Did you know that the modern investing landscape boasts thousands of ETFs or Exchange-Traded Funds? If you’re reading this, you likely have a clue. However, the world of ETPs, or Exchange-Traded Products, is even more expansive, offering many investment opportunities.

If you’re not yet familiar with these financial instruments, don’t worry. This article aims to shed light on the intricacies of both ETFs and ETPs.

We’ll explore the most important aspects of both of them in order to make you understand how they can fit into your investment strategy. Let’s dive in!

What are Exchange-Traded Products (ETPs)?

Exchange-Traded Products (ETPs) are investment vehicles that are traded on stock exchanges, similar to individual stocks (but remember, ETPs are not stocks). They provide a way for investors to gain exposure to a variety of assets, including stocks, crypto, commodities, and bonds, without having to buy individual assets directly.

Basically, ETPs combine various securities into a portfolio, giving investors exposure to a diverse range of assets while being traded like stocks on major exchanges. They are intended to offer diversified exposure, high liquidity, transparency, and cost-effectiveness.

As passive investments designed to mirror the performance of a specific market, they achieve this by tracking an underlying benchmark index and typically trading at or near their net asset value (NAV).

The main types of ETPs include:

- Exchange-Traded Funds (ETFs);

- Exchange-Traded Notes (ETNs);

- Exchange-Traded Commodities (ETCs).

Each of these has different structures and focuses on different types of investments.

What are Exchange-Traded Funds (ETFs)?

Exchange-Traded Funds (ETFs) are a specific type of exchange-traded product (ETP).

ETFs consist of a collection of securities traded like individual stocks. Investors don’t own the individual securities within the ETF but rather shares of the fund itself. ETFs are popular because they provide a simple and efficient way for investors to gain diversified exposure to an entire index or market segment with a single trade.

The key difference between ETPs and ETFs is that while every ETF is an ETP, not every ETP is an ETF.

ETP vs. ETF: What Are The Key Differences?

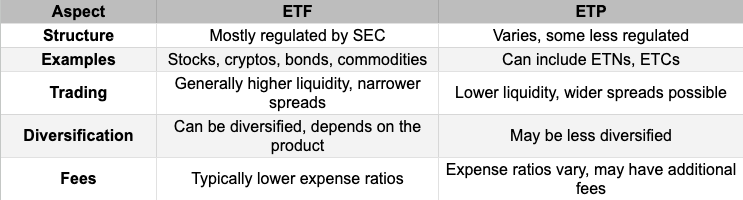

Now that we’ve taken a closer look at ETPs and ETFs individually (with small comparative remarks, though), it’s time to focus on comparing them broadly.

So, first of all, remember that both are traded on exchanges and offer investors access to a variety of asset classes, but they do have some key differences. To keep it simple, think of it this way: All ETFs are ETPs, but not all ETPs are ETFs.

But that’s not all, and we will present further the key differences between these two.

ETP vs. ETF: Structure and Regulation Differences

Regarding their structure, most ETPs are structured as ETFs, which are registered with the Securities and Exchange Commission (SEC) and regulated under the Investment Company Act of 1940. This means they have a higher level of oversight and transparency.

ETFs usually focus on stocks, bonds, or debt securities and must meet certain diversification requirements. They’re traded on the stock exchange, making them liquid and flexible.

However, there’s a big regulatory difference between ETFs and other ETPs, like ETNs. ETFs must follow strict regulations and are overseen by a board of directors and FINRA. On the other hand, ETNs don’t have board oversight and are subject to less rigorous regulations, which makes them riskier.

ETP vs. ETF: Trading and Liquidity Differences

When it comes to trading and liquidity, ETFs generally have the upper hand compared to other exchange-traded products (ETPs).

Both ETFs and ETPs are traded on stock exchanges, but ETFs typically offer higher liquidity and narrower bid-ask spreads. This means ETFs can be bought and sold more easily and quickly, often with less impact on the market price.

A few factors influence the higher liquidity of ETFs.

First, ETFs usually hold a broad basket of securities, including stocks, bonds, crypto, or other assets, which helps boost their liquidity.

Second, ETFs often have higher trading volumes compared to other ETPs, meaning more shares are bought and sold daily, making it easier for investors to enter and exit positions.

The bid-ask spread is crucial for ETFs, which is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

Since ETFs trade on exchanges like individual stocks, the bid-ask spread is an important indicator of trading costs and liquidity. Popular ETFs with high trading volumes usually have narrower bid-ask spreads because there are more buyers and sellers actively trading, keeping the prices closer together.

Conversely, ETFs holding highly liquid assets like large-cap stocks will generally have narrower spreads than those holding less liquid or more volatile assets.

ETP vs. ETF: Diversification and Risk Differences

ETFs and ETPs both offer ways to diversify and manage risk, but the level of diversification depends on the specific product and its underlying assets.

For instance, exchange-traded commodities (ETCs) give you access to commodities like gold or oil, which can help diversify your investments beyond traditional stocks and bonds.

On the other hand, ETFs such as iShares Core ETFs are designed to help investors build well-rounded portfolios for long-term goals. These ETFs typically track a broad range of underlying assets, providing more extensive diversification compared to some ETPs that may focus on specific industries or commodities.

However, a lack of diversification can be a risk with both ETFs and ETPs. If an ETF or ETP focuses heavily on one sector or commodity, you could face significant losses if that sector or commodity performs poorly.

Additionally, leveraged or inverse ETFs, which aim to amplify returns or profit from declines, can have tax implications due to their daily resets. This could potentially result in unexpected taxable gains or losses.

ETP vs. ETF: Fees

ETFs generally come out ahead when it comes to fees. They typically have a single main fee – the expense ratio – which is an annual percentage of the fund’s assets that covers management and operational costs.

Expense ratios for ETFs are often very low, especially for index funds. You might also incur trading commissions when buying or selling ETF shares, but many brokers now offer commission-free ETF trades.

The fee structure for ETPs can be more complex. Expense ratios vary depending on the ETP type and its inner workings. For instance, ETCs that track commodities through derivatives contracts often have higher expense ratios than ETFs due to the management costs associated with those contracts. ETNs can have expense ratios comparable to ETFs, but some may have additional fees for features like leverage or to cover the credit risks of the issuing bank.

Beyond expense ratios, ETPs, particularly those with lower trading volume, may have wider bid-ask spreads compared to ETFs. This means the difference between the price you can buy (ask price) and sell (bid price) might be larger, potentially impacting your returns. Some ETPs may also have additional fees, such as performance fees, based on the ETP’s returns.

Other Types of ETPs

As we already mentioned, there are also other types of ETPs in addition to ETFs.

Beyond ETFs, other types of exchange-traded products (ETPs) include exchange-traded notes (ETNs) and exchange-traded commodities (ETCs).

Exchange-Traded Notes (ETNs)

ETNs combine the characteristics of bonds with the ease of trading stocks.

Unlike ETFs that hold physical assets, ETNs are unsecured debt securities issued by financial institutions. These notes pledge to provide returns based on the performance of a specific market index or reference measure, minus any applicable fees, upon maturity.

ETCs are not governed by UCITS regulations and must not adhere to its diversification requirements. As a result, these products generally carry higher risks than ETFs due to their credit risk and lack of asset backing.

There are two types of Exchange-Traded Notes (ETNs): collateralized and uncollateralized.

- Collateralized ETNs – provide partial or full protection against counterparty risk.

- Uncollateralized ETNs – are entirely exposed to it.

Therefore, investors must thoroughly understand the inherent risks associated with an ETN before making an investment.

Benefits of Exchange-Traded Notes (ETNs)

- Price Tracking – ETNs are designed to closely follow the performance of their underlying index or benchmark without experiencing the tracking errors that can affect ETFs.

- Tax Efficiency – ETNs can offer tax advantages in certain scenarios. Since they do not distribute dividends, investors may not incur taxes until the ETN is sold or matures, potentially deferring tax liabilities.

- Market Exposure – ETNs provide access to a wide range of assets, including commodities, emerging markets, private equity, and specific investment strategies that might be difficult or expensive to access directly.

- Diversification – ETNs can offer diversification by providing exposure to niche markets and alternative investment strategies that are not typically available through traditional investment vehicles.

- Flexibility – ETNs allow investors to gain exposure to different asset classes and strategies without the need to directly invest in those assets, providing a flexible way to diversify their portfolios.

- Accessibility – ETNs trade on major exchanges, making them easy to buy and sell, similar to stocks, and providing investors with straightforward access to diverse investment opportunities.

Risks of Exchange-Traded Notes (ETNs)

- Credit Risk – As debt instruments, the value of ETNs depends on the creditworthiness of the issuing bank. If the issuer encounters financial trouble, the ETN could lose value regardless of the performance of the underlying index.

- Liquidity Risk – Some ETNs may have lower trading volumes compared to ETFs, which can lead to wider bid-ask spreads and make it harder to buy or sell the ETN at desired prices.

- Issuer Risk – Since ETNs are unsecured debt obligations, they carry the risk that the issuer may default on its obligations, impacting the ETN’s value and return.

- Market Risk – ETNs are subject to market risk, meaning their value can fluctuate based on the performance of the underlying index or benchmark. Poor performance of the underlying asset can result in losses for the investor.

Exchange-Traded Commodities (ETCs)

ETCs provide exposure to commodities like metals, energy, and agricultural products without requiring direct investment in physical commodities or futures contracts.

ETCs track the price of a single commodity or a basket of commodities, enabling investors to access commodity markets via a security traded on a stock exchange.

Some of the most popular ETCs include SPDR Gold Shares (GLD) and iShares Silver Trust (SLV).

There are distinct differences between ETCs and commodity ETFs. Commodity ETFs, regulated under the Investment Company Act of 1940 in the U.S., are structured as funds. They hold either physical commodities (such as gold or silver) or futures contracts on commodities. These ETFs are considered equity products and are regulated similarly to mutual funds and other ETFs.

In contrast, ETCs are structured as debt securities, similar to exchange-traded notes (ETNs), and are not considered traditional funds. They are debt instruments issued by a single entity, which introduces credit risks related to the issuer.

ETCs can be broadly classified into two categories:

- Physical ETCs – These ETCs hold physical commodities, such as gold or silver bars, in secure vaults. Investors in physical ETCs have a claim on the underlying metal, and the ETC’s value is directly tied to the price of the physical commodity.

- Synthetic ETCs – Instead of holding physical commodities, synthetic ETCs use derivatives like futures contracts to replicate the performance of the underlying commodity. This approach allows for exposure to a broader range of commodities, including those that are difficult or impractical to store physically.

Benefits of Exchange-Traded Commodities (ETCs)

- Direct Commodity Exposure – ETCs provide a straightforward way to invest in commodities, offering a potential hedge against inflation and a means of diversification beyond traditional stocks and bonds.

- Variety – Investors can select from a range of commodities, including gold, silver, oil, and agricultural products, based on their investment goals and market perspectives.

- Transparency – ETCs offer clear insights into their holdings and pricing, with the ETC’s value closely mirroring the price of the underlying commodity or commodities.

- Ease of Trading – ETCs are traded on stock exchanges, making them easily accessible to investors through regular brokerage accounts. This convenience allows for simple buying and selling during market hours.

- Liquidity – ETCs typically offer high liquidity, allowing investors to quickly enter and exit positions without significantly impacting the market price.

- Cost Efficiency – ETCs often have lower management fees compared to actively managed funds, making them a cost-effective option for gaining exposure to commodities.

Risks of Exchange-Traded Commodities (ETCs)

- Volatility – Commodity markets are often highly volatile, with prices affected by factors like geopolitical events, weather conditions, and changes in supply and demand.

- Counterparty Risk – Synthetic ETCs may involve counterparty risk, as their performance relies on the issuer’s or counterparty’s ability to meet their obligations under the derivative contracts.

- Credit Risk – Since ETCs are unsecured debt instruments issued by a single entity, they carry credit risk. If the issuer encounters financial problems, the ETC could lose value regardless of the underlying commodities’ performance.

- Storage and Insurance Costs – For physical ETCs, there may be additional costs associated with storing and insuring the underlying physical commodities, which can affect the overall returns.

Most Common Types of ETFs

- Stock Index ETFs – These ETFs mirror major stock market indexes like the S&P 500, Nasdaq 100, or Dow Jones Industrial Average, providing exposure to a broad range of stocks.

- Industry and Sector ETFs – Focused on specific industries or sectors, such as technology or financial services, these ETFs track the performance of companies within those particular areas.

- Bond ETFs – These ETFs follow indexes of government, corporate, or municipal bonds, offering investors a way to gain exposure to fixed-income securities.

- Commodity ETFs – These track the prices of commodities like gold, silver, oil, and grains. They may hold physical commodities or use futures contracts and other derivatives.

- Currency ETFs – Designed to track foreign currency exchange rates, these ETFs provide exposure to various international currencies.

- Inverse ETFs 0 These ETFs are structured to deliver returns that are opposite to the performance of their benchmark indexes, allowing investors to profit from market declines.

- Leveraged ETFs – Aimed at amplifying returns, these ETFs seek to deliver two to three times (or more) the daily performance of an underlying index or asset, both positively and negatively.

- Crypto ETFs – These ETFs focus on major cryptocurrencies like Bitcoin or Ethereum. They may either directly hold cryptocurrencies or use derivatives to offer exposure to the crypto market.

How ETPs and ETFs Compare to Mutual Funds?

ETPs, ETFs, and mutual funds are all investment options that allow you to pool your money with other investors. Thisprovides diversification and professional management, but they each have their own quirks.

Imagine a basket overflowing with investment goodies. This basket represents the underlying assets, like stocks, crypto, or bonds, that these investment vehicles hold. Professional managers might pick what goes in the basket for some funds (actively managed), while others simply follow a predetermined recipe (passively managed).

The key difference lies in how you buy and sell your share of the basket. ETFs and ETPs trade throughout the day on stock exchanges, just like individual stocks. The price you pay will depend on what other investors are willing to spend at that moment. Mutual funds, on the other hand, are like a restaurant basket you can only buy at closing time. The price is determined after the market closes, reflecting the value of everything in the basket at that specific time.

Both ETFs and ETPs can be passively or actively managed, and their structure can be fixed or constantly changing. Mutual funds, on the other hand, are typically open-ended and actively managed.

So, the next time you’re considering how to invest your money, think about whether you prefer the flexibility of an exchange-traded option or the potentially lower fees of a mutual fund. And if crypto is your thing, keep an eye out for it below.

Why ETPs and ETFs are Important for Crypto?

Although the debate over whether cryptocurrencies are best classified as securities or commodities remains unresolved, one fact is clear: cryptocurrencies are undeniably financial assets.

As such, there has long been a demand for more accessible trading mechanisms. Some Exchange-Traded Products (ETPs), such as Exchange-Traded Funds (ETFs), offer a streamlined way to invest in these assets, as we already mentioned. For instance, ETFs provide investors with a means to gain exposure to cryptocurrencies without the need for direct ownership or managing private keys, thus simplifying the investment process and reducing risks associated with storage and security.

For years, the financial community has eagerly anticipated the approval of a Bitcoin ETF, which would allow mainstream investors to gain exposure to Bitcoin through a regulated financial product. This anticipation reached a milestone in January 2024, when the U.S. Securities and Exchange Commission approved the first Spot Bitcoin ETF, with BlackRock leading the way.

This development marks a significant shift in crypto investing, as it opens the door for greater institutional involvement and provides investors with a new, regulated avenue to participate in the crypto market. And this initial success triggered a chain reaction within the ETF market.

Building on the momentum, several other spot Bitcoin ETFs likely emerged, catering to a wider range of investors. These new offerings might boast different expense ratios, investment strategies, and potentially even leverage options, providing investors with a more tailored way to gain exposure to Bitcoin.

The focus, however, likely didn’t remain solely on Bitcoin. The success of the first Bitcoin ETF likely paved the way for similar vehicles focused on other major cryptocurrencies like Ethereum. And on July 22, 2024, the SEC approved some Ethereum ETFs. This expansion would offer investors a way to diversify their crypto holdings beyond Bitcoin and potentially benefit from the growth of other established blockchain projects.

Spot ETFs’ increased accessibility and legitimacy likely attracted a significant influx of institutional investors. With their vast pools of capital, these institutions could have further bolstered the crypto market, potentially leading to greater stability and price appreciation.

Conclusion

While ETFs and ETPs may initially seem complex, understanding their nuances can significantly improve your investment strategy. Unlike mutual funds and other traditional investment funds, ETFs and ETPs offer the flexibility of trading throughout the day on stock exchanges, providing real-time pricing and greater liquidity.

By exploring the key aspects of these financial instruments, you can make informed decisions and potentially maximize your investment returns.

So, whether you’re a seasoned investor or just starting out, embracing the diverse opportunities ETFs and ETPs offer can be a valuable addition to your portfolio.