How to Invest in DeFi: From Novice to DeFi Investor

Table of contents

Decentralized finance (DeFi) has revolutionized how we think about traditional financial systems. With its promise of open, permissionless, and borderless financial services, DeFi has gained significant traction and captured the attention of investors worldwide. If you’re intrigued by the potential of DeFi and want to embark on your journey as a DeFi investor, this guide is for you.

In this article, we will take you from being a novice to a confident DeFi investor, equipping you with the knowledge and tools necessary to navigate this exciting and rapidly evolving landscape.

How to Invest in DeFi: Step-by-Step Guide

All of the above are just a few ways to invest in DeFi. In any case, all of these ways are directly or indirectly conditional on holding crypto. So, let’s see how you can buy crypto to invest it in the various forms of DeFi.

Step 1. Get a Crypto Wallet and Set It Up

To fully leverage the potential of DeFi, which encompasses activities like staking and lending, it is essential to have a non-custodial wallet at your disposal. While several decentralized, self-custodial digital wallets compatible with Ethereum exist, MetaMask is the most reputable option. In this guide, we will focus on investing in DeFi using MetaMask, but feel free to utilize any other wallet that suits your preferences, such as Trust Wallet, Coinbase Wallet, or other reliable alternatives.

Step 1.1. Get MetaMask from the Official Website by Clicking the “Download” Button

Upon visiting the MetaMask website, you will immediately spot the prominent “Download” button. Click on it to proceed. This will redirect you to the Chrome Web Store’s Download section.

Step 1.2. Add MetaMask to Your Browser

While in the Chrome Web Store, simply click the “add extension” button in your browser. Confirm the addition by selecting “Add Extension.”

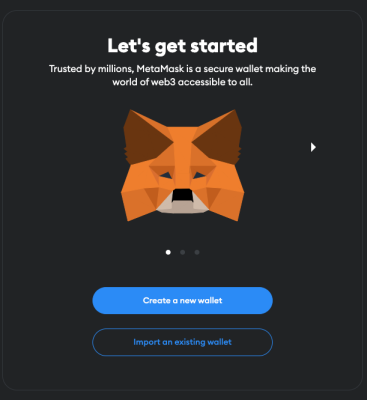

Step 1.3. Create Your MetaMask Wallet or Import an Existing One

Once you’ve clicked the “add extension” button, you’ll be taken to the MetaMask account setup page. If you already have a wallet, choose “Import an existing wallet.” If you don’t have a wallet yet, click “Create a new wallet.”

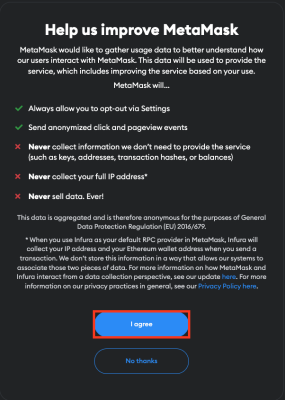

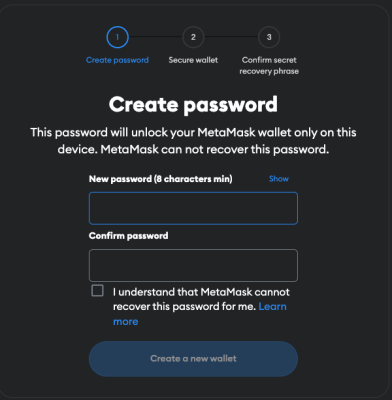

During the setup process, read and accept the terms and conditions. Set a password for your account, secure your wallet by safely storing your Secret Recovery Phrase (be cautious, as losing this code could result in losing your MetaMask assets), and confirm your Secret Recovery Phrase.

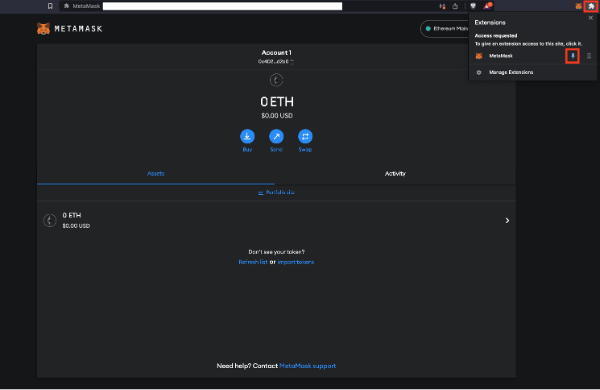

Step 1.4. Pin the MetaMask Extension

With your MetaMask account now configured, you can conveniently pin the MetaMask extension near your browser’s search bar for easy access. To access your MetaMask wallet in the future, simply click on the Foxface icon located in the top-right corner.

Step 2. Fund Your Wallet

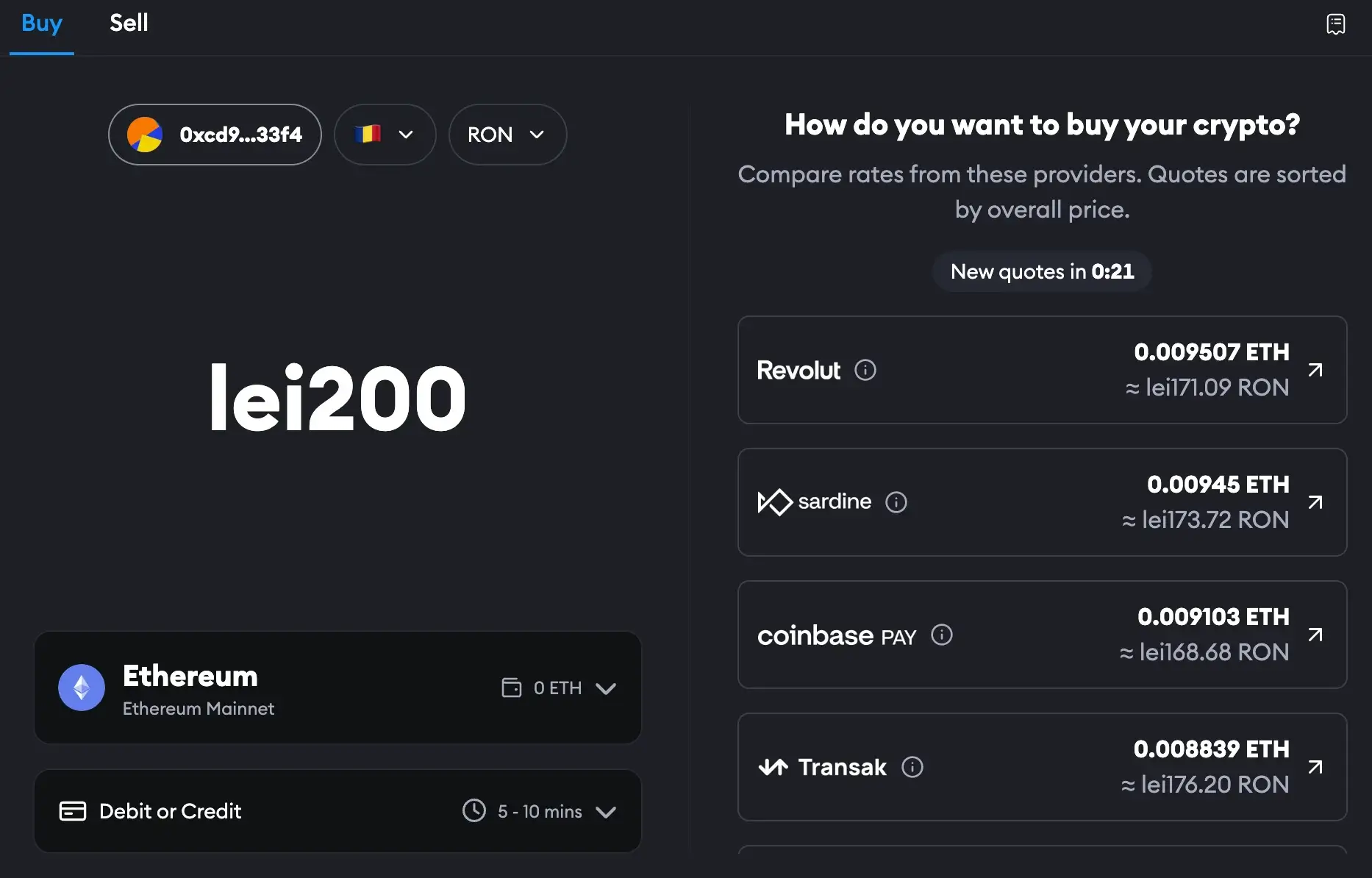

Buy the native tokens for the blockchain of your choice: in our case, ETH for Ethereum, the native token on MetaMask.

To purchase ETH directly from MetaMask, click on the “+” button, then choose the desired payment processor through which you wish to buy ETH. You will be presented with more options based on the processors available at your location. For example, we can choose from 5 different options: Revolut, Sardine, Coinbase Pay, Transak, and Ramp.

Among these options, Revolut provides the simplest method for purchasing ETH on MetaMask using a bank card, Apple Pay, or Google Pay.

Once you have made your selection, proceed with the chosen processor. The process is straightforward and efficient, allowing for a quick transaction experience.

Step 3. Buy DeFi Assets

Once having chosen the DeFi protocol you are interested in investing in, you need to purchase the corresponding DeFi tokens or coins.

You can buy tokens on any of the decentralized exchanges out there.

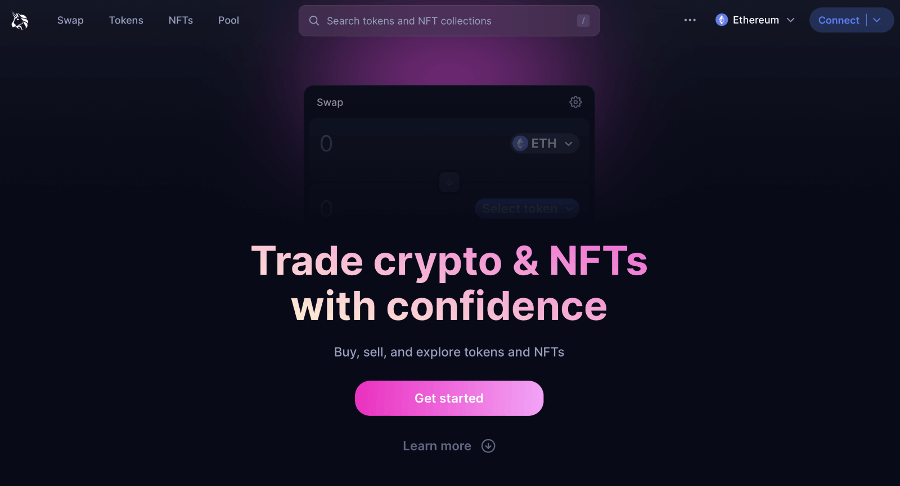

The MetaMask wallet seamlessly integrates with various decentralized exchanges (DEXs), offering users various options. Some of the DEXs that can be integrated with MetaMask include 1inch Network, VoltSwap, UniSwap, Biswap, and many more. To show you how to go through this process, we will choose UniSwap, but you can select any other DEX.

Step 3.1. Connect Your MetaMask Wallet to the Chosen DEX

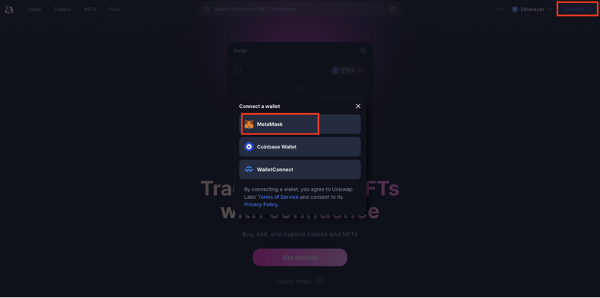

To connect your MetaMask wallet with your preferred DEX, start by copying your wallet address from account 1. While some DeFi platforms may offer simpler connection methods, in the example mentioned, the connection process is instant and straightforward.

After clicking the “Connect” button on the UniSwap platform and selecting MetaMask, you can confirm the connection, ensuring seamless integration between your MetaMask wallet and UniSwap.

Step 3.2. Trade Your ETH for Your Preferred DeFi Assets

Select Ethereum as the payment and your preferred DeFi asset as the coin you want to buy and proceed with the transaction.

Step 4. Engage in Staking, Lending, and Utilizing DeFi Protocols

Now that your wallet is set up and connected to the necessary platforms, it’s time to explore the exciting world of DeFi. You can begin by staking or utilizing your assets in yield farming, lending them out, or participating in various DeFi protocols.

The Most Popular Ways to Invest in DeFi

The most popular ways to invest in DeFi include lending, trading, and staking. Let’s take a peek at what these terms convey.

DeFi Lending

DeFi lending operates similarly to traditional bank lending services but with a crucial distinction — it is facilitated by decentralized peer-to-peer applications (DApps).

These DeFi lending platforms enable users to borrow and lend funds, presenting an opportunity for cryptocurrency holders to generate substantial income.

The process of DeFi lending is straightforward, emphasizing trustless financial transactions. Users can securely lock their crypto assets on the DeFi lending platform directly, eliminating intermediary concerns. Also, borrowers can access loans directly from the decentralized platform through peer-to-peer lending arrangements.

Moreover, DeFi lending protocols empower lenders to earn interest on their crypto assets. In contrast to traditional bank loan systems, DeFi lending allows individuals to become lenders akin to banks. Lenders can easily lend their assets to others, accumulating interest on the loans provided.

Similar to loan offices in traditional banks, DeFi lending primarily relies on lending pools. Users can contribute their assets to these pools, ensuring swift distribution among borrowers facilitated by smart contracts.

Lenders need to understand the different interest allocation mechanisms available, as various options exist. Similarly, borrowers should conduct thorough research on lending pools, as each pool may have its own unique approach to borrowing.

DeFi Trading

This is the simplest and most common way to invest in DeFi.

DeFi Trading refers to the act of buying, selling, and exchanging cryptocurrencies and other digital assets within decentralized financial platforms.

Unlike traditional centralized exchanges, DeFi trading occurs on decentralized exchanges (DEXs) that use smart contracts on blockchain networks.

Basically, this is similar to buying and selling cryptocurrencies on platforms like Binance but occurs on decentralized exchanges (DEXs) like UniSwap. It involves acquiring coins to hold and sell at a higher price, all within a decentralized and transparent trading environment.

DeFi trading platforms often provide a wide range of trading options, including spot trading, where users can buy and sell assets at current market prices, as well as more advanced features, such as margin trading and decentralized derivatives trading.

DeFi Staking & Yield Farming

DeFi staking involves locking crypto assets in a smart contract to earn rewards and generate passive income. It offers an appealing incentive for cryptocurrency investors to hold onto their assets while potentially earning significant returns. Both fungible tokens and non-fungible tokens (NFTs) can be staked, with rewards typically resulting in earning more of the same token. Compared to traditional savings accounts, DeFi staking attracts investors with the promise of higher rewards.

In contrast, yield farming in DeFi refers to leveraging various protocols to maximize returns on cryptocurrency holdings. This strategy involves providing liquidity to decentralized exchanges (DEXs) or lending platforms in exchange for rewards such as interest payments or additional tokens. Yield farming can be more complex and dynamic than staking, often involving actively seeking out opportunities across different DeFi protocols to optimize returns.

Unlike proof-of-work (PoW) blockchains that rely on computational power for transaction verification, DeFi staking operates on proof-of-stake (PoS) networks. Validators, who are the primary stakers, verify transactions within these networks. This approach offers an alternative consensus mechanism that is more energy-efficient and cost-effective than PoW.

What is DeFi?

DeFi, short for Decentralized Finance, is a part of the crypto industry that aims to bring the functions of traditional finance into the realm of digital currencies. It achieves this by breaking down different financial services and making them decentralized.

DeFi presents many practical benefits, positioning it as a compelling alternative to traditional financial systems.

One primary advantage lies in its ability to eliminate intermediaries such as banks or brokers, reducing costs and granting users enhanced control over their funds. Basically, DeFi allows you to do things like lending, borrowing, earning interest, and trading assets using smart contracts. It’s similar to traditional banking but with the power of cryptocurrency.

Rather than relying on a bank or institutional approval, various financial activities such as lending, borrowing, and trading can be seamlessly conducted via open-source protocols within a decentralized financial network. The absence of bureaucratic back-offices or layers of management ensures that your transactions are exclusively governed by you and the smart contract, eliminating unnecessary delays or processing hurdles.

Furthermore, DeFi’s inclusive nature makes it accessible to individuals worldwide with an internet connection, extending financial services to unbanked and underbanked populations. The underlying blockchain technology ensures transparency and immutability, strengthening security measures and mitigating the risk of fraudulent activities.

Last but not least, DeFi empowers individuals by bestowing financial sovereignty and propels innovation in the financial sector by enabling unrestricted access to a wide range of financial services across borders.

In simple terms related to how DeFi works, imagine you have some digital money and want to earn interest on it. Instead of going to a traditional bank, you can use a DeFi platform that automatically lends your money to others and makes interest for you. It’s like having a digital piggy bank that works for you.

DeFi projects include various applications and tools such as asset management platforms, decentralized exchanges (DEX), and infrastructure for DeFi development. These projects continue to improve over time, with better token economics and more secure systems, although they still come with risks.

Why is DeFi Popular?

It’s clear as daylight that DeFi has taken the financial world by storm. By replacing human trust with math-based trust, paperwork with smart contracts, legal enforcement with cryptographic enforcement, and third-party audit with open-source code and public ledger, DeFi has revolutionized traditional finance from the ground up.

DeFi empowers developers to create an array of groundbreaking financial products. From decentralized banking to money markets and asset management firms, these innovative platforms have brought unprecedented possibilities to users’ fingertips.

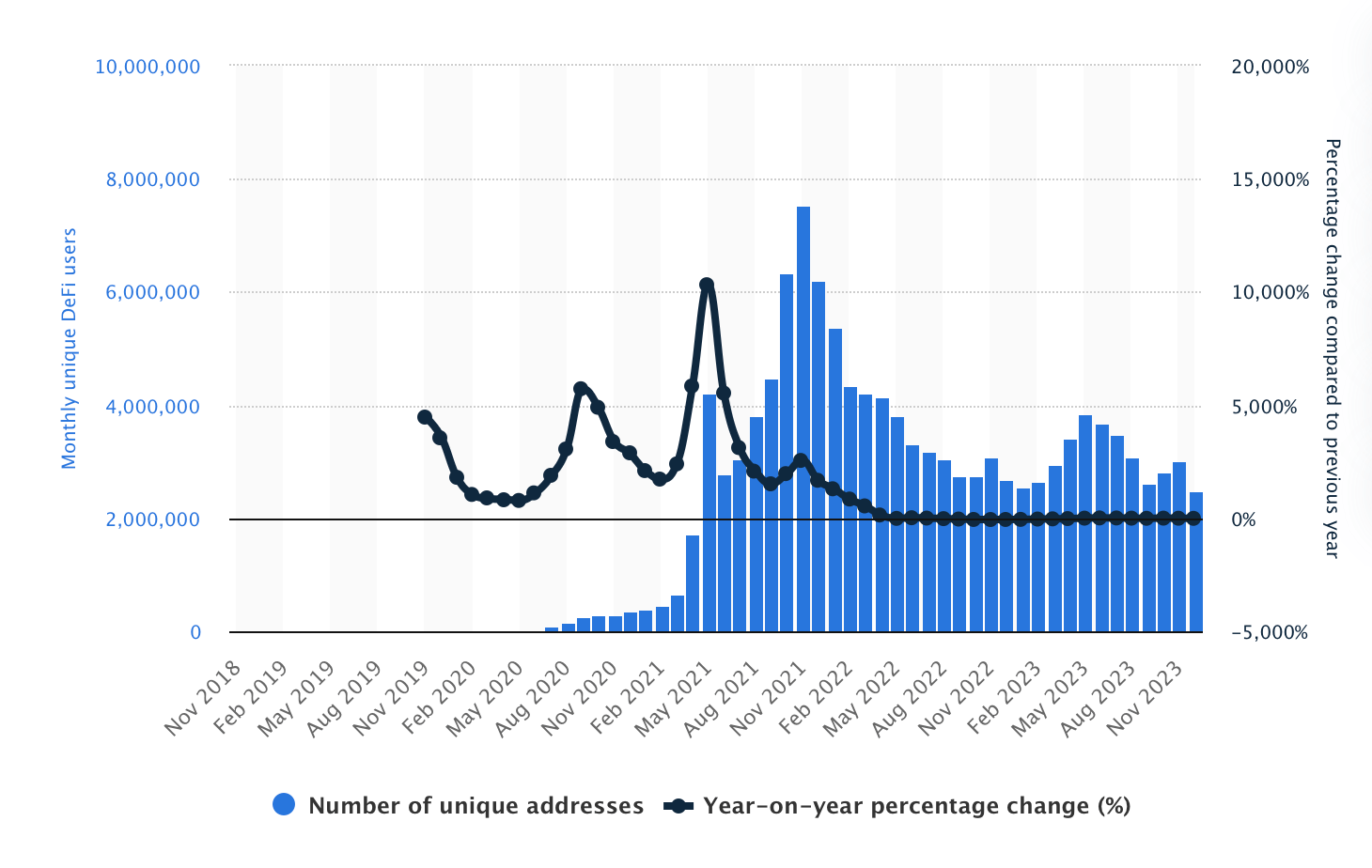

Also, the staggering growth of DeFi speaks for itself. In 2020 alone, the total value locked (TVL) in DeFi increased twentyfold, showcasing the tremendous interest and confidence in this new frontier of finance. With a rapidly expanding user base surpassing one million people, DeFi has emerged as the go-to choice for those seeking alternative investment channels. And even though it was a bear market and the entire crypto market suffered, you can see that the DeFi ecosystem still remained at an impressive value, and the more visible the bull market looks, the more it will grow.

Considering the benefits it brings and looking at the numbers that already exist by 2023, this year, the trajectory to the moon for DeFi technology is visible. So, we can understand why the technology is so popular.

Is DeFi Good to Invest In?

If you’re new to DeFi and wondering about its safety, finding the best DeFi investment may seem challenging. While DeFi offers user anonymity and promises greater efficiency, it’s crucial to know the risks involved, such as regulatory uncertainties and unexpected vulnerabilities. Smart contract code flaws and crypto scams like rug pulls are additional risks to consider.

Moreover, the decentralized nature of DeFi may not always hold true, as small stakeholder groups often replace traditional banking roles. Besides, without safeguards or insurance, unfortunate accidents could result in a complete loss of assets. Despite these risks, thorough research and evaluating risk tolerance can help identify promising DeFi projects.

So, if you can take on board the aspects mentioned above, it’s worth investing in DeFi, but again, be careful what you invest in. Investing solely in DeFi projects with provable real use cases, such as governance, staking, etc., is best.

Besides, according to statistics, we can see that people are adopting more and more, thus meaning that they see more advantages than disadvantages in this industry.

FAQ

What is the Best DeFi Investment?

All ways of investing in DeFi (lending, trading, staking, and others) can bring good returns, but the best return is brought by DeFi trading.

What is the Best Way to Invest in DeFi?

The best way to invest in DeFi is based on a very well-founded strategy and through a DEX that will allow you to invest in other ways to earn through DeFi.

What DeFi Coins to Invest In?

There are a multitude of DeFi projects on the market with enormous potential. Among the most popular DeFi crypto are Avalanche (AVAX), UniSwap (UNI), Chainlink (LINK), Lido DAO (LDO), PancakeSwap (CAKE), 1inch Network (1INCH), and Ankr (ANKR).

How Much Money Do I Need to Use DeFi?

The amount of money needed to use DeFi varies depending on your investment goals and chosen protocols. You can start with as little as $1 or a few hundred dollars for activities like staking and providing liquidity.

However, more complex DeFi investment strategies or certain projects may require a larger capital base. It’s important to assess your financial situation and risk tolerance and thoroughly research before investing in DeFi. Start with an amount you’re comfortable with and gradually increase investments as you gain experience.

Final Words

DeFi presents a remarkable investment opportunity that, if approached with caution and diligence, can potentially yield substantial rewards. However, it is essential to recognize that the DeFi industry is still new, and as with any emerging market, there are risks.

While the potential for high returns is enticing, exercising caution and conducting thorough research before investing in any DeFi project is crucial. The industry has attracted its fair share of opportunistic actors seeking to exploit inexperienced investors. Being aware of this makes it even more important to educate yourself and carefully assess the projects and platforms you invest in.

Moreover, the current state of inflated prices adds another layer of complexity to the decision-making process. It becomes challenging to determine whether the prices accurately reflect genuine market demand or result from orchestrated efforts to drive up prices temporarily. This uncertainty emphasizes the need for careful analysis and a long-term investment approach.

While the potential rewards of DeFi investment are enticing, balancing the excitement with a rational assessment of risks is crucial.