If you’re an older crypto enthusiast, you probably know this, but if you don’t, yield farming was the main reason for the DeFi boom in 2020.

While it may not be as popular now, it’s still a great way to earn passive income. Thus, in this article, we’ll show you the top 9 DeFi yield farm platforms.

The Best Crypto Yield Farming Platforms

1. Uniswap – The Best DeFi Yield Farming Platform Overall

Uniswap is our top pick for the best yield farming platform, and it’s easy to see why.

As one of the most popular decentralized exchanges (DEXs), Uniswap runs on the Ethereum blockchain, making it super simple for users to swap tokens and provide liquidity.

Instead of the usual order books in traditional exchanges, Uniswap uses an automated market maker (AMM) system, which lets you trade tokens directly from your wallet without any middleman.

By adding your tokens to Uniswap‘s liquidity pools, you get a share of the trading fees based on how much you’ve contributed.

Plus, Uniswap rewards users with its governance token, UNI, giving you even more incentive to join and have a say in the platform’s future decisions.

Uniswap Supported Chains

Uniswap supports many blockchain networks, including Ethereum, Arbitrum, Celo, BNB Chain, Base, Blast, ZKsync, Zora, and Avalanche. Thus, users have plenty of options when providing liquidity.

Pros of Uniswap

- It’s a fully decentralized exchange without the need for an order book.

- Users can create liquidity pools for any trading pair they like.

- Backed by a strong community and dedicated development team.

- Uniswap V3 allows users to customize liquidity pools for better capital efficiency.

- No need to open an account to start using it.

Cons of Uniswap

- It is not the best option for beginners due to its complexity.

- Only supports ETH tokens, limiting the variety of assets.

- Gas fees on Ethereum can sometimes be relatively high.

2. Aave – Best for ETH-Based Tokens Yield Farming

Aave is a decentralized lending and borrowing platform built on the Ethereum blockchain, and it ranks as our second choice in this list. It allows users to lend and borrow various cryptocurrencies without permission or trust.

Users can deposit their crypto into liquidity pools to earn interest, while borrowers use those deposits as collateral to borrow other cryptocurrencies.

Yield farming on Aave works by providing liquidity to the platform’s “money markets” and earning interest and additional rewards. When users deposit assets, they receive tokens (like aDAI or aUSDC), representing their share in the pool and growing in value over time as interest accrues.

Aave also rewards liquidity providers with governance tokens, such as AAVE, offering further participation incentives.

Aave Supported Chains

The leading supported chains are Ethereum, Polygon, Avalanche, Arbitrum, and Optimism.

Pros of AAVE

- Provides lower-risk options for lending and borrowing assets on the blockchain.

- Has a long-standing reputation and track record in DeFi.

- Introduced unique features like flash loans, allowing users to borrow without collateral.

- The Aave community controls the protocol’s future through the governance token AAVE.

Cons of AAVE

- Flash loans have been exploited in the past.

- It is not the most accessible platform for beginners to navigate.

- Loans must be over-collateralized, which can limit borrowing flexibility.

3. SushiSwap – Best for Its Community-Driven Model

SushiSwap is a DeFi yield farming platform that originated as a fork of Uniswap, but it offers extra features and incentives for liquidity providers.

On SushiSwap, yield farming involves staking tokens in liquidity pools, where users can earn SUSHI tokens, the platform’s native governance and utility token.

Besides earning trading fees, liquidity providers also receive SUSHI rewards, which are distributed daily to encourage participation.

What sets SushiSwap apart from Uniswap is its community-driven governance model. SUSHI holders can vote on proposals and changes to the platform, giving users more influence over its development.

SushiSwap also expands its offerings with features like decentralized lending and borrowing through the Kashi lending platform.

SushiSwap Supported Chains

SushiSwap supports seven chains, including Ethereum, Polygon, Optimism, and Base.

Pros of SushiSwap

- Strong focus on community involvement since its launch.

- Users who stake SUSHI tokens earn a share of the trading fees.

- SushiSwap provides additional DeFi services like lending, borrowing, and a launchpad for new projects.

Cons of SushiSwap

- As a fork of Uniswap V2, it lacks many unique features.

- High costs when using the platform on Ethereum.

4. PancakeSwap – Best for BNB-Based Tokens Yield Farming

PancakeSwap is a DeFi yield farming platform built on the Binance Smart Chain (BSC). It offers an alternative to Ethereum-based DEXs, providing users with fast transactions and lower fees.

PancakeSwap operates similarly to other automated market maker (AMM) platforms, allowing users to swap BEP-20 tokens and provide liquidity to liquidity pools.

Yield farming on PancakeSwap involves staking tokens in liquidity pools to earn CAKE, the platform’s native governance and utility token. Users can stake various BEP-20 tokens in PancakeSwap’s liquidity pools and earn CAKE rewards, which can be used for governance voting, liquidity provision, or trading on the platform.

PancakeSwap Supported Chains

BNB Smart Chain, Arbitrum, opBNB, and Base.

Pros of PancakeSwap

- Best yield farming crypto platform for BNB Chain tokens.

- No account registrations are needed.

Cons of PancakeSwap

- Only supports BNB Chain-based tokens.

5. Curve Finance – Best for Stablecoin Yield Farming

Curve Finance is a DeFi yield farming platform focusing on stablecoin trading with low slippage. Also, it was designed to provide efficient, low-cost trading for stablecoin pairs like DAI, USDC, and USDT by using specialized liquidity pools and algorithms.

Yield farming on Curve Finance works by users providing liquidity to stablecoin pools. In return, they earn trading fees and CRV, the platform’s native governance token. When users deposit stablecoins into Curve’s liquidity pools, they receive LP (liquidity provider) tokens representing their share of the pool’s assets. These LP tokens generate trading fee income and earn CRV rewards, encouraging more participation in the platform.

Curve Finance Supported Chains

Curve Finance is available on multiple chains, including Ethereum, Arbitrum, Aurora, Avalanche, Fantom, Harmony, Optimism, Polygon, xDai, and Moonbeam.

Pros of Curve Finance

- It specializes in stablecoins and wrapped assets, making it ideal for those focused on farming on stablecoin yield.

- Great for people seeking low-slippage trading in stable assets.

Cons of Curve Finance

- Has faced security issues, including hacks, due to code vulnerabilities.

- It can be complex for beginners to navigate and use effectively.

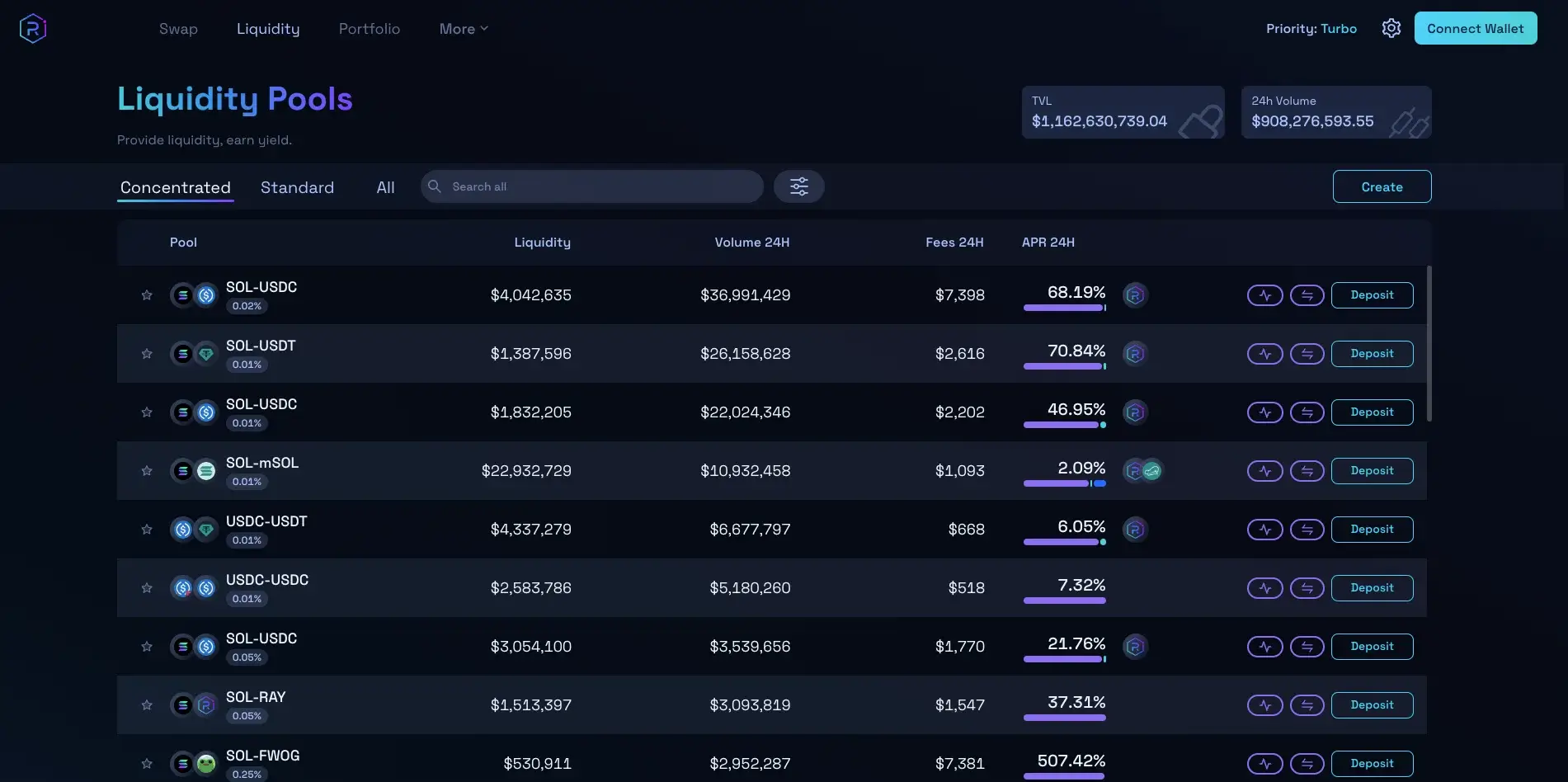

6. Raydium – The Best Solana-Based DEX with High APYs and Deep Liquidity

Raydium is a DeFi and yield farming platform built on the Solana blockchain. Thanks to the power of Solana’s network, it’s well-known for fast transactions and low fees.

Raydium stands out as one of the best platforms for Solana-based tokens due to its efficient trading system and the deep liquidity it provides for these tokens.

Raydium offers some of the market’s highest annual percentage yields (APYs), with several liquidity pairs providing over 100% returns.

Raydium Supported Chains

Raydium supports any tokens on the Solana blockchain.

Pros of Raydium

- Fast transaction times thanks to the Solana blockchain.

- Offers deep liquidity for popular SOL pairs.

- High APYs, with some pairs offering returns over 100%.

- Well-established within the Solana ecosystem.

Cons of Raydium

- Less liquidity for less popular or newer token pairs.

- Not as beginner-friendly due to its more advanced DeFi features.

6. Yearn Finance – Best for Automated Yield Optimization

Yearn Finance is a DeFi platform designed to help users get the best returns from yield farming. Created by Andre Cronje, the platform automates the process by pooling liquidity from different DeFi protocols and investing it where the highest returns are available.

Yield farming on Yearn Finance works by depositing funds into vaults, which are smart contracts that automatically invest the funds in the most profitable DeFi strategies. These strategies may include liquidity provisioning, lending, or borrowing to generate returns. Users can select vaults that match their risk preferences and investment goals. Once deposited, users receive tokens, which represent their share of the vault and continuously grow in value as the vault earns yields.

Additionally, Yearn Finance distributes its governance token, YFI, to participants, allowing them to help steer the platform’s direction.

Yearn Finance Supported Chains

Yearn Finance is available on multiple blockchains, including Ethereum, Arbitrum, Optimism, Polygon, and Fantom.

Pros of Yearn Finance

- Automatically optimizes yield farming to get the best returns.

- Easy to use, no need to manually switch between platforms.

- Helps maximize profits with minimal effort.

- Users can participate in platform governance with YFI tokens.

Cons of Yearn Finance

- Has been hacked before, which increases risk.

- No insurance fund to protect against losses from hacks.

- The limited supply of YFI tokens makes governance participation harder for new users.

The Best Yield Farming Alternatives in 2024

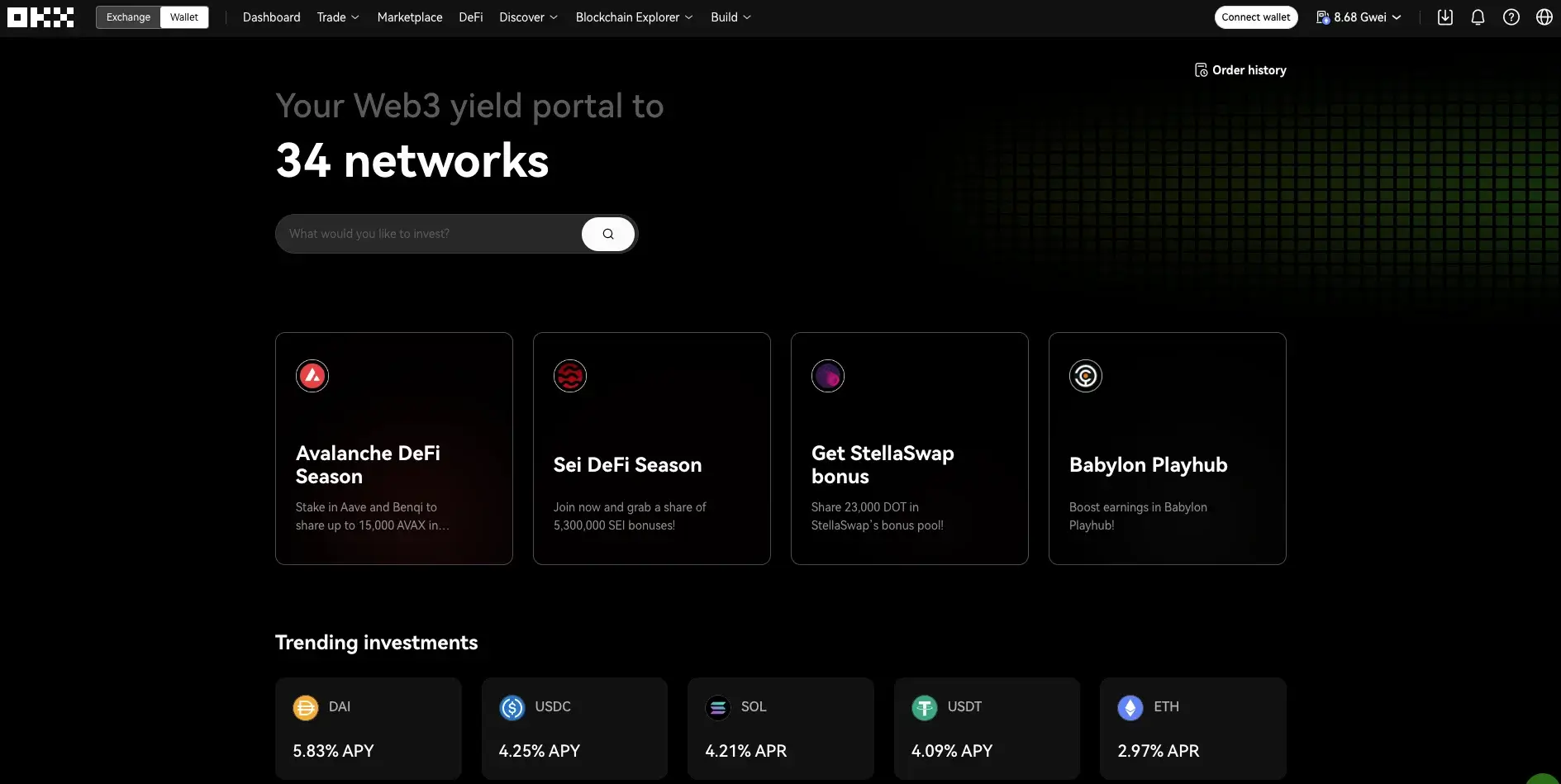

1. OKX – Best Alternative to DeFi Yield Farming Overall

Our top alternative pick for DeFi yield farming is OKX, specifically its DeFi yield farming section.

While OKX is best known for its low-fee spot and derivatives trading, it offers a complete crypto ecosystem, making it ideal for users who want everything in one place. It also has a well-developed DeFi yield farming option that offers staking and interest accounts. Yields vary as with any platform, but OKX offers up to 30% stablecoin yields.

The aggregator streamlines the process by automatically searching for the best yields so users don’t have to compare platforms manually. It’s user-friendly, letting investors search for tokens and filter by network, cryptocurrency, or incentive structure.

Beyond yield farming, OKX also provides a staking feature for those looking to generate passive income without providing liquidity. With staking, users only need to commit a single token for each agreement, unlike yield farming, where you need pairs.

The platform also provides fixed-income accounts that appeal to investors who want predictable returns.

OKX Supported Chains

OKX stands out because its DeFi Aggregator pulls yield farming opportunities from 34 blockchains, including Ethereum, Bitcoin, Sui, IOST, DOT, and Base.

Pros of OKX

- Simple to use.

- Access to verified, reliable yield farming pairs.

- No gas or transaction fees.

- Offers yield farming, staking, and interest-earning options.

- Attractive APYs.

- Flexible yield farming pools with various options.

- Supports multiple blockchain networks.

- Strong reputation in the crypto industry.

Cons of OKX

- Fewer cryptocurrencies and trading pairs than some competitors.

- Limited to ETH-based coins for yield farming.

2. Binance – Best Alternative to DeFi Yield Farming Based on Its Versatility

Binance is our third top alternative to DeFi yield farming crypto platforms. While primarily known as the largest crypto exchange in the world, Binance offers much more, making it a great option for those seeking a versatile platform.

In addition to its vast marketplace of over 1,600 markets and 800 coins, Binance provides several ways to earn passive income, including Ethereum staking and interest-bearing accounts on various cryptocurrencies.

Binance may not focus on traditional DeFi yield farming, but it compensates with its flexible and fixed interest-bearing contracts. Users can stake coins or stablecoins and earn competitive yields, with up to 25% APY on certain crypto assets and 5.8% on stablecoins.

For users seeking reliable, higher-yield investment opportunities within a well-established ecosystem, Binance is an excellent choice.

Binance Supported Chains

Binance supports yield farming across a dozen blockchains, including BNB Chain, Polygon, Avalanche, Fantom, Optimism, and Arbitrum.

Pros of Binance

- Large selection of cryptocurrencies and stablecoins for yield farming.

- Offers both flexible and fixed-term yield farming options.

- Highly regulated and trusted platform.

- Competitive yields, especially on stablecoins.

- Simple interface for accessing passive income features.

Cons of Binance

- It is not primarily a yield farming platform.

- Limited yield farming options compared to dedicated DeFi platforms.

- It can be too complex for beginners.

- Lower yield rates on popular assets compared to niche DeFi platforms.

- High yields often require locking assets for extended periods.

Coindoo’s Methodology on Picking the Best Yield Farming Crypto Platforms

When we selected the best yield farming crypto platforms, we based our evaluations on several key factors to help you make informed decisions.

- Security was our top priority. We focused on platforms with audited smart contracts and development teams that had solid reputations, ensuring a safer environment for investments.

- We also examined yield potential by comparing annual percentage yields (APY) across platforms and analyzing tokenomics to confirm the sustainability of the rewards offered.

- Liquidity was another essential factor. Platforms with deep liquidity pools and high trading volumes provided more stable prices and reduced the risk of slippage during trades.

- In terms of user experience, we looked for platforms that were easy to use and accessible, particularly on mobile devices, to offer a smoother and more satisfying experience.

- We also evaluated governance, considering decentralization and strong community involvement as important elements for platform stability and long-term success.

- Eventually, we carefully assessed the risks involved in yield farming, such as impermanent loss and smart contract vulnerabilities.

So, by analyzing these risks along with other factors, we identified platforms that offered the best mix of high yields, security, and user-friendliness.

What Is Yield Farming?

Yield farming involves depositing crypto into decentralized finance (DeFi) platforms or liquidity pools to earn rewards. Basically, you’re providing liquidity or lending your assets to these platforms, and in return, liquidity providers (LPs) are rewarded with an annual percentage yield (APY), often paid out in real-time.

While yield farming was a major growth driver in the DeFi industry during its peak in 2020, the excitement diminished following the collapse of the TerraUSD stablecoin in 2022. Despite the reduced hype, many still pursue yield farming to generate passive income, though it remains a higher-risk strategy compared to other methods.

As yield farming strategies are high-risk, it is essential to remember that while the potential for high returns exists, market volatility, technical vulnerabilities, and other uncertainties within the DeFi space make it a risky investment strategy.

How to Use a Yield Farming Platform to Provide Liquidity in General?

If you want to generate passive income through yield farming, here’s a step-by-step guide on how to use a yield farming platform, using an automated market maker (AMM) like PancakeSwap as an example:

1. Choose a Yield Farming Protocol

First, select a decentralized trading platform that offers yield farming. These platforms facilitate the process of providing liquidity to different pools.

2. Access the Liquidity Section

Once on the platform, find the “Liquidity” section. This is where liquidity providers (LPs) deposit their assets into pools to help facilitate trading on the platform.

3. Select Your Assets for Deposit

Choose which pairs of cryptocurrency assets you want to deposit into a liquidity pool. For example, you can select BNB and CAKE to contribute to the BNB/CAKE pool. The assets you deposit will be used to support trading between these two cryptocurrencies.

4. Deposit Your Assets and Receive LP Tokens

After depositing your chosen assets, the platform will give you LP tokens. These tokens represent your share of the liquidity pool and entitle you to a portion of the transaction fees generated by the pool.

5. Earn Yield Farming Rewards

Next, take your LP tokens and go to the “Farms” section of the platform. You can deposit your LP tokens into the appropriate farm (e.g., BNB/CAKE farm) to start earning yield farming rewards. These rewards typically come as additional cryptocurrency, which you can claim over time.

6. Governance Tokens as Additional Rewards

Many DeFi platforms also reward users with governance tokens. These tokens allow you to vote on platform decisions and can often be traded on exchanges, adding further value to your yield farming efforts.

FAQs

What are Yield Farmers?

Yield farmers participate in DeFi protocols to earn rewards by providing liquidity to various platforms. They essentially lend or stake their cryptocurrencies to earn interest or other incentives, generally from the yield farming process.

Is Yield Farming Profitable?

Yield farming can offer substantial returns, but it’s important to understand that it also carries significant risks.

Conclusion

So, while yield farming may have peaked in popularity during the DeFi boom of 2020, it remains an effective strategy for earning passive income in the crypto industry if you’re OK with the risks involved.

We hope this article helps you discover the top 9 yield farming crypto platforms, allowing you to make informed decisions and maximize your earnings.