Table of contents

Whether you’re navigating the stock market, forex, or crypto, the concept of leverage trading often takes center stage. And for good reasons. It’s a powerful tool in the arsenal of traders and investors, offering the potential for enhanced returns. However, as Warren Buffett points out, the combination of ignorance and leverage can lead to intriguing outcomes.

In the right hands, leveraging can significantly amplify returns. Yet, in amateurish hands, it poses not only a risk to cash flow but also to psychological well-being. As Buffett implies, it’s a double-edged sword that demands respect and understanding.

That’s why this guide serves as a comprehensive resource to understand leverage trading, its fundamentals, the role of leverage, and the critical importance of comprehending the associated risks and rewards.

What is Leverage Trading?

Leverage trading, also known as margin trading or trading on margin, is a trading strategy with high potential rewards but comes with equally high risks. It allows you to have a much larger market exposure than the initial deposit you put in to start the trade.

Basically, “leverage” involves borrowing funds to make an investment, where the borrowed money represents a form of debt.

While most of us try to steer clear of debt in our daily lives, investors use leverage to potentially enhance their returns on investment (ROI). The catch is that with increased potential returns comes heightened risk. If the investment doesn’t go as planned, losses could surpass their initial investment, leading to increased debt.

It can be traced back to 1933, originating in the United States, but the inventor of this remains unclear.

Initially, unregulated environments permitted excessively high leverage ratios, leading to frequent margin calls and significant losses. So, to protect investors, regulatory bodies implemented measures such as margin requirements and maximum leverage limits.

Consequently, leverage trading has transformed from an unregulated practice into a more controlled and regulated one today.

Leverage is applicable across various financial markets like forex, indices, stocks, crypto, commodities, treasuries, and exchange-traded funds (ETFs).

How Does Leverage Trading Work?

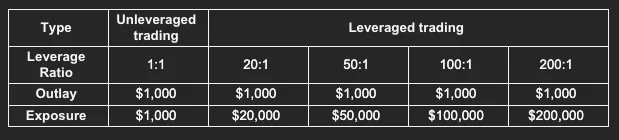

If you’re curious about how leverage trading works, well, you must know that it enables you to use a smaller amount of initial funds or capital to gain exposure to larger trade positions in an underlying asset or financial instrument.

When you create a trade on a brokerage platform using leverage, each trade increases your exposure to an underlying asset or financial instrument of interest. In simpler terms, leverage essentially magnifies the amount of money you use for trading.

For instance, in leverage trading of stocks or shares, you can purchase a greater quantity of shares. So, with leverage of 50:1, your investment is magnified by 50 times; with 100:1, it’s magnified by 100 times, and so forth.

However, it’s important to note that trading with leverage has a major downside – if the trade moves against you, your losses will also be amplified. In other words, greater exposure leads to more significant gains but also more substantial losses, potentially exceeding your initial investment.

Leverage Trading in Stock Trading and Leveraged Products

Most of the time, investors use leverage trading in highly volatile markets such as forex or crypto, but it is often used in stock trading.

In the stock market, leverage is typically achieved through margin trading or using derivatives.

Derivatives are financial instruments that derive value from the underlying asset, such as a stock, commodity, or index. Derivatives can be used to magnify your profits or losses. For example, if you buy a call option on a stock, your profit will be magnified by the leverage you use. However, your losses will also be magnified.

Speaking about leveraged products, you must know that there are two main types of leveraged products when we talk about stock trading:

- ETFs (Exchange-Traded Funds) – ETFs are baskets of securities that track a particular index or other benchmark. Some ETFs are leveraged, meaning they use borrowed funds to magnify their returns.

- CFDs (Contracts for Difference) – CFDs are a type of derivative contract that allows traders to speculate on the price movements of an underlying asset without owning the asset itself. CFDs are typically settled in cash, meaning the trader does not have to deliver or take delivery of the underlying asset physically.

Understanding Leverage Ratios

In trading, the leverage ratio measures the relationship between a trader’s personal capital and the borrowed funds utilized for their trading positions.

How Do You Calculate Leverage Ratios?

The leverage ratio is determined by the formula:

Leverage Ratio = Total Exposure / Margin Required

Where:

- Total Exposure is the combined value of the trader’s open positions.

- Margin Required is the capital amount the trader needs to deposit with their broker to open a position.

The leverage ratio can vary based on the traded market, brokerage platform, and position size. For instance, if a trader holds a $10,000 account and opens a position with a 5:1 leverage ratio, they can trade with a total exposure of $50,000 ($10,000 x 5), using only $10,000 of their own capital. The remaining $40,000 is borrowed from their broker.

The leverage offered often depends on the market’s volatility and liquidity. Less liquid or more volatile markets may have lower leverage to safeguard positions from sudden price swings. Conversely, highly liquid markets, like forex, can feature exceptionally high leverage ratios.

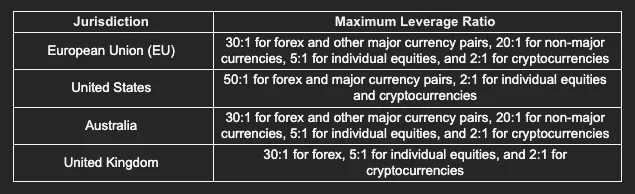

To prevent excessive risk, global regulators establish maximum leverage limits for retail traders.

SIDENOTE. It’s important to note that certain crypto exchanges provide leverage ratios for cryptocurrencies that exceed the limits set by regulators in their jurisdiction. Many crypto exchanges have faced fines and regulatory actions for this. Therefore, it’s vital to conduct thorough research before engaging in leverage trading on a crypto exchange.

How Does Leverage Trading Work in Crypto?

Leverage trading in the crypto market operates much like it does in other financial markets, such as forex, indices, stocks, and commodities.

In crypto, leverage trading is typically conducted through futures contracts, which are agreements to buy or sell an asset at a predetermined price on a future date.

Futures Margin in Crypto Trading

To trade with leverage, traders deposit a certain amount of capital, known as the initial margin.

The initial margin is the minimum capital a trader must deposit to open a leveraged position. It serves as collateral to protect the exchange from potential losses. The amount of initial margin required depends on the specific exchange and the desired leverage ratio.

If the crypto trader’s prediction is wrong and the asset’s price moves against them, they must deposit additional funds to maintain their position. This is known as the margin call, maintenance margin, margin requirement, or margin maintenance requirement. If the trader fails to meet the margin call, their position will be liquidated, and they will lose their initial margin and any additional funds they have deposited.

Leverage Trading, the Good and the Bad

Leverage trading offers several advantages that can significantly benefit investors, but at the same time, it comes with risks that can be disastrous for individuals who use it. Like Yin and Yang, if you’re smart and have a bit of luck, you can have unimaginable gains, or you can lose not only everything you have but be left with debts that can affect your whole life. Let’s see the most common of them:

Advantages of Leverage Trading

Allows You to Open Larger Positions

Leverage trading lets you make large trades with a small upfront investment because you are accessing additional funds from your broker.

Increased High Returns Potential

This advantage comes as a result of the previous one. With leverage, you can amplify your returns. If you use 5x leverage, you essentially buy five times more stocks, crypto, or other assets. When the market moves in your favor, your potential returns increase fivefold, boosting your overall investment gains.

Smart Capital Usage

Leverage helps you use your money more efficiently. You can keep a small balance in your account, freeing up funds. These funds can be redirected to other low-risk investments, spreading out your investment portfolio. Alternatively, you can simultaneously take multiple positions in different assets, enhancing your profit opportunities while managing risk.

Profitable in Low Volatility

Leverage allows you to make profits even when the market isn’t experiencing significant price swings. By taking larger positions, you can still achieve meaningful returns during periods of low market volatility.

Risks of Trading with Leverage

Risk of Increased Losses

Even slight movements in the market against your position can lead to amplified losses. Sometimes, these losses can be severe enough to wipe out your entire account balance.

Margin Calls and Liquidation

Leverage trading requires you to maintain a specific amount of equity (initial margin) in your account to cover potential losses. A margin call occurs if the market goes in the opposite direction and your account falls below the required margin. To meet the margin requirements, you must deposit more funds or close some or all of your positions. Failure to do so may lead to liquidation by the broker, resulting in noteworthy losses.

Interest Charges on Borrowed Funds

When you borrow funds for leverage trading, you incur interest charges. These charges accumulate over time, depending on how long your position remains open. These interest costs can eat into your profits or deepen your losses.

Overleveraging Risks

Despite the attractiveness of leverage, many traders take substantial risks by opening large positions. Often driven by the fear of missing out, this behavior can lead to trading beyond one’s comfort level. Traders may believe each subsequent trade will be favorable, exposing them to significant risks.

Fast-Paced Trading Environment

Leverage trading operates in a rapidly demanding trading environment, promoting short-term strategies. The stress and pressure associated with fast-paced trading often result in impulsive decision-making and emotional trading. Such behaviors increase the likelihood of costly mistakes.

Key Risk Management Strategies for Leveraged Trading: Crypto and Forex Trading

Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders may be the most important tools for managing risk in trading. These tools help traders minimize losses and lock in gains when engaging in leveraged trading.

A stop-loss order is a safety net that automatically cancels a trade at a set price, preventing further losses. Conversely, a take-profit order lets traders secure profits by closing a trade when the target price is hit.

These orders are crucial for smart risk management, especially in leveraged trading, where losses can quickly add up. They become particularly handy in unpredictable markets where sudden price swings can result in substantial losses if not handled carefully.

Negative Balance Protection

When trading forex, stocks, or cryptocurrencies on a CFD broker, negative balance protection comes as a crucial safety feature. This protection system shields traders from falling into debt on their trading accounts, a risk that comes with leveraging.

Negative balance protection serves as a last-resort risk-management tool, especially when things go wrong. Imagine accidentally opening a large position, losing an internet connection before setting a stop, and potentially losing all your funds. With negative balance protection, you won’t end up in debt with your broker, offering a safety net during critical situations.

So, choosing a broker with this safeguard is vital before depositing any funds.

FAQ

Is Leverage Trading Risky?

Yes, leverage trading involves high risk. There’s a chance of losing not only your initial investment but also any extra funds you add to keep your position. If the market goes against you, you might be required to deposit more money on short notice to maintain your position. Failure to meet this request within the given time could lead to the liquidation of your position at a loss, and you would be responsible for covering any resulting deficit in your account.

How Much Leverage Should I Use?

You should select a leverage level that aligns with your comfort level. If you prefer a cautious approach, oppose high risks, or are still learning the ropes of trading, lower leverage, such as 5:1 or 10:1, might be suitable.

On the other hand, seasoned or risk-tolerant traders may find comfort in higher leverage ratios, such as 50:1 or 100:1 and above. But again, choosing a leverage level that suits your risk appetite and trading experience is crucial.

Key Takeaways: Leverage Trading

- Leverage trading is a high-risk strategy that can amplify both profits and losses. It allows you to open larger positions with a smaller amount of capital.

- Leverage is applicable across various financial markets, including forex, indices, stocks, crypto, commodities, treasuries, and ETFs.

- The leverage ratio measures the relationship between a trader’s personal capital and how traders borrow funds for their trading positions. Calculated as total exposure divided by the margin required, this ratio significantly influences the trader’s ability to control larger positions.

- In the crypto market, leverage trading is typically conducted through futures contracts. Traders deposit an initial margin, which serves as collateral to protect the exchange from potential losses. If the market moves against the trader, additional funds may be required to maintain the position, leading to margin calls and potential liquidation.

- There are several risks associated with leverage trading, including margin calls, liquidation, interest charges, overleveraging, and a fast-paced trading environment.