YouHodler is a crypto-backed lending company with offices in Cyprus and Switzerland. It is an active member of the Blockchain Association of Financial Commission and the Crypto Valley Association and has a Ledger Vault 150M insurance fund to protect customers. This provides advanced security to customers’ funds in the custody of the company.

There are 4 supported fiat currencies (USD, EUR, GBP, and CHF) as well as over 30 of the most popular cryptocurrencies. Deposits and withdrawals can be made using crypto/stablecoins. Customers who prefer to use fiat currencies can also make deposits using their bank cards or wire transfer. The company also accepts deposits and withdrawals through SWIFT and SEPA, which sets it apart from most crypto companies that do not support such methods.

YouHodler Review: Main Products

The company has a wide range of products and services that it offers to its customers in order to have the most successful experience when using cryptocurrencies.

Savings

Among its top products is savings. Crypto owners can save their assets with YouHodler and earn interest on their digital assets. There are 30 supported cryptocurrencies to choose from. Unlike other platforms that promise higher interest rates for staking their own tokens, YouHodler does not have a token, and all customers earn the rewards due to them on any assets of their interest. Notably, it is one of the few companies that pay interest on DOGE and one of the highest interest rates on stablecoins.

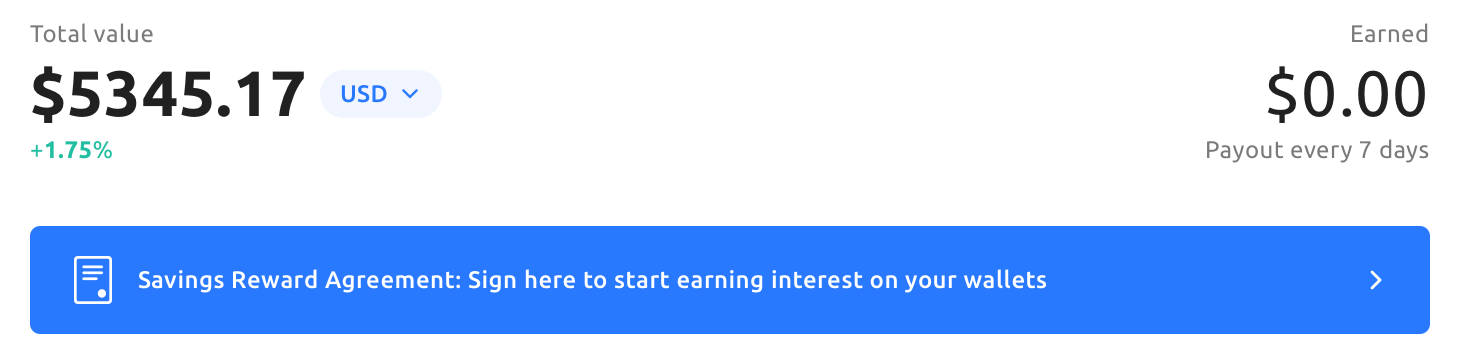

Customers can withdraw their funds at any time, as there are no lock-up periods. Payouts are done weekly, and users can decide to compound their interest to earn even more over time. To start earning interest on savings, customers only need to deposit funds to their YouHodler wallet and click on the “Sign Savings Reward” button at the top of the wallet, and they will start earning instantly.

Earnings are sent to the wallets once a week. Customers can earn up to 12% APR + compounding interest in Bitcoin (BTC), Pax Gold (PAXG), and all major stablecoins, depending on the assets they are saving with the company.

Crypto Loans

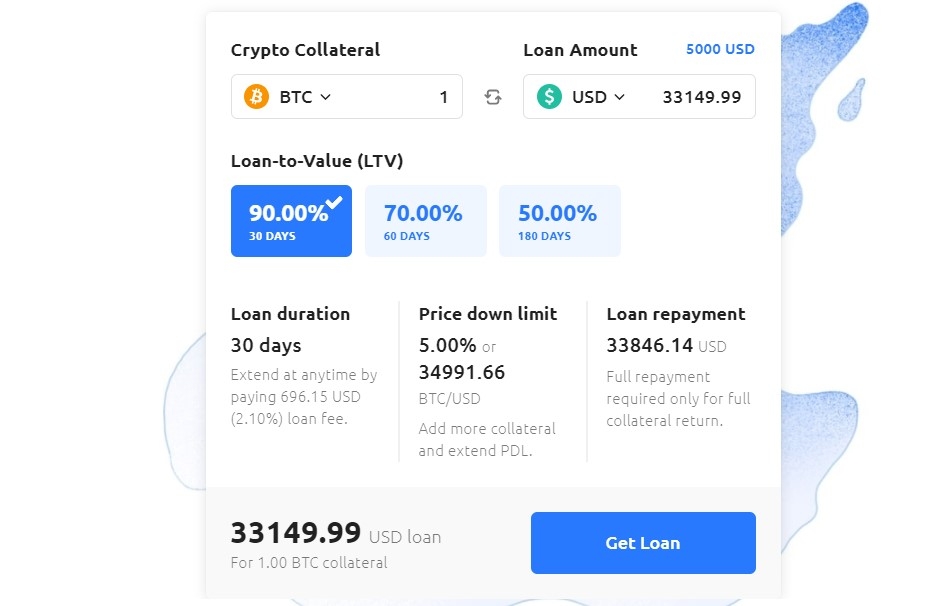

The company offers a Loan-to-Value (LTV) of up to 90%, which is the highest on the market. Customers can use any of 27 supported cryptocurrencies as collateral for the loans and enjoy unlimited loan terms. Loans can always be extended indefinitely. The minimum loan amount is $100, which can be received in USD/EUR/GBP/CHF and BTC.

Non-fungible Tokens (NFTs) can also be used as collateral for loans on this platform. This is because of the high interest in this asset class, which is becoming increasingly popular. YouHodler is licensed to accept NFTs as collateral for their loans, so those who have such valuable assets can use them to secure the loans.

Multi HODL

Take advantage of market volatility and boost your savings. This product combines the best of both crypto exchanges and CFD trading into one to help customers maximize profit and keep their risks at a minimum. With a simple interface, customers will easily get accustomed to its use and enjoy quick execution. There is a maximum leverage of X30, which helps to keep risks low and, at the same time, magnify profits. The potential profit is +300%, while the potential risk is -50%. Fees are only charged on profitable deals. Real market execution and easy edition on already opened deals are available.

YouHodler Exchange

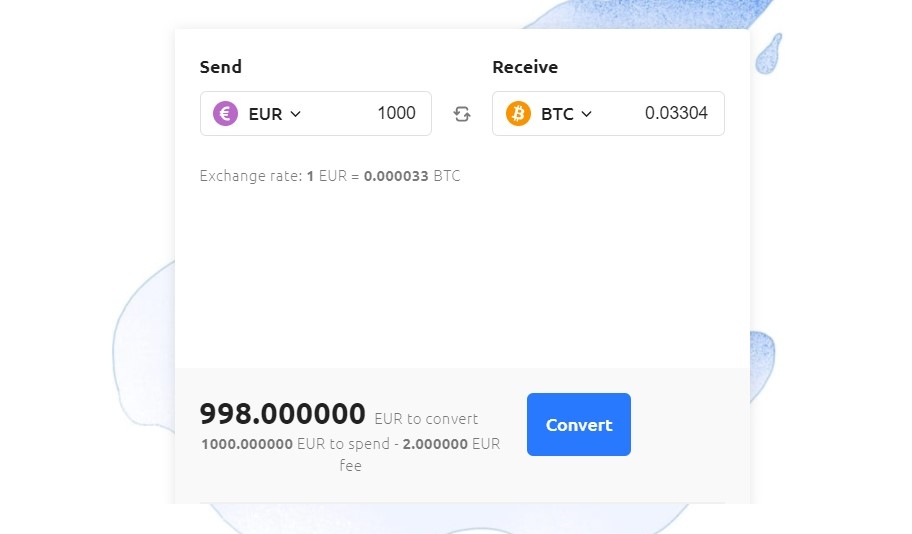

Are you looking to trade digital assets? YouHodler also provides the best cryptocurrency exchange where this can be done. Customers can exchange their cryptocurrency, fiat, and stablecoins at the best price at the time of the trade and enjoy low fees. There is no restriction on trading pairs, so they can trade between any pair of cryptos. This is rare on any crypto exchange, including the top ones. Exchange can be done between any set of supported crypto/fiat or stablecoins with no restrictions whatsoever.

It is designed for users of all experience levels. New users are walked through the process to help them trade their currencies very easily. The deposit and withdrawals have also been simplified to achieve this purpose, so anyone can use it and trade assets fairly easily.

How Safe Is YouHodler?

YouHodler is a legally registered company in Cyprus. On top of that, it has an official pawnbroker license from Switzerland, which authorizes it to issue loans with collateral such as NFTs. For the safety of funds and customer data, it employs the use of Ledger, Cryptocurrency Security Standard (CCSS), Elliptic, and others. With these, the company follows all the industry best practices for IT security checks, data protection, access rights, and data encryption to ensure all its operations are 100% secure.

Customer Support

There are many ways customers can reach the YouHodler team. The first is by email, and the second is by a live chat which is active at all times. If a customer is not satisfied with the service at any time, he can file a complaint by email or through the help center. There is also provision for such customers to reach the Blockchain Association with the complaints as they deem necessary.

YouHodler Review: Verdict

YouHodler seems to be a company that cares about its customers’ welfare and promises a significant return on investments for savings. The loan terms are also favorable for anyone to take and pay at their convenience. Not many crypto companies offer the quality of services provided by YouHodler, which has a strong team of experts behind it.