Ripple is preparing to launch its U.S. dollar-backed stablecoin, Ripple USD (RLUSD), in Japan through a new partnership with financial giant SBI Holdings.

The European Union may be preparing to anchor its upcoming digital euro on major public blockchains such as Ethereum or Solana, according to reports.

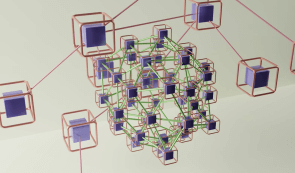

Global payments leader SWIFT has quietly begun testing Ripple’s XRP Ledger and Hedera Hashgraph, signaling one of the strongest moves yet by traditional finance toward integrating blockchain into cross-border transactions.

Anchorage Digital, the first federally chartered crypto bank in the United States, has won a major regulatory victory after the Office of the Comptroller of the Currency (OCC) officially removed its 2022 consent order.

Stablecoins may soon reshape not only crypto markets but also U.S. government debt markets, according to a new Coinbase research report published on Aug. 21.

Singapore’s largest bank, DBS, has taken another major step into digital finance by launching a new initiative to tokenize structured notes on the Ethereum blockchain.

Stablecoins are rapidly moving from niche crypto assets into the center of global financial debates. Recent discussions by the U.S. Federal Reserve, major American banks, and Chinese policymakers reveal how these digital tokens have become a strategic focus in reshaping payments, markets, and cross-border finance.

The battle for control of Stargate, one of the most active cross-chain protocols, is intensifying. The Wormhole Foundation has entered the fray, announcing plans to counter LayerZero’s $110 million acquisition proposal with a higher offer.

Instead of late-night token trading, the latest gathering of crypto engineers in Brooklyn focused on something very different: how stablecoins could quietly become the money powering artificial intelligence.

Circle has rolled out Gateway, a new cross-chain system designed to give businesses seamless access to their USDC holdings across multiple blockchains.

China is reportedly exploring the launch of yuan-backed stablecoins in a move that could reshape the global financial landscape and strengthen its bid to reduce reliance on the U.S. dollar.

For years, a handful of megacap tech companies known as the “Magnificent-7” have dominated U.S. stock market performance, driving indexes higher even when other sectors lagged.