APR vs. APY: What Is The Difference Between APR and APY?

Remember when you signed up for a credit card because the interest rate looked super low, but a few months in, you realized you were paying more than expected? Or maybe when you opened a savings account, thinking you’d get an excellent return, only to discover the interest wasn’t adding up how you thought?

We’ve all been there—getting tripped up because we didn’t quite understand the difference between APR and APY.

In this article, we’ll explain exactly how APR and APY differ so that you’ll know exactly what to look for next time. Whether you’re borrowing money or saving it, understanding this can save you a lot of headaches—and money—in the future.

[nativeAds]

Top 5 APR vs. APY Key Takeaways

- APR represents the basic interest rate on loans or credit, showing the annual cost of borrowing without considering how often interest is compounded.

- APY reflects the actual rate of return on savings or investments, factoring in compounding interest over a year.

- The key difference between APR and APY is that APY includes the effect of compound interest, while APR does not, making APY more accurate for calculating yearly returns or costs.

- Regarding other differences, APR is commonly used for loans, mortgages, and credit card purchases, while APY is used for savings accounts and investment products that benefit from compounding interest.

- When borrowing, aim for the lowest APR to minimize costs. When saving or investing, seek the highest APY to maximize your returns.

What Is APR?

The Annual Percentage Rate (APR) represents the yearly interest rate you either pay on a loan as a borrower or earn on an investment, expressed as a percentage. It shows the true yearly cost of borrowing money or the income you make from an investment.

While APR includes any extra fees or charges tied to the transaction, it doesn’t factor in how often the interest is added to your balance (also known as compounding).

APR is useful because it gives you one number to compare across different loans, credit cards, or investment options.

Whether you’re considering a mortgage, a personal loan, or credit card, the APR gives you a clear idea of the total cost of borrowing or the potential return you’ll get over the course of a year.

Keep in mind, though, that while APR gives a good snapshot of costs, it doesn’t show how frequently the interest is added to your balance, which can affect the overall amount you end up paying or earning over time.

Calculating APR

The formula for calculating APR is simple:

APR = Periodic Rate x Number of Periods in a Year.

For example, if the interest rate is 1% per month, the APR would be:

APR = 1% x 12 (since there are 12 months in a year) = 12%.

What Is APY?

The Annual Percentage Yield (APY) is the actual rate of return you earn on an investment, and it takes compounding interest into account.

Compounding happens when interest is regularly added to your balance, so the more your balance grows, the more interest you earn each time. In other words, as your account balance gets bigger, the interest you earn increases over time.

APY gives a more accurate picture of your earnings because it considers the effect of compound interest and any fees tied to the investment, showing you the true return over time.

Calculating APY

To calculate APY, you use the formula:

APY = (1 + Periodic Rate)^Number of Periods – 1.

For example, if you invest $10,000 in a savings account with an annual interest rate of 2%, compounded monthly, the calculation would look like this:

APY = (1 + 0.02/12)^12 – 1 = 0.0202, or 2.02%.

This means that after a year, you’d earn $202 in interest on your $10,000 investment.

APR vs. APY: Types of Accounts

Financial products and accounts use either APR or APY, which have different meanings. It’s important to know which one applies to the account you’re considering, so here are the most common examples:

APR Accounts

- Loans: Credit cards, mortgages, auto loans, and personal loans.

- Lines of Credit: Home equity lines of credit (HELOCs), business lines of credit.

APY Accounts

- Savings Accounts: Traditional savings accounts, high-yield savings accounts.

- Certificates of Deposit (CDs): Short-term CDs, long-term CDs.

- Retirement Accounts: 401(k)s, IRAs.

- Money Market Accounts

- 529 Accounts

- Bonds

APR vs. APY: What Are The Differences Between Them?

Main Differences Between APR and APY

The main difference between APR and APY is how they handle compounding interest. APY shows the actual return you’ll get over a year, considering the effect of compounding, while APR is just the basic interest rate without considering compounding.

Here’s a simple example:

- APR – If a loan has a 5% APR, you’ll pay 5% interest on the original amount (the principal) each year, with no extra fees or compounding. So, if you borrow $1,000, you’ll pay $50 in interest for the year.

- APY – If a savings account offers 5% APR but compounds monthly, the APY will be a little higher because the interest gets added to your balance every month. So, by the end of the year, you’ll earn more than just 5% because each month’s interest adds to your balance, which then earns more interest the following month. So, APY permanently takes into account compound interest.

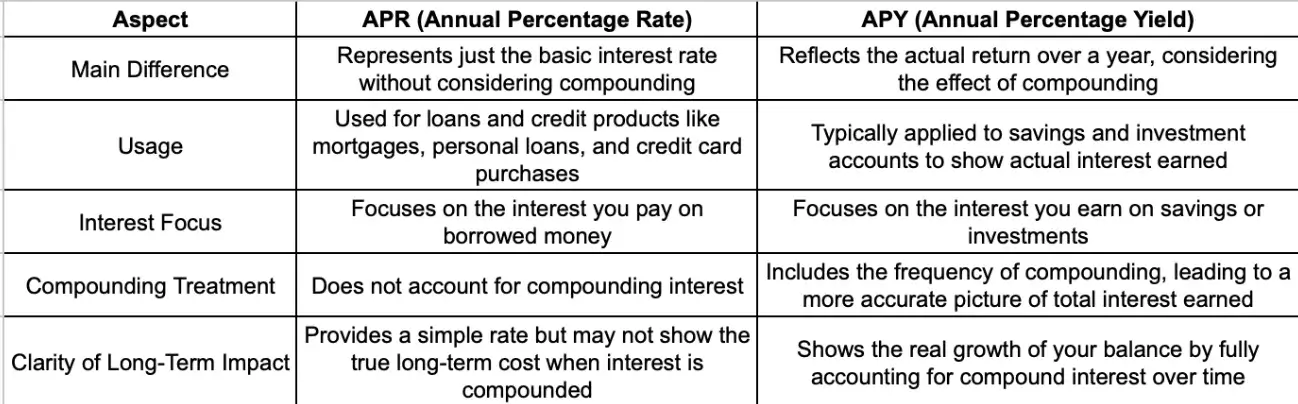

Other Differences Between APR vs. APY

Besides how they handle compounding interest, there are also other minor differences between them.

One of these differences is in their usage. APR is typically applied to loans and credit products like mortgages, credit card purchases, or personal loans. It tells you the annual cost of borrowing money, giving a straightforward percentage that reflects just the interest rate you’ll pay. On the other hand, APY is most often used for savings or investment accounts, showing the actual interest you’ll earn on deposits while considering compound interest.

Another key difference is the focus on interest earned versus interest paid. APR highlights what you pay when you take out a loan. While it provides a flat annual rate, it doesn’t account for how often interest might be added to your balance. APY, however, shows what you earn from savings or investments. It includes the effect of compounding, meaning it provides a more accurate picture of your money’s growth over time.

The compounding frequency also plays a crucial role in separating APR and APY. APR assumes a simple interest calculation without factoring in compounding. APY, by contrast, always includes how frequently interest is compounded, whether daily, monthly, or yearly.

Over the long term, the differences between APR and APY become more pronounced. While APR gives a clear idea of the annual percentage charged on your loan, it doesn’t show the total cost over time if interest compounds frequently. In contrast, APY shows how much your savings or investments will grow because it fully considers the compounding effect.

APR vs. APY: Which Is Better?

Well, it depends—especially on whether you’re the borrower or the lender.

If you’re a borrower: When borrowing money, you always want the lowest possible interest rate. But it’s essential to know the difference between APR and APY. APR is just the primary interest rate times the number of periods in a year without including any compounding. APY, however, includes how often the interest is compounded, giving you a clearer picture of what you’ll pay over a year.

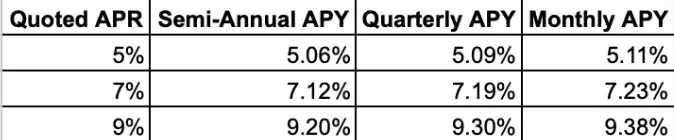

For example, if a lender offers you a 5% APR on a loan, that sounds good. However, if the loan compounds interest monthly, the actual annual cost (APY) is 5.11%. The difference seems slight but can add up, especially with long-term loans.

Here’s a quick breakdown:

As you can see, the more often interest is compounded, the higher your actual cost will be. So, when looking at loan offers, be sure to ask about both the APR and the APY (and how often the interest compounds) to ensure you’re getting the best deal.

If you’re a lender: Now, let’s flip the script. If you’re looking to save money, you’ll want the highest interest rate possible from the bank. Banks usually advertise the rate they’ll pay on savings accounts using APY, which includes compound interest and sounds more appealing than just the flat APR. But you should always check how often the interest is compounded because that can greatly affect how much you’ll earn.

FAQs

Are APY and APR The Same?

Although APY and APR are used to calculate interest, they serve different purposes. APY tells you how much interest you’ll earn on an interest-bearing account, like a money market or IRA. Conversely, APR shows how much interest you’ll pay when taking out a loan or using a credit card.

Is It Better to Have a Higher APY or a Lower APR?

Generally, a higher APY is better because you’ll earn more on your savings or investments. On the other hand, a lower APR is better when you borrow money, as it means you’ll pay less in interest rates over time.

Why Is APR Higher Than APY?

Generally, APR rates are higher than APY rates. This happens because lenders set APRs based on the borrower’s credit profile, and people who are seen as riskier borrowers tend to get higher APRs.

What Do APR and APY Mean in Crypto?

APR and APY function similarly to traditional finance in the crypto industry. APY refers to the interest you earn on crypto savings accounts, while APR is the interest rate that borrowers must pay on crypto loans.

Conclusion

Now you know the essential differences between APR and APY, so next time you evaluate loans or savings accounts, keep these distinctions in mind to avoid surprises and make choices that benefit your financial future!