Table of contents

- 1. Earn Crypto By Using Layer3 or Intract

- 2. Earn crypto by shopping online

- 3. Learn and Earn

- 4. Using Brave browser

- 5. Using Presearch – Get Paid to Search

- 6. Earn Crypto from Crypto Airdrops

- 7. Be a ‘Bug’ Hunter – Find Security-Related Bugs and Get Rewarded in Crypto

- 8. Freecash.com – Complete Offers and Get Cash

- 18. Become a Testnet Hunter

- 20. Play P2E Games – Play in a Metaverse or a Virtual World and Earn Crypto

- 22. Be Active on /r/Cryptocurrency

- 23. Stake Your Cryptocurrency

- 24. Listen to Podcasts and Get Free Cryptocurrency

- 25. Earn XTM Tokens by Being Active on Torum

- 26. Participate in Giveaways

- 27. Earn by Driving with DIMO

- Conclusion

Want to get some cryptocurrency but you’re low on cash? Let’s see how we can get some free crypto.

Buying a cryptocurrency and watching it grow its value over time is one of the most satisfying things that you get as a crypto investor. But there’s something even better – you can do some simple task, earn cryptocurrency for it, and see it grow over time. I’ve always been a fan of working for cryptocurrency or finding smart ways to earn free crypto.

1. Earn Crypto By Using Layer3 or Intract

Airdrops are starting the 2024 bull market. Any quality project had at least 10M in their token airdropped to their users. But what do you do if you don’t have time to do your research? You do Quests.

Layer3 is a platform where you can do quests and earn XP. XP doesn’t help you with anything else than gamifying the protocol. But, by doing quests – you quality for various airdrops. Layer3 had a few quests about Blurr, Jupiter, Arbitrum, Optimism, Starknet, Zetachain, Scroll, Linea, Base and many more protocols.

If you want a platform where you can earn crypto by doing quests, Layer3 is the best option to do so. Lately, Layer3 also added the ability to earn a small amount of USDT/USDC for doing some quests. It’s not much, but sometimes it can cover the gas costs.

Using Layer3, the majority of users made at least $5000 in total from the last 3 airdrops alone: Jupiter, Zetachain and Starknet. If we add Arbitrum, Optimism, Blurr, Celestia and a few others – the amount would be higher than $20,000.

Intract.io is platform where you can do exciting crypto related quests, but they offer a few other incentives, such as:

- Alpha information from crypto world, sent as newsletter to your email

- Access to lotteries where you can win high valued prizes

Same as Layer3, by interacting with protocols and doing the quests – you can become eligible for airdrops.

Intract.io is fairly new, but extremely promising on the Web3 Quests world. We believe using it might lead in a few airdrops worth at least $10,000 annually. And it’s also super fun!

2. Earn crypto by shopping online

Did you ever know that you can spend fiat currency and earn crypto? A few years ago, this was not possible. But now, some companies allow you to shop and earn cryptocurrency.

Below, we’ll mention the most known and respectable ones:

- Lolli – With Lolli, you can get up to 30% cashback using their extension. Lolli is available for USA users only. We’ve also written a Lolli review in the past, which you can check to find out more details;

- Shopnext.io – Shopnext allows you to link your card to different merchants and earn based on your spending. You’ll get rewards in their token, which you can convert for Bitcoin, Ethereum, or another crypto asset.

- Stormx – Stormx is another well-known platform where you can shop and get cashback in crypto. They’ve paid more than $5 million to their users so far. You can install the StormX extension and start earning.

3. Learn and Earn

To promote their new tokens, certain companies offer small tokens to reward users who read more about their projects. This is usually made possible by creating a partnership with a big brand. All you need is to learn, complete quizzes, and claim a few dollars worth of crypto.

You can do this on various platforms, such as:

Coinbase

Coinbase probably has one of the most popular learn and earn programs, having done this for over 6 years. To start earning on Coinbase Learn and Earn, you should log into your Coinbase account and head to Coinbase Learn.

There, you can choose from multiple guides, and each level will offer you a reward. However, this service is not available worldwide; only certain countries and accounts are eligible. But you can earn tens of dollars in crypto if approved.

CoinMarketCap

CoinMarketCap usually lists a few digital assets that you can learn about and earn some tokens. Usually, you can watch videos, complete quizzes, and do other such activities to earn various types of crypto coins and tokens, including BNB, DFI, TRX, SXP, ROSE, NEAR, LIKE, PERP, XMS, URUS, NFTB, SAND, and many more.

Revolut

Revolut has an app section where you can complete a few quizzes and earn around $5-$10 in crypto. It’s not much, but that amount can increase in a better market, especially with the growth of the blockchain industry. Furthermore, you can also stake crypto on Revolut now, so you do not even need to move your funds. Besides, the guides available change periodically.

Binance

Binance is the largest cryptocurrency in the market in terms of both trading volume and user base, and it is no wonder why. The platform offers numerous opportunities for beginners and experienced investors alike, and one of them is the option to earn crypto while completing quizzes.

This feature is available on Binance Academy, and the quizzes published by the exchange are quite extensive, meaning that you can also improve your crypto knowledge significantly.

CoinGecko

CoinGecko is popular thanks to its detailed analysis of various crypto-related topics. Furthermore, on CoinGecko, you can complete various actions to earn crypto. For instance, you can watch videos to learn about top and emerging crypto projects, then complete missions to put your knowledge to the test, and afterward get rewarded.

At the moment, you might find guides about Zeebu, Aleph Xero, Oasys, Sei, NYM, Tezos, Kyber Network, and the best crypto security practices.

4. Using Brave browser

Brave Browser is one of the most known privacy-focused browsers right now. In the past, Brave Browser offered rewards if you invited someone to join their program.

A lot of BAT was offered to convince people to try Brave Browser because the product itself was strong and had a real use case. But that doesn’t mean that you can’t earn crypto with Brave Browser now. Their Brave rewards program allows people to see ads and get earnings.

Some users reported earning an income of $5 per month from Brave Browser by just surfing the web. The point is that you will lose money if you don’t use the Brave Browser.

5. Using Presearch – Get Paid to Search

Presearch is a search engine, just like Google. It’s not the world’s best search engine – but it does its job extremely well.

All you need to do is create an account on Presearch, and then you can earn an income by surfing the web.

Users can earn an income between 0.10 PRE and 0.50 PRE per search, limited to 8 PRE per day. And an extra 25 PRE when you invite a friend to Presearch.

As PRE is just a bit under 5 dollars worth of cents, the rewards might not be so big – but it’s an extra income.

6. Earn Crypto from Crypto Airdrops

Uniswap was not the first airdrop, but it was the one that put the airdrops back on the table. The airdrop was worth 5 figures at the top value.

Bitcoin Cash was an ‘airdrop’ to Bitcoin holders as well. Basically, the BTC holders got new BCH tokens based on the number of BTC in their wallets. The airdrop was worth almost 20% of a bitcoin in 2017.

Note: Bitcoin Cash appeared after one of the hard forks that Bitcoin had; it was not purely an airdrop.

There were many others worth 4 figures or 5 figures.

Free crypto airdrops have been hunted by hundreds of thousands of people ever since.

However, not all crypto airdrops were so big.

Yet, to get an airdrop, all you need to do is find new projects, get involved, try their services, and test their protocol, and you might be eligible for getting digital assets as a reward.

7. Be a ‘Bug’ Hunter – Find Security-Related Bugs and Get Rewarded in Crypto

Any big crypto exchange has a good bug bounty program. You cannot create a top exchange without a bug bounty program that will make your platform even more secure.

That’s why crypto exchanges have decided to offer big bounty rewards.

After all, it’s better to pay someone a large amount to solve a bug that can turn into a massive hack or even the company’s insolvency.

Kraken has one of the best bug bounty programs in the crypto ecosystem, where you can get up to $100,000 in Bitcoin for a major vulnerability.

Crypto.com has another bug bounty program that rewards its users with up to $80,000 for finding security flaws.

Lastly, Binance’s bug bounty program offers up to $100,000 in crypto rewards for all of its crypto ecosystems (Binance smart contracts).

These are the best ones, but each major platform should have one. Offering a reward to keep the funds safe is something that has long been necessary for the industry.

8. Freecash.com – Complete Offers and Get Cash

Freecash.com is a place where you can earn rewards by completing different offers.

For example, you could win up to $25 if you install a poker app and level up, $0.5 if you install an app, or $7 if you order a crypto card.

After creating an account, you can do various tasks and earn some of their coins – which you can exchange for Bitcoin, Dogecoin, Ethereum, or Litecoin.

The Freecash platform started accepting cryptocurrency withdrawals 3 years ago. They don’t have many cryptocurrency withdrawal options, but you can trade any cryptocurrency above for another one using a CEX or a DEX.

You probably won’t make a fortune with Freecash, but you earn free cryptocurrency. And it doesn’t take so much to get it. I personally have 94 offers that I can do, while a friend of mine has 100+.

Oh, and did I mention that you can win up to $250 by signing up on Freecash?

Don’t get your hopes high – we won just $0.25 when we registered, but it’s a start.

9. Affiliate and Referral Programs

The affiliate and referral method is one of the most well-known methods in cryptocurrency and in general. All you need to do is invite someone using your referral/affiliate link – and you’ll earn a reward or commission.

For example: Let’s say I invited 2000 traders to Binance. For each transaction, Binance would pay me 30% of their fee. Let’s say all of the 2000 traders have a trading volume of 10M, and Binance’s fee is 0.10%.

That means I earn $3,000 monthly from my referrals’ trading volume. Pretty cool, right? Binance was just an example, but there are more crypto affiliate programs, such as:

- Ledger – Ledger offers a 10% affiliate commission. So, if you buy a ledger through this link – we’ll make 10% of its worth. Yay, and thank you!

- Coinbase – Coinbase offered $25 in BTC if you referred someone who purchased cryptocurrency worth $100 or more on their platform. And that offer is available since BTC was under $2,000.

- Paxful – Paxful is another example of a good affiliate program, where you can earn 50% of the fees that Paxful gets from your referrals’ trading fees and 10% from the fees of the users invited by your referrals. Sounds tough? You can read the Paxful affiliate program review.

Affiliate marketing is one of the most challenging things, though, as you need to do a lot of work to obtain a monthly income. Also, some programs pay only once.

Note: Affiliate marketing requires a lot of research and expertise, which you can obtain by searching affiliate marketing courses, surfing the web for tutorials, and, most importantly, by trying.

10. Micro Tasks Websites

A microtask website is a place where you need to do some small tasks to earn a certain fiat currency or token.

Tasks can vary from the simple task of testing a website, putting your email in a list, re-tweeting a tweet, etc. These tasks are easy, and the payout is small.

We’ve selected two micro tasks websites where you can get tokens:

- Cointiply – Cointiply has paid its members with over 290 BTC since its launch. Their app has over 500k installs and mostly has good reviews on Trustpilot.

- FreeCryptoRewards– You can withdraw over 20 cryptocurrencies, and the process takes a maximum of 48 hours.

There may be more websites like the two above, but remember to check the Trustpilot reviews prior, as there might be ones that won’t pay a dime.

11. Earn Crypto by Watching Videos

Yes, there are some platforms where you can watch videos and earn some digital assets.

They’re similar to YouTube, but in this case, you are also getting something.

One of these services is Odysee, where you can watch videos or upload videos and earn LBRY.

You won’t make too much by watching videos or by the earn rewards page from Odysee, but you can earn crypto if you upload quality videos from tips from other users.

Most importantly, you can even upload videos that you have uploaded to YouTube.

We recently saw someone with 124 views on his video who had already earned $1.6. But we also saw someone with 3000 views that earned only $0.2. It depends on your niche and how good your content is.

Odysee is a way to get some extra income if you’re already a content creator or want to become one. It’s a hard process to make a fortune on it, but it’s a needed protocol for decentralization.

12. Crypto Faucets

Did you know that at one point in the past, there was a ‘faucet’ that used to give 5 BTC for free? Gavin Anderson, one of the pioneers of Bitcoin, was its creator.

Gavin Anderson created the terminology of a faucet in the cryptocurrency world by being the first to create a website where people would get free crypto. His project helped people earn millions in crypto, 19700 BTC more exactly.

After Gavin, more and more people created this type of website and called them ‘Bitcoin faucets.’ The strategy was simple: visitors would enter the Bitcoin faucet webpage and see a lot of ads, which the webmaster used to gain a profit.

The webmaster would pay the visitor bits of Bitcoin, called Satoshi.

Bitcoin faucets were a big opportunity in the past. Right now, you probably won’t make a fortune, but it’s another way to earn crypto for free.

If you’re interested in finding out the best faucets, you can check these articles:

- A list of the best bitcoin faucets

- Best dogecoin faucets list

- Best Litecoin faucets list

- Best Ethereum Faucets

One of the best things about crypto faucets is that you don’t need to spend too much time or do something complicated, but the reward is small.

13. Earn Crypto by Using a Crypto Debit Card

The first crypto debit card launched by a business was created back in 2017.

In 2023, most big exchanges have their own crypto debit card, and you can earn crypto by using it.

Most of the cryptocurrency debit cards offer a small cashback on your purchases, offered either in BTC or their own cryptocurrency.

The most awesome thing is that you can use a cryptocurrency debit card to shop using Shopnext, Lolli, or StormX and earn twice.

The most known crypto debit cards are Crypto.com debit cards and Wirex debit cards, each of them offering a cashback.

But some competitors started to appear, such as:

- Trastra debit card – You can get it for free!

- Fold debit cards – Where you have two options: the free one or the $10 per month one with improved benefits.

- Juno debit card – which offers a 5% cashback on many brands with no cap per month.

Crypto debit cards are useful as they allow you to get some extra money from your purchases. It won’t hurt to have one or two.

14. Freelance for Bitcoin on Different Websites

The easiest way you can earn cryptocurrency is by working for it. Many projects are looking for employees – from technical support and writers to management positions.

My first cryptocurrency bag was made by freelancing on different websites for coins. All you have to do is find a good platform where you can find some projects – and then do your best.

Here are some of the best ones:

- Jobs4Bitcoin – This subreddit is where I landed my first gig. Access is very simple, and you can advertise yourself freely.

- Fiverr – The bad part about Fiverr is that the fees are a bit high, and you don’t have a way to earn crypto, but you can withdraw the earnings to Paypal and use PayPal to buy crypto.

- Upwork – Same as Fiverr, you cannot withdraw crypto from Upwork – but you can find cryptocurrency-related jobs and use the funds you get to buy crypto

- Anytask – On Anytask, you can earn Electroneum (ETN) only. Electroneum is a cryptocurrency created in 2017, which can also be mined.

Similar to this one, there is another way to earn crypto.

15. Get a Job in the Crypto Industry

The blockchain, the protocols, and the whole new industry that appeared almost ‘overnight’ opened a lot of jobs around the world.

There are tens of thousands of projects that are working hard to become well-known. Some have a token, while some don’t. But all of them are looking for capable people to help them succeed.

And here are the best websites to find a crypto job:

- CryptocurrencyJobs – A place where you can find the latest companies hiring. Various jobs are available, from being an intern to the Head of Product or a CMO.

- BitcoinerJobs – What makes this platform different is the fact that it shows which companies are paying in Bitcoin.

- Bitcointalk Marketplace – You can create a topic, post about your experience, and receive messages from interested parties. Here’s a good post.

- Crypto.Jobs – Probably the oldest and the most awesome platform where you can get a crypto job.

Right now, there may not be so many jobs due to the market conditions. But someone with the right skills could surely find one.

16. Publish Content and Get Tokens

Another great way to earn crypto is by publishing content on various platforms.

The best are decentralized blockchain platforms where readers can donate tokens if your content is useful – basically, you get coins for writing quality posts.

Let’s list some of those platforms:

- Steemit – The oldest protocol where you can earn crypto for posting. Unfortunately, the project was acquired in the past, and the contributors are not so happy about it anymore.

- Ecency – Decentralized social media network powered by Hive since 2016.

- ZapRead – Zapread wants to create a social economy where the top authors, the community, the groups, and even the platform earn something. It has a big focus on Bitcoin.

- Publish0x – One of the oldest platforms where you can post and earn crypto.

Don’t expect to make a fortune here, as it depends on your writing skills and your target audience, but it’s a way to earn crypto that you should know.

17. Create Nodes & Become a Validator

Creating a node is probably one of the hardest things to do, as it requires technical knowledge about setting up a VPS and blockchain programming in some cases.

But it’s one of the most rewarding ones. In the past, creating a node for a project, keeping it up to date, and running for a few months can turn out in a life-changing amount of crypto.

The best I’ve heard was around $100,000, but the regular profit is around $2,000+.

What you have to do here is:

- Check daily for new projects appearing in the crypto world.

- Learn their protocol and programming language if you don’t know it.

- Set up a node, maintain it for a few months

- Hope for the best from the project

There may be projects that won’t deliver, and there may be somewhere the bonus will be low, but by trying and trying, you’ll surely hit a winner.

18. Become a Testnet Hunter

Testnets are something relatively new in cryptocurrency. It requires you to go to a protocol and interact with all of their decentralized apps.

One of the most known testnets of 2022 was the Aptos blockchain, which had an airdrop of over $2,000 for testing it.

On a testnet, you just have to go and try the protocol, see how it moves, interact with things, be active on Discord, spot some bugs, and maybe try some staking (if they have it available).

Aleph Zero testnet had a testnet bounty of 300 AZERO per month of testing (over $300 at today’s price).

Most testnets probably won’t have an airdrop for the testers, but you don’t need crypto to test it; you just have to dedicate some of your time.

19. Be Active on Bitcointalk

A signature campaign on Bitcointalk was the real OG way to make more Bitcoin before Bitcoin even became mainstream.

There are certain businesses that will offer you an opportunity to advertise them in your BitcoinTalk forum’s signature and earn crypto by the number of posts you make.

Of course, not all of your posts will be accepted, as the posts are subject to the campaign’s terms of service.

To find out more about this, you can check the following topic.

On Bitcointalk, there are also some bounties where you can make some crypto, businesses that require some services, or advertise what you can do on their marketplace, as mentioned before.

20. Play P2E Games – Play in a Metaverse or a Virtual World and Earn Crypto

But now, there are plenty of play-to-earn games where you can make a living by playing games. Let’s get into a small list of the best games that you can play:

- Gods Unchained – If you’re good at Hearthstone, you’re going to love Gods unchained.

- Splinterlands – A different type of card game that gained a lot of popularity in 2022.

- Axie Infinity – Axie Infinity is still one of the easiest and most relaxing P2E games in 2023.

- Illuvium – An MMORPG built in cryptocurrency

- League of Kingdoms – An MMO Strategy game similar to Clash of Clans

And there are many, many more P2E games that you can play. For some, you need only an account, while others require an NFT or a pack of cards.

21. Stream to Earn

Stream to earn crypto is something that appeared a few years ago. While the market is not fully developed, there are some stream platforms that you can use to earn cryptocurrency:

Dlive – Dlive is a decentralized streaming platform based on a blockchain protocol. Streamers can earn Lemons, the price of a Lemon being fixed at 0.012$. You’d need around 4250 to withdraw from the platform – and you also have an alternative to withdrawing in USDT, BTT, or TRX.

Twitch – Twitch is accepting cryptocurrency payments through Bitpay. Streamers can also put their address to receive cryptocurrency on their channel to receive crypto directly. Twitch accepts Bitcoin, Ethereum, Litecoin, Dogecoin, Shiba Inu, and many other cryptocurrencies.

22. Be Active on /r/Cryptocurrency

The /r/cryptocurrency subreddit is a crypto ecosystem where you can make money by contributing to posts, polls, and so on. By doing this, you earn MOONS.

Moon is an ERC-20 cryptocurrency on Arbitrum Nova. The token was launched in 2020 as a part of the community points project.

What do you need to do?

- Be active on /r/cryptocurrency;

- Comment & post useful stuff – you will earn MOONs based on your karma, so don’t post useless things;

- Vote on polls;

- Post quality memes on /r/cryptocurrencymemes;

The karma obtained for the tasks above will turn into small amounts of MOONS, which you can sell to other cryptocurrencies or HODL.

23. Stake Your Cryptocurrency

By the time you’ve completed most of the tasks above, you probably earned some crypto. It’s time to learn about staking.

Staking is the process of securing a network by locking your tokens and earnings at a certain annual percentage rate (APR).

By staking a cryptocurrency, you’re helping secure the protocol and also helping yourself get some extra cryptocurrency, but you should remember that your coins need to be locked up for a certain period in order to start earning staking rewards.

One of the easiest ways to earn more cryptocurrency is by staking, but the downside is that you cannot complete transactions with your staked coins while they are locked up. However, you can choose from various types of staking, and some of them are pretty accessible. For instance, Lido Finance offers simplified participation in staking by allowing users to stake their tokens without locking them.

24. Listen to Podcasts and Get Free Cryptocurrency

Wondering if it’s possible to listen to your favorite podcast and earn crypto? Using Fountain, that’s now a possibility in 2023. Fountain integrated Zebedee’s API, which can be used to reward users with small amounts of BTC (Satoshis).

There are many popular podcasts there, such as the Pomp Podcast, Unchained, What Bitcoin Did, Bitcoin Magazine Podcast, and many more. Besides the fact that you can improve your knowledge about protocols and coins – you can also earn a small income.

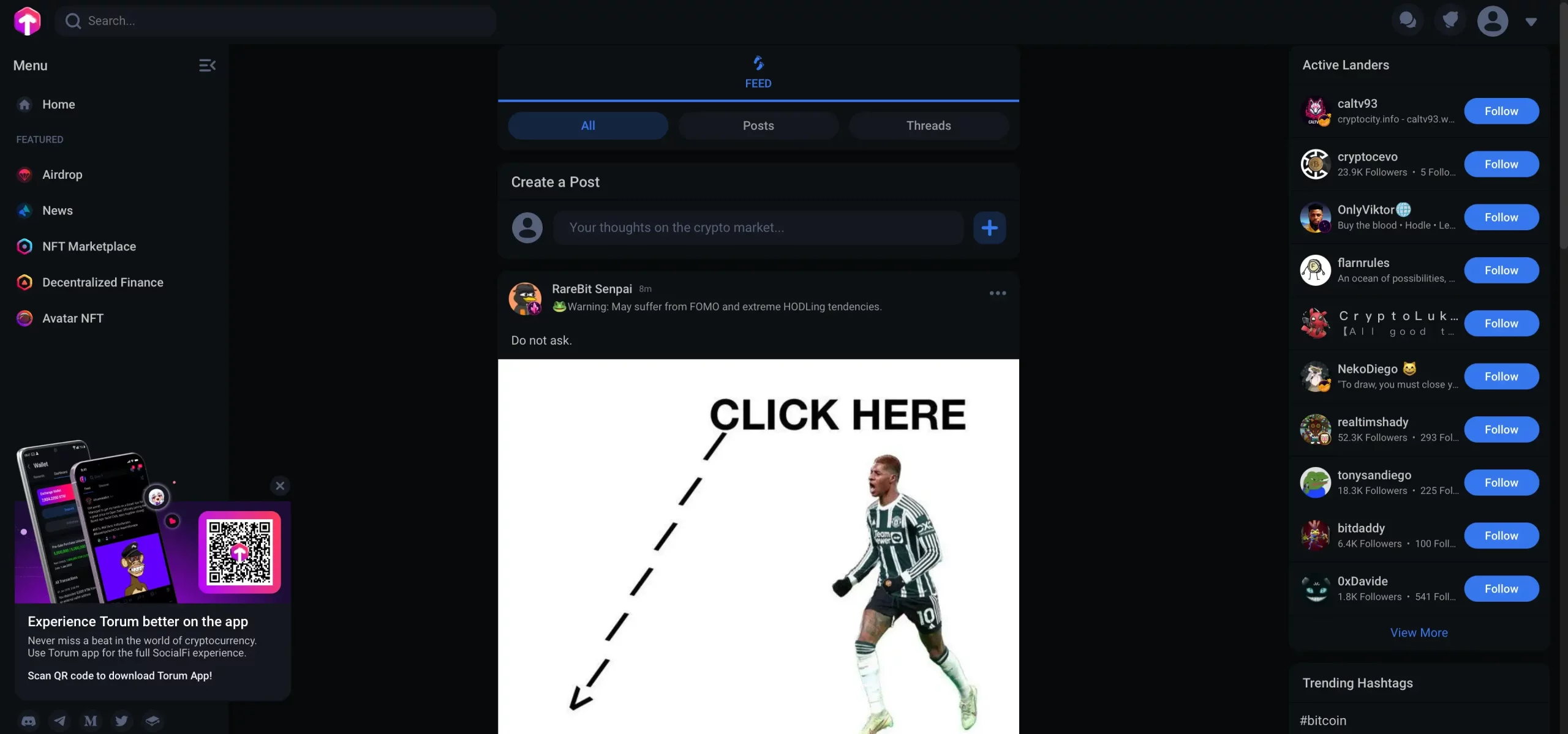

25. Earn XTM Tokens by Being Active on Torum

Torum is an innovative social media platform where users can talk freely about investing, business, and even day-to-day events.

Torum has its own token – XTM – which is listed on multiple exchanges, including Kucoin, Uniswap, Huobi, and MEXC. You can earn coins by doing a few missions on Torum, which are similar to quests in a game. Users can receive 75 XTM tokens when they join Torum.

With over 240,000 users, being active on Torum and completing the daily quests can bring a bit of an extra income.

26. Participate in Giveaways

The crypto industry is a place where a lot of new projects promote themselves by organizing a giveaway. Crypto companies spend thousands of dollars on such events in order to increase the number of followers on various channels.

Participating in giveaways is a full-time job – such as trading. There are tens or hundreds of giveaways going on per minute, and some of them need a bit of work.

There’s also risk – some of the giveaways might not pay, and you’d lose your time helping them. There’s no exact protocol for giveaways, but most of the projects use Twitter – as it’s easy to access for any crypto enthusiast, and most of the people already have an account there.

How much you can earn is subject to your luck and the number of giveaways you participate in. If you’re someone with a lot of time on their hand looking for some way to spend it -you might try this one.

27. Earn by Driving with DIMO

DIMO is another great project that started in 2022. According to their website, they’re “The user-owned digital ecosystem that’s driving change.”. The only downside of DIMO is that you need to have money for a $300 investment, which can bring a consistent income in the long term.

DIMO has an AutoPi miner, which offers valuable information about your card, such as support for major brands, car health diagnostics, private location tracking, and many more. These details are sent directly into your DIMO app. But the coolest part is the DIMO Rewards.

By driving and offering DIMO data about your card, you could get rewarded and make a nice side income.

Conclusion

There are many, many ways to earn cryptocurrency for free or to work for those assets.

Everything strongly depends on what you are interested in, how much time you are willing to spend conducting such activities, and your goals or expectations. However, we believe that you will find at least one option that suits your preferences.

Remember to keep an eye on this article as we’re going to update it weekly, and also subscribe to Coindoo’s newsletter to receive special ways to earn crypto.