The violent market meltdown on October 10 has taken on a new meaning after fresh accusations that the sell-off did not unfold naturally.

The crypto market has been in freefall, and panic is spreading quickly. Prices that only weeks ago were setting new highs are suddenly testing support after support, and sentiment has flipped from euphoria to fear in record time.

The global geography of Bitcoin mining has shifted once again — and this time, it happened in the most unlikely place.

For years, the Trump family positioned itself at the front line of crypto enthusiasm, betting on tokens, mining ventures and digital-first financial companies - and it worked spectacularly while the market was rising.

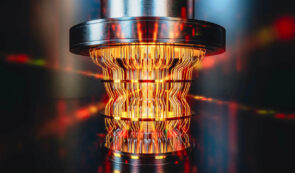

Institutional crypto adoption has mostly been fueled by ETFs, halving cycles, and macro liquidity — but an entirely different topic is quietly reshaping the way large money looks at Bitcoin: whether the network can still rely on its current cryptography decades from now.

Bitcoin is trying to climb back on its feet after one of the sharpest market shake-ups of the year.

Crypto markets may have been shaken for a reason no one expected — not panic selling, not macro headlines, not ETF news, but a glitch that rippled into a historic wipeout.

Bitcoin has climbed back above $87,000, reversing part of last week’s sharp drawdown and signaling renewed momentum after hitting deeply oversold levels.

The sharp drop in Bitcoin this week has renewed debate about whether large corporate holders might reconsider their exposure.

Many investors looking at Bitcoin’s latest pullback are bracing for a dramatic washout. But one crypto analyst argues the opposite: the downturn might already be close to exhausting itself — and the next leg higher could begin from a level far above where most bears expect.

The recent slump across digital assets has generated loud warnings of an incoming market crash, yet macro strategist Lyn Alden argues that the current pullback doesn’t resemble the kind of euphoric blow-off that normally precedes severe capitulation.

The crypto market is bleeding again, but former hedge fund manager Raoul Pal doesn’t view chaos as a reason to retreat.