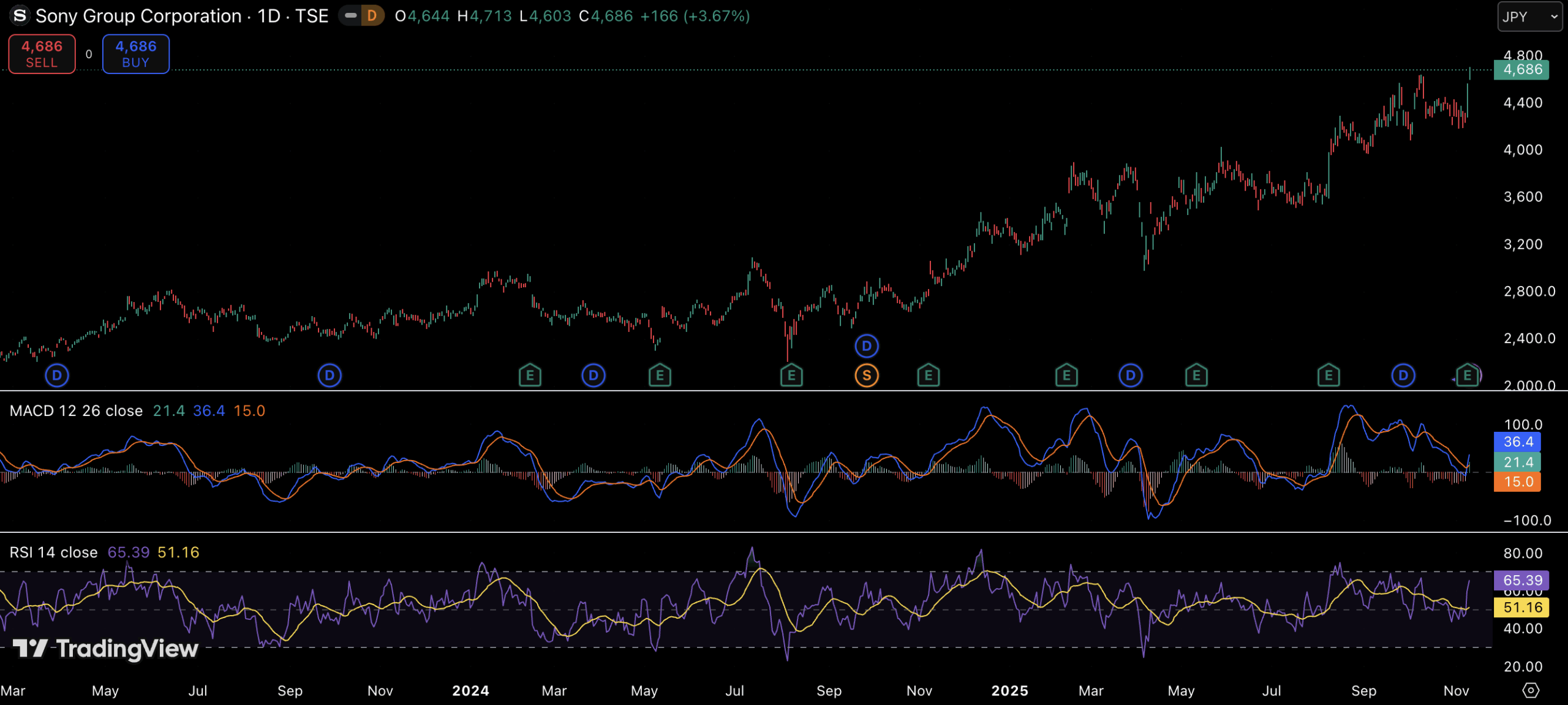

Sony Stock: Rises After Strong September-Quarter Earnings and $660M Buyback

Sony Group Corporation reported stronger-than-expected quarterly earnings, powered by its image sensor, gaming, and music divisions.

- Quarterly profit rose on strong chip, gaming, and music sales.

- Sony approved a $660M share buyback after spinning off its finance arm.

- Full-year outlook: ¥12T ($79B) in sales, ¥1.43T ($9.4B) in operating profit.

- Shares jumped 3.7% to ¥4,686 ($31) after the results.

The company also unveiled a major share repurchase program worth up to 100 billion yen (about $660 million) after completing the spin-off of its financial services subsidiary.

Strong Quarter Driven by Chips and Entertainment

For the quarter ended September 30, 2025, Sony posted revenue of 3.11 trillion yen ($20.5 billion), up from 2.97 trillion yen a year earlier. Operating profit climbed to 428.9 billion yen ($2.8 billion), while net income attributable to shareholders rose to 361.9 billion yen ($2.4 billion), or 60.48 yen per share.

During the first half of the fiscal year (April–September), the company generated 5.73 trillion yen ($37.8 billion) in revenue, marking a 3.5% increase year over year. Operating profit jumped 20.4% to 768.9 billion yen ($5.1 billion), and net income from continuing operations advanced 13.7% to 570.4 billion yen ($3.8 billion).

Sony said its Imaging & Sensing Solutions unit, which supplies sensors for smartphones and digital cameras, remained the primary growth driver. Its Game & Network Services segment also performed well, supported by digital content and PlayStation network revenues, while the Music division benefited from higher streaming and licensing income. However, the Electronics business, including TVs and other hardware, showed weaker sales compared to the prior year.

Financial Spin-Off Completed

The Japanese tech giant finalized the long-awaited spin-off of Sony Financial Group Inc. (SFGI) on October 1, 2025. Shareholders received one SFGI share for every Sony share held as a dividend in kind. Following the separation, Sony no longer consolidates the financial business in its earnings but will continue to hold a minority stake.

The restructuring aims to simplify Sony’s group structure and sharpen its focus on core growth areas such as entertainment, gaming, and imaging technology. Accounting adjustments related to the deconsolidation will be reflected in Sony’s financial results for the fiscal year ending March 2026.

New Buyback and Dividend Plan

Alongside the earnings release, Sony’s board approved a share repurchase program of up to 35 million shares, valued at as much as 100 billion yen ($660 million). The buyback window runs from November 12, 2025, through May 14, 2026.

The company also announced an interim dividend of 12.5 yen per share, with plans to issue another 12.5 yen at the end of the fiscal year, bringing the total to 25 yen ($0.17) per share for the year.

FY2026 Outlook and Market Reaction

Looking ahead, Sony forecasts full-year sales of 12 trillion yen ($79 billion) and operating profit of 1.43 trillion yen ($9.4 billion) for the fiscal year ending March 31, 2026. Net income attributable to shareholders is projected to reach 1.05 trillion yen ($6.9 billion).

The company noted that these estimates already factor in potential effects from recent U.S. tariff policy changes.

Investors welcomed the strong results and capital return plan. On the Tokyo Stock Exchange, Sony shares surged 3.7% following the announcement, closing at 4,686 yen ($31). The stock’s technical chart shows momentum building since mid-2025, with the latest breakout supported by rising relative strength (RSI near 65) and improving MACD signals—suggesting bullish sentiment among traders.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.