If you’re thinking about starting your own cryptocurrency, you might be worried about needing technical skills. But don’t stress too much because we are here, and we’ll cover the basics so you can understand the process.

In this article, we’ll explore how to create a cryptocurrency on your own and what you need to do to succeed. Keep in mind that there are many aspects to consider beyond just creating the currency itself.

Before everything else, let’s clarify that a cryptocurrency is a digital currency, based on a coin or a token, that regulates the generation of units and transfer of funds verification using encryption techniques independently of a central bank.

Cryptocurrency allows peer-to-peer transactions with low to no fees anywhere in the world. It also provides excellent privacy and is difficult to hack due to the consensus validation mechanism.

Now, let’s dive into the technical process of how to create your own cryptocurrency and discuss what you need to consider during and after its creation.

How to Create Your Own Cryptocurrency – 3 Different Methods to Choose From

In order to create your own cryptocurrency, you have 3 main methods to do this:

1. Create Your Own Crypto on Top of an Existing Blockchain Infrastructure: This method involves creating your token using an existing blockchain infrastructure. It’s the least complex and easiest to achieve. We’ve prepared a step-by-step guide below to help you create your own token.

2. Create a Cryptocurrency by Forking an Existing Blockchain Platform: This involves making modifications to an existing blockchain platform to create your cryptocurrency. While feasible, it requires more technical expertise and resources.

3. Create Your Own Blockchain Platform: This option involves building your blockchain platform from scratch. It offers the most customization but is also the most complex and resource-intensive. We recommend consulting with a blockchain developer or assembling a team to ensure the best chance of success and a robust blockchain architecture.

1. Create Your Own Cryptocurrency on Top of an Existing Blockchain Infrastructure

If you have decided to build a crypto token, you can use the smart contract’s functionalities of networks like Ethereum and NEO. With ERC-20 and NEP-5, you can quickly set up your token without needing too much technical skill.

The greatest advantage of building a cryptocurrency on top of an existing protocol is that you can piggyback on an existing network (like Ethereum) and rely on it to update, manage, and improve the technical side of the cryptocurrency.

However, that comes with a significant downside.

You will have little to no autonomy and always depend on the hosting blockchain. You don’t have any say in the future development of the blockchain, and you may have to pay specific fees to complete transactions (like Gas in Ethereum).

And if the network is shut down, the smart contracts your token is built on will also shut down.

However, if you’re willing to tackle the challenge and opt to develop your own cryptocurrency by leveraging an existing protocol, here’s a detailed guide on how to do it using the Ethereum blockchain:

Step-by-Step Guide

Step 1. Create a Web3 Wallet and Buy Some ETH (Test ETH)

To initiate the deployment of your contract on the Ethereum Sepolia testnet, you must first install the MetaMask browser extension or utilize another Web3-compatible wallet.

After setting up your wallet, you must obtain some test ETH.

Step 2. Writing a Smart Contract

Building a secure smart contract for your cryptocurrency is like building a complex machine from scratch. It requires expertise you might not have as a beginner.

That’s why we will use this example and recommend using pre-built, high-quality parts instead.

OpenZeppelin offers a collection of secure and tested smart contract building blocks similar to those pre-built parts. They have a specific block specifically designed for creating tokens on the Ethereum blockchain, called the ERC-20 token standard.

Instead of writing the entire contract yourself, you can leverage this pre-made ERC-20 block from OpenZeppelin.

Here’s how it works:

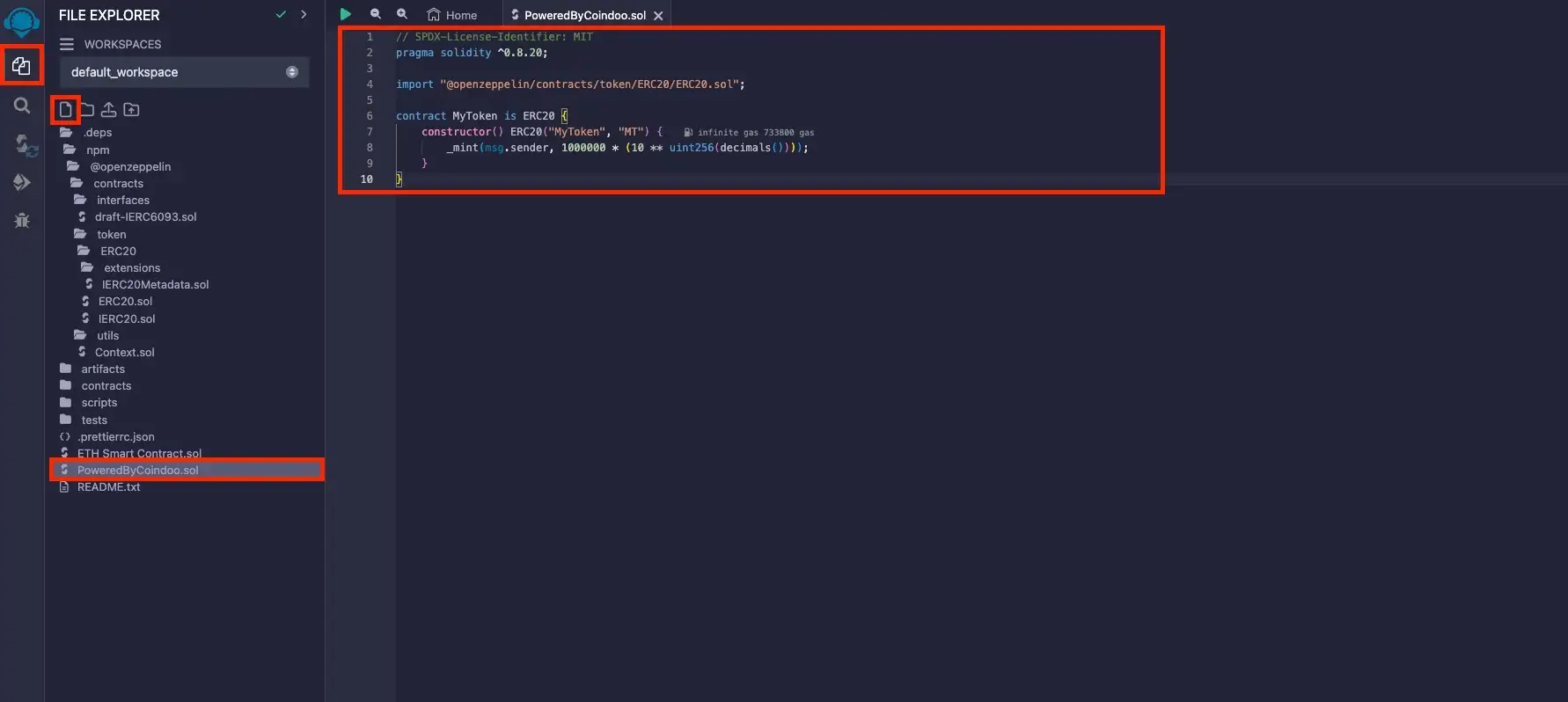

- Use Remix IDE, a web-based tool for working with smart contracts.

- Create a new file where you’ll write your token’s code.

- Instead of writing everything yourself, simply “plug in” the OpenZeppelin ERC-20 code. This code has been thoroughly tested and is considered secure.

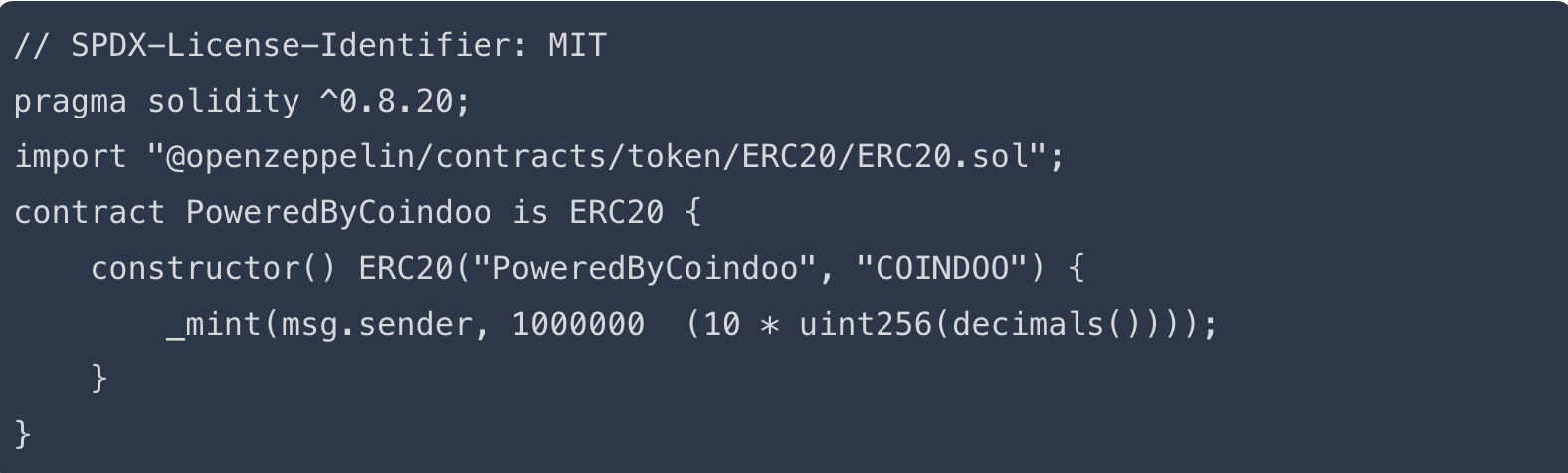

// SPDX-License-Identifier: MIT – Specifies the license under which the contract is released.

pragma solidity ^0.8.0; – Specifies the compiler version to use.

import “@openzeppelin/contracts/token/ERC20/ERC20.sol”; – Imports the ERC20 contract from OpenZeppelin as a base.

contract PoweredByCoindoo is ERC20 { – Defines the name of the contract and extends the ERC20 contract.

constructor() ERC20(“PoweredByCoindoo”, “COINDOO”) { – Initializes the token with a name (“PoweredByCoindoo”) and a symbol (“COINDOO”).

_mint(msg.sender, 1000000 10 * decimals()); – Mints an initial supply of tokens (1 million) and assigns them to the deploying contract’s address. Adjusts the number of tokens by the decimals value (defaults to 18 in OpenZeppelin implementation).

- You can still personalize your token by changing its name and symbol within the provided code. For instance, our token is named “PoweredByCoindoo,” and the ticker is “COINDOO.”

The pre-written code performs essential functions like setting the token’s name and creating an initial supply.

While you can further customize the code for specific functionalities, this method allows you to launch your cryptocurrency with a secure and efficient starting point.

Step 3. Deploy the Smart Contract

Once you’ve finished customizing your smart contract, it’s time to deploy it.

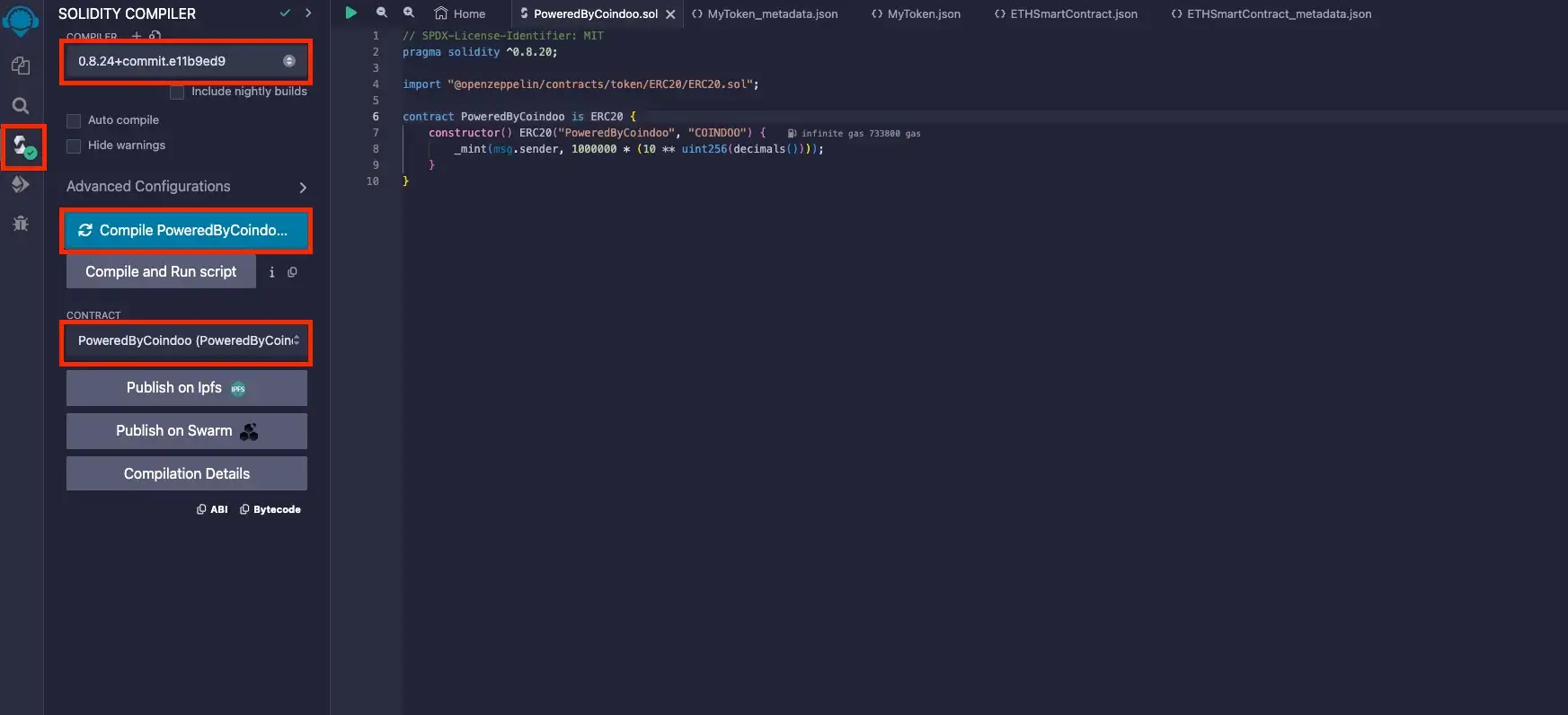

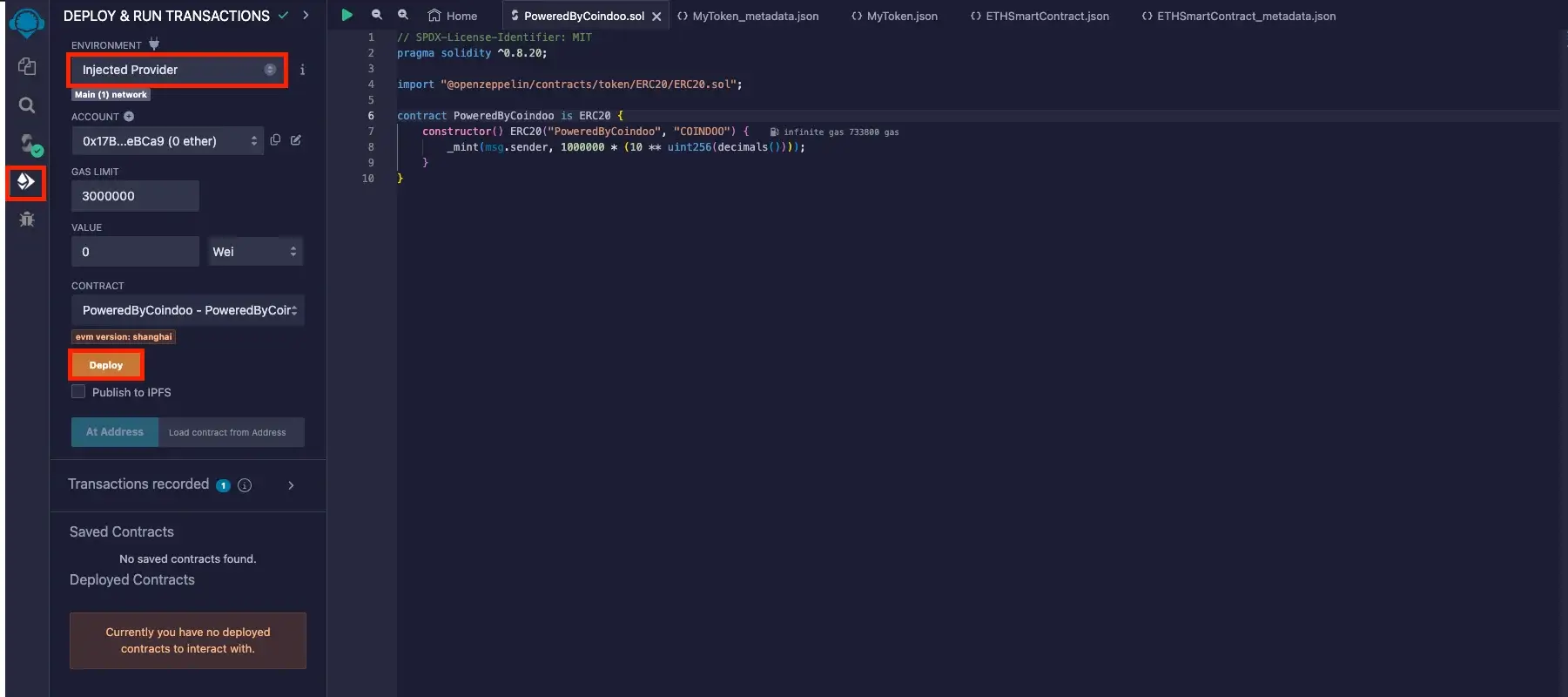

Click the Solidity compiler button to ensure the correct compiler version and selected contract are displayed. Then, click the Compile (projectname).sol button. If the compilation is successful, you’ll see a green check mark on the Compile button.

After that, navigate to the Deploy & Run Transactions tab. Choose the Injected Provider option under the Environment for deployment. Before deploying, ensure your MetaMask is set to the Sepolia testnet and your smart contract is selected for deployment. Finally, click the Deploy button to initiate the deployment process.

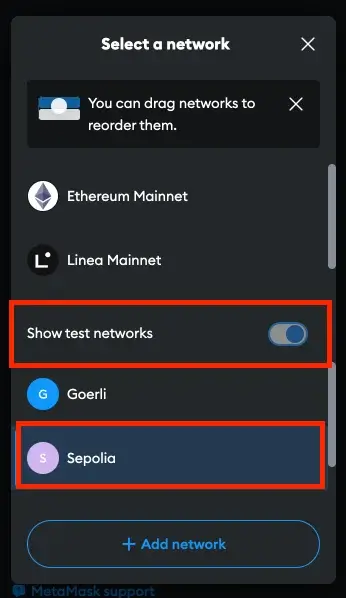

If you’re unsure how to switch to the Sepolia network in MetaMask, open the MetaMask extension, click the Network Selector in the top-left corner, and select Sepolia. If you don’t see it, ensure that the Show test networks option is enabled.

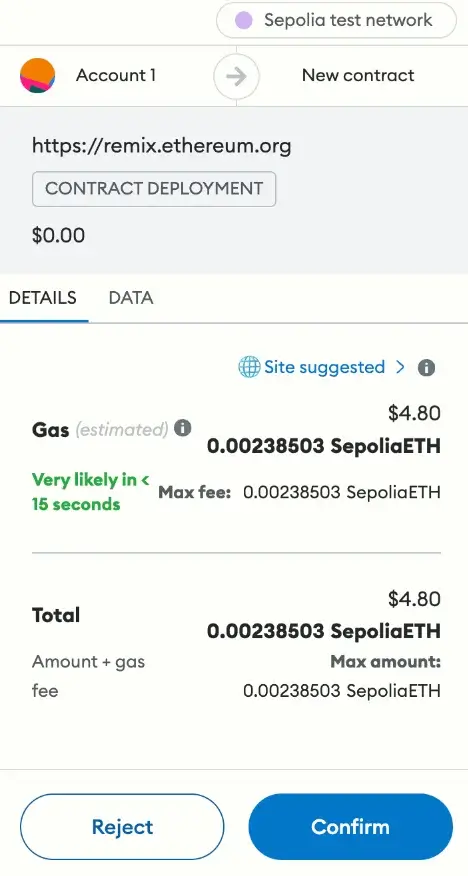

Step 4. Confirm the Transaction in MetaMask

Once you’ve clicked on deploy, you’ll be directed to a MetaMask page to pay the gas fee. Once the transaction is approved, your token contract will be successfully deployed on Ethereum’s Sepolia testnet!

Next, you will be able to engage with it by clicking the arrow (>) adjacent to the contract’s name in the “Deployed Contracts” section to explore the contract’s functions.

Also, to view your contract on a blockchain explorer, visit the Etherscan Sepolia Explorer and search for your contract’s address. Your token’s name and symbol are listed under the Token Tracker section.

2. Create a Cryptocurrency by Forking an Existing Blockchain

While launching a blockchain, you don’t have to reinvent the wheel. You can simply take the open-source code of an existing blockchain and add modifications to serve your own purposes.

For example, the open-source code of Bitcoin was released in January 2009. Since then, anyone can launch his private cryptocurrency based on it.

However, getting access to the source code doesn’t spare you the work you have to put into building a network large enough to have your blockchain considered secure.

You can try forking Bitcoin manually or automatically with a fork generator like ForkGen.

Developing your blockchain using existing, already-proven code is a big plus. But the least complicated part is creating your fork out of a consecrated blockchain.

You may have the autonomy of a crypto coin, but the big downside is that you have to get the community’s support to succeed. And if your network isn’t large enough, you will be susceptible to a 51% Attack.

SIDENOTE. A 51% Attack (Majority Attack) is an attack on the blockchain by a miner (or group of miners) who owns more than 50% of the network’s mining hash rate or computational power.

3. Create Your Own Blockchain

If you’ve got the money, the time, knowledge, and the team, you can just go forward and build your blockchain from scratch and base your own crypto coin on it. This may be the case, primarily if existing blockchain protocols cannot support your vision.

When you create your cryptocurrency from scratch, you get the best control over it, especially the consensus mechanism.

In the blockchain, the consensus mechanism refers to the system of rules used to approve the transactions on a chain. To define the identity of your cryptocurrency, you should also look into the current consensus mechanisms and choose the most fitting one.

There are quite a few distributed consensus mechanisms, and the Proof of Work (POW) and Proof of Stake (POS) are the most widespread.

Proof of Work is based on blockchain members solving computational puzzles through hash functions. In exchange for the effort, miners receive a fraction of the coin each time they solve an equation.

With the energy consumption and mining costs continuously growing, the need for a new consensus mechanism manifested in Proof of Stake. PoS, a significantly cheaper and environmentally friendly mining method, doesn’t require powerful computers but the confirmation of operations through existing coins.

The more coins someone holds, the more chances he has to validate. In a PoS consensus mechanism, validators are people who stake their coins.

The great advantage is that you will be autonomous and may bring significant innovations to blockchain technology. On the other hand, starting from scratch is the costliest option. You will need a passionate team to develop the project.

SIDENOTE. You can employ and commission dedicated development companies (known as blockchain as a Service – BaaS) to build a blockchain for you.

Important Factors to Consider When Creating a Cryptocurrency

1. Define the Purpose of Your Cryptocurrency

When launching a cryptocurrency, you first need to define the purpose it will serve. Identify a problem or an unmet request on the market and create your cryptocurrency as a solution to that problem.

It’s important to understand that most cryptocurrencies have no intrinsic value and no governmental institution backing them. Their monetary value comes from the people empowering them. When it comes to people who invest in crypto, there are at least two kinds: crypto investors and speculators.

- Investors usually invest in it in the long run. They either buy the coin or token in its ICO stages or buy in along the way. Investors help raise the value by keeping the currency for extended periods and acquiring products and services.

- Speculators are those who only buy in and cash out shortly for profit. Because of speculation, most of the new altcoins are reduced to dust soon after release. Even Bitcoin and other popular altcoins are affected by speculators, especially when their value increases significantly.

However, a well-taught plan and a revolutionizing concept considerably increase the chances of success.

For example, Bitcoin came out as a purely peer-to-peer version of electronic cash. It was meant to allow online payments to be transferred between parties without the need for a financial institution. Even though it’s far from perfect, people believe in it, making Bitcoin the #1 cryptocurrency.

Besides Bitcoin, there is Ethereum, the pioneer for blockchain-based smart contracts, which has kept its position as the #2 cryptocurrency for years.

SIDENOTE. A smart contract is a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code.

In both scenarios, the initiators came up with revolutionary concepts.

Bitcoin was a purely peer-to-peer version of electronic cash. In Ethereum’s case, it consisted of Smart Contracts and Distributed Applications built on an existing blockchain. The investors have stuck with them for better or worse.

So, just as in these two examples, both currencies have a real-world utility that attracts investors and speculators. Therefore, look for a utility or solution that is as necessary for humanity as possible.

2. Create a Brand Identity

Now, in 2024, there are thousands of cryptocurrencies in the market. If you want to start a cryptocurrency, even a cryptocurrency token or coin, you will need a brand. And, well, a brand is an emotional and/or philosophical concept. It is closely related to what people think of you.

To create a brand, you first need to design a brand identity. Brand identity refers to the visual components that represent the brand ideas.

To create a cryptocurrency brand identity, focus on the following three elements:

- Name;

- Symbol;

- Logo.

The name you choose can be related to the purpose or made up. However, you will have to give it meaning through your story because the name you choose will become your brand. It has to be catchy to build a community around it.

Besides being catchy, your name must also be easily pronounced. Getting too creative with the spelling and pronunciation will make it harder for your audience to pronounce your brand name correctly.

Just drop them if you want to use tails like coins, tokens, or cash. In the early years of cryptocurrency, it was a common practice to use “coin” in the name (Bitcoin, Litecoin, Dogecoin), but it became overused.

After finding a suitable name, you will also need a fitting symbol.

Your cryptocurrency’s symbol must be a combination of 3-4 letters, preferably an abbreviation of the name. It has to be unique, easy to remember, and easy to associate with the name. The symbol is also used on listings and exchanges to identify your cryptocurrency.

Next up is the logo. It will be the first graphical element of your identity that investors will see. When you enter the cryptocurrency market, you must ensure your logo is easily identifiable and looks good in a small format on listings. Nowadays, cryptocurrency exchanges and listings are essential.

Your cryptocurrency token or coin will mainly be added to a table with other currencies. If your logo can draw attention to those listings, extending your community will make it easier.

Effective branding may kickstart a project and keep it flying. In the days, Dogecoin (DOGE) took an internet meme and turned it into a cryptocurrency. The well-known Shiba Inu meme was used to brand the coin, and the community found it quite entertaining and chose to support it massively.

While Dogecoin got listed on big exchanges like Binance and Coinbase and flourished in the top 10 cryptos, the concept of the doge meme-coin seems to be replicated by DogeCash and DogeToken. By looking at CoinMarketCap, the two new currencies don’t seem to be doing well. This situation may illustrate the importance of being original and innovative when trying to create a new cryptocurrency.

3. Do You Want to Create a Coin or a Token?

Before creating your cryptocurrency, you should decide between building a cryptocurrency coin or creating a token.

Coins don’t just store or exchange value. They are also used to back applications, transactions, smart contracts, and even for staking.

Tokens represent particular assets or utilities, tradable to commodities, loyalty points, cryptocurrencies, and others.

Coins took over many characteristics of tokens. The main difference between them is that a coin is based on its own blockchain network, independently of any platform. A token is based on top of a protocol through a smart contract built on a blockchain platform such as:

- Ethereum;

- Omni;

- TRON;

- Binance Coin;

- Stellar;

- NEO.

4. Check the Potential Legal Issues

Before going forward with creating a new cryptocurrency, make sure to check the legislation in your area.

Digital coins and tokens are mainly unregulated. However, the fear of illegal usage, high volatility, and investment risks stirred the reticence of governmental agencies.

To ensure legal compliance, you can even ask for an external audit.

Cryptocurrency Legal Status in China

Since 2021, when China chose to ban cryptocurrency, it has been the first government to restrict financial institutions from engaging in cryptocurrency transactions.

China also prohibited any crypto mining by June 2021 and finally outlawed cryptocurrencies outright in September.

The country has gotten concerned, especially about the effects of mining on the environment and people using digital currencies for fraud and money laundering.

Even though they have outlawed any cryptocurrency, China has started pushing their digital yuan currency, and they are trying to make this token widely available to consumers.

Cryptocurrency Legal Status in the USA

The president, in March 2022, issued an executive order directing major government agencies to coordinate their efforts in formulating cryptocurrency rules to safeguard investors and prevent unlawful usage without limiting innovation.

Some states, like Wyoming and Texas, passed crypto-friendly laws to attract business.

But around the USA, the federal authorities are taking care of the cryptocurrencies to ensure that there is no money laundering, protecting investors and people who invest in them.

Cryptocurrencies are not illegal in the United States. But when it comes to acquiring them, what services and exchanges you should use and what you can use them for may differ depending on your state. However, after the fall of the FTX Exchange, new regulations are expected in the crypto space.

The IRS, the agency in charge of enforcing tax payment regulations, is still taxing as “property” cryptocurrencies, including non-fungible tokens (NFTs) in the United States, and are subject to capital gains taxes.

And when it comes to laws, if a cryptocurrency constitutes security, it falls under corresponding regulations of Federal Law. Futures and contracts of cryptocurrencies that include commodities fall under the Commodity Exchange Act.

Cryptocurrency Legal Status in France

The French government refers to cryptocurrencies as crypto assets or digital assets, which may be contained in a digital commodity. They encourage the development of cryptocurrencies and blockchain technology and offer a favorable framework.

Individuals who choose to invest as part of the wealth management plan are subject to a flat-rate tax of 30% beginning on January 1, 2023, regardless of transaction volume. In this case, they can pick the timetable, subject to additional social security contributions of 17.2%. This option is for the households’ interest or those in the 11% tax bracket and allows the social welfare tax (GSG) deduction of up to 6.8%.

Also, in France, cryptocurrencies fall under anti-money laundry regulations, know your customer obligations, and several other EU securities laws.

Cryptocurrency Legal Status in Russia

As for Russia, the Central Bank has submitted its own proposal to the Finance Ministry, which states that the Central Bank wants to ban the issuing and circulation of private cryptocurrencies, with a fine of 30-50,000 rubles for individuals and up to 1 million rubles for the entities that violate this rule. Also, there is another ban on advertising cryptocurrencies.

The general governmental stand in Russia is against cryptocurrencies, but they support blockchain technology.

There are no laws to govern cryptocurrencies directly, only the Digital Rights law covering more aspects of the online sphere.

In Russia, the Rouble is the only means of payment; therefore, they consider cryptocurrencies ineligible for payment. Cryptos also fall under the existing anti-laundry law without any express regulations.

When it comes to taxes, there applies only the general tax code, and for any gains, there is a proportional income tax.

Cryptocurrency Legal Status in Korea

In Korea, cryptocurrency regulation has just begun, and no clear guidance provides regulatory authority.

But recently, they have introduced some laws so they can identify the customer, and not only these laws also fall under the KYC and AML. And the new companies have to submit all the company details to the financial intelligence unit.

Korea does not consider them currencies, electronic currencies, or financial investment instruments, but they can be confiscated if obtained through criminal activities.

Korea banned cryptocurrency margin trading and ICOs for coins and tokens registered as securities.

It is unclear what laws apply to Bitcoin and other already existing cryptocurrencies.

Exchanges are not prohibited, but they have to abide by the Real-Name Verification System, requiring their customers to provide essential identification information before opening cryptocurrency accounts.

There is no official taxation law for cryptocurrency, only the applicable law.

5. ICO or IEO?

Once you have created a cryptocurrency, you might as well want to give it value. To do so, you will need investors, and to reach investors, you can approach an Initial Coin Offering (ICO) strategy or an Initial Exchange Offering (IEO) strategy.

ICOs had a boom in 2017 and 2018, raising billions of USD. However, in 2019, IEOs took the lead.

If you have decided on an ICO, go ahead and check our previous article on how to market an ICO.

If you have decided to go with an IEO, the crypto exchange is the one that manages the crowd sale, the KYC (Know Your Customer), AML (Anti-Money Laundering), and most of the Marketing activities as well. Some of the best crypto exchanges that offer services for IEOs are Binance Launchpad, Bittrex, and Kucoin Spotlight.

In January 2019, BitTorrent launched a token sale on Binance Launchpad and raised $7.2 million, hitting the hard cap in less than 15 minutes.

However, BitTorrent was a significant brand to begin with.

When launching an IEO, you should also pay attention to your website and whitepaper. Keep it accurate and connect with your community on social media. You can even go forward and have some press releases published about you.

Benefits of Having Your Own Cryptocurrency

Over the past years, blockchain technology has gained so much popularity that it has pushed more money into that sector. Currently, thousands of cryptocurrencies are running on several blockchains that act as a support structure for digital coins.

Bitcoin is the pioneer cryptocurrency. However, other cryptocurrencies exist to cover different niches. It is anticipated that each business will wish to use blockchain technology to advance. There are several reasons why someone would want to develop their cryptocurrency, and these are some of the reasons:

- Reduce the Risk of Fraud: Cryptocurrencies are considered one of the most secure ways of conducting transactions. If you learn how to create a cryptocurrency, you can reduce the risk of committing fraudulent transactions.

- Maintain Transaction Anonymity: Generally, cryptocurrencies are referred to as anonymous digital currencies. The identities of those performing cryptocurrency transactions are usually a secret and will always remain a secret. Once you discover how to create a cryptocurrency, you can conduct anonymous financial transactions.

- Lower the Costs of Operations: The average transaction cost on the Bitcoin network was as low as $8.07 on March 13, 2024. The same can be said about other existing cryptocurrency networks. Lower operation costs incentivize users to develop their cryptocurrency to lower costs and maximize profits.

- Increase the Level of Security During Transactions: Data encryption and asymmetric cryptography help increase security in ongoing transactions. Each transaction must be authenticated and approved as legitimate before it can be completed. Therefore, the desire for fraud-free transactions pushes individuals to want to come up with their cryptocurrency.

- Cut Out Middlemen in Transactions: Using cryptocurrencies eliminates intermediaries since one can run their web domain on a blockchain domain. This means that cryptocurrency owners own their domains and will not need to pay fees for hosting. On the other hand, owning a cryptocurrency gives one free access to code from an open-source community that will allow them to develop a superior product. These are the main reasons you should learn how to start your cryptocurrency.

Pros and Cons of Making Your Own Coin

Pros:

- You can customize the cryptocurrency as you wish;

- Chance to develop better blockchain technology;

- Possibility for the cryptocurrency to accumulate significance and make more capital.

Cons:

- Demands technical expertise;

- It can be time-consuming and expensive;

- Requires constant supervision for the cryptocurrency to thrive.

FAQs

Is It Profitable to Make Your Own Cryptocurrency?

Creating your own cryptocurrency can potentially be profitable, but several factors must be considered before embarking on this endeavor.

For example, remember that the crypto market is highly competitive and constantly evolving, involves high upfront costs, and the success of a cryptocurrency is mainly dependent on adoption and usage by individuals and businesses.

However, suppose you respect the aspects mentioned in the article, and the project you want to develop will have a utility you can depend on. In that case, there is a chance that it will be profitable.

Is It Legal to Create a Cryptocurrency?

Cryptocurrency creation is generally legal. However, some countries and jurisdictions have partly or wholly banned cryptocurrency. You can read above on the legality of cryptocurrencies for some major countries in the industry.

How Long Does It Take to Create a Cryptocurrency?

The time it takes to create a cryptocurrency depends on the type of development you want to use. If you are using open-source code, it can take even a few minutes. If you want to develop a cryptocurrency from scratch, according to your own preferences, it depends very much on the difficulty and complexity of the project.

For the initial stage, it can take from 1 to 6 months to create a cryptocurrency.

Of course, this also depends a lot on your technical expertise. If you don’t have it, it’s normal to take longer.

In any case, this would be about how long it takes to develop a cryptocurrency.

However, don’t forget that the challenge continues after development when you have to maintain, promote and constantly improve the project.

Also, keep in mind that projects such as Cardano and Polkadot have been around for years and are still works in progress.

How Much Does it Cost to Create a Cryptocurrency?

The cost of making a cryptocurrency differs widely based on how much you choose to customize the coin or token. Highly customized coins established on native blockchains are the costliest to develop, while establishing a standardized token, for example, on the Ethereum platform, can be free.

However, to give a more precise connection point, a coin on a native blockchain can cost between $10,000 and $30,000. But certainly, the cryptocurrency won’t be a highly customized one.

In the case of token creation, as mentioned above, it can even be free or cost a little, around $500, not requiring a whole team of specialists behind it.

Ultimately, it depends on how big the team you employ is and how far you plan to take your project.

How to Make Your Cryptocurrency: Final Words

Cryptocurrency is one of the most promising investments of our time. The advantages that come with the development of cryptocurrencies outweigh the disadvantages. This means those owning cryptocurrencies have a higher opportunity to benefit from them.

If one plans to run a successful business in the future, it will be a good idea for them to come up with their cryptocurrency. In that way, they will have laid the foundation for successfully growing their business, riding on the advantages of cryptocurrency.