Crypto is known for being one of the newest branches of technology that has rapidly spread into different branches, with the most predominant ones being finance and trading.

But the world of crypto is not without drama. From scams to major hacks, there are several scandals that end up making headlines internationally. And considering the latest happenings of Sam Bankman Fried and the FTX exchange, it’s also time to discuss crypto scandals more broadly.

In today’s article, we will be reviewing some of the biggest crypto scandals that have rocked this industry.

Biggest Crypto Scandals in History

FTX Cryptocurrency Exchange Fraudulent Activity

The biggest crypto scandal is undoubtedly related to the FTX’s collapse. Once hailed as one of the world’s largest cryptocurrency exchanges, FTX recently collapsed. But let’s kick it off from the beginning, shall we?

Cryptocurrency exchange FTX was launched in 2019. Sam Bankman-Fried built it. Since its beginning, the FTX platform has become the coolest kid in the schoolyard, quickly becoming the second-largest crypto exchange in the world based on its aggressive marketing strategy, people associated with FTX, and their substantial investment, with venture capital groups pouring nearly $2 billion into the platform. Moreover, to further entice customers, FTX introduced its own digital token, FTT, in May 2019, offering additional perks like discounts and NFT rewards for staking FTT.

FTX provided a convenient avenue for storing and trading cryptocurrencies by offering a user-friendly interface and secure digital wallets. However, the platform’s journey took a fateful turn with events that would shake the entire crypto market.

The tide turned for Bankman-Fried and FTX in late 2021 and early 2022 when the prices of cryptocurrencies, including Bitcoin, experienced a sharp decline. While many significant platforms shuttered their operations, FTX continued acquiring competitors, seemingly unaffected by the market downturn.

However, the true extent of FTX’s problems came to light in November 2022 when CoinDesk published an article exposing the heavy dependence of Alameda Research, also founded by Sam Bankman-Fried, on FTX’s digital token FTT. The leaked FTX balance sheet revealed a lack of diversification and excessive interdependence between the two companies. With $9 billion in liabilities and only $900 million in assets, the balance sheet painted a bleak picture, showing a negative balance of $8 billion.

It was discovered that Alameda Research routinely borrowed capital from FTX, primarily sourced from customer deposits. Additionally, Bankman-Fried and FTX’s failure to produce audited balance sheets and comply with standard financial reporting procedures raised concerns about the company’s liquidity and ability to cover customer assets.

As news of the scandal spread, FTX and Sam Bankman-Fried faced a mass withdrawal of funds, leading to significant losses. In a desperate attempt to cover the capital shortfall, Bankman-Fried ordered asset sales and sought additional financing. However, FTX’s inability to fulfill withdrawal requests eventually led to the company filing for bankruptcy.

Bankman-Fried faced severe legal repercussions, being arrested on multiple fraud charges, including money laundering, wire fraud, campaign finance violations, and securities fraud, based on the accusations of attorney Damian Williams. FTX investors also initiated a class-action lawsuit against the platform and its celebrity endorsers, accusing them of false representation, deceptive conduct, and involvement in a Ponzi scheme.

The FTX scandal significantly impacted the cryptocurrency market, causing a temporary decline in overall demand. However, Bitcoin staged a comeback, reaching values above $21,000 by January 2023. Nevertheless, the arrest of Bankman-Fried prompted regulatory discussions by the Securities and Exchange Commission, Commodity Futures Trading Commission, and U.S. Congress, seeking to implement stricter regulations for the cryptocurrency industry.

The FTX collapse also cast a shadow of doubt over the stability and security of cryptocurrencies, contributing to increased investor skepticism and caution. The long-term consequences for the broader cryptocurrency market remain uncertain. Still, the dramatic FTX collapse serves as a cautionary tale, potentially deterring future investors and highlighting the need for increased transparency and oversight within the industry.

After the fallout of Bankman-Fried, SEC Chair Gary Gensler has started to liken crypto markets to the Wild West, thus with good chances to appear several new regulations for crypto assets and crypto platforms.

Mt. Gox Hack

One of the biggest crypto platforms/exchanges at its time, Mt. Gox, had at its peak performance almost 70 percent of all Bitcoin transactions running through its platform.

But in 2011, its Bitcoin wallet was hacked in the most unprecedented way. An unknown hacker managed to get a hold of staff credentials, using them to change Bitcoin’s price on the site to 1 cent and then send the coins illegally to his/her own wallet. Mt. Gox responded to this attack by transferring the remained coins into cold wallets.

But things did not get better from here on. Its Bitcoin wallet kept leaking funds continuously. In the end, people started complaining that their transactions sometimes took months to clear. Mt. Gox lost a total of 850,000 Bitcoins in the entire ordeal. This is what finally made the exchange file for bankruptcy in 2014.

The Silk Road Shutdown

The Silk Road was a notorious black market from the Dark Web platform on which many illegal things such as drugs, child pornography, and weapons were sold. The platform received funding from the crypto industry, which made it hard to trace where the money came from.

Bitcoin transactions led to Silk Road’s demise, as people discovered that such transactions were not untraceable and anonymous.

Its founder, Ross Ulbricht, was arrested in the platform’s raid. Other arrests connected to the case include Charlie Shrem, who the FBI arrested for money laundering using the site, and Cornelis Jan “Maikel” Slomp, who received ten years for large-scale drug dealing plus over 130 more arrests.

29,657 Bitcoins seized from Silk Roads’ accounts were auctioned off on 27 June 2014 by the U.S. Marshals Service. Another 144,342 Bitcoins were seized from Ulbricht’s computer, a sum of around $511 million at current rates. They were auctioned off, and Tim Draper purchased the Bitcoins with $17 million.

Mark Karpelès Embezzlement

Mark Karpelès was Mt Gox’s chief manager. When he noticed that the crypto platform was being robbed of Bitcoin left to right and center, he decided to take $1 million from the customer funds for himself to have something to fall back on. $3 million were then illegally taken from client accounts and deposited into his own account, hoping to get away with it.

But when users began noticing this, he was caught and arrested in 2015 by Japanese authorities and charged with embezzlement.

He pleaded not guilty to his charges. However, on March 14, 2019, the Tokyo District Court delivered its verdict on Mark Karpelès, and Karpelès was found guilty of falsifying data, specifically inflating Mt. Gox’s holdings. Yet, he received a suspended prison sentence of 30 months, meaning he would not serve any time unless he committed further offenses within the next four years. The Court acquitted Karpelès on other charges, such as embezzlement and breach of trust, believing that he had acted without malicious intent. Nevertheless, the verdict emphasized the immense damage Karpelès had caused to the trust of Mt. Gox users and condemned his abuse of power.

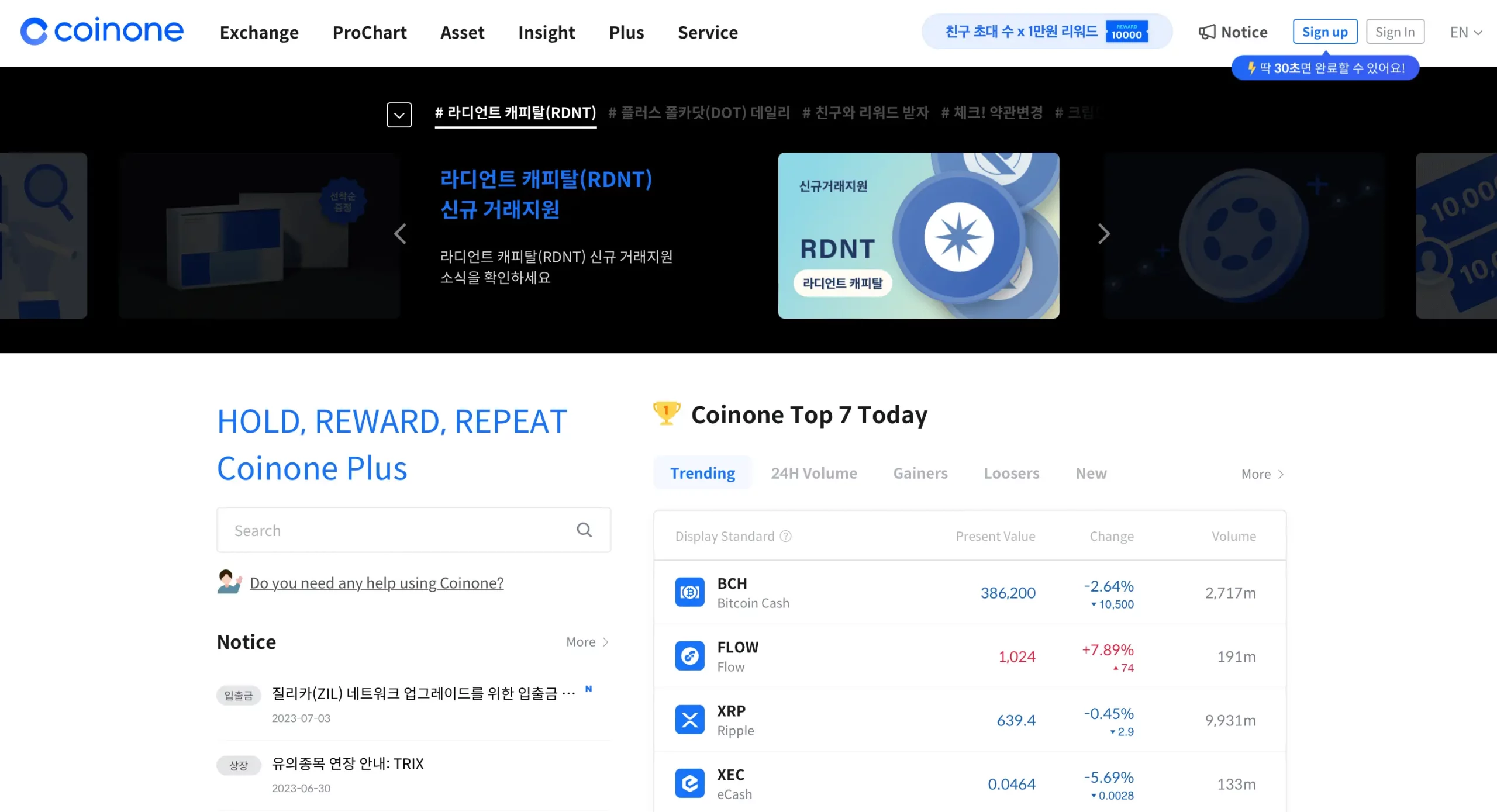

Coinone Margin Trading

Margin trading is not the most recommended trading practice, especially in a volatile financial field like cryptocurrency. Coinone was one of those few crypto companies or exchanges to offer margin trading for Bitcoin, which at first seemed like a good idea to incorporate this advanced trading tool for professional trading.

But it was later found out that the reason for rolling out this feature was that most of the executives of the firm made use of margin trading to wager with Bitcoin on the platform.

India’s Involvement in Bitcoin Scam

India is among the countries that decided to reject cryptos altogether, installing extremely harsh regulations regarding crypto trading, with many politicians demonizing digital assets.

However, it was revealed later that India’s Bharatiya Janata Party was receiving and circulating around $12 million worth of cryptocurrency. How convenient for them. The funny thing is that the party rose to prominence by promising to end the country’s shadow economy and crypto use. How hypocritical does that sound?

The Ponzi Scheme

Trendon Shavers is one of the first known individuals to conduct a Bitcoin Ponzi scheme. He developed Bitcoin Savings and Trust, an investment scheme that guaranteed interest rates of 7 percent per week to investors who loaned Bitcoins to his platform while he applied a market arbitrage strategy.

Shavers managed to gather 7 percent of all Bitcoins in circulation, which he then used to pay returns, making investors believe the scheme was legit. This is why he kept on receiving backing from investors. He then disappeared with all the funds in August 2012.

The stolen amount was estimated to be around 500,000 Bitcoins, approximately $5 million at the time. But then investigators found that a large number of coins, which were thought to not belong to Shavers, belonged to a black market website sued by the scammer to mix his funds to conceal the real amount he stole.

When authorities caught him, he was ordered to pay back $1.2 million to investors and was sentenced to serve a one-year prison term.

The Singapore Crypto Scandal

A wealthy Malaysian named Mr. Pang decided to travel to Singapore in order to purchase Bitcoins with cash in a face-to-face meeting with an alleged broker.

He and his personal broker went to Singapore with a briefcase containing $365,000. When the actual meeting took place, the two men were beaten by the scammers that promised to sell them Bitcoins.

The NiceHash Hack

NiceHash is a marketplace where users can sell and buy hash power for mining and get paid in Bitcoins.

The Slovenia-based crypto-mining pool was hit in 2017 by a hack that locked users out of their accounts. Over 4 million Bitcoins were lost in the attack, making it one of the largest Bitcoin heists of that year. It was later reported that NiceHash returned 60 percent of the roughly 4,700 Bitcoins (BTC) stolen in the attack.

Biggest Crypto Scandals in History | Final Thoughts

While the cryptocurrency space has witnessed numerous events like the ones mentioned above, we have highlighted the ones that garnered significant attention due to their profound impact.

Undoubtedly, more stories meet the scandal criteria; some may have slipped our memory in this seemingly endless list. However, let’s remain hopeful that in 2023, the crypto industry will see more stories of triumph and accomplishment rather than sordid tales of misconduct.