Those familiar with the alternative investment space could already find some companies like FundRise, Masterworks, and Otis, among others. These firms allow users to invest in various asset groups, including commercial real estate, wine, and art.

However, many investors often face challenges in picking the best offerings when dealing with these companies. Fortunately, a new solution is now available to bridge this gap. Known as Hedonova, this investment platform allows investors to access the entire alternative investment space using a single fund.

It operates similar to a mutual fund but targets alternative assets. Keep reading this Hedonova review to learn more.

What Is Hedonova?

Hedonova is a hedge fund that launched in 2020. Alexander Cavendish and Suman Bannerjee, the founders of the company, were alumni of The University of Cambridge and Zurich ETH, M&A at UBS and Morgan Stanley, and portfolio management at some of the largest hedge funds came together and invested their own funds company to test proof of concept before opening up to outside investors.

Hedonova aims to assist its sophisticated investors to gain exposure to their alternative assets. This makes it unique and different from other platforms that offer similar services that invest in just stocks or bonds.

Hedonova assists users to access alternative assets such as wine, art, private equity, carbon credits, and litigation funding, among others. With just as little as $1000, users can access a wide variety of alternative assets through the Hedonova platform.

Why Are Alternative Assets Recommended?

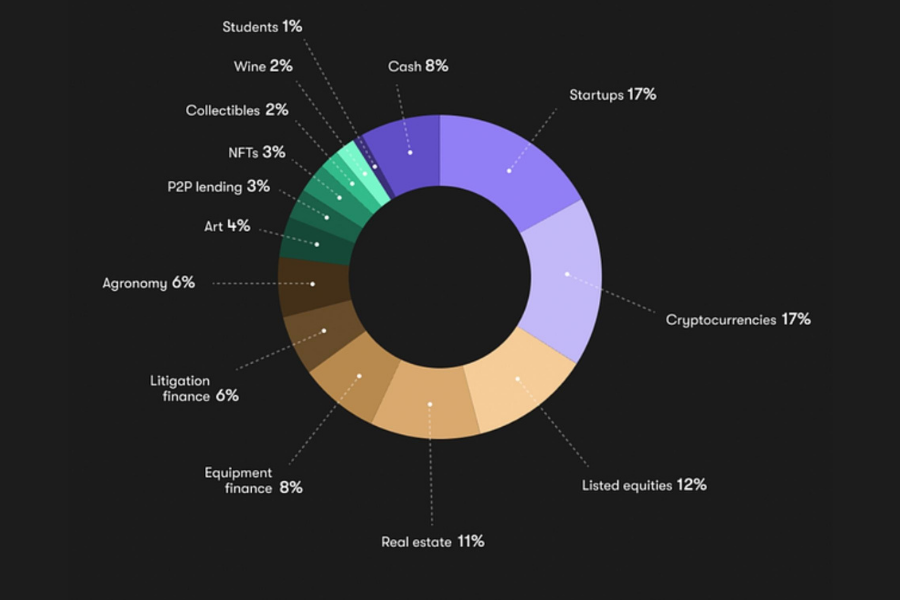

Hedonova invests in a wide range of alternative assets: collectibles, art, litigation finance, music royalties, cryptocurrencies, equipment finance, startups, wine, and student income-share agreements. Importantly, investors can access these alternative investments at a lower price than what would be needed to invest individually. Building a portfolio individually would take upwards of $100,000, while Hedonova has a low minimum of just $1000 to start.

For instance, Hedonova invests in industrial and data center properties in emerging markets like China, India, and the South East economies. Individually, it is almost impossible to own such investments, but through Hedonova, one can quickly grasp the opportunity to be a part of such significant investments.

Why Hedonova?

Investing with Hedonova comes with several advantages. The immediate benefit is the low minimum investment of $1000, which is attractive to many investors. In addition, regarding their investment team, they are highly experienced alternative asset investors with years of experience.

This means they can make important investment decisions on behalf of investors to not worry about regulatory requirements and due diligence. The other advantage of investing with Hedonova is that it is registered with the SEC.

Right from the onset, Hedonova This open jurisdiction adds another reason to choose Hedonova as anyone across the globe can invest. Regarding their correlation to stock markets, Hedonova’s diversified portfolio alienates it from financial markets, meaning that they do not move in tandem, thereby guaranteeing the investor an independent investment.

How to Start Investing in Hedonova

Before you can start investing with Hedonova, you need to be an accredited investor. On the platform, several security offerings are limited to accredited investors only. Their financial sophistication will allow them to sustain the risk of loss, which in that case nulls the different kinds of protections associated with a registered offering. As required by SEC regulations, a form of communication needs to be initiated before any investment is made.

Therefore, for investors to begin investing, they will have to fill up a form available on Hedonova’s website, after which they are contacted either through a scheduled call or via WhatsApp. Once these formalities have been completed, investors have to complete KYC by filling up a form and will then add capital to their already existing Hedonova account and start investing.

How Much Does It Cost to Invest?

Compared to many platforms in the alternative asset investment space, Hedonova has one of the lowest minimum investments of $1000. This is an attractive option for investors to broaden their exposure regarding alternative investment classes. Once an investment has been made, charges apply according to the ‘1 and 10’ model, which is cheaper than hedge funds globally.

Using this model, Hedonova will charge its investors a 1% annual management fee coupled up with a 10% performance fee on profits. Since Hedonova is working internationally and has accredited international investors, taxations made are not done in the United States but as per the stipulated tax laws in the country of the investor.

The People Behind Hedonova

Hedonova currently consists of a team of 16 investors, economists, researchers, engineers, and marketers. The Co-founders Alexander Cavendish and Suman Bannerjee have extensive experience when it comes to investing in emerging markets and alternative investments.

Alex’s career arose from his experience in UBS and Morgan Stanley, which created a path for dealing with financial services at the firm. Neel Aryan Birla is the head of investor relations, having graduated from the University of Cambridge with an economics degree. Sharan Hedge, on the other hand, has been a finance content creator with over 1.5 million followers across platforms and has worked extensively with fortune 500 companies’ CEOs.

The rest of the team is just as competent and of significant help to those who wish to invest in the platform.

Final Thoughts

Judged by its operations, management, and low charges, Hedonova is a promising investment platform. However, with only two years of operational history, investors need to learn more about it before they finally decide to work with it.

These are just some of the risks that investors should be aware of.

Overall, Hedonova currently offers the best annual returns northwards of 60%. Besides, the platform offers a wide range of assets, including cryptocurrency and litigation finance, whose returns range between 25% and 58% respectively from 2020 while their crypto portfolio has returned over 300%.