The crypto industry has much more to offer than Bitcoin if you take your time to dive deeper. An excellent example is the Ethereum network with its native crypto, the 2nd most traded crypto whose ecosystem impacted more sectors.

So, while planning your investments for the next year, make sure that you keep Ethereum on top of your mind because ETH has been set on an upward trend and shows a strong investment potential.

To keep your ETH secure, finding the best Ethereum wallet that will serve your needs and offer you peace of mind is crucial for any crypto investor, regardless of their crypto knowledge.

In this article, we discuss the best ETH wallets to secure your digital assets, addressing security aspects, supported cryptocurrencies, transactional fees, and other vital factors that need to be considered.

What is an Ethereum Wallet?

Depending on your preferred choice, the Ethereum Wallet may consist of a software wallet or a hardware one that allows users to interact with the Ethereum blockchain. The wallet also allows users to securely manage their Ethereum account, thus performing transactions, enabling the creation of smart contracts (smart contract wallet), engaging with dApps, and many other activities.

Ethereum wallets are managed via a private key only the owner should know, but sharing sensitive data or poorly storing it may result in theft or fraud. Usually, the setup process involves downloading or writing down the private key, enabling users to manage their crypto wallets and digital assets.

It is important to remember that crypto wallets, either for Ethereum, Bitcoin, or any other crypto, do not hold your currencies but a pass or code that you will use to access your assets. This brings us to point No. 2: how many types of Ethereum wallets are there?

By understanding the several types of Ethereum wallets, you can securely store your digital assets, thus enjoying your journey without being held back.

Types of Ethereum Wallets

Depending on your crypto management style, there are 2 types of crypto wallets: hardware (cold) and software (hot) wallets. The software wallets need a secure internet connection, rather than the hardware models, which work with cold storage.

We have to give credit to the hot ones for their accessibility and ease of use compared to the cold wallets. However, the offline ones are more secure due to their nature: they limit access to malware attacks.

Now that we’ve learned the 2 main crypto wallet categories, we can divide them further: hot wallets can be mobile, desktop, browser, and web, while cold wallets are only hardware and paper. Also, we recommend the complete guide to pick your cryptocurrency wallet for a more comprehensive overview.

What Makes a Good Ethereum Wallet?

Usually, there are several things you must consider before choosing an ETH wallet, but for now, we are discussing the most important ones:

1. Safety: As you check all the critical terms and conditions before buying a gadget or choosing a platform, you must go through all the safety protocols the wallet follows;

2. Compatibility: A few wallets still do not support ETH, so you must go through the list of supported cryptocurrencies the wallet offers in advance. Otherwise, the wallet will not be helpful in your case;

3. User Interface: The best wallet for you will be the one that offers an excellent user interface that is easy to understand and provides seamless usability;

4. Privacy: No crypto user wants to be required to share too much information. When dealing with crypto, you may still be a little scared by all the attacks and thefts happening in the industry. So, you might not want to share that much information about you, but only what is truly relevant for trading crypto on various platforms.

Top 8 Ethereum Wallets

Best Ethereum Wallets for Beginners

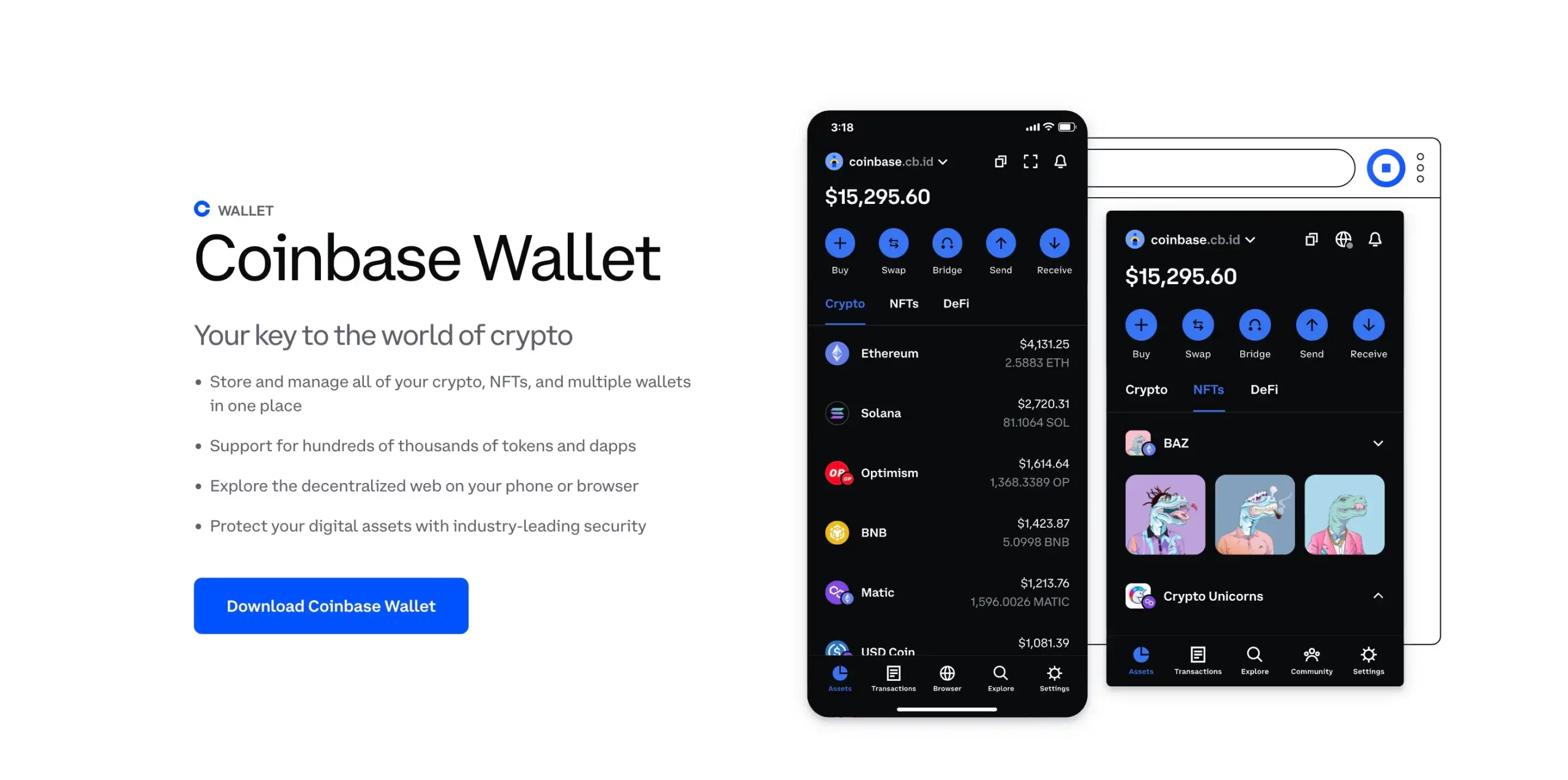

1. Coinbase

Coinbase may be the most straightforward Ethereum wallet of them all. It allows users to transfer their digital assets free of cost, and you do not have to pay a single penny while downloading the application. However, it charges a small fee when buying and selling crypto using the wallet interface.

The security system Coinbase uses is extremely rigid due to the Security Enclave Technology. You can also use the 2-factor authentication method to provide an extra layer of security to all your cryptocurrencies. Also, be sure to verify your mobile number and email address before storing your assets.

Main Features

- Supported coins: Every ERC-20 token, including Ethereum (ETH), as well as other popular cryptocurrencies such as Bitcoin (BTC), Cardano (ADA), Solana (SOL), and many more.

- Type of wallet: Self-custodial wallet.

- Price: Free.

- Fees: Coinbase Wallet charges a 1% transaction fee on all cryptocurrency transactions.

- Customer Service: Email, 24/7 support, and Coinbase Help Center.

- In-App Features: Store and manage your crypto and NFTs.

- Hardware Compatible: Yes – Ledger.

- Mobile App: iOS and Android.

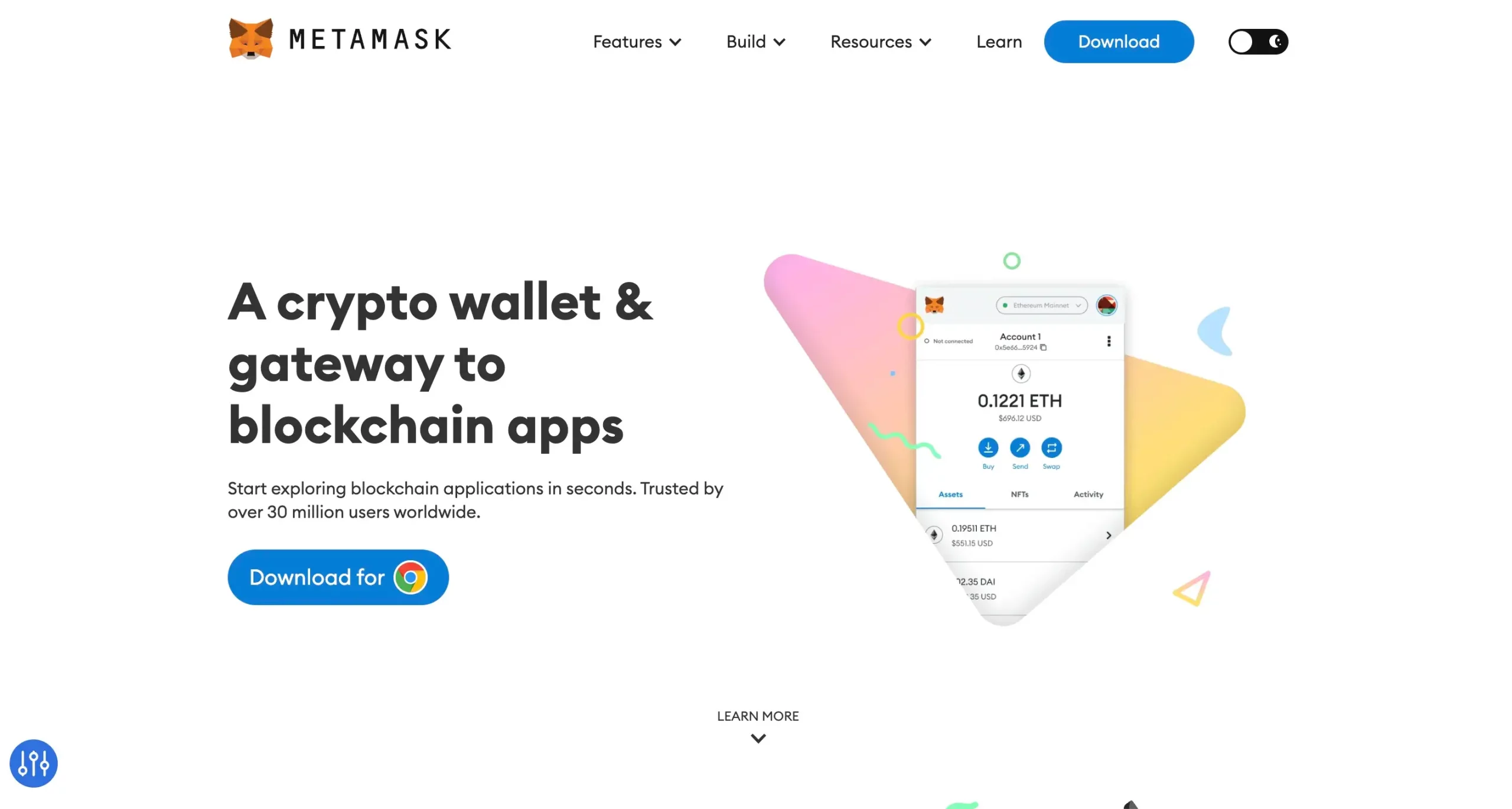

2. MetaMask

Launched in 2016, MetaMask is a self-custodial EVM (Ethereum Virtual Machine) crypto wallet able to access blockchain applications and Web3. Trusted by over 21 million users worldwide, MetaMask supports all Ethereum tokens and NFTs but does not support Bitcoin.

MetaMask can be accessed as a browser extension for Google Chrome and as a mobile wallet for iOS and Android. This way, its user-friendliness stands quite high. Being pretty straightforward, the wallet is great for beginners, allowing users to explore various blockchain or crypto-related concepts such as dApps (Decentralized Applications), NFTs, and many more.

Main Features

- Supported coins: ETH and any ETH-based token, such as Shiba Inu (SHIB), Uniswap (UNI), Aave (AAVE), and Dai (DAI).

- Type of wallet: Non-custodial wallet.

- Price: Free.

- Fees: The transaction fee is 0.875%.

- Customer Service: Live customer support, email, ticket system, and community board.

- In-App Features: Buy, sell, swap, and convert assets.

- Hardware Compatible: Trezor, Ledger, Lattice, Keystone, AirGap Vault on web extension, and the mobile app supports Keystone.

- Mobile App: iOS and Android.

3. Exodus

Exodus is a user-friendly and intuitive multichain Web3 wallet that connects thousands of Web3 apps and dApps across many networks, including Ethereum. Also, crypto investors can manage Ethereum-based tokens and NFTs (Non-Fungible Tokens) in one place.

Launched in 2015, Exodus was developed to enable crypto investors to store ETH and many other cryptocurrencies securely. Besides supporting approximately 300 coins and tokens, Exodus also focuses on NFTs, DeFi, and many more.

Main Features

- Top supported coins: Ethereum (ETH), Bitcoin (BTC), Litecoin (LTC), Tether USD (USDT), and Dogecoin (DOGE).

- The number of supported cryptocurrencies: 364.

- Type of wallet: Software wallet.

- Price: Free.

- Fees: Exodus only charges the network fees for sending crypto. Receiving digital assets does not imply any fees. Yet, you can set custom fees for Bitcoin, Ethereum, and ERC20 transactions on desktop and mobile, while the Web3 wallet supports setting custom fees for ETH and ERC20 transactions.

- Customer Service: Exodus Wallet offers in-app, email, Twitter, Facebook, and Exodus Support+, plus a 30-minute Zoom call, but this will be charged.

- In-App Features: Crypto users can buy, sell, swap, and convert assets within the Exodus app.

- Hardware Compatible: Yes – Trezor.

- Mobile App: iOS and Android.

Best Ethereum Wallets for Security

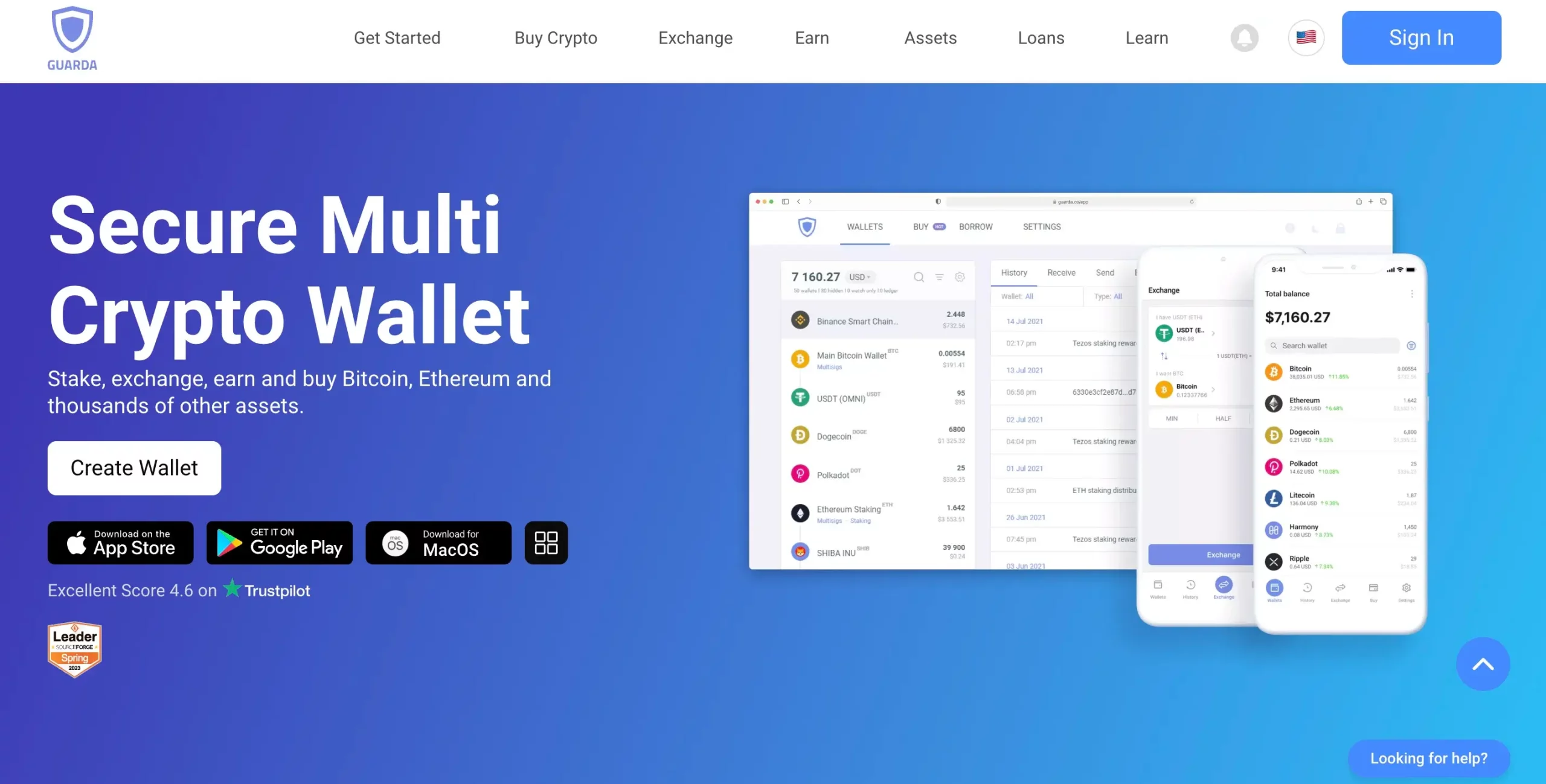

4. Guarda Wallet

Developed in 2017, Guarda is a secure multi-platform cryptocurrency wallet designed to hold, manage, swap, buy, and stake cryptocurrencies, including Ethereum. Also, a new feature has been added – Prepaid Visa Crypto Cards.

Being a non-custodial wallet, Guarda allows users to fully control their funds, and the company cannot access them at any time. Over the years, Guarda’s main focus has been providing high levels of security and privacy for its worldwide users. Since its launch, there have been no reports of security breaches for Guarda Wallet, and this is a significant advantage for its users.

- Top supported coins: Ethereum (ETH), Bitcoin (BTC), Litecoin (LTC), Tether USD (USDT), and Dogecoin (DOGE).

- The number of supported cryptocurrencies: 400k+ from over 50 blockchains.

- Type of wallet: A multi-platform wallet.

- Price: Free.

- Fees: Upon transfer, users will pay the network fee, but for exchanges, there is a 0.5% commission per transaction. However, depending on the traffic volume, their fiat-to-crypto and crypto-to-fiat partners charge up to 2%.

- Customer Service: Email, support tickets, and live chat.

- In-App Features: Buy, sell, swap, stake, borrow, and spend.

- Hardware Compatible: Yes – Ledger.

- Mobile App: iOS and Android.

5. Ledger

Ledger is one of the safest options for storing Ethereum. All wallets provided by Ledger are hardware wallets, meaning that you store your funds offline, and no hacker can access them. Ledger wallets are multicurrency devices that look similar to a USB diver.

On the device, users can store various private keys. The fact that the keys are stored on a device that is not always connected to the internet through a PC or laptop makes it increasingly harder for hackers to access the private keys and, therefore, users’ funds.

Ledger Nano S Plus

Ledger Nano S Plus is one of the oldest and most popular crypto hardware wallets on the market. It combines a minimalist design with top-notch security features and ease of use. The first Ledger Nano S hardware wallet was sold on June 20, 2016.

Besides the security features, such as two-factor authentication, a secure PIN code to lock the device, and excellent backup and recovery options, the hardware wallet impresses through its support for over 5,500 crypto assets. The current price of Ledger Nano S is approximately $79.

Ledger Nano X

Ledger Nano X was launched in 2019. It looks similar to the previous model but has many improved features. It supports over 5,000 coins and tokens, and users can have up to 100 different apps. Unlike Ledger Nano S Plus, Ledger Nano X supports both iOS and Android devices. Ledger Nano X can be purchased for around $149.

Main Features

- Top supported coins: Ethereum (ETH), Bitcoin (BTC), XRP Ripple (XRP), Tether (USDT), NFTs, and many more.

- The number of supported cryptocurrencies: 5,000+/5,500+.

- Type of wallet: Cold wallet.

- Price: $79 (Ledger Nano S) and $149 (Ledger Nano X), but might vary depending on the location or vendor.

- Customer Service: Support page and chatbot.

- Features: Buy, swap, stake, and manage.

- Compatibility: Compatible with smartphones (Android 10+) and 64-bit desktop computers:

- Windows 10 / 11;

- macOS Big Sur / Monterey / Ventura;

- Ubuntu LTS 20.04 / 22.04 (both excluding ARM Processors).

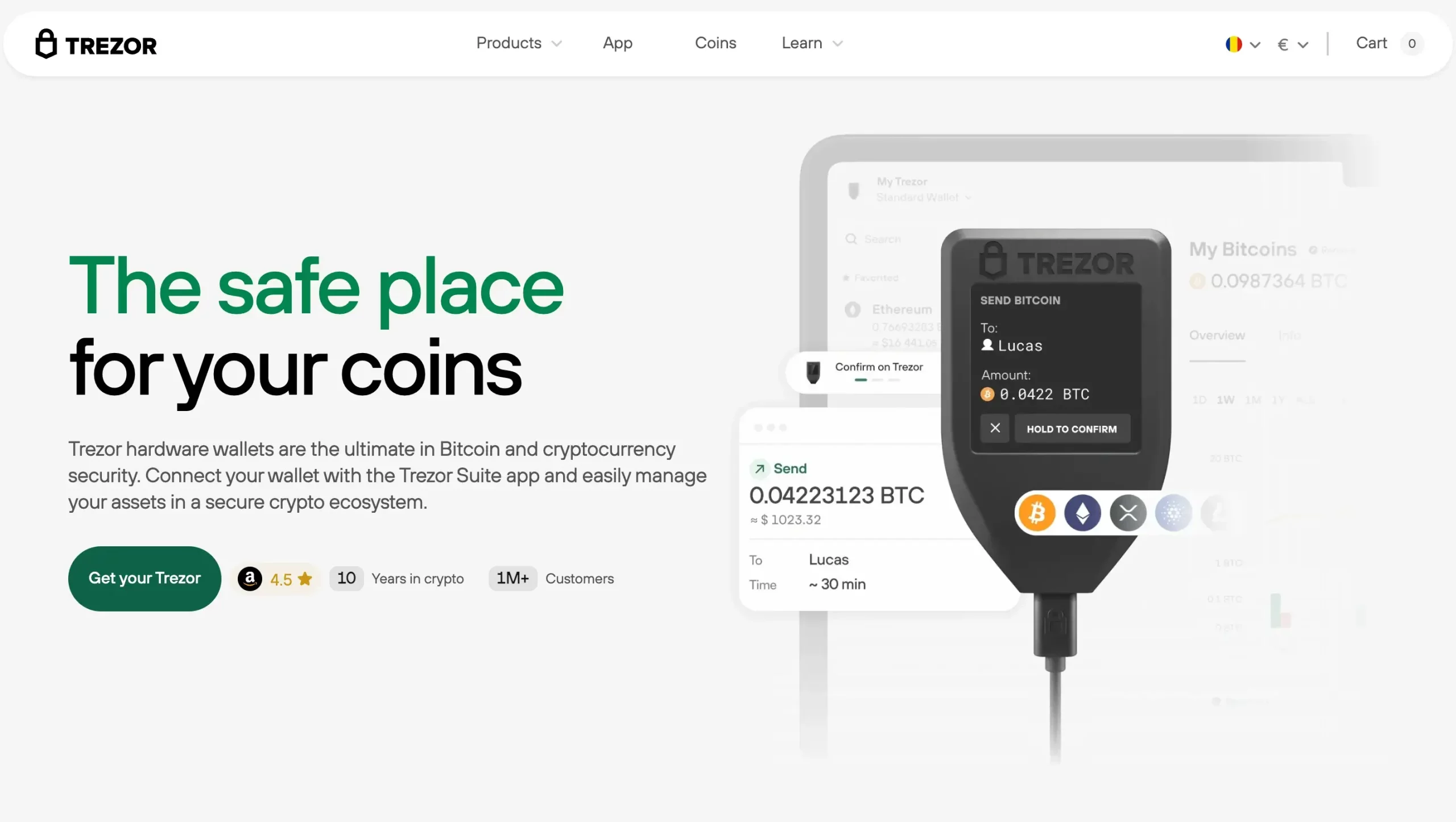

6. Trezor

Trezor can easily be the most secure wallet for storing ETH. It is a hardware wallet designed to provide high levels of safety, security, and privacy. One of the innovations Trezor comes with is its touch screen feature that truly helps crypto investors trade their funds easily.

Furthermore, The device supports thousands of cryptocurrencies and represents a highly secure offline storage option for Ethereum coins. Besides, Trezor has an additional security method that lets users generate and distribute up to 16 recovery shares for their devices. If 1 seed phrase is compromised, the additional shares can provide an additional layer to protect the keys from being stolen. This is called the Shamir backup.

- Top supported coins: Ethereum (ETH), Bitcoin (BTC), XRP Ripple (XRP), Tether (USDT), and many more.

- The number of supported cryptocurrencies: 1,300+/1,400+.

- Type of wallet: Cold wallet.

- Price: $70 (Trezor Model One) and $200 (Trezor Model T), but might vary depending on the location or vendor.

- Customer Service: Support blog.

- Features: Buy, sell, swap, and manage.

- Compatibility: Desktop, Android devices.

Top User-Friendly Ethereum Wallets

7. Argent Wallet

Argent Wallet has a very easy-to-understand user interface, making it an excellent choice for both professional and novice traders. On security, Argent is a non-custodial wallet that uses private keys stored locally on your device with heavy encryption.

This wallet supports Android and iOS devices, so you can continuously track market trends. Argent Wallet allows users to explore the DeFi (decentralized finance) sector efficiently.

- Supported coins: Ethereum (ETH), Dai (DAI), USD Coin (USDC), Basic Attention Token (BAT), and Wrapped Bitcoin.

- The number of supported cryptocurrencies: 240+ Ethereum-based tokens.

- Type of wallet: Non-custodial.

- Price: Free.

- Fees: 0.5% commission for crypto swaps.

- Customer Service: Email, support tickets, and live chat.

- In-App Features: Buy, earn, stake, and trade.

- Hardware Compatible: Ledger Nano S, Ledger Nano X, and Trezor.

- Mobile App: iOS and Android.

8. MyEtherWallet

MyEtherWallet is a popular choice for ETH holders who appreciate enhanced accessibility without sacrificing security. It is a web wallet with a unique approach toward safety, as it allows you to control your private keys by storing them on your device and not on an online server.

It integrates with Ledger Nano S and Trezor, 2 of the most popular hardware wallets. Other advantages include an inbuilt ETH to BTC swap feature and support for all types of ERC-20 tokens.

- Supported coins: Ethereum (ETH), Tether USD (USDT), Dai (DAI), Shiba Inu (SHIB), and Wrapped Bitcoin (WBTC). The browser extension supports additional coins.

- Type of wallet: Multi-platform software wallet.

- Price: Free.

- Fees: Customizable.

- Customer Service: Help center, email, chatbot.

- In-App Features: Buy, sell, swap, and exchange.

- Hardware Compatible: Yes.

- Mobile App: iOS and Android.

Best Wallet for Ethereum | Final Thoughts

Upon reviewing all these, we cannot decide which is the best wallet for Ethereum since it all comes down to your crypto strategy. Yet, a browser extension like MetaMask or Guarda might be helpful if you constantly interact with decentralized apps.

Moreover, if you manage your crypto portfolio and want to connect with thousands of Web3 apps and dApps across multiple networks, Exodus could be your partner in crime.

For experienced crypto traders, MyEtherWallet could be the option as it allows you to deploy Ethereum smart contracts, besides the beneficial in-app features.

So, to sum this up, it all goes down to your crypto needs and strategies, but it is best to look up the security features, transaction fees, and supported currencies as the main differentiators.

FAQ | Best Wallet for Ethereum

Is there an official ETH wallet?

There is yet to be an official ETH wallet, as it all comes down to your crypto investment strategy. Each of the best ETH wallets offers distinctive features to serve your crypto needs.

Which Ethereum Wallet is free?

Almost all hot Ethereum wallets are free, yet transaction fees may be applied within the app. It is best to check each wallet’s transaction fee before embarking.

What is the safest Ethereum wallet?

One of the safest Ethereum wallets could be the hot wallet Guarda, which offers extensive efforts to avoid security breaches that could lead to a loss of funds. You can also opt for a hardware wallet, like Trezor or Ledger. You can also store your funds on multiple wallets, as this will increase the security of your ETH coins.