Investing can be highly emotional as it involves an activity that can make or lose you money. We totally understand, especially when looking at the volatility of the crypto market.

However, even in the world of crypto assets, some variants are categorized as a little less volatile. So, remember that if this technology (blockchain and crypto) has caught your attention, you can be part of it by investing in a stablecoin.

But what is a stablecoin, and which is the safest? In this article, we’ll find out all this and more.

Table of contents

What is a Stablecoin?

A stablecoin is a cryptocurrency designed to maintain a stable value by being tied to traditional currencies like the US dollar (fiat), commodities (like metals), or another cryptocurrency.

These coins, also known as fiat-backed stablecoins, offer a safer option for people who want to use cryptocurrencies without worrying about big price changes.

They emerged in response to complaints about the unpredictable nature of cryptocurrencies in the market. People wanted a cryptocurrency that didn’t experience the same level of ups and downs as coins like Dogecoin, Shiba Inu, or Ripple. They are especially popular for trading, transfers, and providing liquidity in decentralized finance (DeFi).

As of September 9, 2024, stablecoins make up about 9.45% of the total cryptocurrency market, with a value of around $170 billion out of a $1.8 trillion market.

Many of these stablecoins are issued by reputable financial institutions, which helps increase trust and enhance security when using them for payments or trading. Stablecoins act as a bridge between regular currencies and digital money, making them useful for both individuals and regulated financial institutions.

How Does a Stablecoin Work?

Simply put, in order to work a stablecoin, the people or organization managing the stablecoin need to keep a secure reserve of whatever is backing up the stablecoin. For example, they might save $10 million in a reserve to support 10 million units of their stablecoin.

This reserved money acts as a guarantee for the stablecoin. When someone wants to convert their stablecoin into fiat money, an equal amount of whatever is backing the stablecoin (like dollars from the reserve) is taken out and given to them.

In some cases, stablecoins are not only backed by fiat currencies but also by other assets such as government bonds. Additionally, stablecoins play a key role in the broader crypto ecosystem by providing liquidity, reducing transaction risks, and offering a reliable way to store value. Their ability to bridge the gap between fiat currencies and digital assets makes them essential for payments, trading, and everyday transactions.

Types of Stablecoins

As mentioned above, there are several types of stablecoins, more directly or indirectly. From these several stablecoins, there are three main stablecoins, each using different mechanisms to maintain their value:

Fiat-Collateralized Stablecoins

These stablecoins are backed by a reserve of fiat currency, often the US dollar, to ensure their value. Some may use other collateral like precious metals or commodities, but most are tied to US dollar reserves.

Popular examples include Tether (USDT) and TrueUSD (TUSD), both backed by US dollar reserves.

Crypto-Collateralized Stablecoins

These stablecoins are backed by other cryptocurrencies, making them overcollateralized to mitigate volatility risks. For instance, MakerDAO’s Dai (DAI) is pegged to the US dollar but backed by cryptocurrencies like Ethereum (ETH).

Algorithmic Stablecoins

Unlike the other types, algorithmic stablecoins may or may not have reserve assets. Their key feature is stabilizing value through algorithmic supply control. This means a computer program regulates the stablecoin’s supply based on a predefined formula. Unlike central banks with transparent policies, algorithmic stablecoin issuers lack similar advantages in times of crisis.

Stablecoins provide multiple options for different kinds of investors, but choosing the right type depends on your risk tolerance and investment goals.

The Most Popular Stablecoins

As mentioned above, stablecoins comprise about 9.45% of the entire crypto market capitalization, summing around $170 billion within the $1.8 trillion asset class. However, it’s important to know that from this 9.45%, the most popular stablecoins with the highest dominance are the following:

- Tether (USDT);

- USD Coin (USDC);

- Dai (DAI);

- TrueUSD (TUSD);

- Binance USD (BUSD).

Tether (USDT) is still the largest player in the stablecoin market, holding about 70% of the market’s value. Other well-known stablecoins, like USD Coin (USDC), Dai (DAI), and TrueUSD(TUSD), are also important.

Stablecoins Trust Factors: What Makes a Stablecoin Safe?

As stablecoins become more widespread, investors have a range of choices, but this also raises the challenge of determining which stablecoin is fully regulated or secure and trustworthy. In this growing array of options, some factors are essential indicators of a stablecoin’s reliability, although the main purpose of a stablecoin is to keep a stable value.

So, here’s a breakdown of the essential elements to consider when investing in a stablecoin:

- Regulatory Oversight – Ensure the stablecoin issuer operates within a recognized regulatory framework, which provides a level of trust and accountability. Governments and financial institutions are increasingly taking steps to monitor stablecoins, ensuring they meet compliance standards.

- Asset Backing and Audits – Seek stablecoins backed 1:1 by reserve assets like US dollars stored in secure, audited vaults. Regular third-party audits and transparency reports should be easily accessible to verify these reserves.

- Network Security – Examine the security protocols of the underlying blockchain network. The stronger the network security, the less likely the stablecoin is to encounter vulnerabilities. For instance, a stablecoin issued on Ethereum ensures higher security than a network with fewer validators like EOS.

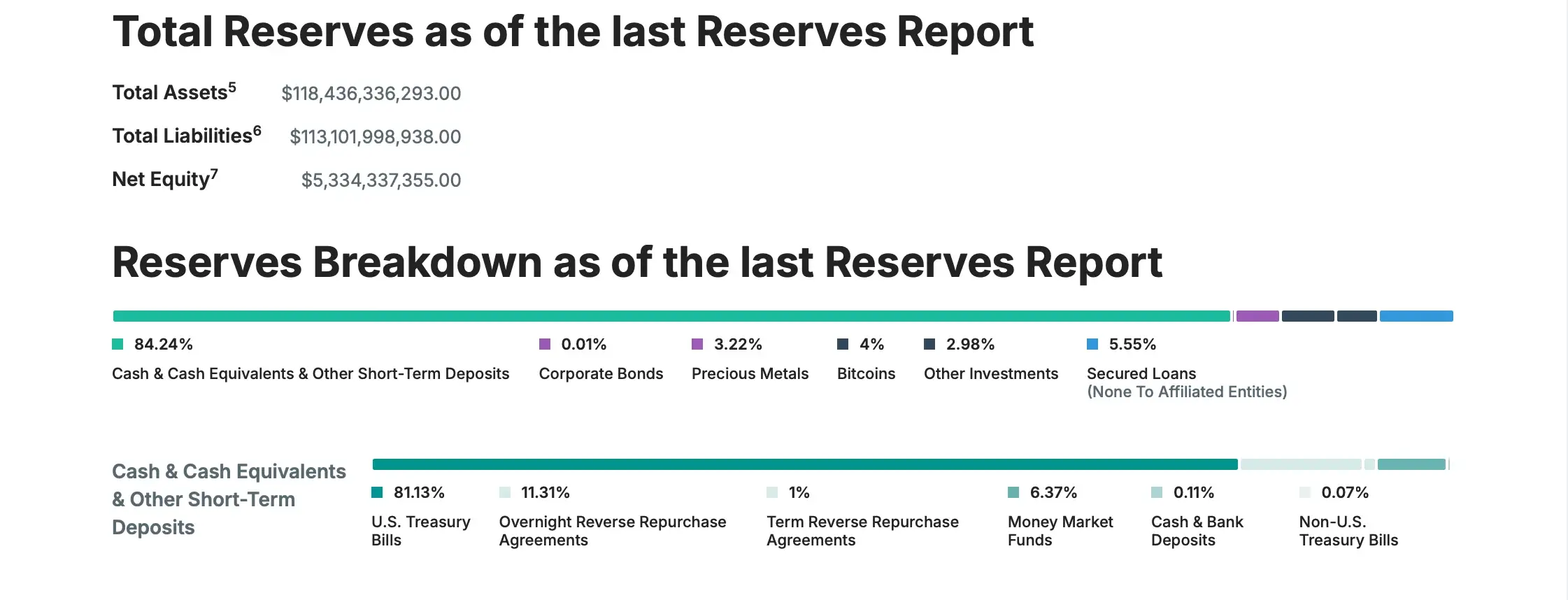

- Duration Risk of Reserves – Assess the types of reserve assets the stablecoin issuer holds. Short-term US Treasuries are generally preferable as they are less susceptible to interest rate fluctuations and offer better liquidity.

Safest Stablecoins: What is the Best Stablecoin to Invest in 2025?

After understanding the trust factors for stablecoins, you might be curious about the safest or best stablecoins in 2025. We’re here to help, presenting arguments for not just the top stablecoin but also the three best stablecoins currently available.

In assembling this list of the best and safest stablecoins, our team conducted a comprehensive multi-factor analysis considering various security and safety aspects, as outlined above. The following three stablecoins stood out as the best in terms of safety based on our analyses:

- USD Coin (USDC);

- Tether (USDT);

- Dai (DAI).

1. USD Coin (USDC) – Safest Stablecoin Overall

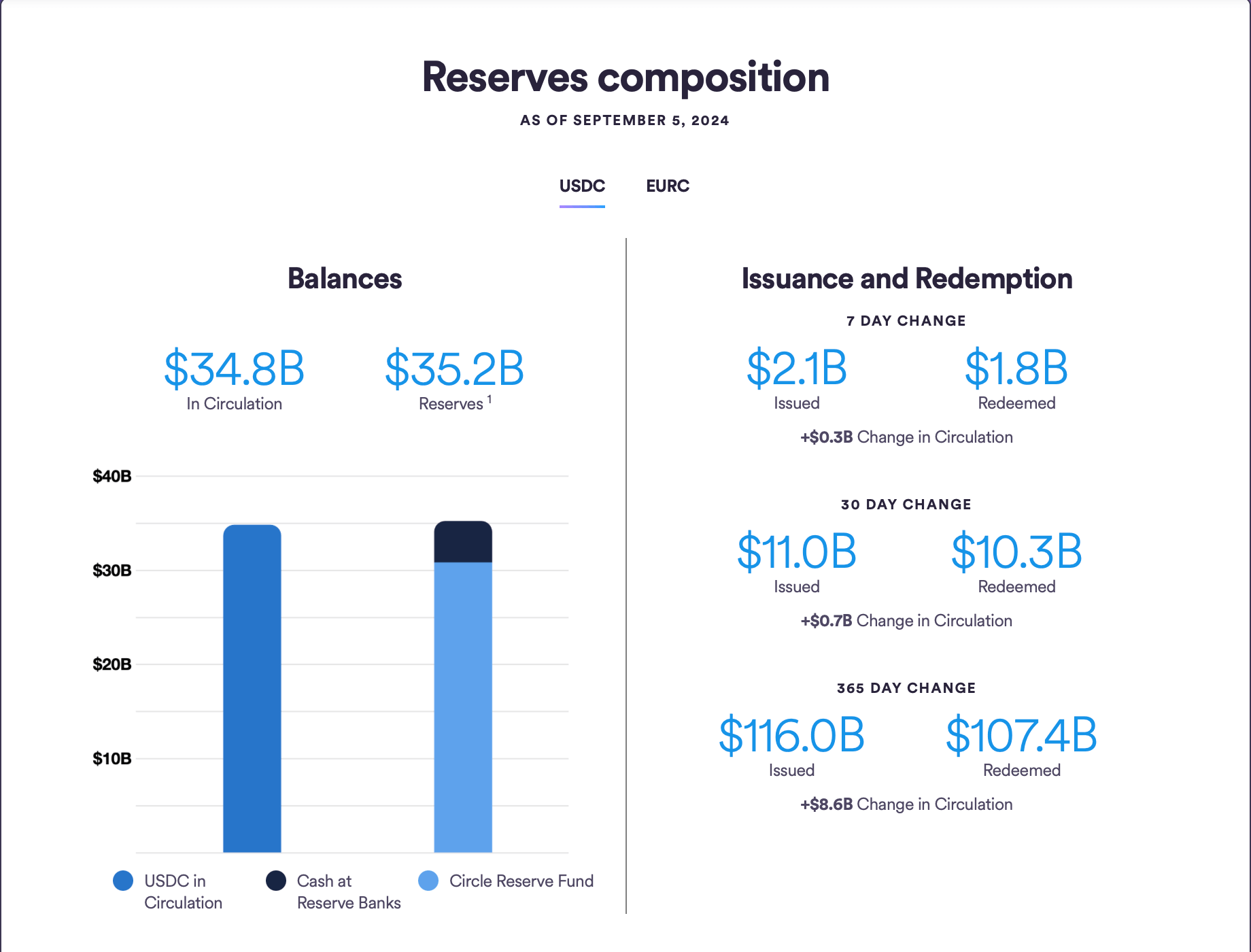

USDC is a top safe stablecoin, securely pegged to the US dollar at a 1:1 ratio. Each unit of this cryptocurrency in circulation is backed by a corresponding $1 held in reserve, a combination of cash and short-term US Treasury bonds.

Centre, a consortium founded by Circle (a regulated fintech company) and the Coinbase cryptocurrency exchange, developed USDC, which is subject to regulations in New York, a jurisdiction renowned for its rigorous auditing practices and strict licensing requirements. This makes it one of the most secure stablecoins, supported by a robust financial and regulatory framework.

Originally launched on a limited basis in September 2018, USDC embodies the mantra of “digital money for the digital age.” It is crafted for a world where cashless transactions are increasingly prevalent.

Why is USDC the Safest Stablecoin Overall?

USDC stands out as the safest stablecoin due to its commitment to transparency and rigorous financial practices. As an idea, monthly attestation reports are openly published, offering a clear overview of the reserves that back USDC.

Currently, USDC is 100% demonstrably supported by US Dollar reserves and short-term US treasury securities with maturities of less than three months.

Adding to its credibility, USDC undergoes annual audits of its financial statements, sticking to the attestation standards outlined by the American Institute of Certified Public Accountants (AICPA).

The Circle Reserve Fund, an SEC-registered entity, further reinforces its security by maintaining a portfolio of short-term US Treasuries and overnight repurchase agreements.

Circle, the entity behind USDC, enjoys backing from major global investors, including BlackRock, JPMorgan, and Goldman Sachs, further solidifying its reputation for stability and reliability.

So, this multi-layered approach to safety and compliance positions USDC as a trusted option in both traditional and crypto financial landscapes.

2. Tether (USDT) – The Safest Alternative to USDC

USDT, or Tether, is a digital dollar (fiat-backed stablecoin) driven by blockchain technology. This stablecoin is pegged 1:1 to the USD, offering individuals and organizations a robust and decentralized means of exchanging value while using a familiar accounting unit.

Being among the pioneers, USDT was one of the earliest stablecoins to be introduced, and it has consistently held the position of the largest stablecoin by crypto market cap since its launch in 2014.

Originally known as Realcoin, it was developed by Brock Pierce, Reeve Collins, and Craig Sellars and is currently operational through Tether Limited Inc.

Tether aims to revolutionize the traditional financial system by adopting a more contemporary approach to money. Through its platform, Tether facilitates transactions with traditional currencies over the blockchain, mitigating the inherent volatility and complexity typically associated with digital currencies.

Why is Tether on #2 and Why is the Safest Alternative to USD Coin?

Although Tether (USDT) is the largest stablecoin by market cap, it is not considered the safest option due to a range of concerns.

One prominent issue revolves around transparency. Tether Limited, the company behind USDT, has faced criticism for its lack of openness regarding the reserves backing the stablecoin. Previous revelations indicated that only a small percentage was backed by actual USD, with a significant portion relying on commercial paper—a form of short-term corporate debt. This lack of clarity has contributed to doubts about whether USDT is fully backed by fiat currencies like USD.

Legal challenges, including allegations of fraud from the Justice Department (having lawsuits with the New York State Department), further contribute to major concerns surrounding USDT’s stability.

Moreover, in 2017, Tether was hacked, where 31 million USDT was stolen. Rather than demonstrating accountability, the company initiated an “emergency hard fork” to mitigate the issue, which later raised concerns about their commitment to transparency and responsibility.

Yet, to resolve some doubts related to Tether’s reserve, they started releasing comprehensive reserve reports conducted by BDO Italia every quarter.

However, even in this case, in contrast to Tether, USDC prioritizes transparency and publishes audits more often of their reserves. This commitment to openness and accountability makes USDC a preferred choice over USDT when considering which stablecoin is the safest.

3. Dai (DAI) – Safest Decentralized Stablecoin

DAI is a stablecoin launched in 2017, built on the Ethereum platform, managed by the Maker Protocol and the decentralized autonomous organization MakerDAO. MakerDAO operates as a decentralized autonomous organization, functioning autonomously through smart contracts on the Ethereum blockchain.

The value of DAI is designed to maintain a soft peg to the US dollar and is backed by a combination of various cryptocurrencies held in smart contract vaults each time new DAI tokens are created. It’s essential to distinguish between Multi-Collateral DAI and Single-Collateral DAI (SAI), an earlier version that only accepted a single cryptocurrency as collateral and lacked support for the DAI Savings Rate.

Multi-Collateral DAI, introduced in November 2019, expanded the collateral options and included features like the DAI Savings Rate, allowing users to earn savings by holding DAI tokens.

Why is DAI the Safest Decentralized Stablecoin?

DAI has made significant changes to enhance its safety. As an idea, only 43.9% of its collateral reserves come from centralized sources, 24.6% come from real-world assets, and 31.5% from Stablecoins. Rather, it has shifted its reliance towards Ethereum derivatives like Wrapped Ether (WETH) and Wrapped Staked Ether (wstETH). This diverse backing improves DAI’s stability, making it one of the safest decentralized stablecoins.

To add to its strength, DAI has an over-collateralization ratio of 25%, making it more resilient as a stable asset.

FAQ

Which is the Major Stablecoin?

In terms of market cap, the major stablecoin in the crypto ecosystem is USDT. However, there are other major stablecoins that should be considered, with attributes that may be even better than USDT. Among these other (more secure) alternatives are USDC and DAI.

Which Stablecoin is the Safest in 2025?

Based on our multi-factor analyses, the safest stablecoin in 2025 is USD Coin (USDC), followed by Tether (USDT) and Dai (DAI).

Is USDC Safe?

Yes, USDC is considered one of the safest stablecoins. Pegged securely to the US dollar at a 1:1 ratio, every USDC in circulation is backed by an equivalent $1 held in reserve, a mix of cash and short-term US Treasury bonds. It is subject to New York regulations and is known for stringent auditing practices. Monthly attestation reports and annual audits ensure transparency, with 100% provable backing by US Dollar reserves. Supported by a robust financial and regulatory framework, USDC is recognized for its safety and reliability.

Is USDT Safe?

Yes, at the time of writing, USDT is a safe stablecoin, but we do not consider it the safest. While Tether is the largest stablecoin by market cap and has introduced measures to enhance transparency, concerns persist regarding its reserves and past legal issues. USDC is often considered a safer alternative due to its stronger commitment to transparency and more frequent reserve audits.

Conclusion

Stablecoins are the way of connecting traditional finance with the world of cryptocurrencies. They provide stability, allowing people to use digital currencies without worrying about big price swings. As the stablecoin market continues to expand, staying informed about regulations and the technology behind each coin will help you make smarter investment choices.

Even though stablecoins are generally less volatile than other cryptocurrencies, it’s still important to do your own research. Understanding what makes a stablecoin safe—such as regulatory oversight, asset backing, and network security—will help you choose a reliable option.

Stablecoins are not just for trading but are also practical for everyday transactions, offering a more secure and accessible way to interact with digital finance. We hope this article has given you the information you need to explore this space confidently.

However, remember that all investments represent a risk, and don’t invest more than you can afford to lose.