The 2024 was a big year for crypto, with some significant milestones and all-time highs. It was a year full of everything good if we compare it with the previous years and if we are looking at the big picture. Bitcoin reached new heights, stablecoins saw solid growth, and the market overall hit $3.91 trillion.

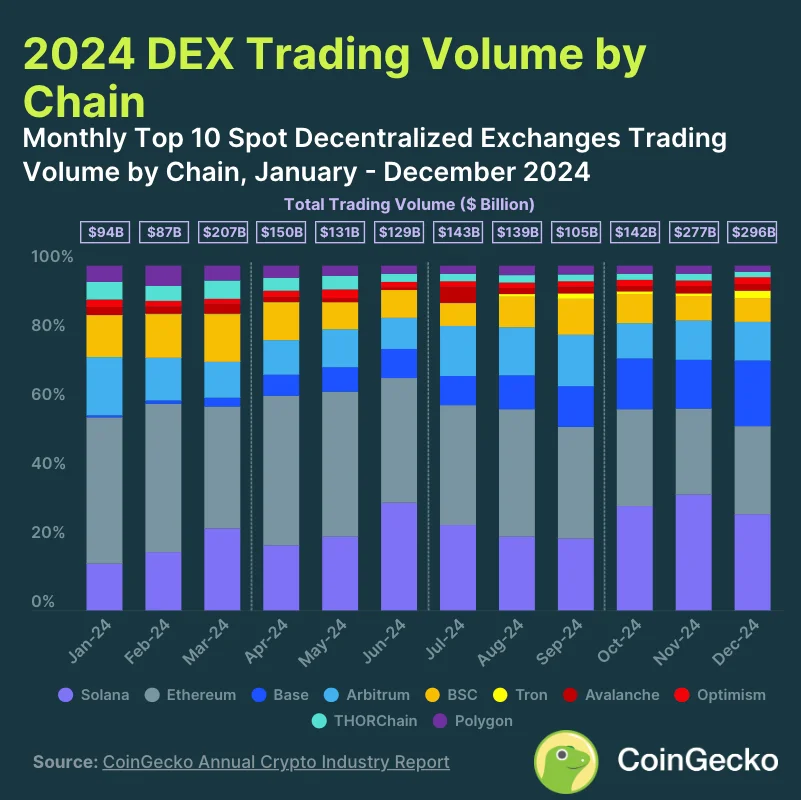

We also saw some big surprises, like Solana overtaking Ethereum for DEX trading. Didn’t know that? Alright, no more spoilers!

As Bobby Ong, CoinGecko’s COO, put it: “2024 was a testament to the meaningful progress crypto has made in achieving TradFi and institutional recognition. On the other hand, on-chain activity also gathered momentum amid heated competition amongst different blockchain ecosystems for users and developers, with memecoins and Crypto x AI dominating discourse. After the past few challenging years, we look forward to the continued bull market in 2025!”

So, without further ado, let’s look at the key highlights from CoinGecko’s 2024 Annual Crypto Industry Report.

Key Takeaways

- The crypto market cap surged 45.7% in Q4 2024, almost doubling in value for the year, reaching $3.91T.

- Bitcoin’s dominance increased to 53.6%, while Ethereum’s market share dropped to 11.8%, marking its lowest since 2021.

- The stablecoin market cap hit an all-time high of $201.6B in Q4 2024, primarily driven by USDT and USDC growth.

- Bitcoin saw a massive 121.5% price surge in 2024, reaching over $108K and outperforming other major asset classes.

- The AI agents market experienced explosive growth, rising 322.2% in Q4 2024, primarily fueled by new projects on Solana and Base.

- Ethereum Layer 2 transactions grew by 48.3% in Q4 2024, with Base accounting for nearly half of all activity.

- Centralized exchange spot trading volume hit a record $6.45T in Q4 2024, marking a 111.7% increase from the previous quarter.

- In Q4 2024, Solana overtook Ethereum as the leading chain for DEX trading, capturing over 30% of the market share.

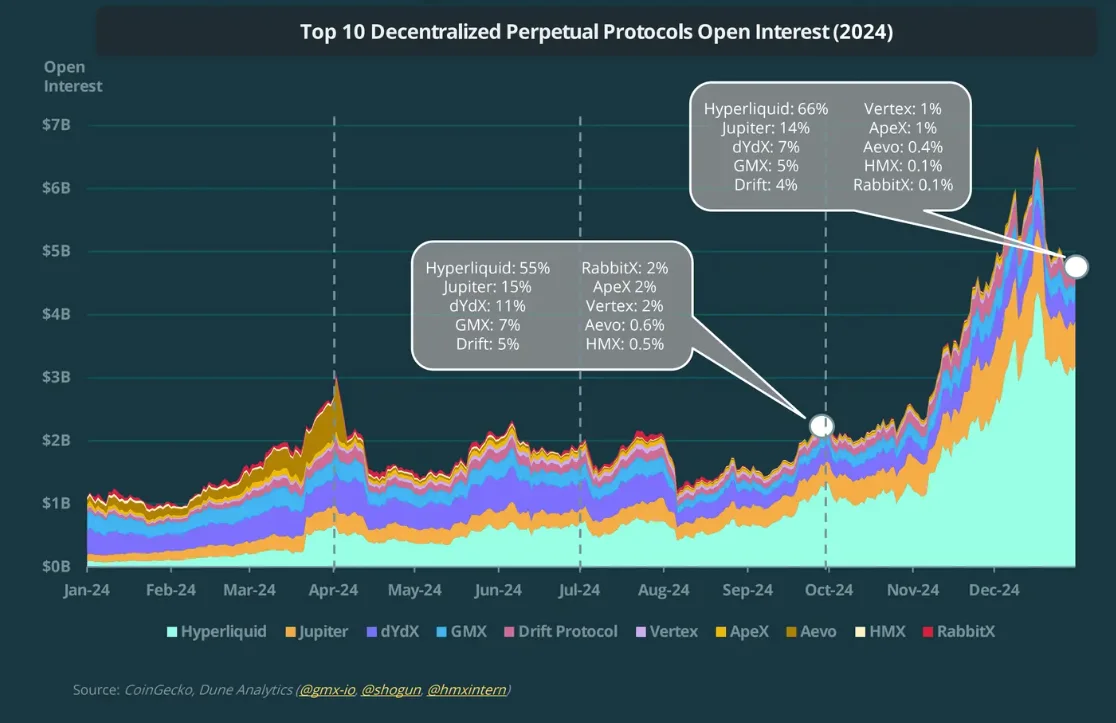

- Decentralized perpetuals saw a 104% increase in open interest, reaching $6.7B by the end of 2024.

1. Crypto Market Cap Surged 45.7% in Q4 2024, Reaching $3.91T

The total crypto market cap jumped 45.7% ($1.07T) in Q4 2024, ending at $3.40T. After slowing in Q3, it hit a local low before rallying in mid-Q4, boosted by Donald Trump’s US Presidential win.

For the year, the market nearly doubled (+97.7%), peaking at $3.91T in December before settling. Q4 trading volume averaged $200.7B, up 128.2% from Q3’s $88.0B.

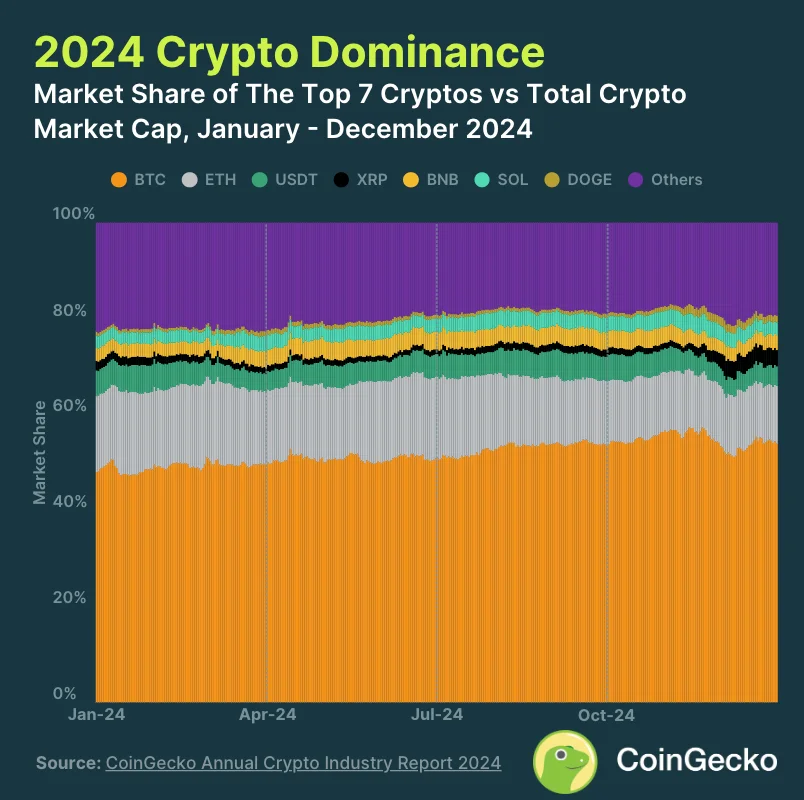

2. Bitcoin Dominance Hits 53.6% as Ethereum Drops to 11.8%

Bitcoin’s dominance grew to 53.6% in Q4 2024, up 0.9%. XRP saw the biggest jump, rising to 3.5% (+2.0%) and climbing from #7 to #4, overtaking BNB and Solana.

Dogecoin entered the top 7 coins by market cap, replacing USDC, which fell out for the first time since April 2021. Meanwhile, Ethereum’s dominance dropped to 11.8%—its lowest since April 2021.

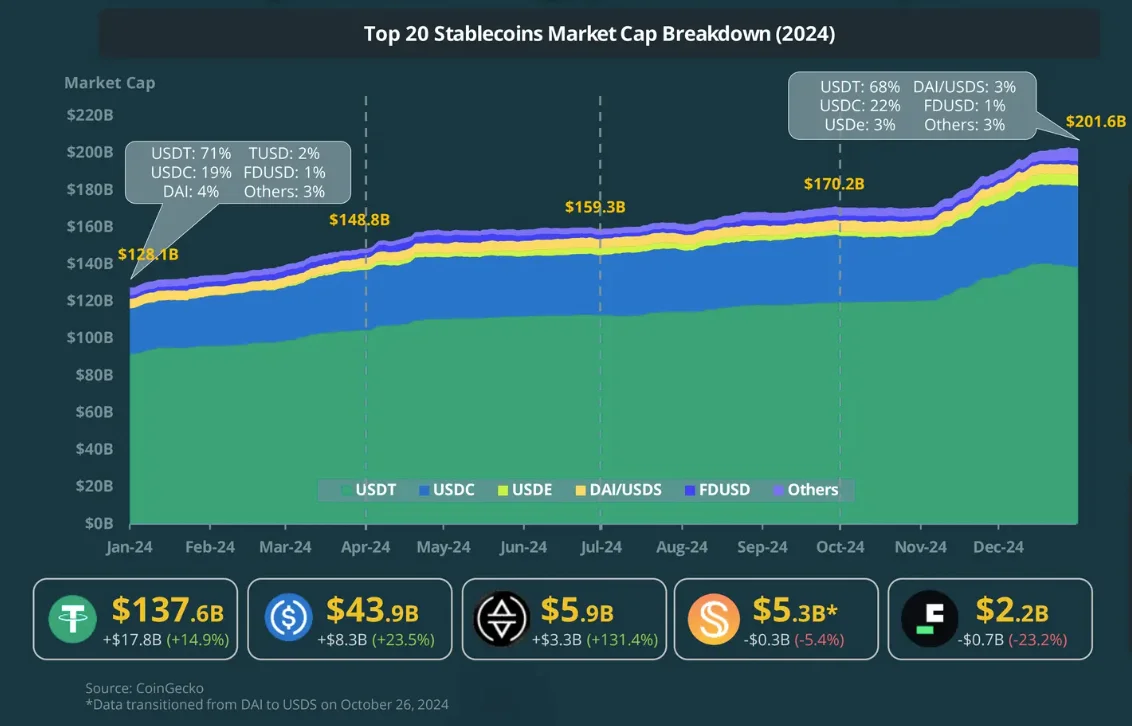

3. Stablecoin Market Cap Hits $201.6B in Q4 2024, Up 18.4%

The total stablecoin market cap grew by $31B (+18.4%) in Q4 2024, reaching an all-time high of $201.6B. USDT (+$17.8B, +14.9%) and USDC (+$8.3B, +23.5%) drove most of the growth, while USDe saw the highest percentage gain (+$3.3B, +131.4%), overtaking DAI/USDS and FDUSD to become the #3 stablecoin by market cap.

Notable gainers included USDO (+512.8%, +$1.4B) and USDX (+199.5%, +$358.4M). In contrast, PYUSD saw the largest drop (-29.3%, -$206.7M).

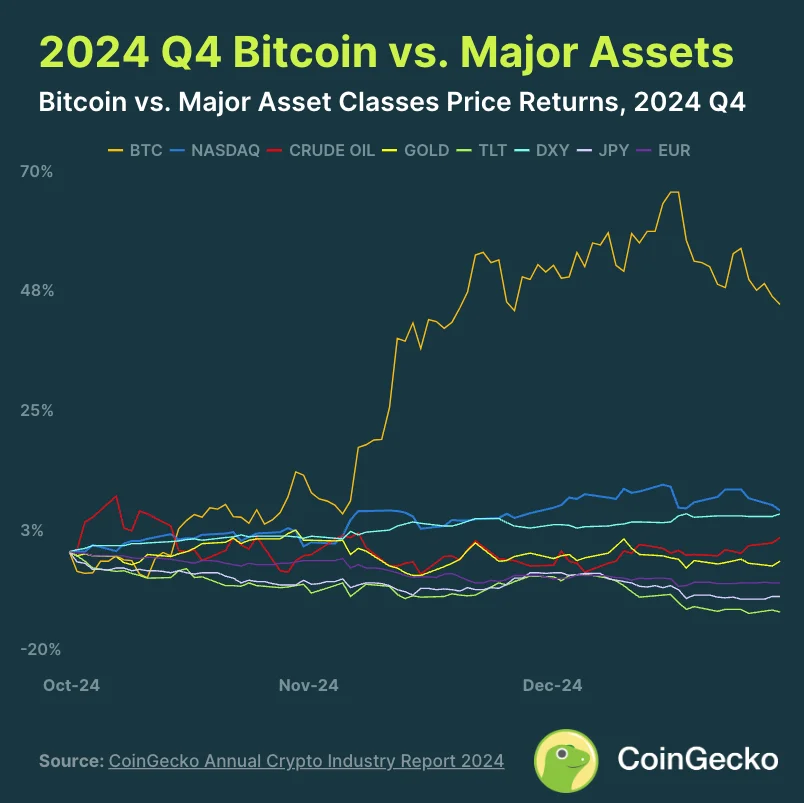

4. Bitcoin Surges 121.5% in 2024, Outperforming Major Asset Classes

Bitcoin (BTC) had a historic 2024, rallying past $100K on December 9 and peaking at $108,135 before ending the year at $93,508 (+121.5%). Trump’s presidential win fueled Q4 yields, Fed rate cuts, and expectations of continued monetary easing.

Daily trading volume soared to $62.6B in Q4 (+101.3% QoQ), with a record $190B on December 6 as BTC broke $100K.

By comparison, Q4 returns for equities included +8.0% for the NASDAQ and +3.0% for the S&P500. The US Dollar Index rose +7.0%, while the Yen dropped -8.0%, erasing carry trade gains.

5. AI Agents Market Cap Soars 322.2% to $15.5B in Q4 2024

The AI agents category exploded in Q4 2024, with the market cap jumping from $4.8B to $15.5B (+322.2%) after GOAT launched Solana in October.

Notable AI agents are currently on Solana and Base. While Base gained significant market share in late 2024 with AIXBT and Virtuals Protocol (VIRTUAL), Solana began reclaiming ground with the launches of GRIFFAIN and AI Rig Complex (ARC) in December.

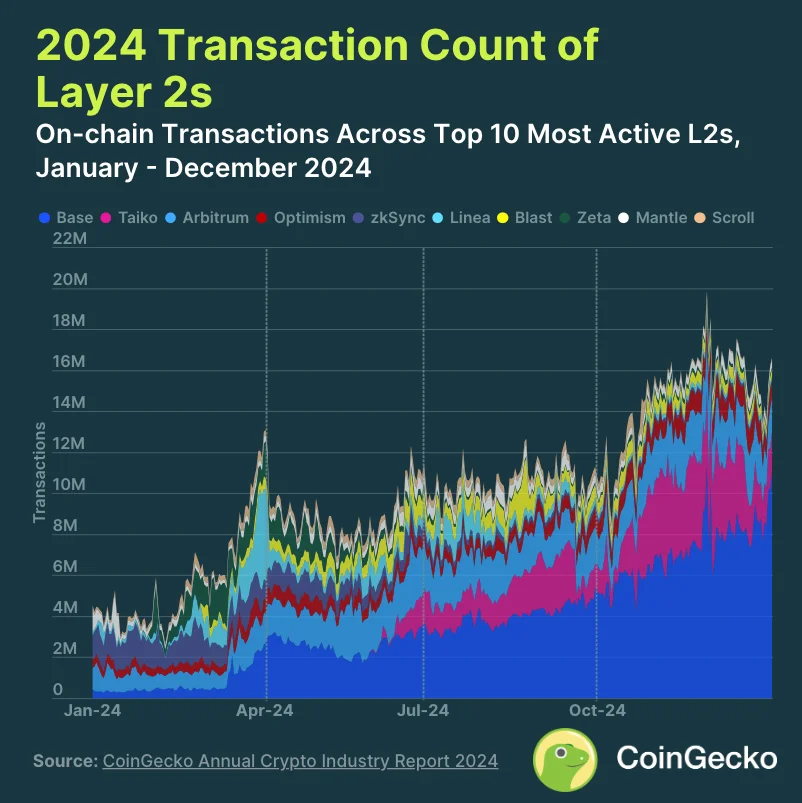

6. Ethereum Layer 2 Transactions Jump 48.3% in Q4 2024, With Base Leading at 48.3% Share

Transactions on the top 10 Ethereum Layer 2s averaged 15M daily in Q4 2024, up +48.3%. Base led the surge with 7.2M daily transactions (+78.7% QoQ), accounting for 48.3% of all Layer 2 activity. By comparison, Ethereum mainnet processed ~1.2M daily transactions.

Taiko overtook Arbitrum as the second most active Layer 2, making up 20.6% of transactions (+85.5% QoQ), while Arbitrum’s share was 13.7% (+14.0%). Taiko’s growth was fueled by the launch of multiple DeFi protocols.

7. CEX Spot Trading Volume Hits Record $6.45T in Q4 2024, Up 111.7% QoQ

Spot trading volume on the top 10 centralized exchanges surged to $6.45T in Q4 2024 (+111.7% QoQ), breaking the $6T mark for the first time. Annual volume reached $17.4T, up from $7.2T in 2023.

Binance led the market, ending December with a 34.7% share and surpassing $1T in monthly volume for the second time in 2024.

Upbit was the fastest-growing CEX, with a +314.8% volume jump to $561.9B after South Korea declared martial law in December, pushing daily volumes to ~$21B from an average of $3.5B.

8. Solana Becomes Top Chain for DEX Trading with 30%+ Share in Q4 2024

Solana overtook Ethereum as the leading chain for DEX trading in Q4 2024, capturing over 30% market share with $219.2B in volume (+152.0%). Ethereum followed with $184.3B, holding a 25%- 28% dominance for the quarter but maintaining a yearly lead with 33.5% of total DEX volume vs. Solana’s 25.2%.

Base surpassed Arbitrum in Q4, reaching a 19.0% share in December and $116.7B in trading volume (+206.5%). Tron was the fastest-growing chain, with trading volume surging 232.7% QoQ to $9.6B, securing 2.1% of the market and the #6 spot.

9. Decentralized Perpetuals Open Interest Jumps 104% to $6.7B in 2024

Open interest in the top 10 decentralized perpetual protocols surged 104.3% in 2024, peaking at $6.7 billion in December, fueled by strong market optimism.

Hyperliquid appeared as the dominant player, grabbing 66.2% of the total open interest by year-end, a dramatic rise from 7.7% at the start of the year. Meanwhile, dYdX and GMX saw their market shares decline.

The top five protocols—Hyperliquid, Jupiter, dYdX, GMX, and Drift—now account for over 97% of the market, signaling consolidation and market maturation.

Conclusion

Looking ahead, the crypto market is changing fast, and there will be new opportunities and challenges along the way. If you’re invested in or just following the space, staying up to date will be important to keep up with the shifts ahead.

With everything happening—new blockchain developments, AI in crypto, and more—there’s a lot to pay attention to.

So, as we wrap up the year and take in the CoinGecko report, make the most of the info above. Good luck, and here’s to another exciting year in crypto!