Table of Contents

- Bitcoin Price Prediction | Introduction

- Bitcoin Price Prediction: Technical Analysis

- Bitcoin Price Prediction: Market Opinions

- Bitcoin Price Forecast for January – February

- Bitcoin Price Forecast for the Rest of the Year

- Bitcoin Price Forecast for the Next Year

- Cryptocurrency Experts and Influencers

- Latest News and Happenings Concerning Bitcoin

- FAQ:

- Bitcoin Price Prediction: Verdict

The world, and most importantly, the U.S. could embrace Bitcoin in 2022, setting the stage for a Bitcoin price prediction that proposes the crypto might outperform the record-setting year, 2021. Bitcoin price is $48,537, at the time of this writing, in correction after breaking all-time high BTC price prediction.

For sure, Bitcoin occupies a special place in the heart of crypto investors, and this fact makes every Bitcoin price prediction as controversial as it can get. Currently, BTC is showcasing signs pointing to a bullish Bitcoin price prediction 2022. In this BTC price prediction, let’s see what’s next for Bitcoin.

Bitcoin Price Prediction | Introduction

At the time of going to press, Bitcoin was trading at $50,434, according to data available on CoinMarketCap. Bitcoin briefly lost its trillion-dollar valuation for a market cap of more than $950 billion, but the fully diluted market cap remains above $1.05 trillion.

For the better part of 2021, Bitcoin price prediction narratives were as brilliant as investors expected them to be. The crypto made a debut above $60,000, cementing its authority within the market and leaving the floor open for wilder Bitcoin price prediction 2022 forecasts.

Bitcoin Price Prediction: Technical Analysis

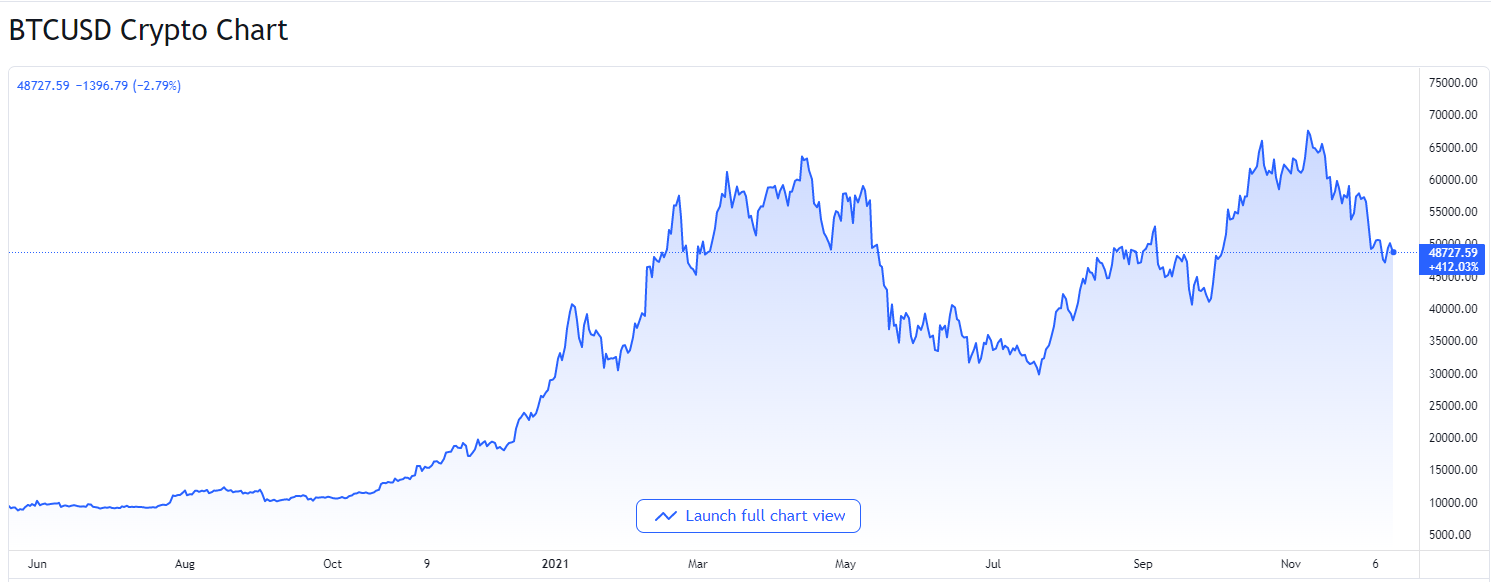

Let’s start the BTC price prediction with a bit of technical analysis to explore the BTCUSD market at the monthly price chart:

| Month | Price |

| November 2021 | 67,566.83 |

| October 2021 | 65,992.84 |

| September 2021 | 52,633.54 |

| August 2021 | 49,546.15 |

| July 2021 | 42,235.55 |

| June 2021 | 40,406.27 |

| May 2021 | 58,803.78 |

| April 2021 | 63,503.46 |

| March 2021 | 61,243.09 |

| February 2021 | 57,539.95 |

| January 2021 | 40,797.61 |

| December 2020 | 29,001.72 |

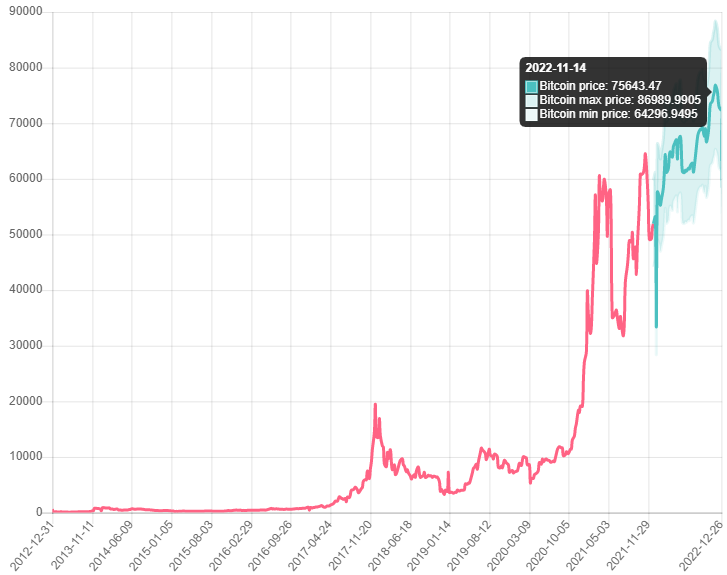

The Bitcoin prices chart above shows the key support level, which is situated at the peak of 2020 bullish trend. Since the start of 2021, the battle has been raging between the buyers and sellers, but the level around $30000 has managed to remain steadfast, thereby giving the right to assert this as the most significant support level.

A conclusion can be drawn at this point to suggest $30000 support could be tested but not broken in 2022. This level was the buy opportunity Bitcoin presented and based on the current price. We might conclude that BTC is hovering above another significant buy zone as the coins go into a trading range.

At this point, the BTC price prediction suggests the coin is providing side-lined buyers with another opportunity to buy before an uptrend looks likely. This resulting price action is likely to send BTC to post a higher high in 2022.

Bitcoin has set up a trading range from $68978 and $65468 to $43451 and $38664 after a correction in December 2021. Since setting up this range, Bitcoin (BTC) has created lower lows, indicating waning bullish momentum and buyer activity, but does not provide evidence of an increase in seller activity and momentum.

Currently, the price is retesting the 79% retracement level for the first time in nearly three months. This retest is well below the 50% level, perhaps proposing the Bitcoin price prediction 2023 narrative that the coin is selling at a discount price.

A spike in buying momentum is expected at this level, which Bitcoin price prediction 2021 suggest could trigger an 11% run-up back to $68000. If the buy orders pile up towards the end of 2021, the Bitcoin price prediction today that points to the return of the all-time high will be asserted.

A daily close below this level, however, will create a lower low on the BTCUSD chart and invalidate the bullish Bitcoin price prediction explained above. If BTC fails to stay within the trading range, it will indicate an increase in selling pressure.

Bitcoin Price Prediction: Market Opinions

From the analysis above, it is clear that the value of Bitcoin is tied to market sentiments and investor expectations. Due to the recent crackdown on Bitcoin mining in China, but has suffered losses, but managed to recover in true Bitcoin fashion.

Investors would love for their bullish Bitcoin price prediction forecasts to be true. Right now, the price of BTC is expected to remain in the trading range until the end of the year. So investors should not expect table results from this crypto. In the first half of 2022, the BTC price will fluctuate significantly.

Bitcoin Price Forecast for January – February

Let’s see what market opinions have to say for January and February 2022.

Gov.Capital

Gov.Capital Bitcoin price forecast for January – February shows bulls are ready to take BTC another leg higher. The forecast suggests a BTC price prediction that could reach highs of $61400 to $75000.

LongForecast

LongForecast BTC price prediction suggests buyers are depressed amid an uncertain market mood going into a new year. But greater gains are in the docket. Investors can look forward to higher high closes above $40000 as a signal to the buying opportunity.

Bitcoin Price Forecast for the Rest of the Year

What has 2022 prepared for Bitcoin? Let’s find out from the experts.

TradingView

TradingView Bitcoin price forecast for the rest of the year projects bullish potential strengthening even as sellers are happily adding on the imbalance. A corrective advance could see BTC trading above $38420 for the rest of the year and retest levels higher than $57000.

PricePrediction.net

The Bitcoin price forecast from PricePrediction.net for the rest of the year proposes pressure on Bitcoin remains despite the seller activity. Bitcoin is ready to take it to $70000 and $87000 in 2022, as the crypto firms are ahead of a string of good news throughout the year to sustain momentum.

Bitcoin Price Forecast for the Next Year

WalletInvestor

WalletInvestor for the next year anticipates mounting pressure towards a retest of $68000 and higher. Accelerating north could justify the Bitcoin price prediction 2022 at $81576 within the next year.

CoinPriceForecast

CoinPriceForecast Bitcoin price prediction eyes $96062 within the next year as sellers go against the tightening chances of losing out on greater gains. This Bitcoin price forecast for the next year exposes sellers’ defense that $68000 could be broken as BTC moves to $73000 by mid-year 2022.

We also recommend: XRP Price Prediction

Cryptocurrency Experts and Influencers

As mentioned above, Bitcoin is still the darling of many investors. Hence, crypto influencers and experts are quick to make a Bitcoin price prediction at every move that either validate in invalidate a Bitcoin price prediction today or claim others are still in play.

PlanB on Twitter, Bitcoin price prediction 2021 forecasts BTC holding ground and advancing further to $135k. However, the first signal of the surge might have invalidated the prediction as BTC fell short of a price target of $98k.

Cathie Wood Bitcoin price prediction 2022 eyes $500k is also in play riding on BTC adoption by institutional players. While speaking to CNBC, the American investor noted Bitcoin has come a long way and from being considered a toxic asset to the pillar of millions of investment portfolios.

MMBTtrader Bitcoin price prediction today is bearish in the short term as the price could fall to the 35k – 30k levels. However, this thesis is only valid if the support level at $40000 breaks. Failure at this point could set BTC up for higher gains.

Latest News and Happenings Concerning Bitcoin

Following months of price reaction, Bitcoin mining has finally recovered from the Chinese crackdown signaling the return of bullish price prediction forecasts. The crackdown took over half of the world’s miners offline virtually overnight, setback prices to 2021 lows.

However, the mining exodus that followed has seen Bitcoin recover lost resources, which is measured by looking at hashrate. Displaced miners are moving fast to get back online, with institutional miners going as far as shipping out of Asia in search of cheaper energy. Thus, more and more people want to own a Bitcoin wallet to be able to store it safely, and this interest is expected to grow in the future. If you are new to crypto investing you can start buying Bitcoin with MoonPay.

FAQ:

Is Bitcoin a Good Investment?

Yes. Bitcoin has gained more than 50000% since it began trading. Moreover, the world’s first crypto has achieved a trillion-dollar valuation, at par with Amazon, Google’s parent company Alphabet, and Apple, all rated solid investments.

What Will Be the Bitcoin Price by 2022?

Bitcoin price prediction 2022 reveals BTC could peak at $100000, but a sustained close above this level is unlikely. Either way, crypto trading experts believe Bitcoin will make explosive gains in 2022.

What Will Be the Bitcoin Price by 2025?

Bitcoin price prediction 2025 is $250000. As a grade-A investment, Bitcoin has consistently delivered value growth, which has been the catalyst for investor confidence that determines buying pressure and bid orders.

Will BTC Price Hit $100k in 2022?

Yes. The price action going into 2022 is incredibly bullish, signaling greater gains are in the 2022 docket. This Bitcoin price prediction 2022 is informed by the fact that Bitcoin has surpassed earlier predictions and exceeded investor expectations.

Bitcoin Price Prediction: Verdict

If recent Bitcoin gains are anything to go by, then the Bitcoin price prediction 2022 is $100k. This Bitcoin price prediction brands crypto a solid investment, and BTC has the track record to prove it. After all, the network has shrugged off the Chinese crackdown. If you decide to make a great investment in Bitcoin this year, we recommend you to try one of the best anonymous Bitcoin wallet on the market.

Images source: Unsplash.com