We all know the Decentralized Finance landscape or DeFi is like a breath of fresh air within the industry, eliminating centralized authorities and other mediators.

However, as beneficial as this is, crypto investors, traders, Web3 developers, and other financial institutions still must draw their knowledge, key insights, and accurate data from somewhere.

Researching through endless data sources could be daunting and sometimes time-consuming, and discovering trending tokens, liquidity pool performance, and other historical data are often scattered across multiple platforms, compromising the decision-making process.

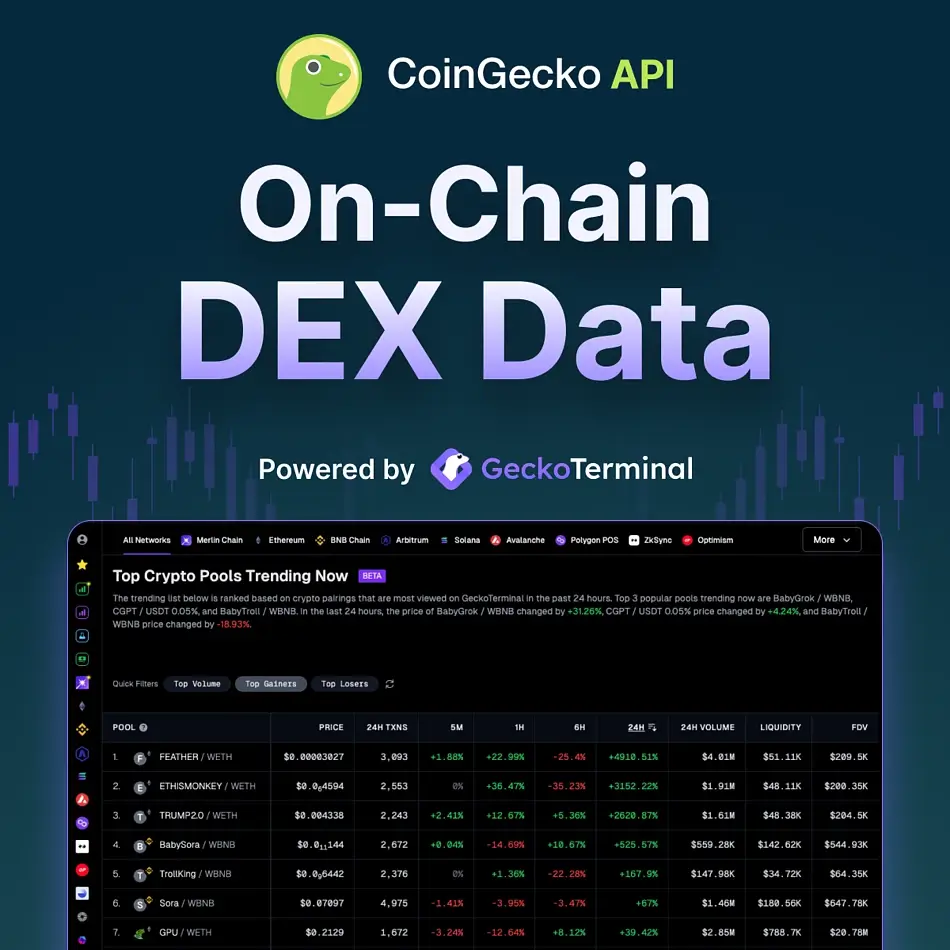

But you don’t need to get overwhelmed, as we are here to present a comprehensive solution – CoinGecko’s On-Chain DEX API.

In today’s article, we discuss this one-stop solution that unlocks valuable insights, helps you consolidate data, and gains real-time transparency within the industry, thus empowering your decision-making process for the better.

Read further as we break down the intricacies of CoinGecko’s on-chain DEX data API, displaying how this independent data aggregator entrusts individuals and businesses within the ever-growing DeFi and crypto world.

What are Crypto DEXs?

DEXs, or Decentralized Financial Exchanges, are peer-to-peer marketplaces where crypto transactions are made directly between crypto trades. As such, there are no middlemen or intermediaries, as seen in Centralized Exchanges.

Usually, the mediators are centralized authorities, such as banks or brokers, yet a DEX fulfills a core crypto need. Some of the most popular DEXs in 2024 are UniSwap, OKX, and SushiSwap.

Moreover, some of the benefits include:

- First and foremost, there is anonymity, as being a DEX, no personal information is required;

- Reduced hacking risks due to crypto traders storing their digital assets within their crypto wallets;

- Crypto traders have access to a broader range of crypto projects and tokens due to increased pool liquidity;

But what does it have to do with CoinGecko’s On-Chain DEX Data API?

By understanding the DEX on-chain data, any investor and crypto trader can gain insights into the DeFi and blockchain ecosystems besides identifying high token pairs or pool trading volumes.

But let’s break it down and discuss the on-chain data from CoinGecko’s API in the following chapters.

What is On-Chain DEX Data, and How Can You Leverage It?

On-chain DEX data is a concept within the crypto and blockchain industry that showcases the abundance of information received directly from the blockchain.

For example, a crypto trader, investor, or developer could gain insights into the transactional data, wallet balances, crypto prices, metadata, or other metrics captured from blockchain activities and used within new and emerging crypto projects.

Unlike CEXs or traditional financial markets, where data is passed through central authorities, in our DEX case, the on-chain data offers a decentralized view, real-time transparency, and the immutability of the blockchain’s interactions.

Having such assets in your hand could be highly beneficial, especially within a volatile crypto market, thus reducing the risk of market manipulation. As a result, understanding and using the on-chain data API from CoinGecko to your advantage could set your crypto project or strategy apart from a newbie.

How CoinGecko Makes On-Chain DEX Data Accessible

As we all know, CoinGecko is one of the world’s leading independent cryptocurrency data aggregators, meaning they do not operate as an exchange or as a crypto wallet. Instead, they help crypto traders and investors by providing information on cryptocurrencies, such as cryptocurrency prices, market cap, trading volumes, etc.

Consequently, CoinGecko is constantly working towards providing some of the most influential and accurate crypto data, such as access to on-chain data through CoinGecko’s API.

We’ve always been committed to furnishing users with comprehensive, reliable, and accurate crypto price and market data and empowering the crypto community.

With on-chain DEX data now accessible through the CoinGecko API, users can harness the information without having to consolidate from multiple sources, dive deeper into the decentralized ecosystem, and unlock new avenues of product creation, said Bobby Ong, COO and Co-founder of CoinGecko.

Understanding CoinGeckos’ On-Chain Data API

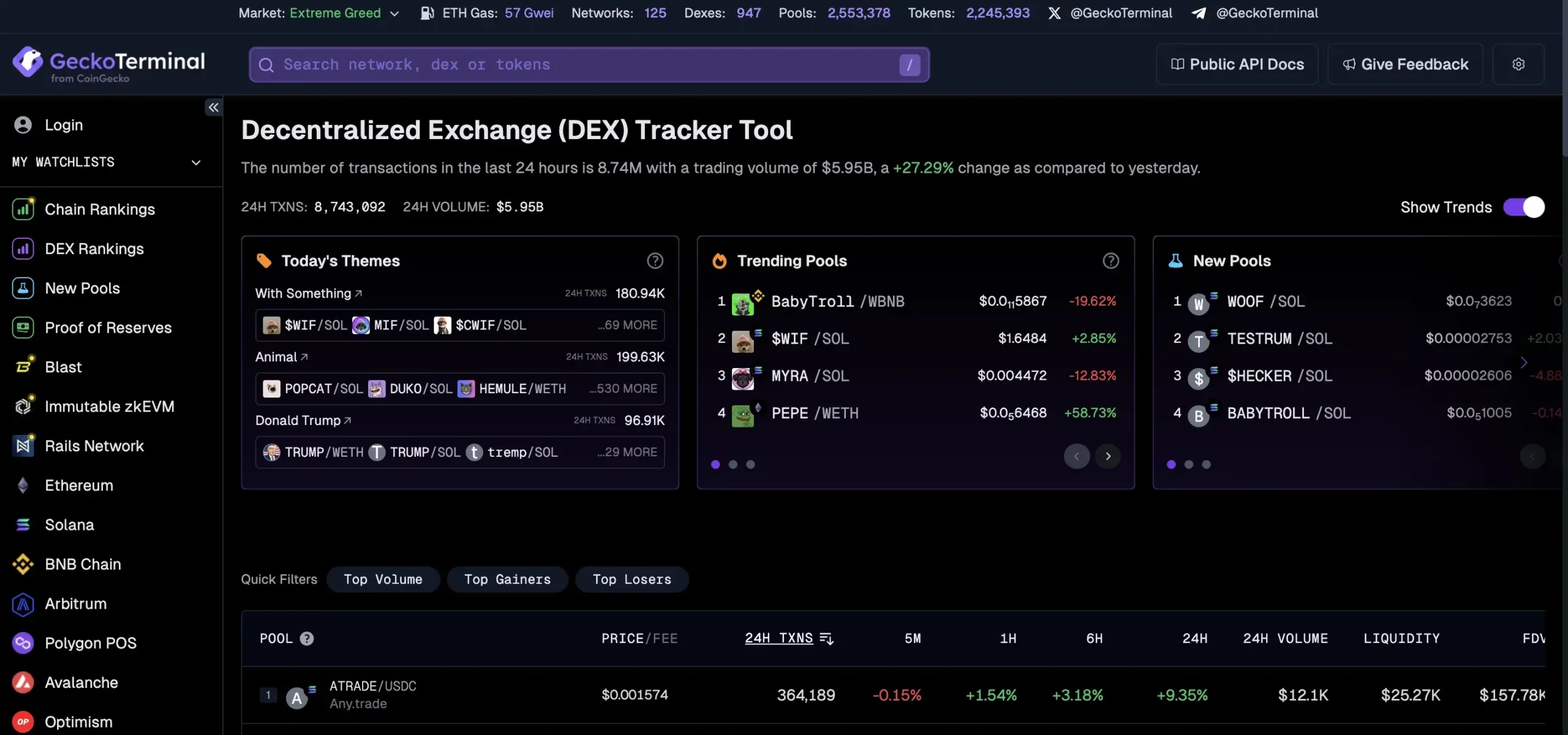

CoinGeko’s API brings new possibilities within the cryptocurrency landscape through 20 new endpoints, covering 2.2 million tokens on-chain across 2.5 million crypto liquidity pools.

However, such an update and beneficial API was only possible with the help of GeckoTerminal, a subsidiary product of CoinGecko.

This state-of-the-art crypto platform offers real-time stats and price analysis on 120 blockchain networks and 900 DEXs, including UniSwap, PancakeSwap, Curve, and many more.

With the help of the paid CoinGeko API, anyone can have access to key insights, such as the crypto liquidity pools, token data by contract address, and Open, High, Low, Close, Volume (OHLCV) chart data:

1. Pools

- Trending pools by network;

- Specific pool by contract address;

- Search pools;

2. Tokens

- Top pools by contract address;

- Token data by contract address;

- Token info by contract address;

3. Open, High, Low, Close, Volume (OHLCV)

- Pool OHLCV chart by contract address;

Please note these are just a couple of the endpoints available through paid subscribers, yet please check CoinGecko’s API documentation for a more detailed overview.

CoinGecko On-Chain Data API Use Cases

As discussed, the on-chain data API could benefit anyone, from Web3 developers and researchers to institutions and enterprises, by understanding price feeds, market data, and historical data of crypto assets, NFTs, and exchanges.

- Centralized and decentralized exchanges;

- Trading applications and platforms;

- Cold and hot crypto wallets;

- Data aggregators, crypto screeners, and crypto portfolio trackers;

- DeFi protocols;

- NFT (Non-Fungible Token) marketplaces;

- Digital banks;

- Research and analysis institutions;

These are just a few examples, so CoinGecko’s API is more comprehensive than these.

CoinGecko API Features:

- More than 70 endpoints;

- Over 10 years of historical data;

- Get access to 2M coins;

- Over 100 blockchain networks;

- More than 900 crypto exchanges;

- 3863 NFT collections tracked across 22 marketplaces like Opensea, Looksrare, and others;

7 Benefits of GoinGecko’s On-Chain DEX API

The on-chain DEX API unlocks unique grounds for anyone aiming to gain a competitive advantage while simplifying their data access.

- Streamlined workflow by accessing everything through a single, reliable API;

- Identify opportunities and make data-driven decisions faster;

- Track your favorite tokens while gaining insights into the crypto market movement;

- Built innovative Web3, blockchain, and crypto apps with ease;

- Enhance your existing products and services with real-time data transparency, thus enriching your offerings;

- Empower your crypto research and analysis of the DeFi niche;

- Get access to multiple data formats, such as JSON, CSV, and others, to easily integrate them within your projects;

Final Thoughts

We hope that by the end of this article, you’ve discovered how to leverage CoinGecko’s On-Chain DEX API, thus helping you navigate this ever-evolving landscape.

Whether you are an investor, developer, or institution, anyone can benefit from this updated API, identifying emerging opportunities while making informed decisions and streamlining anyone’s workflow who wishes to upskill their performance.

So, are you ready to take control of your DeFi journey?