance. Indeed, they are high-risk products, and the regulatory landscape is still in incipient stages, but taking it with a keen eye for safety could be the way to go.

Why are crypto derivatives important?

As profitable as they seem, the risk could be equally penetrating. At its core, crypto derivative offers a way to profit from the market price movements of a said asset, yet when it isn’t done right, the consequences could be devastating.